On-chain information exhibits the following main Bitcoin demand zone is round $56,000, a stage BTC would possibly find yourself revisiting if the decline continues.

Bitcoin Has Subsequent Main On-Chain Help Round $56,000

In line with information from the market intelligence platform IntoTheBlock, BTC’s current drawdown has meant that it could find yourself having to depend on the value vary round $56,000 for help.

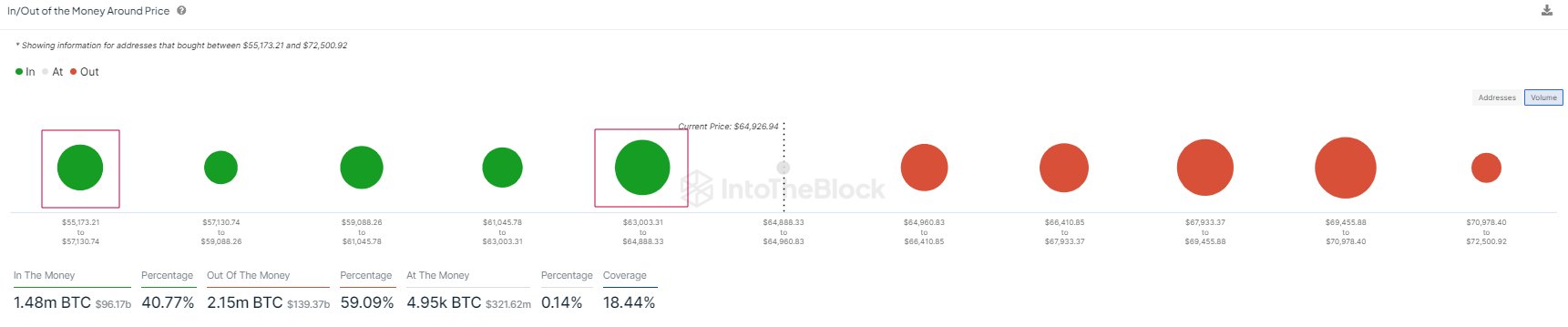

In on-chain evaluation, a stage’s potential as help or resistance is predicated on the overall variety of cash that the buyers final acquired there. Beneath is a chart that exhibits what the assorted value ranges across the present spot value of the cryptocurrency appear to be when it comes to this cost-basis distribution.

The information for the BTC acquisition distribution throughout the assorted value ranges | Supply: IntoTheBlock on X

Within the graph, the dimensions of the dot represents the quantity of Bitcoin that was bought contained in the corresponding value vary. It will seem that the $63,000 to $64,890 stage is at present thick with buyers. To be extra explicit, 1 million buyers acquired 530,000 BTC inside this vary.

Usually, every time the asset retests the associated fee foundation of any investor, they could develop into extra prone to make some form of transfer, because of the significance the extent holds for them.

Buyers who had been in income simply previous to the retest could also be keen to make additional bets, believing that if this stage was worthwhile prior to now it is perhaps so once more sooner or later.

Naturally, this shopping for impact would solely be related for the market if a considerable amount of buyers acquired cash inside a decent value vary. The $63,000 to $64,890 vary qualifies for this.

The vary ought to have acted as a help level for the coin, however BTC has not too long ago slipped underneath it, probably suggesting that this help stage could have damaged down.

As IntoTheBlock has highlighted within the chart, the following main vary of potential help is the $55,200 to $57,100 vary. Thus, ought to the present drawdown proceed, this can be the following related vary.

“Whereas this doesn’t imply that Bitcoin has to go this low, it’s good to maintain this vary in thoughts whereas value is exploring current lows,” notes the analytics agency. A decline to the typical value of this vary ($56,000) would imply a drawdown of virtually 10% from the present spot worth of the coin.

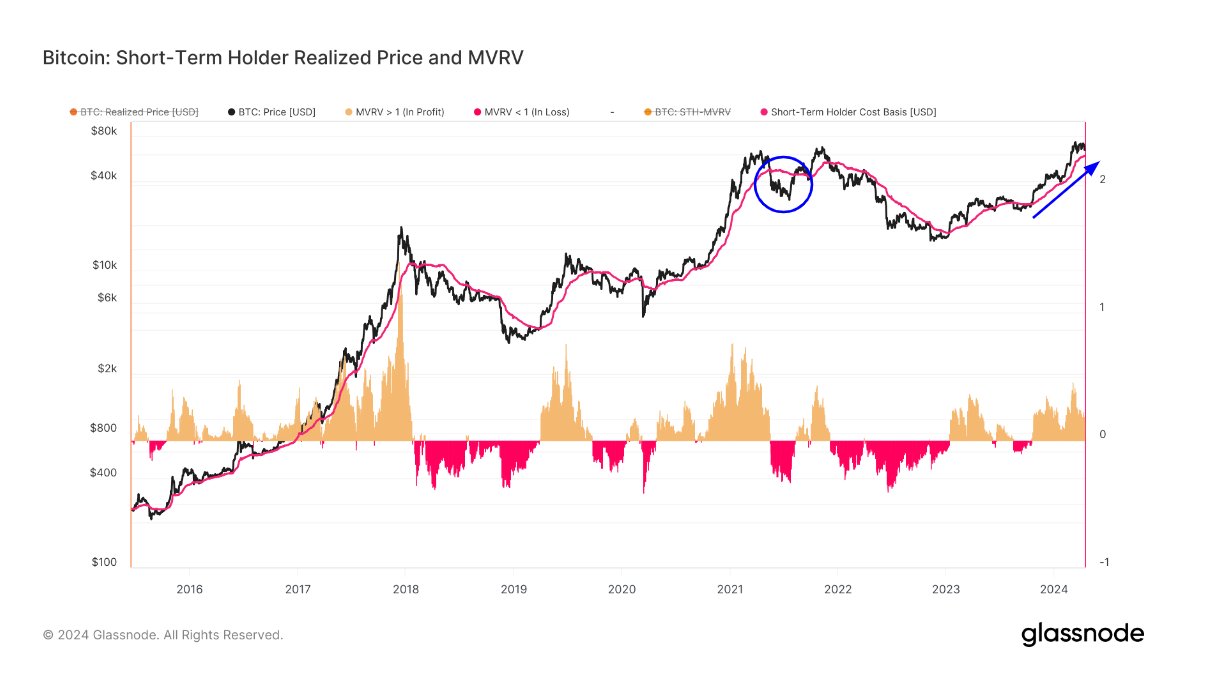

Earlier than this stage, although, there may be one other fascinating on-chain stage that BTC might find yourself revisiting. As analyst James Van Straten has identified in an X put up, the Realized Value (the typical value foundation) of the short-term holders is round $58,800 proper now.

Seems to be like the worth of the metric has been going up since some time now | Supply: @jvs_btc on X

The short-term holders (STHs) right here check with the buyers who purchased inside the previous 155 days. This group’s Realized Value has been at an essential stage traditionally throughout bull runs, because the asset has usually discovered help at it.

Breaks underneath it have, actually, normally led to bearish transitions prior to now. “If we drop under this, I’ll concede to a bear market just like Might 2021,” says Straten.

BTC Value

Bitcoin has registered a decline of virtually 7% over the previous 24 hours and within the course of, has misplaced any restoration it had made earlier. Now, BTC is buying and selling round $62,100.

The worth of the asset seems to have been happening not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site totally at your personal danger.