Taxes impression each American in a method or one other. The IRS reported greater than 162 million particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges improve with earnings. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years outdated, particular person earnings taxes are the largest supply of tax income within the U.S.

returns filed in 2023, and analysis from the Joint Committee on Taxation (JCT) estimates round 90 % of the U.S. inhabitants is represented yearly on these returns. And if you embrace the opposite federal taxes (like company, payroll, excise, and property taxes), nobody is left untouched.

All Individuals are affected by the taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities providers, items, and actions.

code—however do they perceive the tax code?

To seek out out, the Tax Basis’s instructional program, TaxEDU, and Heart for Federal Tax Coverage carried out a ballot with Public Coverage Polling. The ballot surveyed greater than 2,700 U.S. taxpayers over 18 years outdated—spanning the political spectrum and earnings distribution—to gauge Individuals’ information of primary tax ideas and opinions of the present tax code.

The outcomes: most Individuals are confused by and dissatisfied with the federal tax code.

Most U.S. Taxpayers Do Not Perceive the Federal Tax Code

Tax literacy was a focus of the ballot for 2 causes: taxpayers ought to perceive the taxes that impression their day by day lives and monetary decision-making, and information helps enhance the tax coverage debate, resulting in extra sound tax coverage.

The ballot outcomes confirmed that:

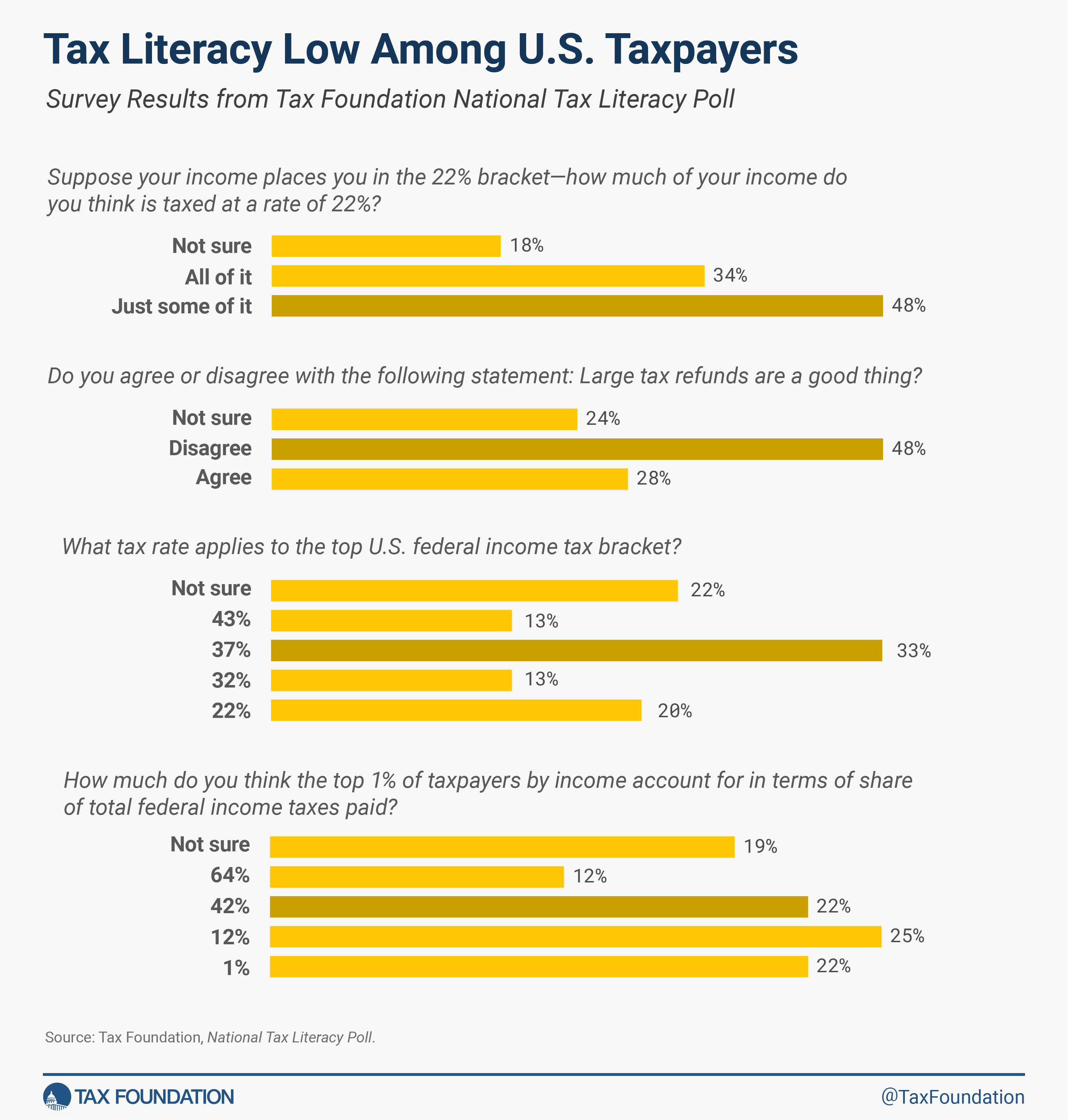

On common, over 61 % of respondents didn’t know or weren’t certain of primary tax ideas associated to earnings tax submitting.

When surveyed about federal earnings tax charges, greater than two-thirds of respondents didn’t know the highest federal earnings tax price and over half didn’t know the way tax brackets work.

When requested which was extra useful: a $1,000 tax credit scoreA tax credit score is a provision that reduces a taxpayer’s ultimate tax invoice, dollar-for-dollar. A tax credit score differs from deductions and exemptions, which cut back taxable earnings, fairly than the taxpayer’s tax invoice instantly.

or a $1,000 tax deductionA tax deduction is a provision that reduces taxable earnings. A commonplace deduction is a single deduction at a set quantity. Itemized deductions are standard amongst higher-income taxpayers who typically have important deductible bills, similar to state and native taxes paid, mortgage curiosity, and charitable contributions.

, 64 % of respondents answered incorrectly or have been uncertain which offered extra worth when submitting.

When requested about ideas incessantly included in tax discussions within the media or standard discourse, 78 % didn’t know the share the highest 1 % of earners pay in taxes and greater than half believed a big tax refundA tax refund is a reimbursement to taxpayers who’ve overpaid their taxes, typically as a consequence of having employers withhold an excessive amount of from paychecks. The U.S. Treasury estimates that just about three-fourths of taxpayers are over-withheld, leading to a tax refund for tens of millions. Overpaying taxes could be seen as an interest-free mortgage to the federal government. Then again, roughly one-fifth of taxpayers underwithhold; this may happen if an individual works a number of jobs and doesn’t appropriately regulate their W-4 to account for added earnings, or if spousal earnings is just not appropriately accounted for on W-4s.

was optimistic.

These outcomes reveal a common lack of tax literacy amongst U.S. taxpayers.

Individuals Usually Dissatisfied with Tax Code

The survey additionally helps perceive taxpayers’ attitudes concerning the U.S. tax code, which can be influenced by misunderstandings of how taxes work.

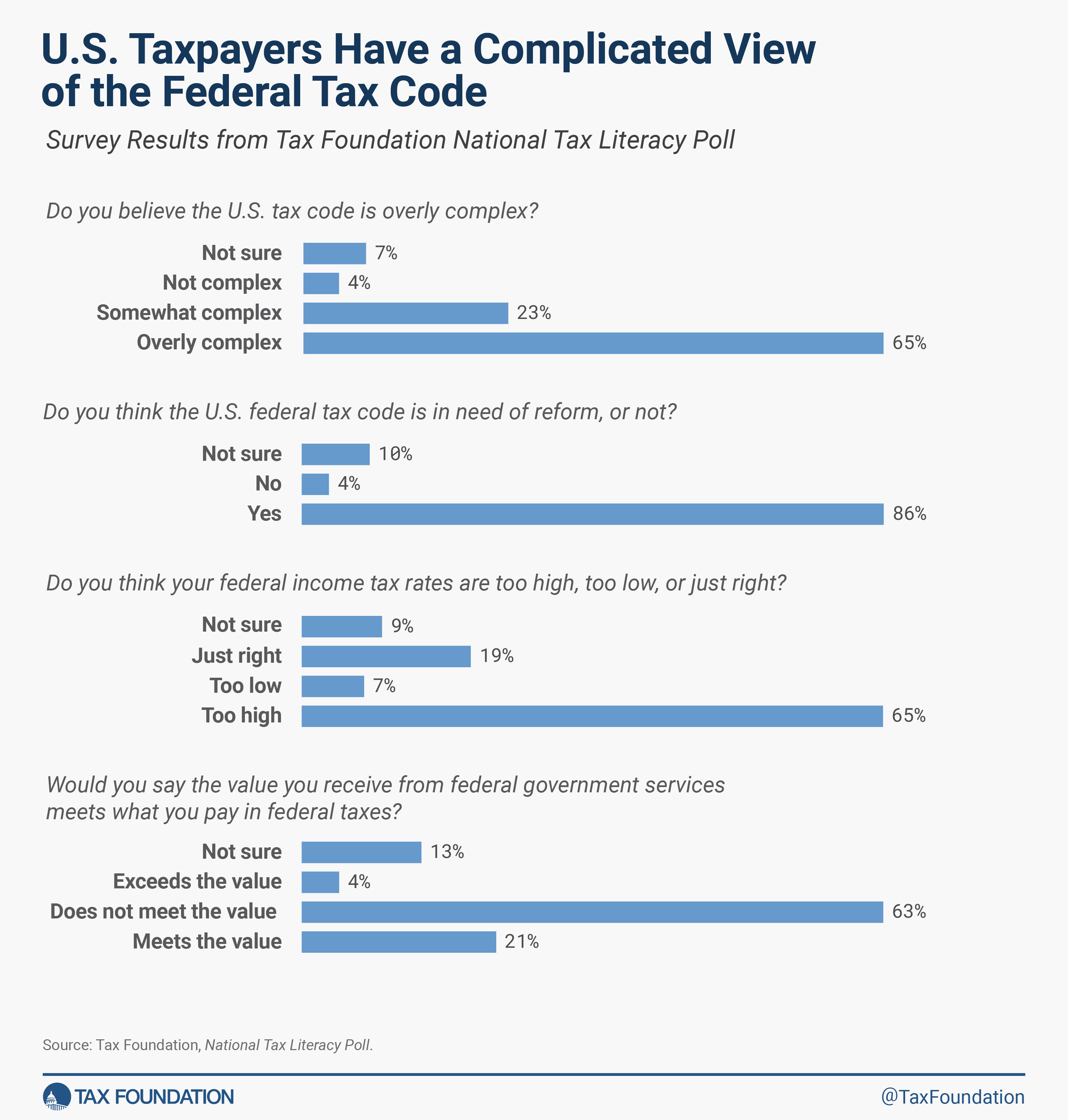

Throughout the political spectrum, the outcomes confirmed a common dissatisfaction with the present tax code. About two-thirds of respondents indicated the tax code is unfair and about the identical share say it’s overly complicated, whereas 86 % imagine the tax code wants reform.

When analyzing the recognition of various tax reforms, the ballot discovered:

71 % assist reducing the highest earnings tax price, but 54 % of respondents need excessive earners to pay extra in taxes.

The contradictions in some responses on this portion of the survey verify the outcomes from the tax literacy part: most of the people tends to misconceive how taxes work.

Lots of the responses level to a need for decrease taxes total. Two-thirds of respondents assume their very own earnings taxes are too excessive. This sentiment has elevated previously 15 years—of these surveyed in 2009, solely 56 % expressed their earnings taxes have been too excessive. As nicely, 63 % imagine what they pay in federal taxes exceeds the worth acquired from authorities providers.

This survey reveals how, regardless of taxes enjoying a major function in private funds and being levied on a large portion of the U.S. inhabitants, most Individuals will not be simply sad with the present tax code but in addition don’t perceive it. Schooling is step one in attaining extra correct and productive conversations about taxes, extra knowledgeable monetary decision-making, and even higher tax insurance policies.

Word: That is the primary in a sequence of weblog posts concerning the Tax Basis’s Nationwide Tax Literacy Ballot. A full evaluation might be launched on the finish of the sequence. The survey information is accessible upon request right now and might be accessible through our web site with the discharge of the complete evaluation.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share