Ripple, one of many financially strongest corporations in your complete crypto sector, blends conventional banking and finance with digital belongings. This complete evaluation addresses the query “What’s Ripple?” and appears at its origins, technological advances and merchandise, market dynamics, a possible IPO, and the continuing authorized battle with the US Securities and Alternate Fee (SEC).

What Is Ripple?

Ripple occupies a novel area of interest within the blockchain universe, setting itself other than typical cryptocurrency initiatives. In contrast to lots of its friends aiming to vary banking as we all know it, Ripple seeks collaboration with the monetary system. At its core, Ripple operates on a public database often known as the XRP Ledger (XRPL), characterised by transparency and open entry.

The Ripple protocol diverges considerably from the likes of Bitcoin because it eschews the idea of mining, the place transactions are confirmed and the community is secured by miners. As a substitute, Ripple depends on validators. These validators play an important function in sustaining the community’s integrity. As an example, when a transaction is initiated—say, a consumer transferring funds to a different—the community’s validators should attain a consensus to substantiate this transaction.

Notably, most validators are operated by Ripple Labs and its companions. They’re accountable for confirming all transactions throughout the Ripple community. This distinctive system empowers Ripple to execute transactions with exceptional velocity and cost-efficiency. Nevertheless, it additionally results in a better diploma of centralization in comparison with networks like Bitcoin or Ethereum.

Central to Ripple’s performance is the XRP token, typically dubbed because the “financial institution coin.” It primarily serves as a bridge foreign money for fiat transactions, embodying the essence of Ripple’s imaginative and prescient to streamline international monetary exchanges. The XRP token thrives on the XRP Ledger (XRPL), a manifestation of distributed ledger know-how (DLT). This mix of know-how and imaginative and prescient positions Ripple as a novel entity within the blockchain area, providing a mix of innovation and pragmatic collaboration with present monetary constructions.

Key Points Of Ripple And XRP

- No Mining, Solely Validators: The XRP Ledger doesn’t make use of mining for transaction affirmation or community safety. As a substitute, Ripple depends on validators. These validators are essential in confirming transactions. Their consensus retains the community safe and environment friendly.

- XRP: The XRP token is central to Ripple’s ecosystem. It’s pre-mined, which means its tokens have been created earlier than the venture’s public launch. Ripple advocates for XRP because of its minimal transaction charges, fast settlement, and scalability, dealing with as much as 1,500 transactions per second.

- XRP Ledger (XRPL): This ledger is vital to recording knowledge like balances and transfers. The XRPL facilitates fast settlements, permitting funds in native foreign money for concerned events, and helps bridging currencies for transactions.

- Distinctive Node Listing (UNL): The XRPL operates by means of a Distinctive Node Listing, comprising 35 validators. For a transaction to be recorded, no less than 80% of those nodes should agree on its legitimacy.

- RippleNet: Separate from the XRPL, RippleNet is an unique community developed by Ripple for fee and alternate. It doesn’t use XRP and gives on the spot settlement, monitoring of cross-border funds, and interplay inside a unified framework for monetary establishments.

- Ripple’s Use Circumstances: Ripple envisioned XRP to function as an alternative choice to conventional methods like SWIFT, enhancing worldwide fee effectivity. Moreover, Ripple desires to ascertain itself as a crypto liquidity supplier in addition to within the discipline of Central Financial institution Digital Currencies (CBDCs).

Unveiling The Origins And Historical past Of Ripple

Ripple’s inception will be traced again to an idea by Ryan Fugger in 2004. He envisioned a decentralized financial system, Ripplepay, to empower people of their monetary interactions. This concept laid the groundwork for what would ultimately grow to be Ripple.

In 2012, the journey took a major flip. Jed McCaleb, identified for his work on the Mt. Gox alternate, and Chris Larsen, a famend determine within the fintech sector, approached Fugger. They proposed a digital foreign money system using the Ripple protocol. This collaboration led to the institution of OpenCoin.

Later, in 2013, OpenCoin was rebranded to Ripple Labs. It was throughout this time that Ripple started to solidify its distinctive method to the blockchain and cryptocurrency world. In contrast to its contemporaries, which targeted solely on a decentralized mannequin, Ripple sought to combine with the prevailing monetary system, significantly focusing on the inefficiencies in cross-border funds.

The Significance Of Ripple XRP In The Ecosystem

XRP, as Ripple’s native cryptocurrency, performs a pivotal function within the Ripple ecosystem. Its significance stems from a number of distinctive options and functionalities that it brings to Ripple’s community.

- Bridge Forex: One of many main makes use of of XRP is as a bridge foreign money in worldwide transactions. This function is essential in RippleNet’s providing of environment friendly and cost-effective cross-border fee options.

- Transaction Effectivity: XRP stands out for its transaction velocity and minimal charges. The community can course of 1,500 transactions per second, with every transaction costing a minimal of 0.00002 XRP.

- Scalability And Environmental Sustainability: XRP’s pre-mined standing means all its tokens have been created earlier than the community went reside.

- Liquidity Supply: XRP serves as a supply of liquidity in Ripple’s On-Demand Liquidity product (now Ripple Funds).

- Decentralized Alternate And Cross-Chain Integration: The XRPL DEX, the decentralized alternate on the XRP Ledger, has been operational since 2012. It offers a platform for buying and selling XRP and different cryptocurrencies with minimal charges.

- Authorized and Regulatory Challenges: The function of XRP has been topic to scrutiny, particularly following the SEC’s lawsuit in opposition to Ripple. The lawsuit’s give attention to whether or not XRP ought to be categorized as a safety has implications for its use and buying and selling, significantly within the US market.

What Is The Distinction Between XRP And Ripple?

Understanding the excellence between XRP and Ripple is essential for greedy the complete scope of what Ripple Labs Inc. gives within the blockchain and cryptocurrency area.

Ripple – The Firm: Ripple refers back to the know-how firm, Ripple Labs Inc., which focuses on creating and managing a world fee community. Based in 2012, Ripple’s main mission is to rework the world of monetary transactions, making them sooner, safer, and less expensive. Ripple develops a number of blockchain-based merchandise, with RippleNet being its flagship community that facilitates cross-border funds.

XRP – The Cryptocurrency: XRP, then again, is a digital asset or cryptocurrency that operates on the XRP Ledger. It was first developed by Ryan Fugger and later enhanced by Jed Caleb and Chris Larsen – which led to what we now know as XRP.

Use Circumstances Of Ripple

Ripple and its related know-how provide numerous purposes within the monetary sector, notably in cross-border funds, crypto liquidity, and central financial institution digital currencies (CBDCs). Every of those use instances represents a major development in how monetary transactions and operations are performed within the fashionable period.

Cross-Border Funds

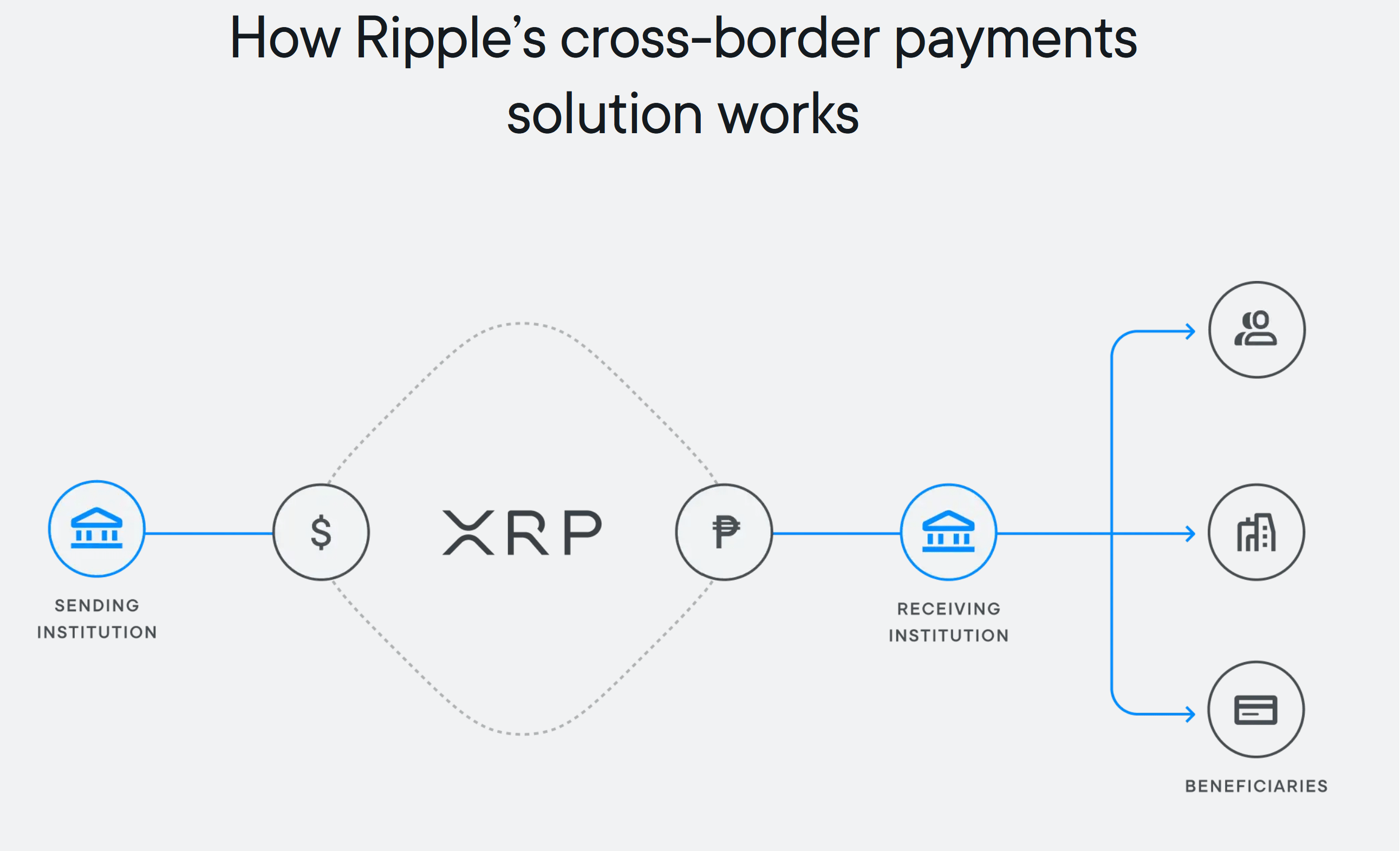

Ripple’s know-how, significantly by means of RippleNet and Ripple Funds, considerably streamlines cross-border funds. Conventional worldwide cash transfers are sometimes gradual, costly, and opaque. Ripple addresses these points by offering a extra environment friendly, clear, and cost-effective resolution.

RippleNet permits fast transaction settlements and reduces the operational prices related to cross-border funds, making it a horny possibility for banks and different monetary establishments. The usage of XRP as a bridge foreign money in Ripple’s On-Demand Liquidity service (new: “Ripple Funds”) additional enhances this effectivity by eliminating the necessity for pre-funding accounts in vacation spot nations, thus liberating up capital and decreasing liquidity prices.

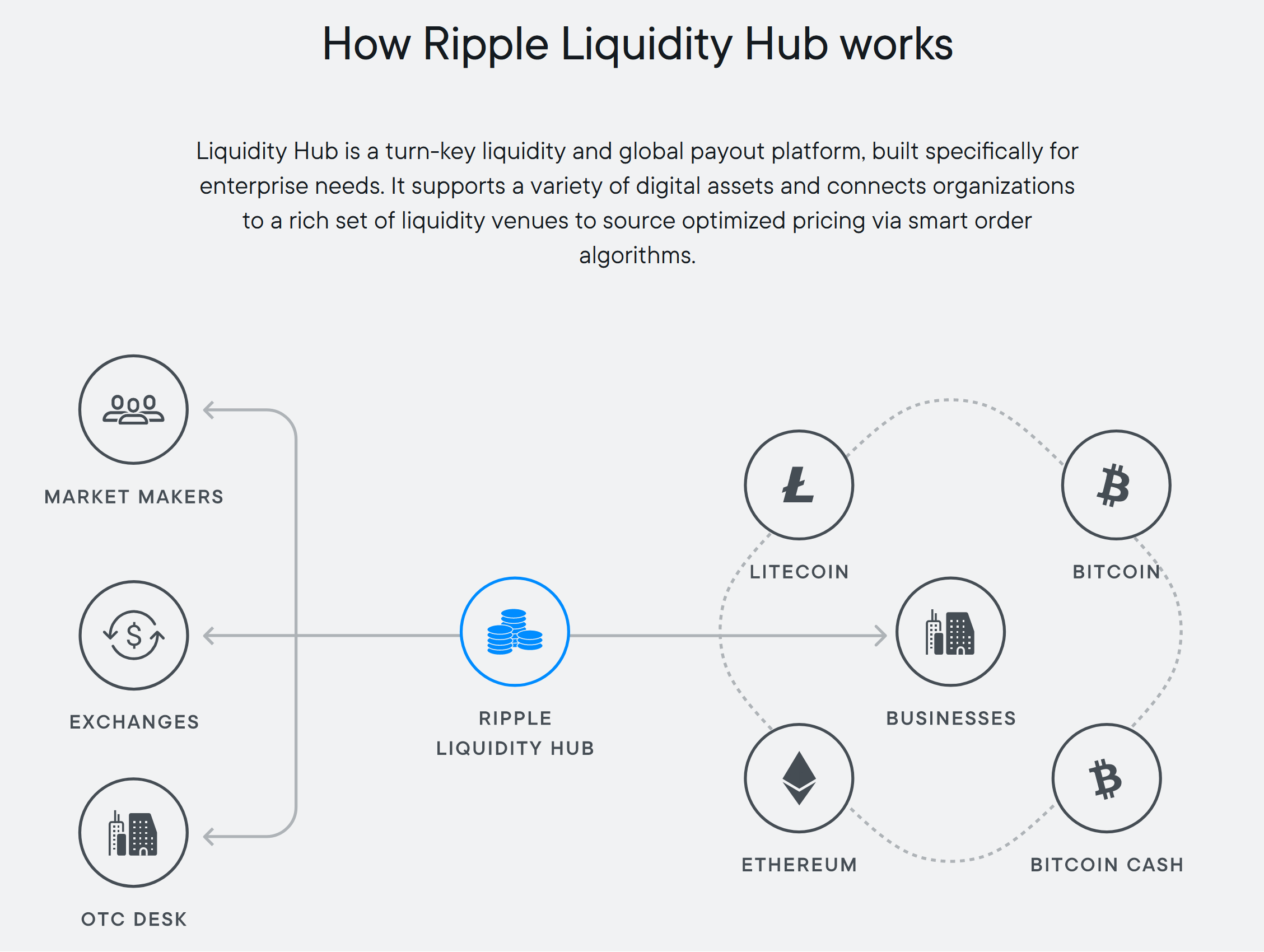

Crypto Liquidity (“Liquidity Hub”)

The Ripple Liquidity Hub serves as a groundbreaking platform for companies to handle their crypto liquidity wants successfully. Designed primarily for monetary establishments and different enterprises, it offers a streamlined method to purchase, promote, and maintain digital belongings.

A key side of the Ripple Liquidity Hub is its skill to supply optimized crypto liquidity. It achieves this by accessing aggregated liquidity swimming pools from varied sources, resembling exchanges and over-the-counter desks. This ensures that companies can receive the absolute best costs for digital belongings throughout a spread of venues.

Moreover, the platform simplifies digital asset administration for enterprises. It comes geared up with an enterprise-level dashboard that facilitates the environment friendly administration, buying and selling, and reporting of digital belongings. This characteristic is especially helpful for companies trying to streamline their crypto portfolio administration.

Some of the progressive facets of the Ripple Liquidity Hub is its enlargement of entry to capital. The platform removes the necessity for companies to carry pre-funded capital positions with a number of liquidity venues, because of its post-trade settlement characteristic. This side considerably enhances capital effectivity for enterprises.

In its dedication to interoperability and the inclusion of varied digital belongings, the Ripple Liquidity Hub initially helps a various vary of digital belongings together with BTC, ETH, LTC, ETC, BCH, and XRP, with the supply various by geography. Ripple plans to additional develop its choices, demonstrating its dedication to fostering an inclusive and aggressive crypto market.

Central Financial institution Digital Forex

Ripple’s engagement within the growth of Central Financial institution Digital Currencies (CBDCs) is a major transfer in direction of modernizing the monetary ecosystem. Ripple has launched a devoted platform for CBDCs, aiming to offer a seamless end-to-end resolution for central banks, governments, and monetary establishments to concern and handle their very own digital currencies.

Ripple’s CBDC platform is designed to deal with a number of use instances, together with each wholesale and retail CBDCs, in addition to issuing stablecoins. The platform’s capabilities lengthen to end-user wallets, permitting customers to securely maintain digital currencies and make funds for items and providers, much like different banking apps. This consists of performance for offline transactions and non-smartphone use instances, broadening the accessibility of digital currencies.

Notably, Ripple has been acknowledged as a frontrunner within the CBDC area, topping aggressive leaderboards by Juniper Analysis and CB Insights for its CBDC know-how.

Ripple’s involvement in CBDC pilot initiatives throughout varied nations showcases its dedication to supporting the event and implementation of digital currencies on the nationwide stage. Remarkably, the corporate has partnered with a number of nations, together with Palau, Bhutan, and Montenegro, to discover and develop their respective CBDCs / stablecoins.

What Is RippleNet?

RippleNet is a distributed community developed by Ripple, designed to facilitate real-time, cross-border transactions. As a peer-to-peer distributed utility, it maintains a digital ledger that emulates the roles of Nostro and Vostro accounts generally utilized in worldwide banking.

RippleNet is thought for its two main layers: a bi-directional messaging layer and a settlement layer. The messaging layer handles the communication of transactions, whereas the settlement layer ensures the ultimate switch of funds.

It operates inside a cloud atmosphere hosted by Ripple, which considerably lowers technical infrastructure prices for its customers. It integrates with monetary establishments’ middleware by means of API operations, successfully replicating funding into RippleNet digital accounts.

Importantly, RippleNet is SOC 2 licensed, guaranteeing excessive requirements of safety, availability, confidentiality, and privateness. It improves the cross-border fee expertise by providing environment friendly messaging, optimized settlement, and distinctive liquidity options.

RippleNet’s clientele features a numerous vary of sectors, together with conventional remitters, digital remitters, FX brokers, fee service corporations, and banks (encompassing international tier-1 banks, multi-country regional banks, native banks, and digital banks), in addition to multinational companies.

What Is Ripple’s On-Demand Liquidity (New: Ripple Funds)?

Ripple’s On-Demand Liquidity (ODL), now often known as “Ripple Funds,” is a liquidity administration resolution that facilitates on the spot and environment friendly cross-border cash transfers with out requiring pre-funding within the vacation spot market. It makes use of XRP as a bridge foreign money to supply liquidity on demand, enabling real-time fund motion.

The evolution of ODL has led to vital enhancements in effectivity and consumer expertise. Initially, the product required funds to be originated in fiat foreign money, transformed to XRP, after which once more transformed to fiat foreign money within the vacation spot nation. The refined Ripple Funds permits prospects to ship XRP for cross-border funds instantly by means of a crypto pockets, leveraging the pockets to supply XRP on demand.

This reduces friction within the fee stream and offers better flexibility and option to prospects. It additionally streamlines the onboarding course of for brand new companions and currencies, enabling a number of currencies by means of a single pockets.

The adoption of Ripple Fee has grown, with progressive corporations like FlashFX utilizing it to assist funds in new currencies like GBP and EUR, which weren’t beforehand supported. This enlargement is a part of Ripple’s broader international momentum, particularly in areas like Southeast Asia, the place there may be vital development because of progressive crypto rules and the presence of progressive corporations. Firms like Novatti and Tranglo, as an example, play a significant function within the community as fiat on and off-ramps.

Ripple’s Potential IPO And Worth Predictions

Ripple’s potential Preliminary Public Providing (IPO) has been a subject of great curiosity throughout the cryptocurrency and monetary communities. Whereas Ripple has not formally introduced plans for an IPO, there are vivid speculations surrounding this chance.

In a latest evaluation, Wall Road knowledgeable Linda Jones urged that Ripple’s pre-IPO shares may probably rise by 2,000%. She identified that the present valuation of Ripple’s pre-IPO shares on Linqto stands at $35 per share. This interprets to a $5.7 billion valuation.

Jones emphasised the importance of the corporate’s substantial holdings in XRP, with 42 billion XRP in escrow. They might contribute to an mixture value of roughly $107 billion, far exceeding its present valuation on Linqto. This evaluation considers the potential decision of the authorized battle with the SEC and its affect on XRP’s worth, indicating optimism about Ripple’s future IPO valuation.

Ripple Vs. The SEC: A Complete Overview

As of early 2024, Ripple Labs has achieved a number of notable victories in opposition to america Securities and Alternate Fee (SEC). Listed here are the important thing developments:

- Abstract Judgment Win For Ripple (July 13, 2023): Ripple Labs achieved a partial victory in its authorized battle with the SEC. The US District Court docket for the Southern District of New York dominated that XRP gross sales on exchanges and thru algorithms didn’t represent funding contracts. Consequently, these gross sales aren’t topic to federal securities legal guidelines. Nevertheless, the court docket discovered Ripple’s direct institutional gross sales in violation of those legal guidelines. It deemed them unregistered gives and gross sales of funding contracts.

- Denial Of SEC’s Interlocutory Enchantment (October 3, 2023): The SEC’s try to enchantment the abstract judgment loss was denied by Decide Torres. This marked a major setback for the regulator and underlined Ripple’s strengthening place within the lawsuit.

- SEC Drops Claims In opposition to Ripple Executives (October 19, 2023): The SEC withdrew its fees in opposition to executives Brad Garlinghouse and Christian Larsen. This resolution narrowed the lawsuit’s focus solely on Ripple Labs.

- Pending Trial and Treatments Part: The trial, set to happen between April and June 2024, shall be crucial for Ripple Labs. The principle focus shall be on the institutional gross sales of XRP value $770 million, which have been deemed unregistered securities gross sales. The treatments section will decide the penalties for these gross sales, with the SEC probably in search of your complete quantity as fines.

For a extra in-depth have a look at the XRP lawsuit, learn our devoted article.

FAQ: What Is Ripple

What Is Ripple?

Ripple is a know-how firm that makes a speciality of digital fee protocols and foreign money alternate networks. Its real-time gross settlement system and the cryptocurrency XRP are well-known options.

Will Ripple Change SWIFT?

Ripple, whereas targeted on enhancing international monetary transactions, isn’t set to completely substitute SWIFT. Nevertheless, the corporate’s sooner and cheaper options provide a aggressive various.

What Distinguishes XRP From Different Cryptocurrencies?

XRP stands out amongst cryptocurrencies like Bitcoin and Ethereum because of its excessive velocity and low transaction prices. This makes it significantly suited to fast cross-border funds.

Will Ripple Go Public?

Ripple plans to contemplate going public as soon as it resolves its authorized battle with the SEC. The potential IPO would rely on the result of the lawsuit and market circumstances.

Is Ripple Inventory Price Something?

Presently, Ripple is a personal firm, so it doesn’t have publicly traded inventory. An evaluation of the corporate’s worth can solely happen if it undergoes an IPO and turns into a public firm.

Is XRP The Identical As Bitcoin?

No, XRP and Bitcoin are totally different. Bitcoin is a decentralized digital foreign money with out a central financial institution, working on a peer-to-peer community. Ripple makes use of XRP for its fee know-how and is famend for its fast transaction processing instances.

Does Ripple Have A Good Future?

Ripple’s future is topic to varied elements. These embody the result of its lawsuit with the SEC, market adoption, and total cryptocurrency market developments. Its give attention to fee options presents potential development alternatives.

Who Invented Ripple?

Chris Larsen and Jed McCaleb co-founded Ripple. They based the corporate, initially often known as Opencoin, in 2012 earlier than renaming it to Ripple.

Featured picture from Shutterstock

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site completely at your individual danger.