KEY

TAKEAWAYS

- Vitality sector breaking larger on worth chart

- XLE tail on Relative Rotation Graph persevering with to choose up steam

- The exploration & manufacturing business is main contained in the vitality sector

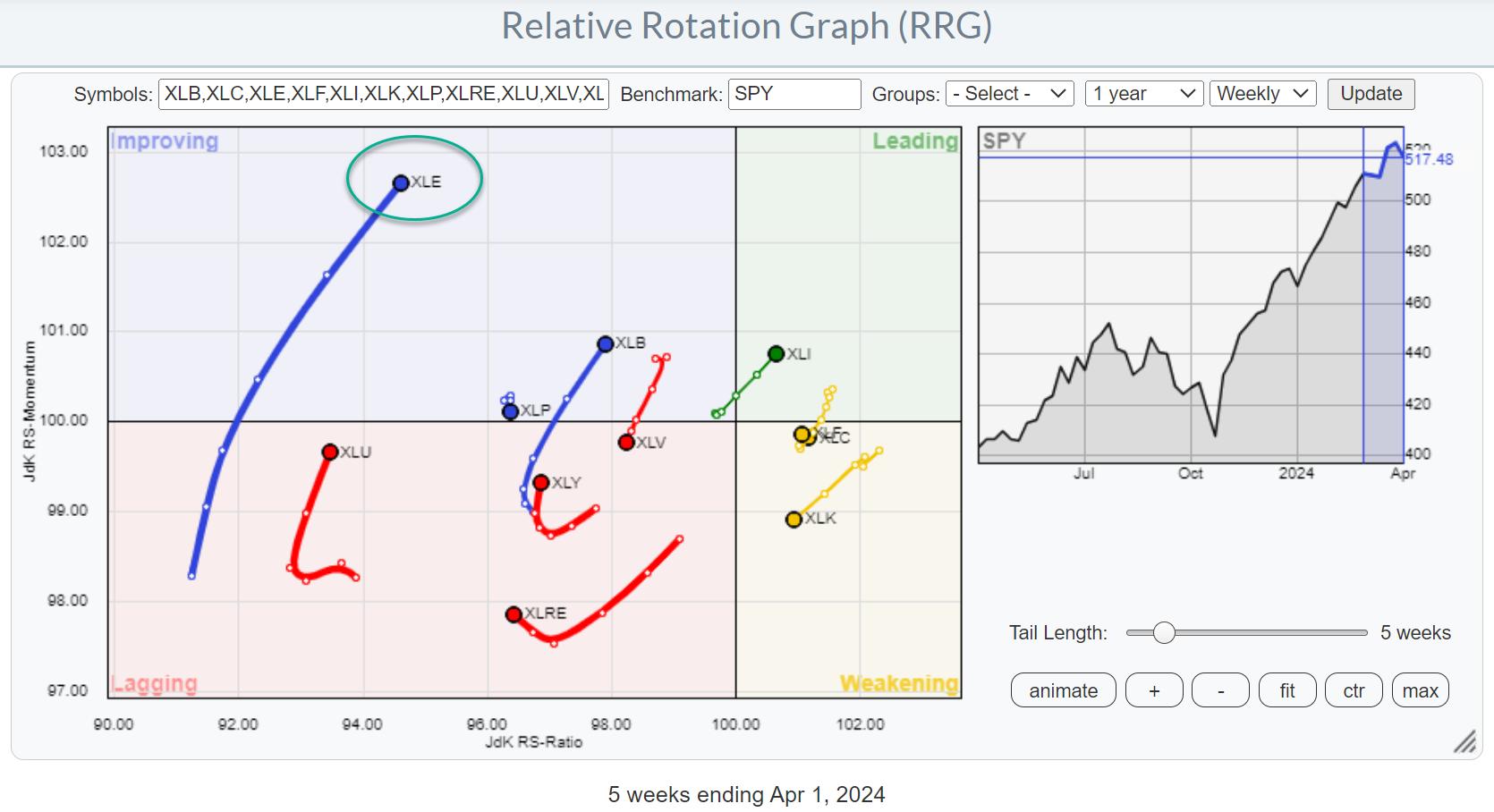

Robust Rotation on the Weekly RRG

For just a few weeks already, the development within the vitality sector (XLE) is changing into more and more seen within the lengthening of the XLE tail on the Relative Rotation Graph.

The latest rotation from lagging into enhancing on the weekly RRG is now beginning to decide up steam and likewise transfer larger on the RS-Ratio scale indicating an extra enchancment of relative energy.

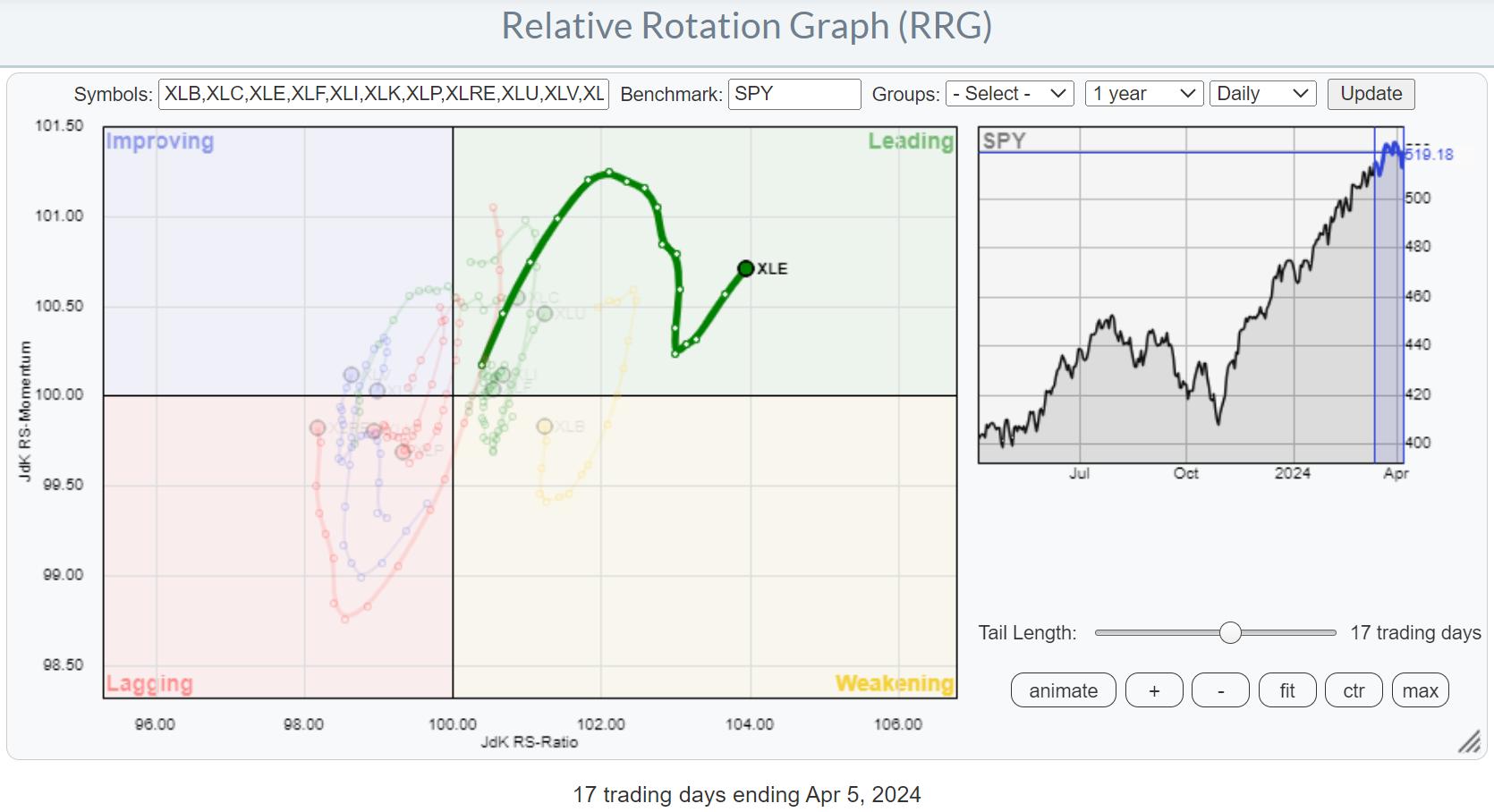

Each day Rotation is Confirming Energy

This enchancment is additional emphasised on the every day RRG, the place we discover the XLE tail effectively contained in the main quadrant with a latest “hook” again up, after a dip in relative momentum.

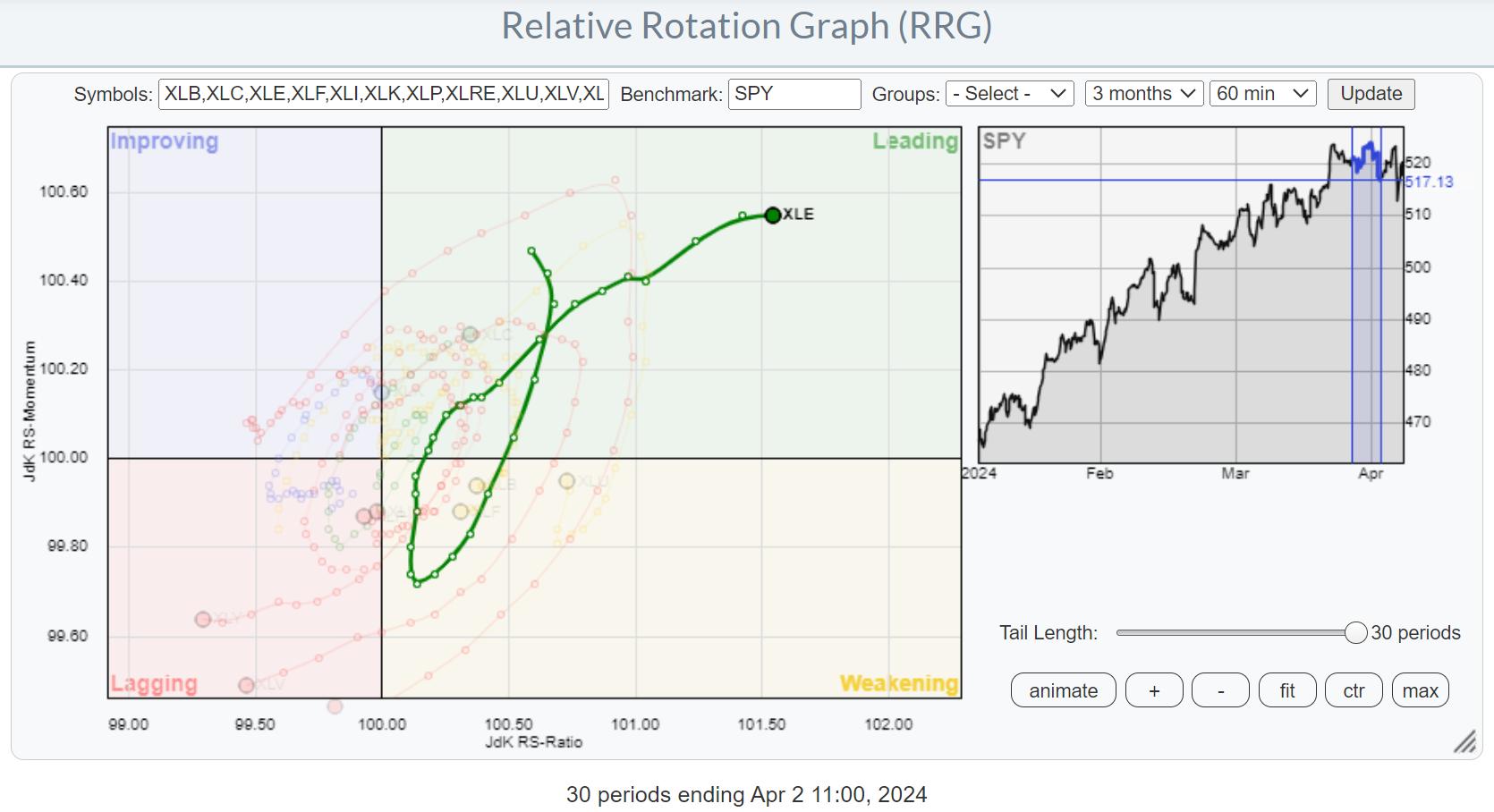

Clockwise vs Counter-Clockwise

As a facet notice, this can be a good instance the place a tail “appears” to be making a counter-clockwise rotation. However in actuality, beneath the hood, on a smaller time-frame, there’s a clockwise rotation seen.

On this case, the pivot on the every day tail was on 4/1 (no joke). After I zoom in on 4/1 and the encircling days utilizing an hourly RRG. A transparent clockwise rotation reveals up.

Value Breaking Main Resistance

The vitality sector was additionally talked about in my earlier article as one of many sectors that was near breaking a significant overhead resistance stage.

That is now taking place. With the surplus provide of round $94 now out of the best way, new upside potential was unlocked. It will actually assist additional enhance the relative energy of this sector.

Industries

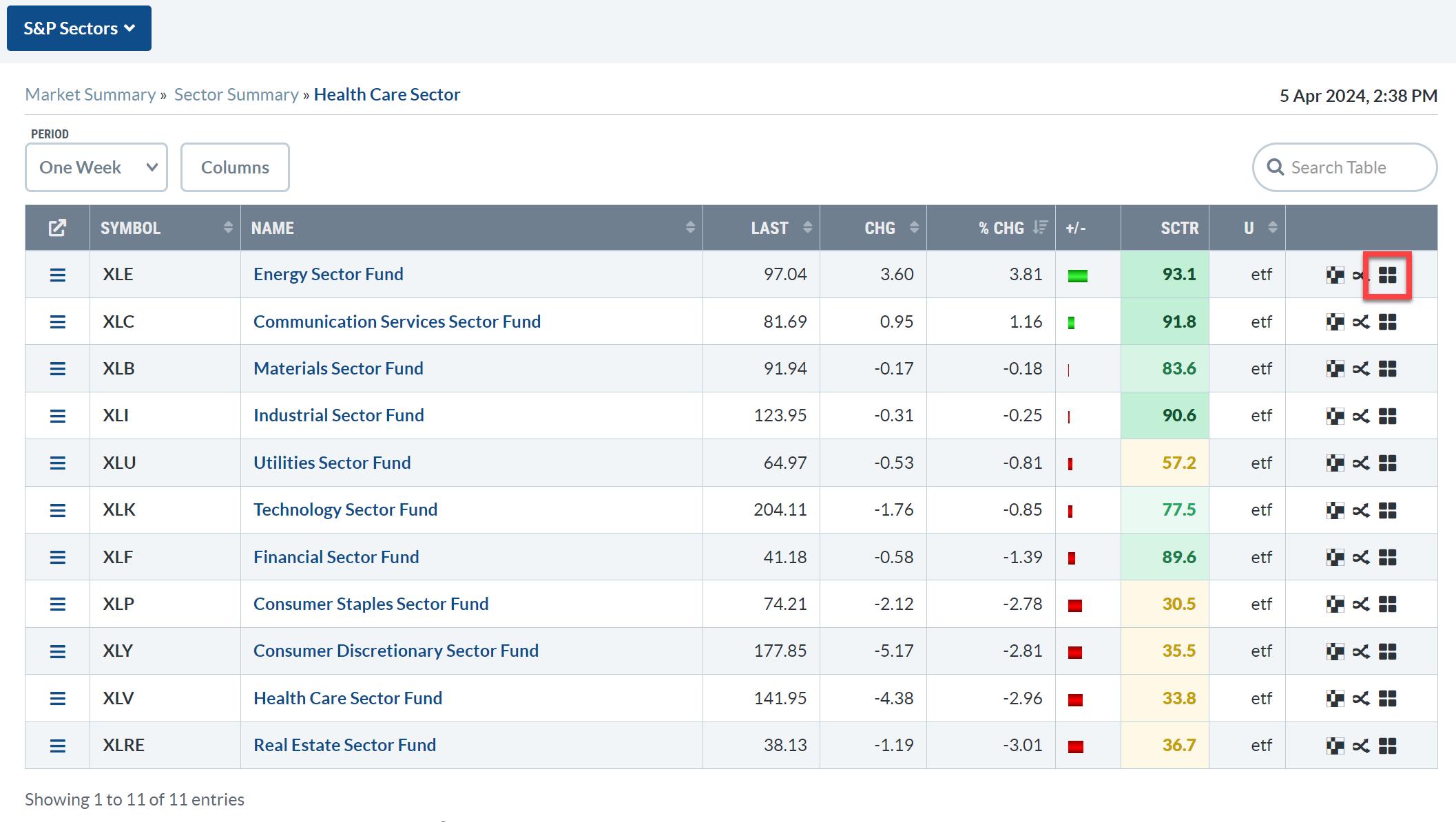

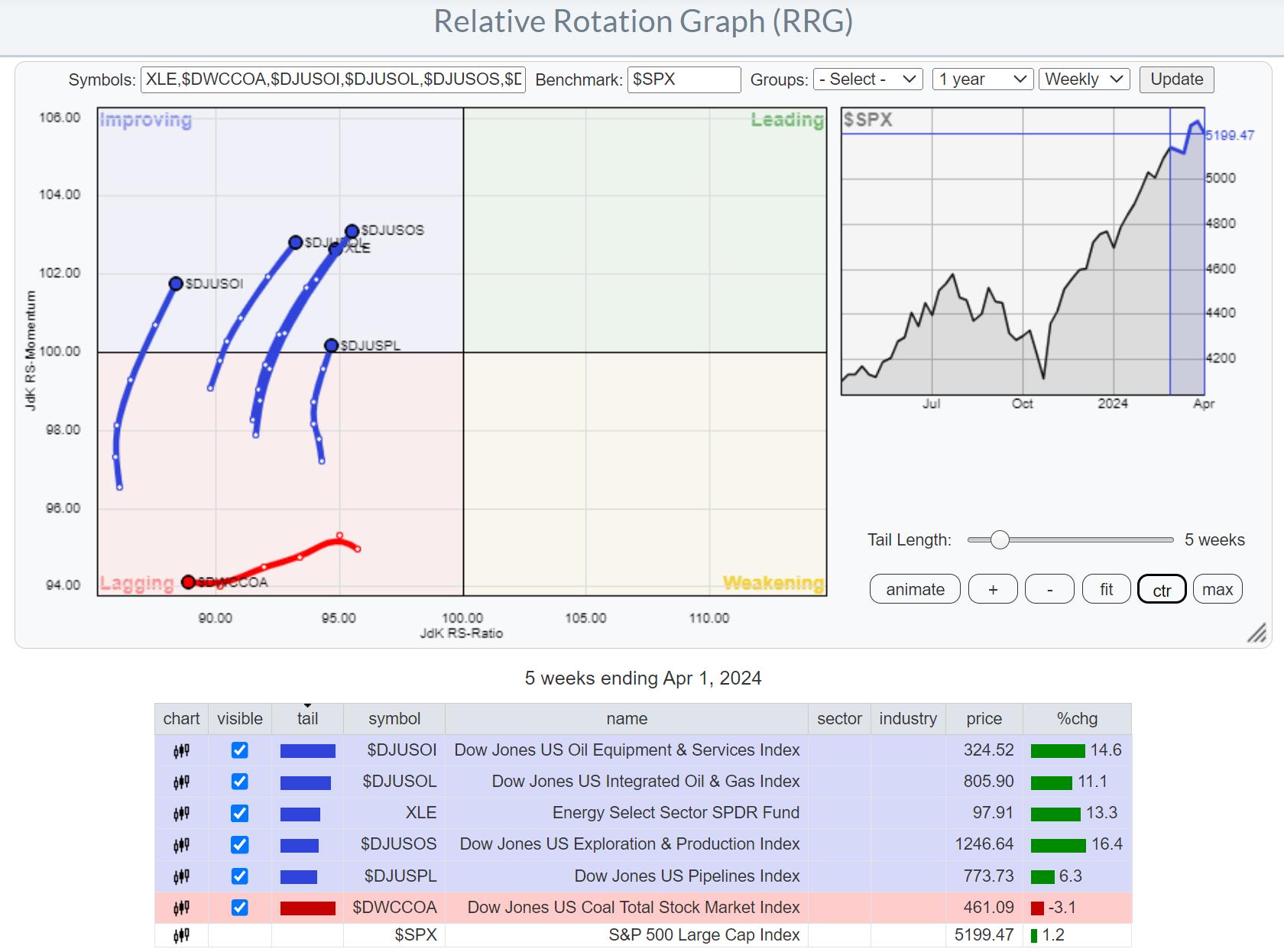

From the sector abstract web page, we are able to dive deeper into the vitality sector by opening up an RRG that reveals the rotations for the varied industries contained in the sector. Simply click on on the small RRG icon on the finish of the road.

Initially, this RRG will use the $SPX index because the benchmark. The general energy of the sector is clearly seen in all teams, besides Coal, shifting contained in the enhancing quadrant at a constructive RRG-Heading.

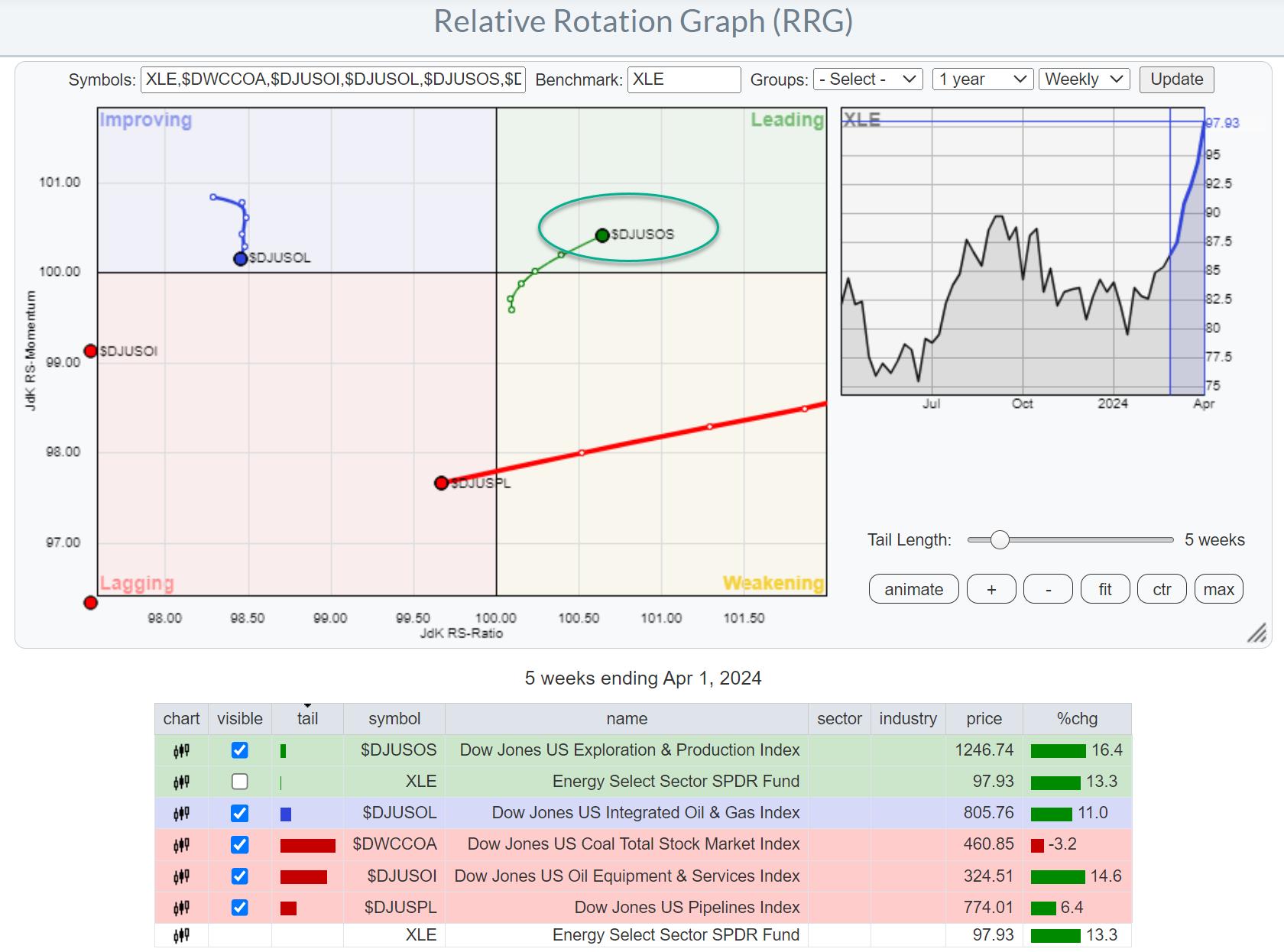

However issues change after we change the benchmark to XLE, which permits us to see the rotation of those teams inside their very own universe. We already know that the sector is doing effectively, however which industries ought to we focus our consideration on?

Exploration & Manufacturing Stands Out

This modifications the image tremendously and instantly reveals that there’s actually ONE group that’s main the Vitality sector. And that’s Exploration and Manufacturing.

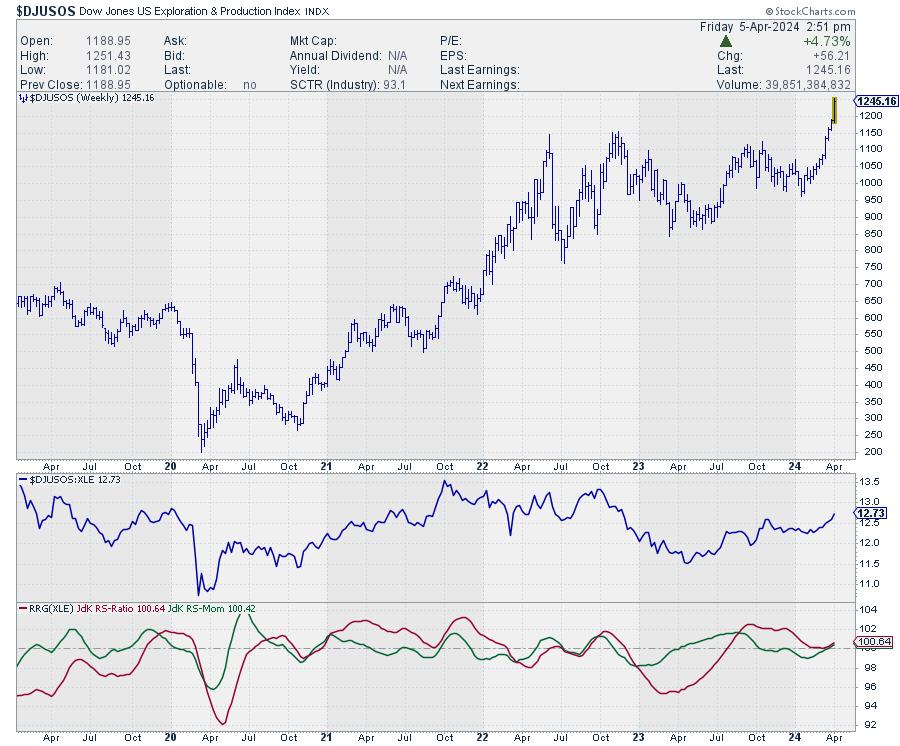

The value chart for this group speaks volumes. The upward break already occurred just a few weeks in the past, and now relative energy is admittedly choosing up tempo, with each RRG strains turning larger above the 100 stage and pushing the tail additional into the main quadrant on the RRG.

Zooming in on Particular person Shares

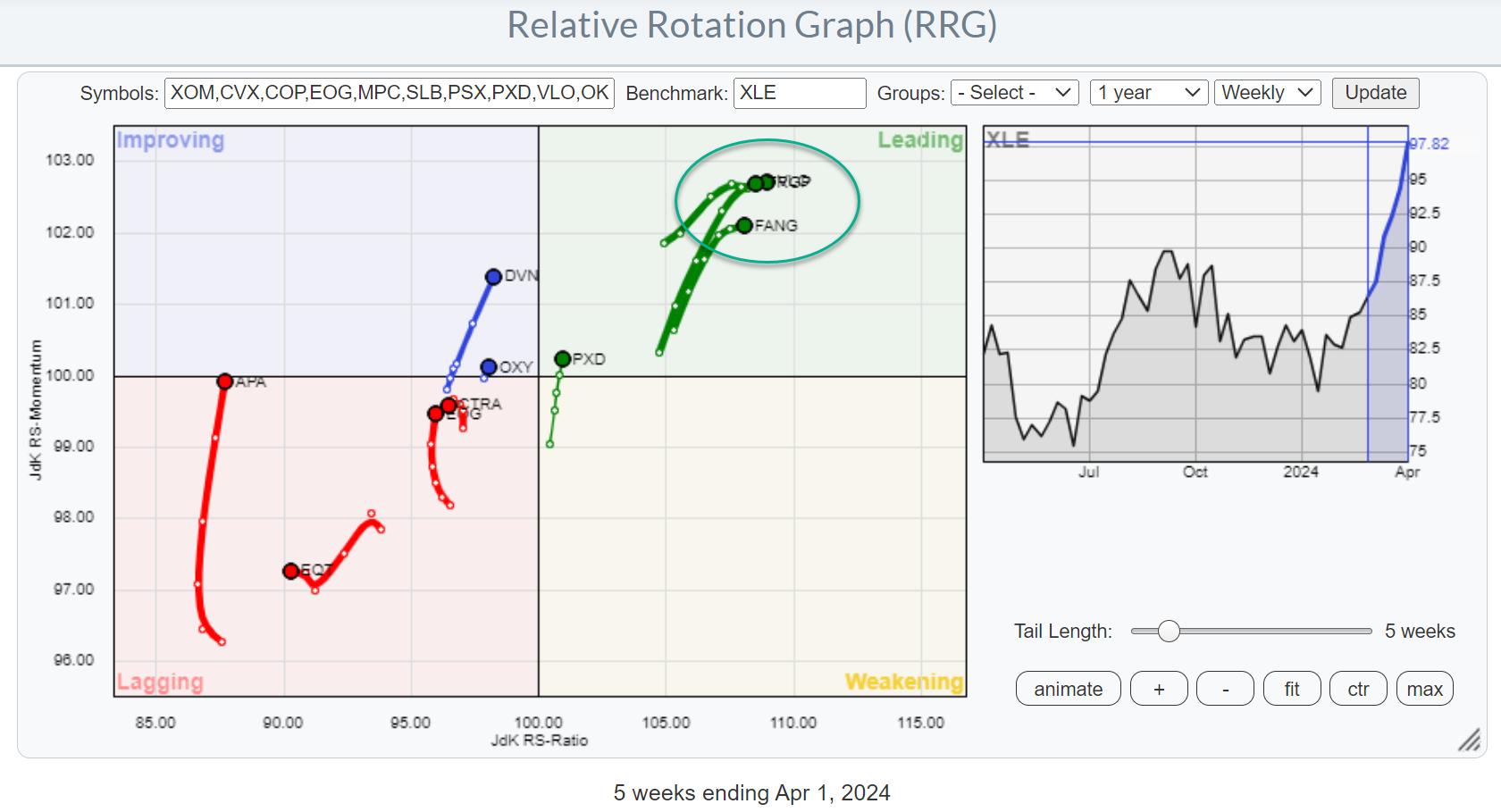

Loading the predefined RRG for members of the Vitality sector after which hiding tails/shares that aren’t in exploration and manufacturing provides the RRG above.

Going over the person worth charts reveals that the shares contained in the main quadrant, the cluster in inexperienced, has already made a major transfer larger in worth phrases. They’ve been main the preliminary rally for this group.

When in search of higher threat/reward alternatives, the tails somewhat extra to the left and even contained in the lagging quadrant most likely supply higher possibilities. Keep in mind, the sector and the group are already doing effectively so these shares are effectively contained in the enhancing or main quadrant and touring at a robust heading whenever you use $SPX because the benchmark.

Considered one of these shares is OXY. Its tail has simply moved into the enhancing quadrant, albeit nonetheless a brief tail its shifting in the correct path. The upward break within the worth chart this week will definitely assist an extra enchancment in relative energy and certain make this one of many new leaders on this business.

#StayAlert and have an amazing weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to every message, however I’ll actually learn them and, the place fairly potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Drive in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Study Extra