After a corrective motion within the earlier week, the Markets continued to put on a tentative look all through the previous week as effectively. Within the earlier technical notice, it was talked about that the extent of 22525 has now develop into an intermediate prime for the markets and any runway upsides shouldn’t be anticipated. It was additionally talked about that this corrective undertone would possibly persist for some extra time. Volatility additionally cooled off as India Vix declined by 10.74% to 12.22. The markets continued to remain and commerce on the analyzed traces whereas they oscillated within the 470-50 factors vary over the previous few days. The headline index lastly closed with a negligible acquire of 73.40 factors (+0.33%).

Nothing a lot needs to be anticipated from the approaching week; the markets are prone to keep in an outlined vary with no tangible upsides seen past just a few technical rebounds. Importantly, we’ve month-to-month derivatives expiry lined up. Additionally, on prime of it, we’ve only a 3-day buying and selling week. Monday is a buying and selling vacation on account of Holi and Friday is a buying and selling vacation on account of Good Friday. The month-to-month derivatives expiry and the brief buying and selling week might not assist the markets for any type of runaway upmove happening. The earlier week’s excessive level is prone to act as resistance over the approaching days; bay and enormous, apart from any intermittent technical rebounds, we’re unlikely to see any runaway type of upmove.

The approaching week is predicted to see the degrees of 22200 and 22380 performing as speedy resistance factors for the markets. The helps are available at 21700 and 21610 ranges. The buying and selling vary is predicted to remain reasonably wider than standard.

The weekly RSI stands at 65.63; it stays impartial and exhibits no divergence. Nonetheless, when subjected to sample evaluation, it exhibits a unfavourable divergence towards the worth. The weekly MACD has proven a unfavourable crossover; it’s now bearish and trades beneath its sign line.

The sample evaluation exhibits that the final section of the upmove that the Nifty had has include a unfavourable divergence of the RSI towards the worth. Whereas the worth marked larger highs, the RSI didn’t and this led to the unfavourable divergence. Within the course of, the Nifty has additionally fashioned an intermediate excessive at 22525 ranges. The closest assist exists within the type of a 20-week MA which at present stands at 21407. This will hold the markets underneath corrective strain; no vital upmove could be anticipated and the corrective undertone might proceed to persist for a while.

All in all, we’re prone to see banking and finance house attempting to enhance their relative efficiency. In addition to this, the defensive pockets like IT, Pharma, FMCG, and many others., may even see some resilient present as they attempt to enhance their relative energy towards the broader markets. It needs to be famous that each one upmove or technical rebounds are prone to discover promoting strain at larger ranges. It’s strongly really helpful to make use of all technical rebounds as and once they happen to guard earnings at larger ranges. Whereas persevering with to remain extremely selective in method, a cautious outlook is suggested for the approaching week.

Sector Evaluation for the approaching week

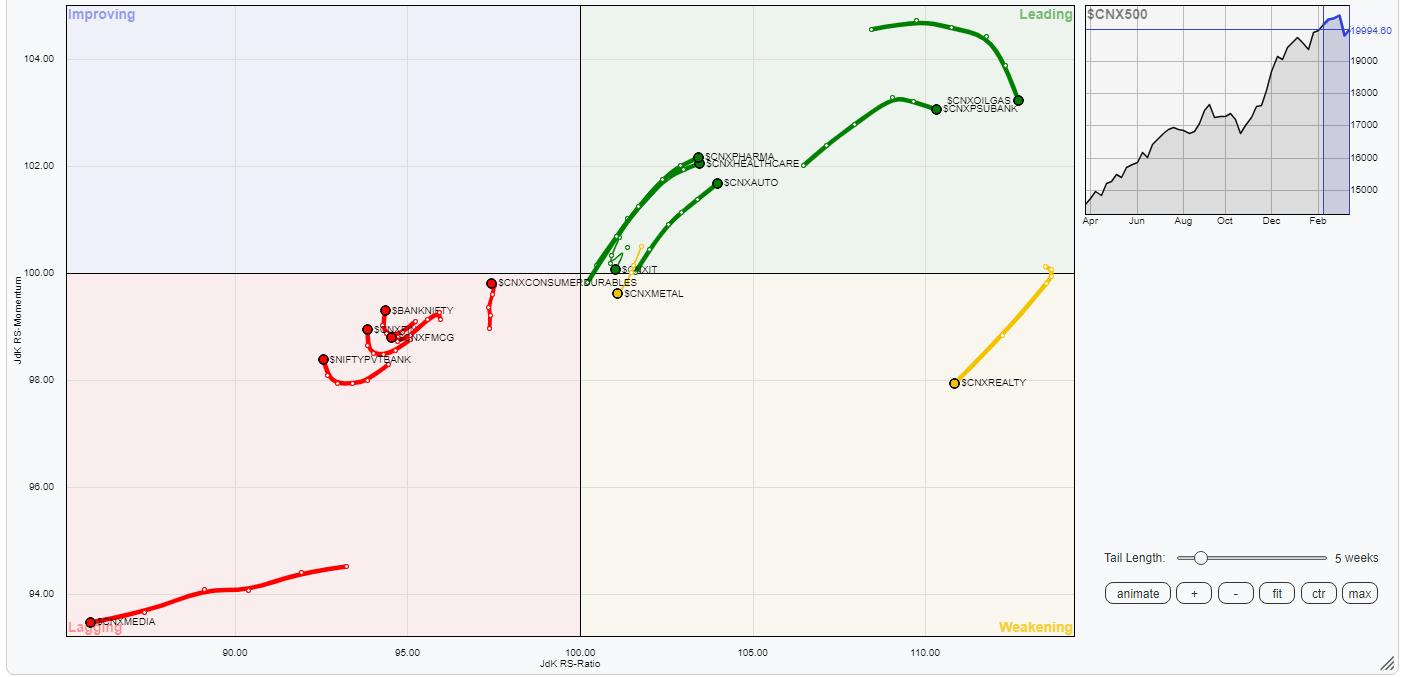

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present that we are able to count on relative outperformance from Nifty Auto, Commodities, IT, Power, Pharma, Infrastructure, Nifty PSU Financial institution, and PSE shares as these teams are positioned contained in the main quadrant. Nonetheless, few amongst these teams like PSE, Commodities, and Power are exhibiting some slowdown of their relative efficiency towards the broader markets.

The Midcap 100, Metallic, and Realty Sectors are contained in the weakening quadrant. Particular person efficiency would possibly proceed however we are able to count on the relative efficiency to get weaker from this house.

Nifty Media continues to languish contained in the lagging quadrant. Nifty Financial institution, Companies Sector, Monetary Companies, and FMCG sectors are additionally contained in the lagging quadrant, however they’re seen bettering on their relative momentum towards the broader Nifty 500 index.

The Nifty Consumption Index is contained in the bettering quadrant.

Vital Notice: RRG™ charts present the relative energy and momentum of a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Shoppers. He presently contributes each day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly E-newsletter, at present in its 18th yr of publication.