The latest approval of Bitcoin exchange-traded funds (ETFs) by the SEC despatched jitters by the monetary world. Preliminary issues about fading demand appear unfounded as Bitcoin ETFs proceed to shatter buying and selling quantity data. That is additional bolstered by three consecutive classes of web inflows into these funding autos.

Bitcoin ETF Inflows Sign Lengthy-Time period Investor Urge for food

A latest dip in ETF exercise sparked fears that the preliminary pleasure could be short-lived. Nonetheless, these fears have been quelled by a resurgence in inflows.

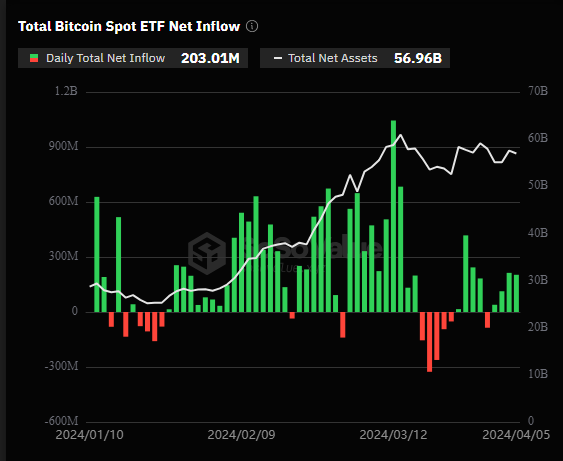

Based on knowledge from SoSoValue, yesterday noticed a web influx of $203 million into Bitcoin spot ETFs, marking the third straight day of constructive influx.

This sustained inexperienced streak means that traders stay considering gaining publicity to the highest crypto by ETFs, probably anticipating a value surge as a result of upcoming Bitcoin halving – a pre-programmed code replace that cuts manufacturing in half, traditionally main to cost will increase.

BlackRock’s Bitcoin ETF Leads The Pack

BlackRock, the world’s largest asset supervisor, has emerged as a frontrunner within the crypto ETF area. Their iShares Bitcoin Belief (IBIT) recorded the very best web influx on a single day, exceeding $144 million.

BTC market cap at the moment at $1.3 trillion. Chart: TradingView.com

This spectacular determine has pushed IBIT’s complete web influx over the previous two weeks to over $14 billion. BlackRock’s dedication to Bitcoin ETFs is additional underscored by their latest choice to incorporate distinguished Wall Avenue establishments like Goldman Sachs, Citigroup, Citadel Securities, and UBS as Approved Individuals (APs) of their spot Bitcoin ETF prospectus.

These additions place these banking giants as first-time individuals within the ETF market, becoming a member of established gamers like JPMorgan and Jane Avenue.

The inclusion of such heavyweights is seen as a major vote of confidence in the way forward for Bitcoin ETFs and a possible catalyst for additional mainstream adoption.

Volatility On The Horizon For ETFs

Whereas the latest surge in demand paints a bullish image for Bitcoin ETFs, consultants warn that volatility could also be lurking on the horizon. CryptoQuant, a cryptocurrency evaluation platform, factors to alerts within the futures market that recommend potential value swings within the close to future.

A constantly excessive premium usually signifies sturdy institutional shopping for stress, significantly in gentle of the latest inflows witnessed in US Bitcoin ETFs. This elevated institutional exercise can contribute to cost fluctuations, creating alternatives for each beneficial properties and losses.

Regardless of the potential for short-term volatility, the general outlook for Bitcoin ETFs stays constructive. The sustained demand, coupled with the backing of main monetary establishments like BlackRock, means that these funding autos are poised to play a major function in bridging the hole between conventional finance and the cryptocurrency world.

Featured picture from Vegavid Expertise, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site fully at your personal threat.