The VIX ended the week simply above 16, bringing it to its highest degree in 2024. What does this inform us about investor sentiment, and the way does this evaluate to earlier market cycles?

Let’s take a fast tour of market historical past by way of the lens of the VIX, specializing in which ranges have tended to be good indicators of market reversals, after which relate that again to our present setup with a VIX round 16 as we transfer additional into the 2nd quarter of 2024.

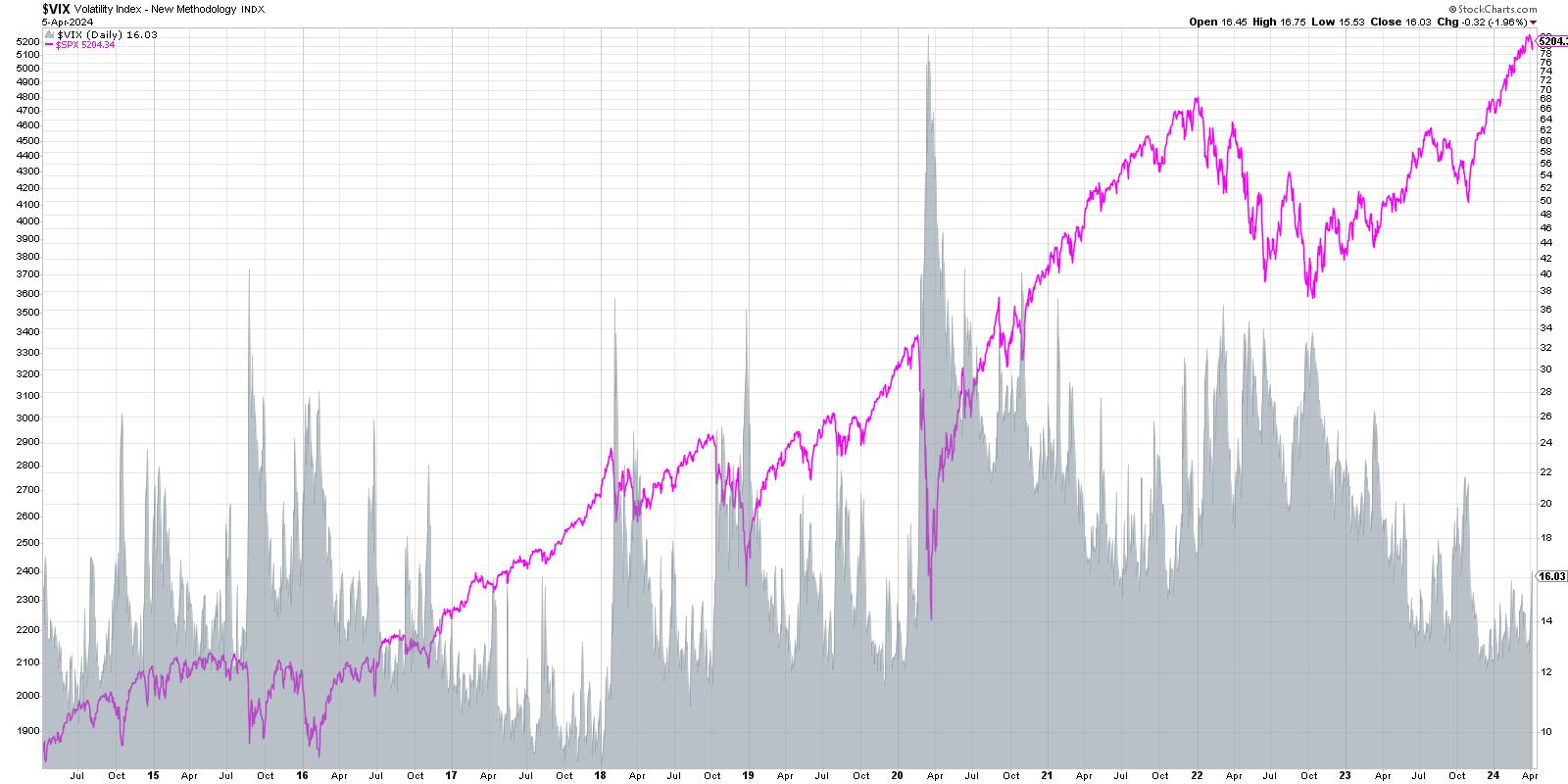

We’re beginning with a ten-year chart of the S&P 500 index (proven in pink) and evaluating that to the VIX (shaded in grey). You may most likely be drawn to the spikes within the VIX in 2020, 2019, and 2015, every of which represented important drawdowns for the S&P 500.

Why does the VIX are inclined to push greater when the SPX drops decrease? This goes again to one among my favourite market maxims, “The market goes up the escalator and down the elevator.” Mainly, bull markets are marked by slow-and-steady accumulation on the way in which up, as buyers add positions over time. However when buyers get nervous, fearing a drop in inventory costs, they have an inclination to panic and promote in a short time. Certainly, there’s usually a suggestions loop the place promoting drives costs decrease, which then begets additional promoting, which drives down costs even additional.

The VIX is usually referred to as the “worry gauge” due to this inverse relationship to inventory costs, however I favor the time period “uncertainty gauge” as a greater reflection of what the sequence is definitely designed to measure.

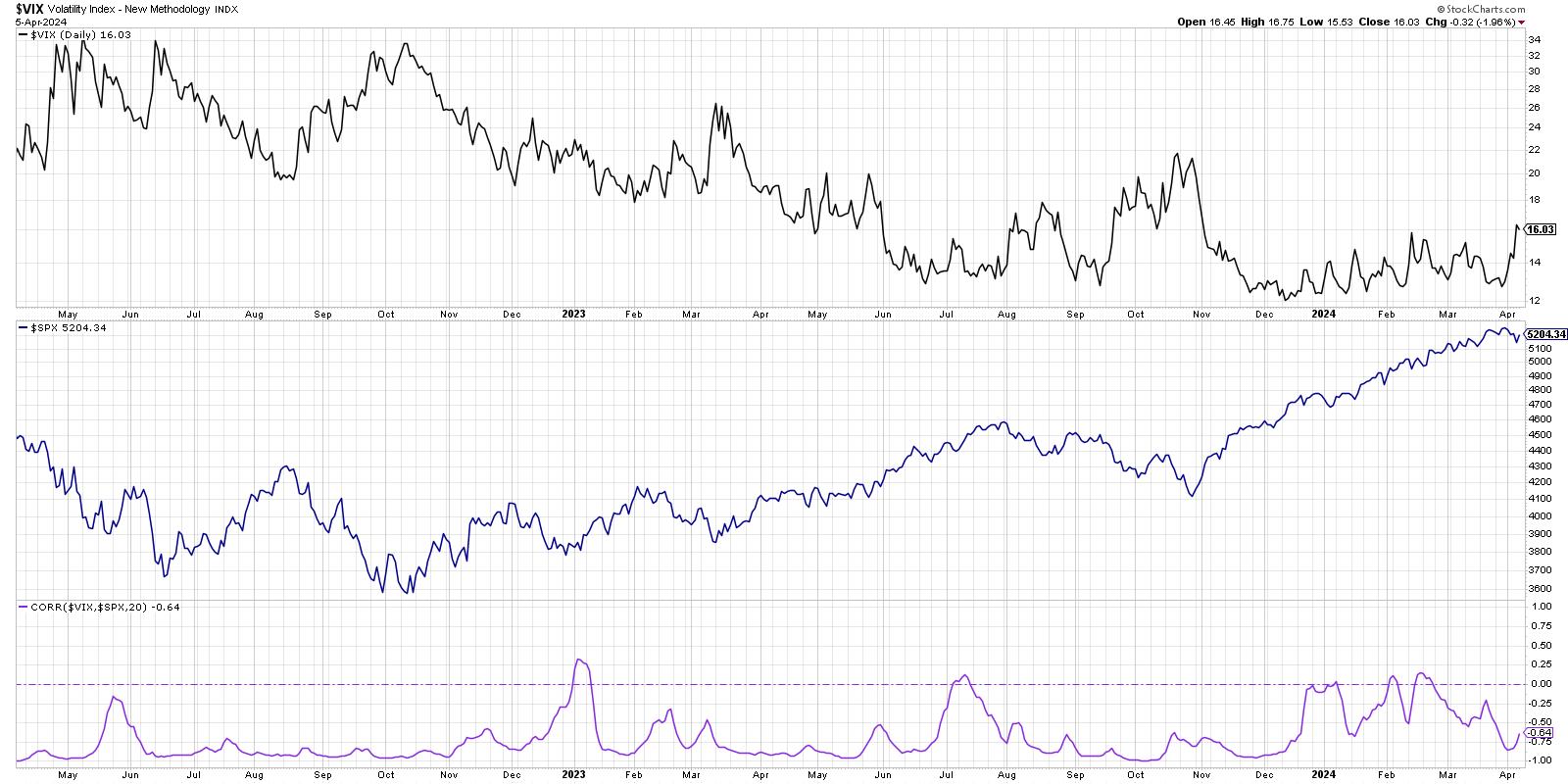

Let us take a look at the inverse relationship in additional element.

Right here we’re displaying the VIX within the prime panel, the S&P 500 within the center, after which the 20-day rolling correlation between the 2 knowledge sequence. Discover how there’s usually a robust inverse relationship between the 2? Whereas there have often been spikes within the correlation to across the zero degree (principally, no relationship between the 2 knowledge sequence), the correlation has normally remained within the -0.7 to -1.0 vary.

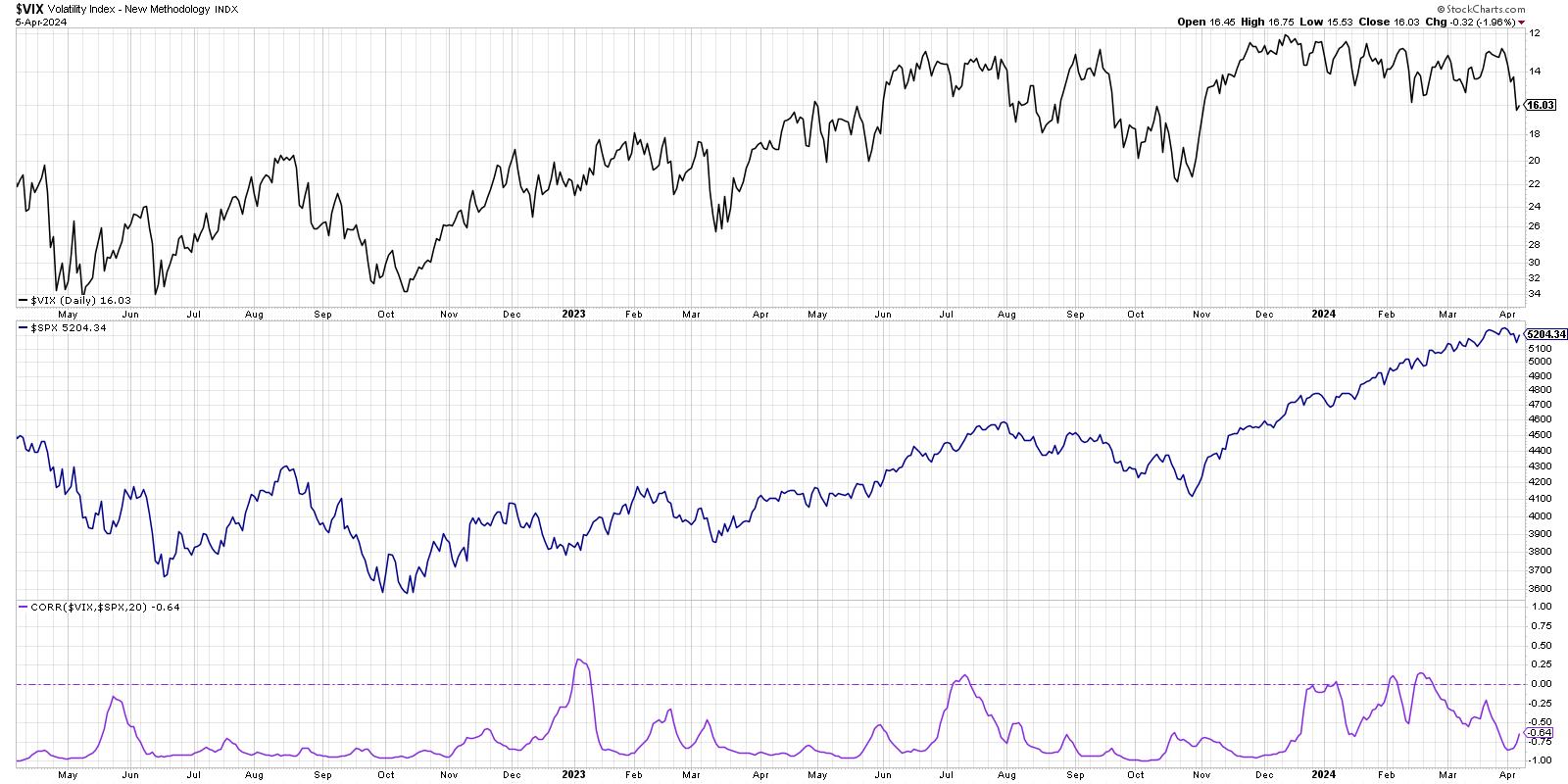

After I’m contemplating two sequence with an inverse relationship, it may be useful to invert one of many knowledge sequence.

Now we’re displaying the VIX the wrong way up within the prime panel, which makes it simpler to acknowledge how drops within the S&P 500 normally coincide with spikes within the VIX. So have we seen sufficient of an increase within the VIX to boost a pink flag on this bull market? Not fairly, in my view. However I do have some key ranges I will be watching by way of Q2.

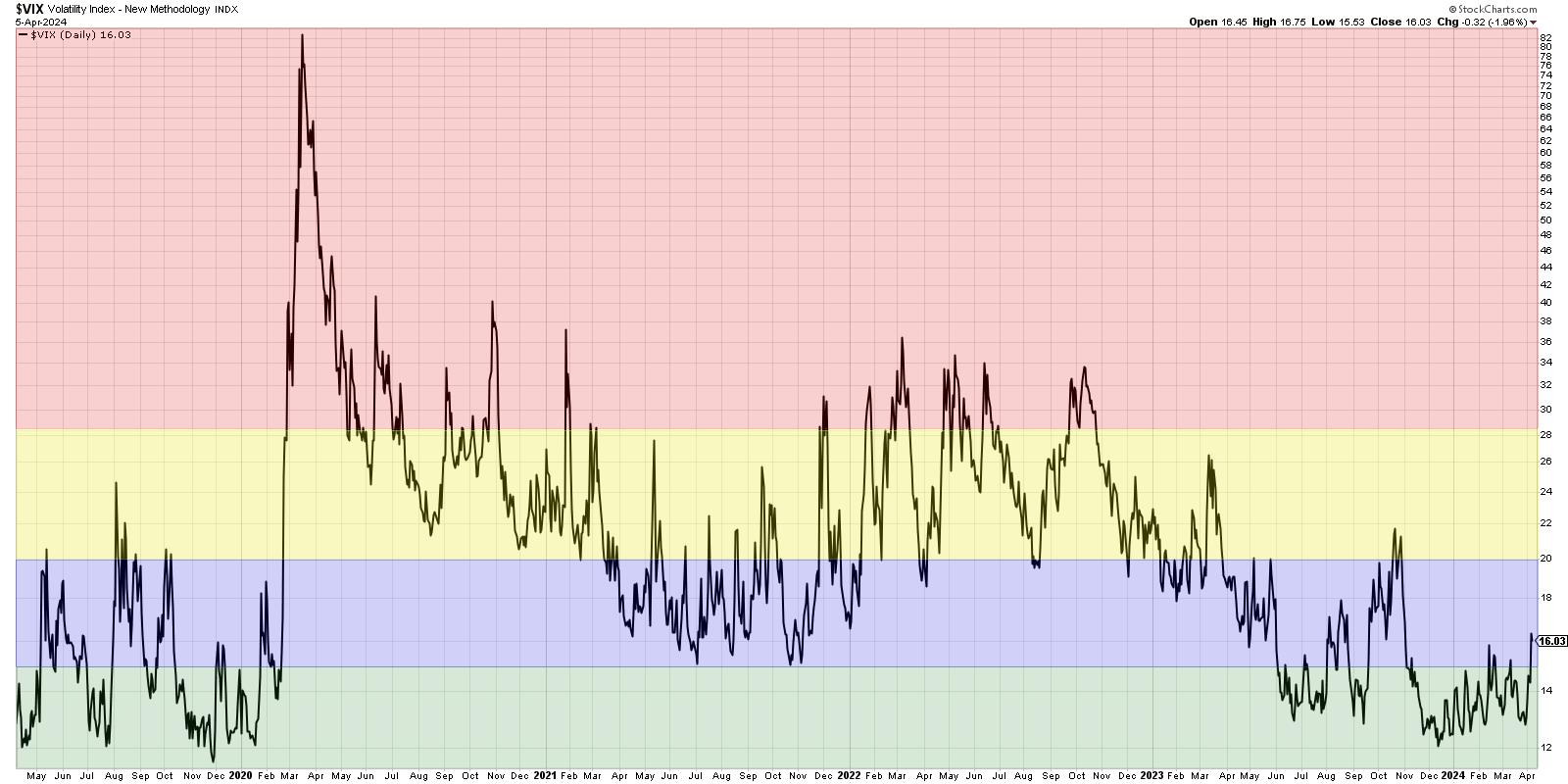

In a low-volatility setting just like the one we have seen within the final eight months, much like 2019 and 2017, the VIX spends a substantial amount of time under the 15 degree (green-shaded space). Thus, a VIX under 15 represents a low-volatility bull market section. When the VIX pushes above 15 however stays under 20 (blue-shaded space), this means that the long-term pattern remains to be constructive, however we’re possible getting into a pullback section inside that bullish pattern. Once we see a VIX push above 20 however not above 28.5 (yellow-shaded space), that might imply we at the moment are in a high-volatility setting. The S&P 500 might be in a transparent pullback by now, and buyers will likely be questioning whether or not it is the start of a a lot deeper bearish section.

The final time we broke above 20 was heading into the October 2023 market low. I used to be pretty bearish on the time, as a result of the VIX pushing above 20 normally means we’re simply getting began with a market decline. The energy of worth motion off the October low, together with bullish rotations in breadth and momentum indicators, instructed us that the VIX above 20 was a false alarm.

Now, if the VIX pushes above the 28.5 degree (red-shaded space), then the S&P 500 has basically entered a confirmed bearish section. This can be a degree I realized about from Tim Hayes at Ned Davis Analysis, primarily based on analysis they’d carried out on a deep historical past of the VIX. The final two occasions we noticed a rotation above that key 28.5 degree? November 2021 simply earlier than the 2022 market prime, and February 2020 at the start of the COVID period. A VIX above 28.5 is definitely pretty unusual, and I’ve realized to deal with extremes within the VIX as a significant pink flag and an excellent cause to rotate to risk-off positions.

A fast evaluate of market historical past tells us {that a} VIX round 16 signifies a probable pullback state of affairs inside a bullish section. Nevertheless, it additionally tells me to be ready for a better VIX, which might imply greater ranges of uncertainty. As we have seen with these charts, greater uncertainty normally means a better threat that the market takes the elevator all the way down to a lot decrease ranges!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any means signify the views or opinions of some other particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor determination making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing threat by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to establish funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra