Overlook lengthy maintain instances. Delighting clients means resolving their points shortly on the primary name. First name decision (FCR) tackles this head-on, decreasing buyer frustration and delivering the quick service they count on.

This text will present you enhance your FCR, unlock your group’s time, and create happier clients.

What Is First Name Decision (FCR)?

First Name Decision (FCR) is a metric utilized in name facilities to measure what number of buyer interactions are resolved on the very first contact, eliminating the necessity for any follow-up calls or contacts. It’s primarily a strategy to gauge a name heart’s effectivity in resolving buyer points.

FCR considers conditions the place a buyer’s downside is resolved:

- With out requiring an escalation to a supervisor or specialist

- With out transferring the decision to a different division

- With out scheduling a callback for a later decision

- While not having to create a separate assist desk ticket for additional investigation

A excessive FCR charge signifies a well-functioning customer support group that may effectively deal with buyer inquiries. Corporations sometimes set FCR targets to trace progress and establish areas for enchancment.

Why Is FCR Vital? (+Advantages)

A powerful first-call decision charge is a trademark of wonderful buyer assist. By monitoring and enhancing FCR, contact facilities can streamline operations and get a number of key benefits:

- Enhanced buyer satisfaction: Prospects admire having their points resolved in a single interplay. A excessive FCR demonstrates that you simply prioritize buyer wants and may clear up issues effectively. This exhibits respect for his or her worthwhile time.

- Improved buyer journey: FCR straight correlates with fast decision, minimal wait instances, and single factors of contact. Time after time, the numbers converse for themselves. Prospects love FCR, and the outcomes profit an organization’s backside line.

- Lowered common deal with time (AHT): When brokers resolve points shortly, it signifies a extra environment friendly operation. They’ll handle a better quantity of assist requests with out sacrificing high quality service.

- Decrease operational prices: FCR straight reduces prices related to callbacks, transfers, and escalations. It minimizes the necessity for extra buyer contacts, resulting in decrease operational bills.

- Boosted agent morale: Assist brokers really feel a way of accomplishment once they independently resolve buyer points. This success contributes to greater job satisfaction and motivation.

- Useful metrics and insights: FCR is a key efficiency indicator (KPI). It offers worthwhile insights into the effectiveness of your information base, agent instruments, and coaching applications.

- Improved buyer retention: Frictionless service experiences foster buyer loyalty. Excessive FCR minimizes buyer effort and strengthens buyer satisfaction, resulting in a extra loyal buyer base.

- Steady enchancment: FCR reporting helps establish areas for enchancment. Analyzing these insights helps you optimize processes, refine agent coaching, and improve the buyer expertise by means of ongoing enchancment cycles.

“For those who deal with 1,000 interactions per week, and your common first contact decision charge is 70%), that signifies that 30% of your tickets require a number of responses. Growing your typical first contact decision charge by simply ten factors to an 80% success charge means you’ll ship not less than 300 fewer emails per week or 15,600 per 12 months.”

Len Markidan

A powerful FCR technique advantages each your clients and what you are promoting. It fosters constructive buyer experiences, will increase effectivity, and empowers your name heart brokers.

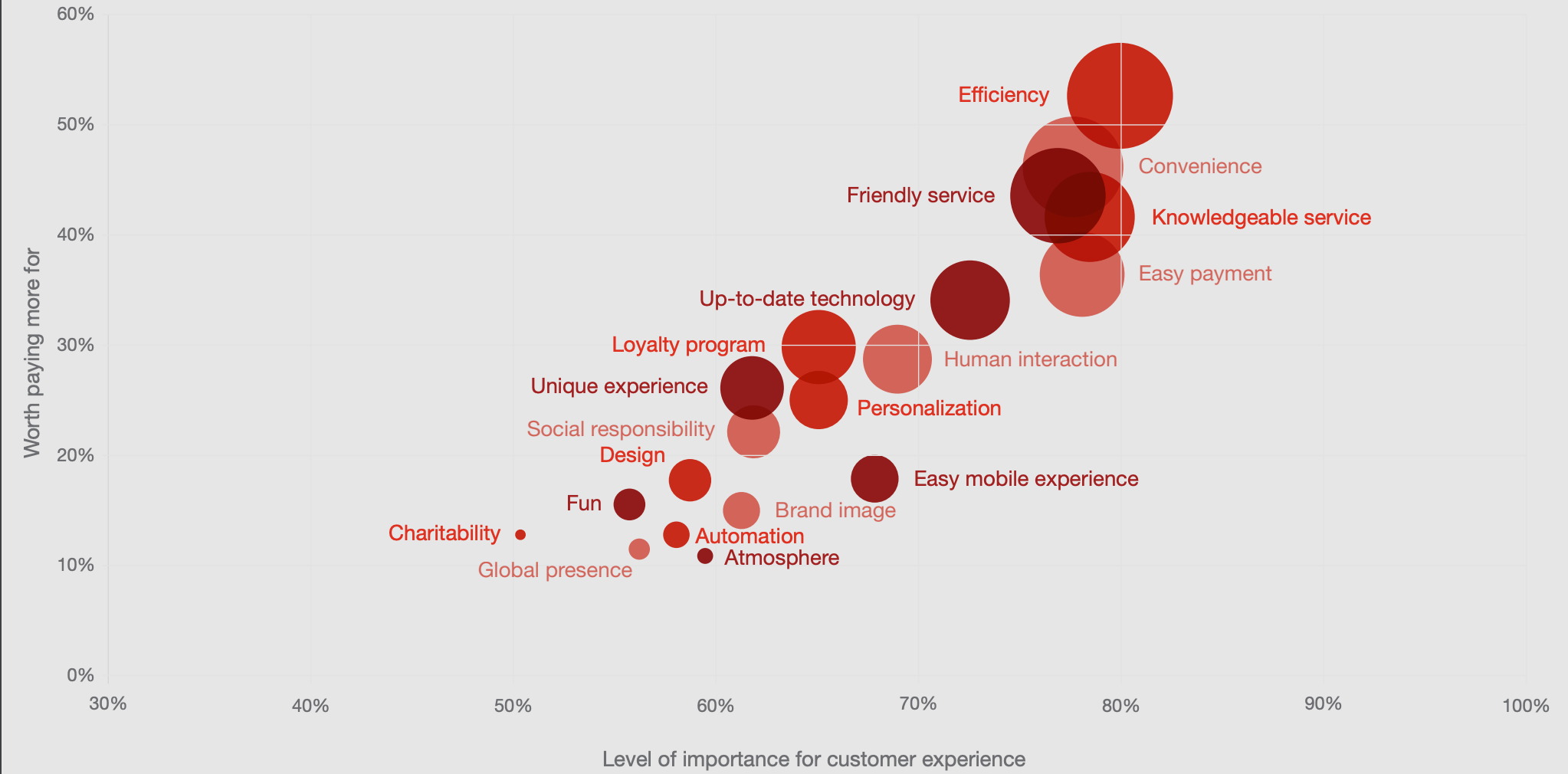

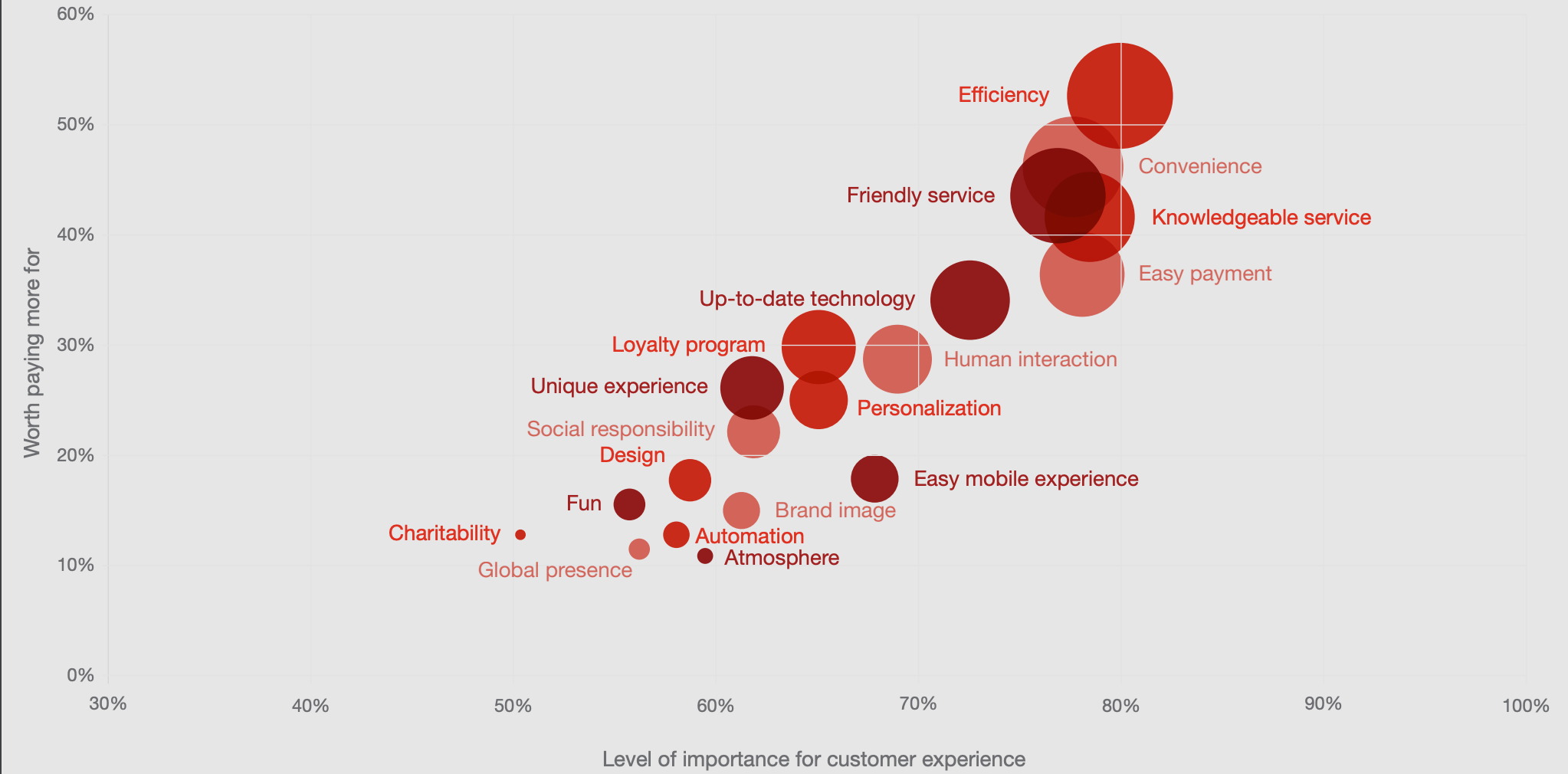

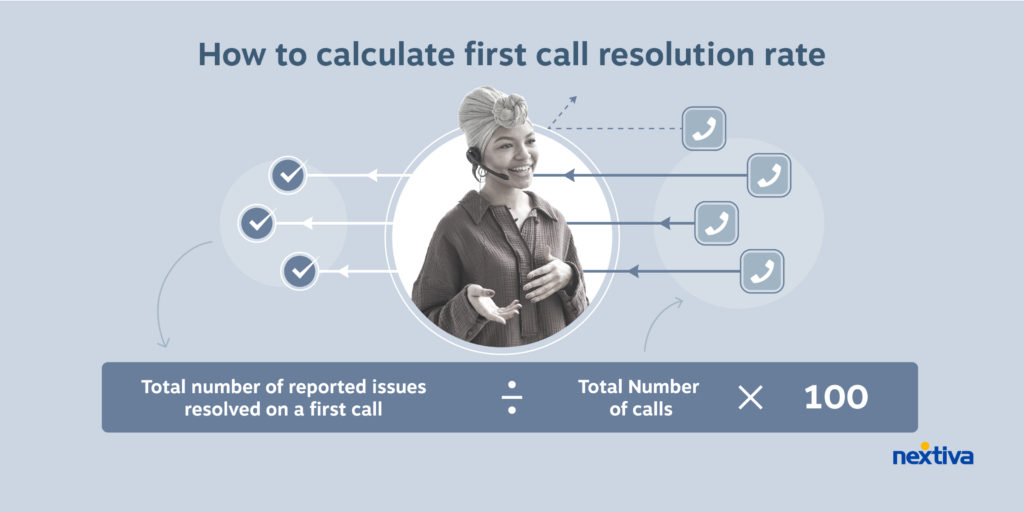

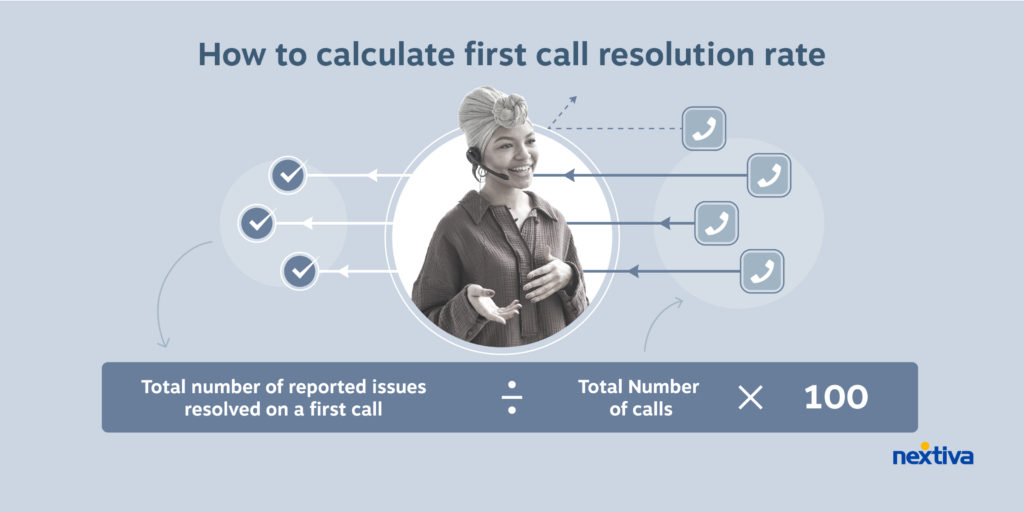

How To Calculate First Name Decision (FCR Formulation)

The system for calculating your FCR charge is:

Variety of points resolved on first contact / Complete variety of buyer contacts x 100

This offers you a transparent proportion of inquiries the place the shopper didn’t have to make additional contact to have their challenge addressed totally.

Different calculation (with a caveat)

An alternate methodology is to divide the variety of points resolved on the primary calls by the overall variety of first calls obtained. Nonetheless, this strategy doesn’t account for contacts made by means of different channels (chat, electronic mail) and may misrepresent the FCR charge.

There are essential issues when decoding FCR information. As an illustration, some buyer interactions might contain advanced points requiring escalation, which wouldn’t essentially replicate poorly on the agent’s capacity.

FCR must be seen as one piece of the puzzle alongside different name heart metrics like buyer satisfaction and common deal with time.

What’s a very good FCR charge?

FCR goal charge is dependent upon your business, however a variety of 70-75% is the business customary for sturdy name facilities. This implies roughly 3 in 4 points must be dealt with in a single contact.

That stated, there’s no single “good” first contact decision charge that applies universally, because the goal can fluctuate by firm dimension, assist channels, and the recency of the product/service.

Listed below are some basic FCR charge benchmarks:

- World-class customer support: 80%+

- Sturdy efficiency: 70-79%

- Common: 60-69%

- Wants enchancment: Below 60%

The bottom line is to match your FCR charge to previous efficiency, not business averages. Deal with steady enchancment vs. chasing static targets.

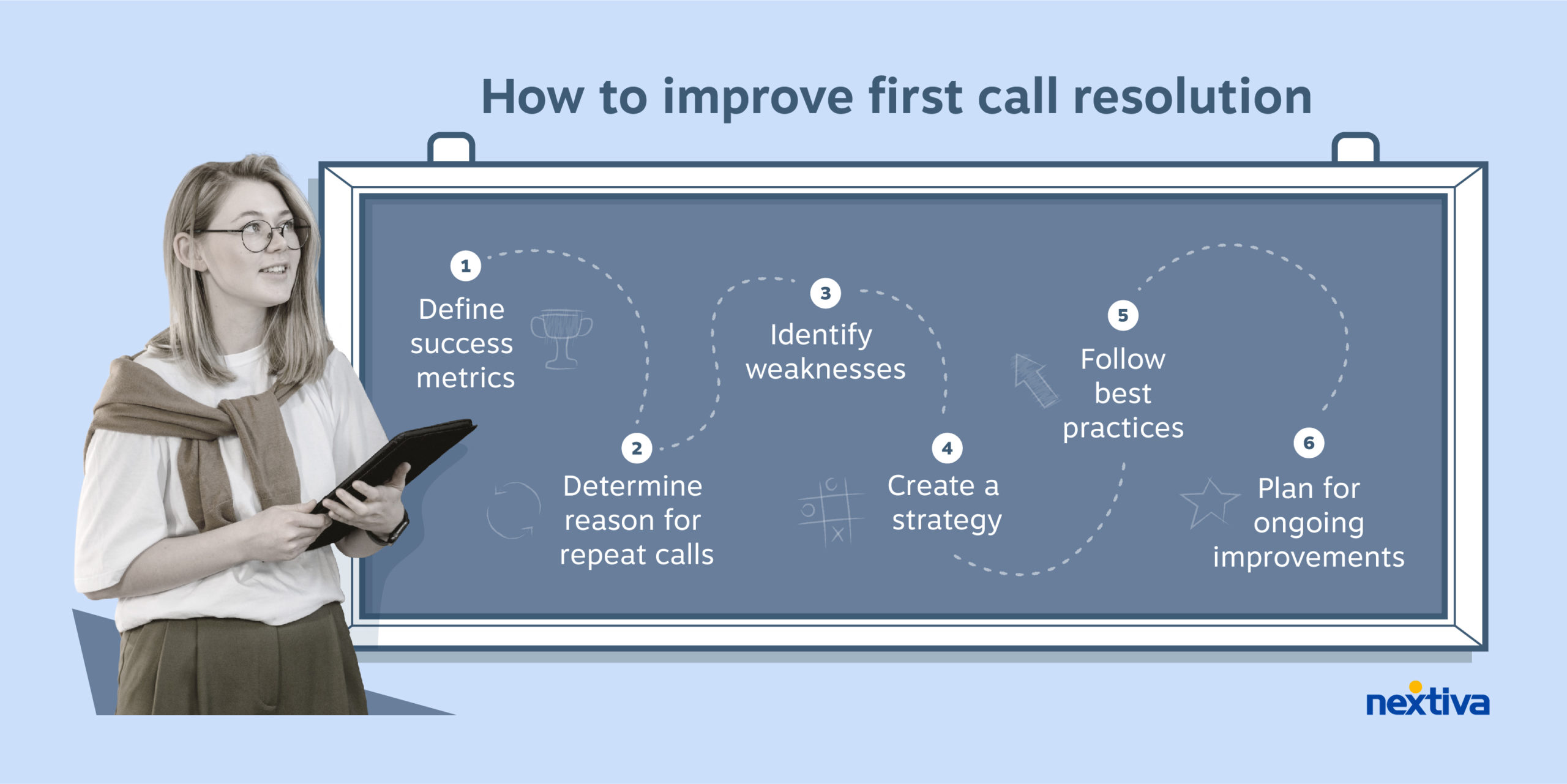

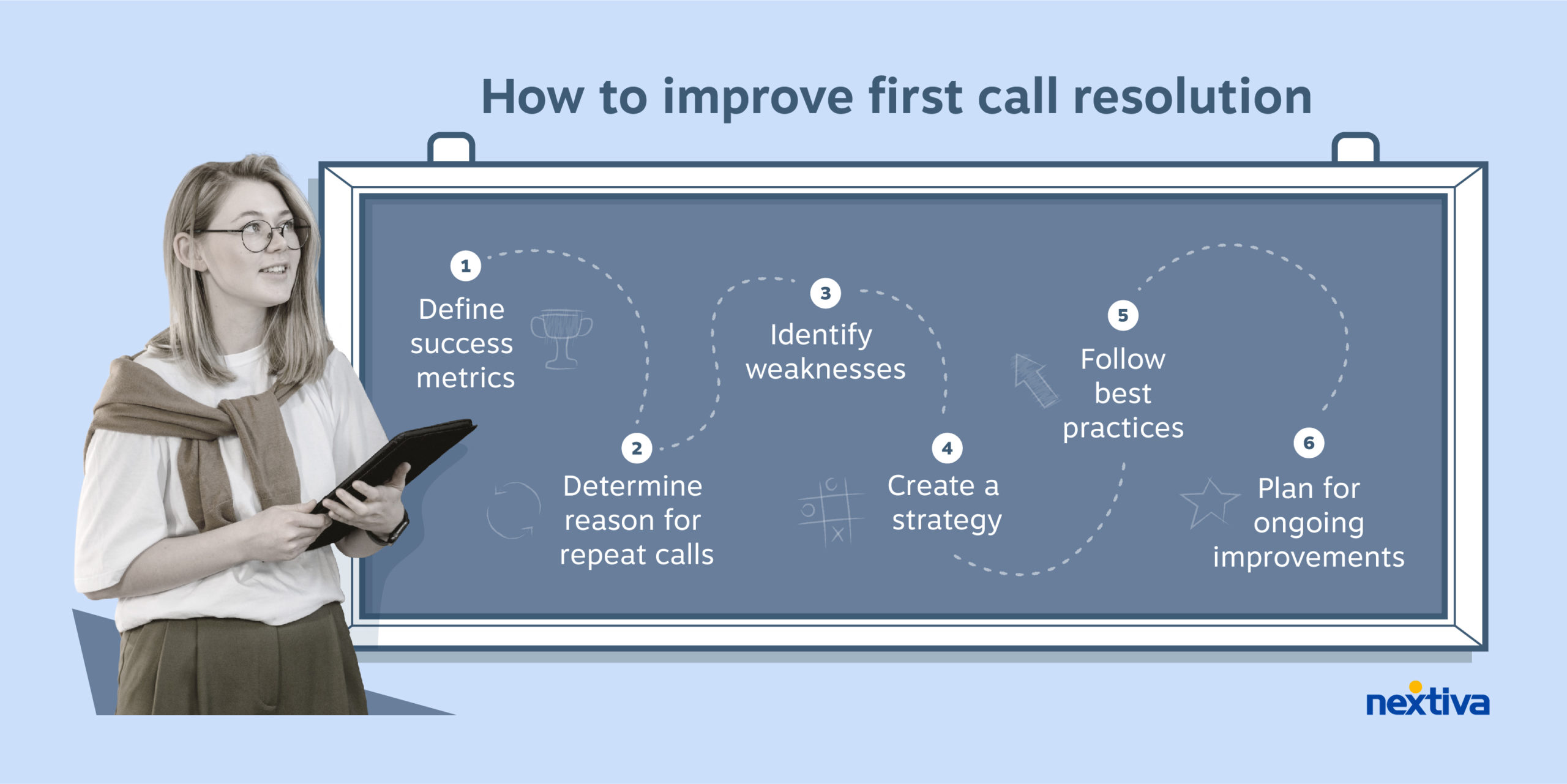

Suggestions for Bettering FCR

First contact decision is a golden metric in customer support. Listed below are just a few name decision greatest practices and techniques to empower your assist group, streamline processes, and obtain greater FCR charges.

1. Set customer-centric FCR benchmarks

Analysis what FCR charge is typical to your business and take into account how difficult your buyer calls normally are.

Then use surveys and name recordings to see what an incredible decision appears to be like like out of your clients’ perspective. This may make it easier to set targets which might be each formidable and achievable, and that maintain your clients joyful.

Be ready to regulate these targets should you get slammed with extra calls than normal — having further workers or a backup name heart prepared can assist you preserve a excessive FCR even throughout peak instances. Don’t overlook to trace your progress recurrently and replace your targets as issues change.

2. Empower your brokers

Give your brokers all of the information they want with complete guides, clear guidelines for making selections, and entry to consultants for difficult conditions.

Communication is essential too, so spend money on coaching and tutorials that assist brokers join with clients, clarify issues clearly, and maintain good information of what’s occurring.

And since issues can at all times get higher, present ongoing coaching to sharpen their problem-solving abilities and maintain their product information up-to-date.

Function-playing workout routines may be a good way to observe dealing with surprising conditions that come up. Lastly, ensure your coaching is on level by encouraging brokers to share their suggestions and counsel enhancements.

3. Streamline your processes for effectivity

Standardize the way you deal with frequent points so everybody’s on the identical web page. Design workflows that unlock brokers to give attention to fixing issues, not wrestling with advanced programs.

Use name information and information about your clients to search out areas the place you may enhance coaching, processes, and even firm insurance policies. Don’t simply give attention to the contact heart — search for root causes of repeat calls outdoors the middle too, like perhaps outdated paperwork or departments not speaking to one another.

Be upfront with clients about what’s occurring and the way lengthy issues may take. Setting expectations from the beginning helps keep away from frustration and clarifies what may be achieved in a single name.

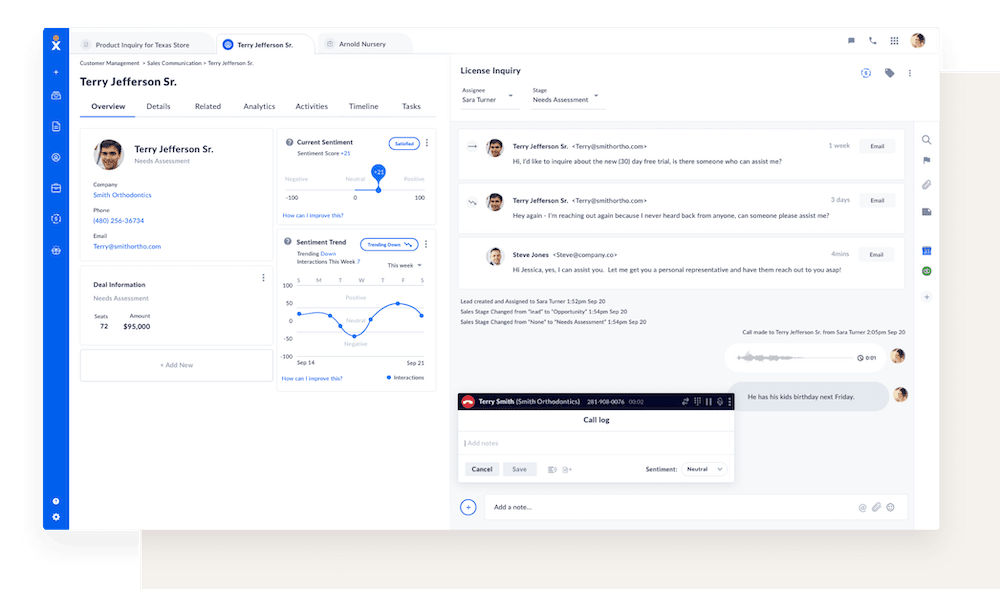

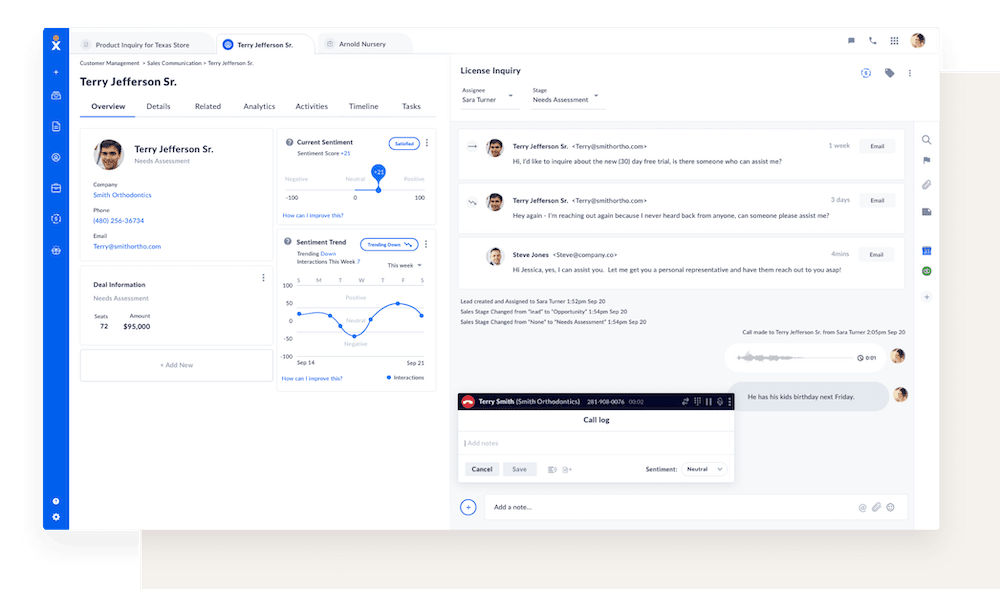

4. Leverage the appropriate instruments & expertise

Use good name heart software program to get clients to the appropriate agent for the job, relying on their challenge and the agent’s abilities.

Automation and self-service choices like chatbots or on-line information bases can deal with easy questions and unlock brokers for extra advanced issues.

Spend money on user-friendly programs that put the data brokers want at their fingertips. Use conversational intelligence like interactive voice response (IVR) for efficient name routing so the calls don’t go to the unsuitable division and go away clients feeling annoyed.

5. Construct a collaborative group

Encourage skilled brokers to mentor new group members and create an setting the place everybody feels comfy sharing concepts. Develop a transparent course of for escalating advanced points to the appropriate individuals to get resolved shortly.

Have a good time successes as a group — this motivates everybody and retains the environment constructive.

Collaboration throughout departments is essential too. By working collectively, you may handle the basis causes of buyer points and ensure everybody within the firm focuses on maintaining clients joyful.

6. Frequently enhance

Control your FCR tendencies to see if any recurring points result in repeat calls. Handle these points with extra coaching or by fixing underlying issues. Constantly investing in your brokers and your processes ensures your group at all times delivers distinctive customer support and retains your FCR charge on high.

How To Monitor & Measure FCR Success

Companies use totally different strategies to measure first name decision charges, every with its benefits and limitations:

- Buyer surveys: Straightforward to implement by means of post-call surveys or emails, gathering buyer suggestions on whether or not the difficulty was resolved on the primary contact. Nonetheless, this methodology may be inclined to sampling bias, as solely a particular group of shoppers may reply.

- Name monitoring: Use name heart software program to trace how calls are dealt with and measure agent efficiency. This consists of categorizing calls as closed/resolved on first contact, escalated, or needing follow-up. Whereas efficient, it depends on having clear name tagging protocols for correct information.

- High quality assurance (QA) evaluation: QA analysts hearken to name recordings and assess if brokers totally resolved buyer inquiries through the first interplay. This offers in-depth insights however is a handbook course of requiring time and sources.

- Repeat name evaluation: Analyzes name logs to establish the frequency of repeat calls regarding related points. This strategy focuses on tendencies in name sorts somewhat than particular person instances.

- Buyer callbacks: Proactively contacting a pattern of serviced clients inside just a few days to verify if their challenge remained resolved or required a follow-up name. This methodology provides a direct strategy however may be labor-intensive.

The best strategy to monitoring FCR efficiency is combining metrics from name monitoring instruments, high quality assurance tagging, and focused buyer surveys/callbacks to get a balanced perspective on true first name decision charges.

When evaluating your FCR metrics, set a goal benchmark however be ready to regulate if name volumes spike. Monitoring FCR over time helps establish causes of repeat contacts so you may enhance information bases, agent coaching, and merchandise.

Win FCR However Don’t Lose Prospects

Excessive first name decision is a win-win for each companies and clients. A mix of the methods outlined above and constantly monitoring progress assist companies enhance their customer support expertise.

Keep in mind, FCR is a journey, not a vacation spot. A dedication to ongoing coaching, course of refinement, and technological developments will guarantee your customer support group is well-equipped to ship distinctive first-call decision.

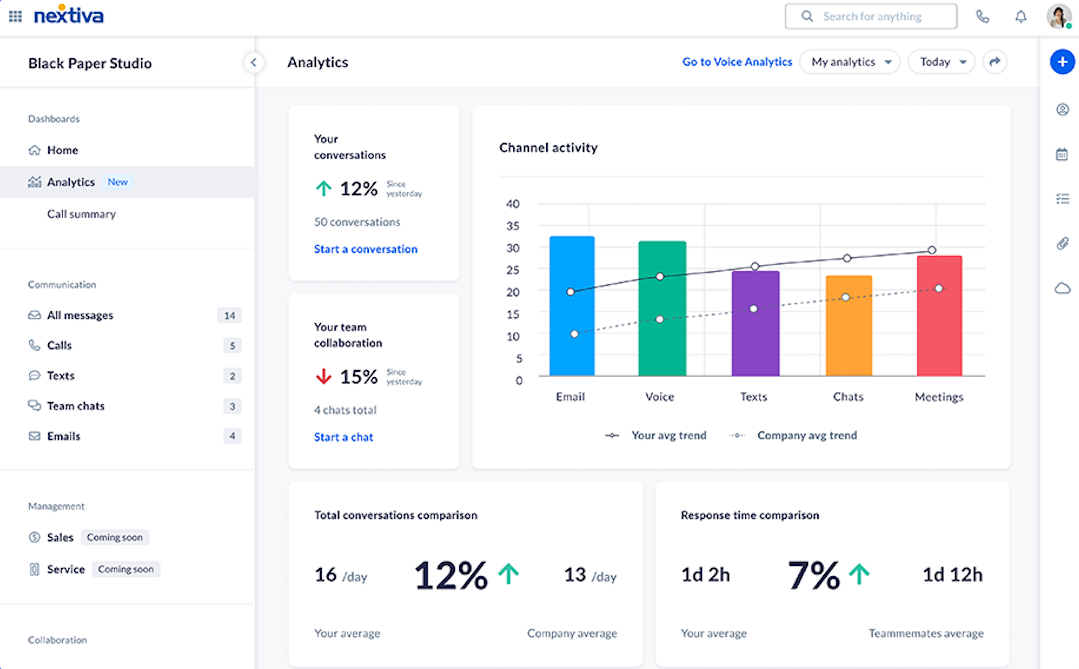

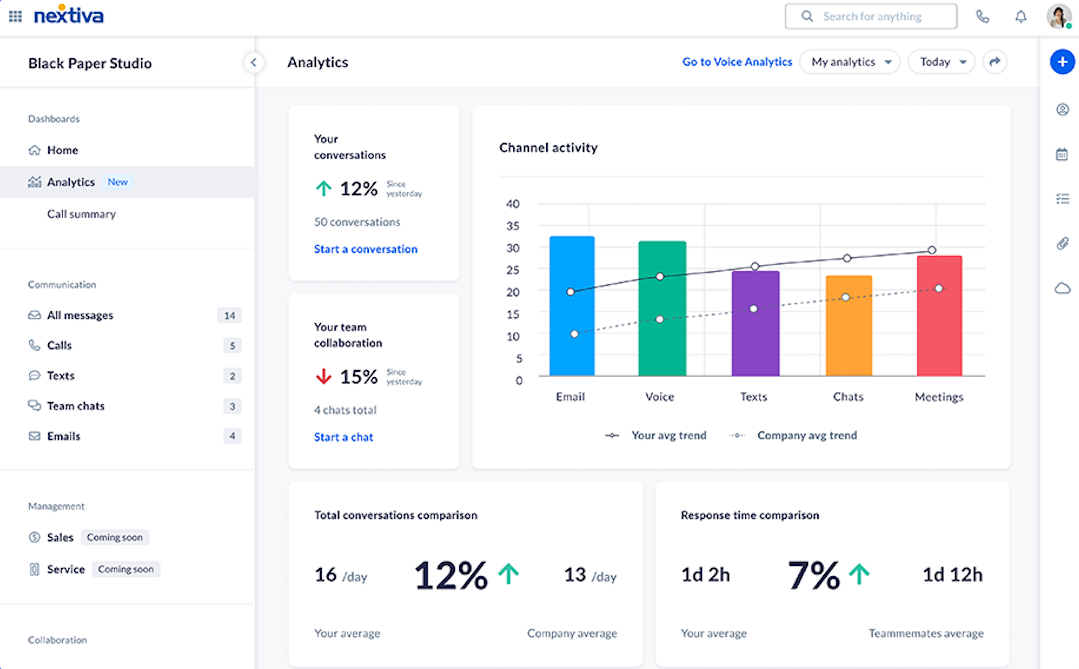

First Name Decision Made Easy With Nextiva

Excessive first name decision is the important thing to decreasing buyer churn and boosting satisfaction. And Nextiva can assist you obtain FCR excellence with its suite of cloud name heart options.

What does Nextiva have on the desk?

- Easy monitoring: Constructed-in name analytics simplify FCR monitoring and enchancment.

- Actionable insights: Voice analytics pinpoint downside areas for focused fixes.

- Empowered brokers: Actual-time dashboards & stories optimize decision-making.

- Maximized effectivity: Clever routing enables you to deal with extra calls with fewer brokers.

- Unified assist: Provide seamless service throughout telephone, electronic mail, chat, and social media.

- Self-service choices: A sturdy information base and FAQs empowers brokers.

Get a cloud contact heart resolution from Nextiva.

IVR, name recording, VoIP numbers, name routing, superior reporting–built-in in ONE cloud platform.

First Name Decision FAQs

Frequent challenges with FCR embody:

– Lack of agent information: Prepare brokers completely on merchandise, providers, and troubleshooting procedures.

– Advanced buyer points: Empower brokers to escalate advanced points or provide self-service choices.

– Info silos: Guarantee brokers have entry to all related buyer info.

– Deal with telephone calls: Embody resolutions by way of electronic mail, chat, or self-service.

To mitigate these challenges, give attention to agent coaching, information base growth, and enhancing inside communication.

FCR can influence different metrics in each constructive and detrimental methods. Initially, greater FCR may result in:

– Elevated discuss instances: Brokers might take longer resolving points on the primary contact, investigating completely, or consulting colleagues.

– Larger wait instances: Brokers spending extra time per name can result in a brief rise in wait instances for different clients.

Nonetheless, these are short-term rising pains. As your group improves:

Each discuss instances and wait instances ought to enhance. With higher problem-solving abilities, brokers can resolve points effectively, bringing down total name length and wait instances.

Don’t confuse short-term will increase with inefficiency. Deal with the long-term good thing about empowered brokers resolving points fully on the primary attempt.

Whereas FCR is a worthwhile metric, it’s essential to think about it alongside different key efficiency indicators (KPIs) to realize a complete view of buyer expertise. Some complementary metrics embody:

– First Response Time: Measures how shortly buyer inquiries obtain an preliminary response.

– Buyer Effort Rating (CES): Evaluates how simple it’s for patrons to get their issues resolved.

– Buyer Satisfaction Rating (CSAT): Gauges how happy clients are with the service they obtain.

– Web Promoter Rating (NPS): Measures buyer loyalty and the probability of recommending the corporate to others.

FCR influences these metrics as a result of a excessive first name decision charge can result in shorter response instances, decrease buyer effort, elevated satisfaction, and constructive word-of-mouth.

Listed below are some key greatest practices to enhance FCR.

– Empower brokers: Spend money on coaching and a complete information base to equip brokers for dealing with various points.

– Follow lively listening: Prepare brokers to know buyer considerations clearly, avoiding misunderstandings and guaranteeing first-time decision.

– Clearly talk: Emphasize concise explanations tailor-made to the shopper’s technical stage.

– Provide self-service choices: Present a user-friendly information base, FAQs, and discover chatbots for easy inquiries.

– Monitor & enhance: Monitor FCR charges, analyze repeat contacts to establish roadblocks, and constantly work on enchancment.