KEY

TAKEAWAYS

- Convey the New Market Components Panel to a Relative Rotation Graph

- Similar method utilizing completely different index household exhibits a unique picture

With the discharge of the brand new Panels characteristic on the StockCharts dashboard, there are a variety of ways in which customers of RRG charts can take benefit! Let’s take a detailed take a look at one specifically.

Market Components Panel

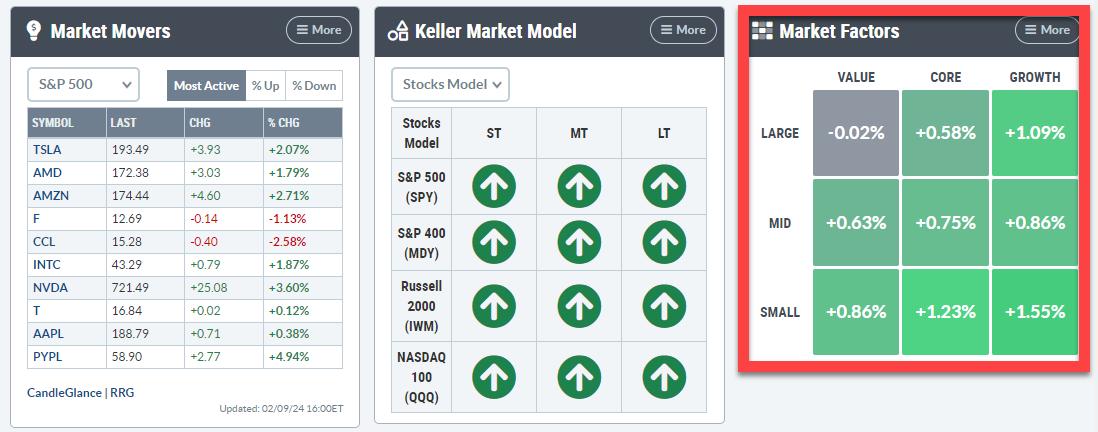

One of the vital vital new panels accessible for customers is the “Market Components” panel.

This panel slices the S&P 1500 into 9 segments damaged down by size-value-growth. It is extremely just like the one used within the RRG dropdown.

The one distinction, and there’s fairly a definite distinction (as you will notice), is that this panel makes use of S&P indices and solely covers the S&P 1500 segments. That means the S&P 400, 500, and 600, together with its progress and worth brothers and sisters.

Two Key RRGs

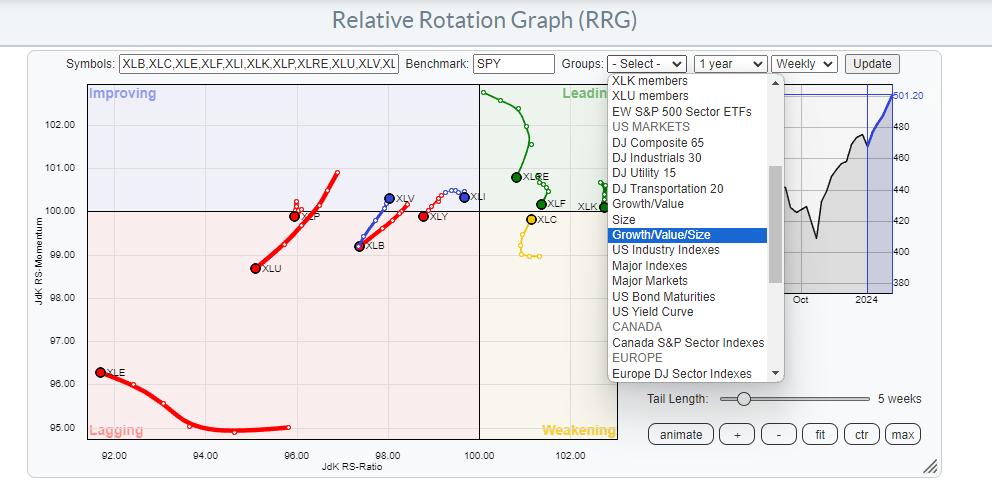

Right here is the RRG from the pre-defined record.

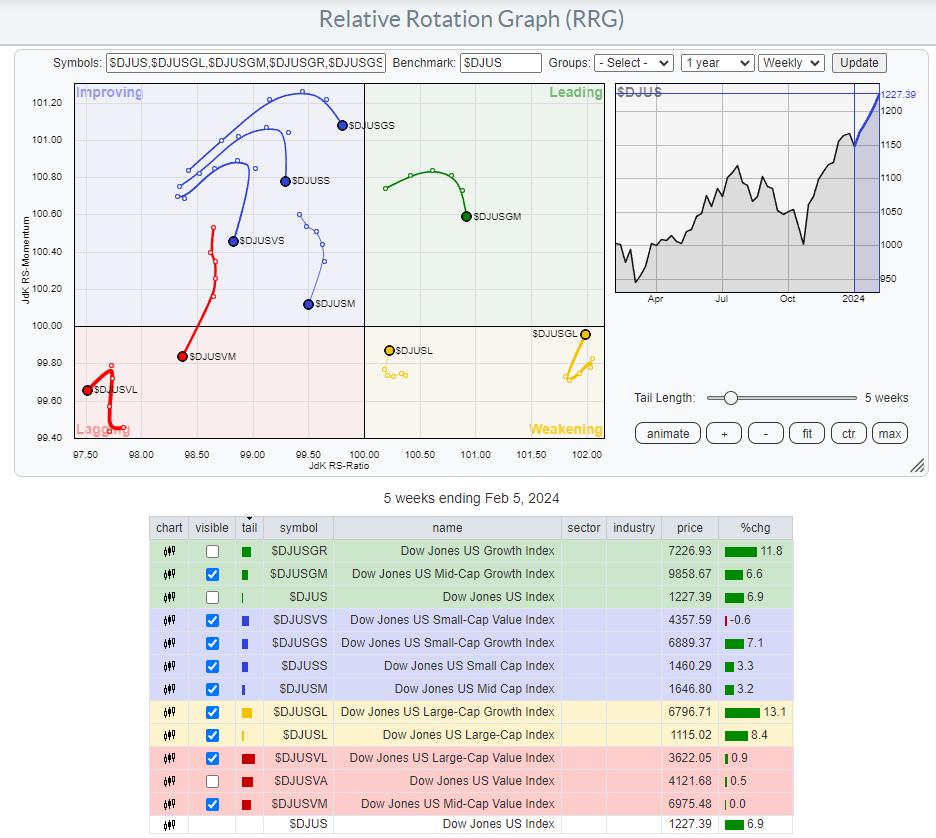

As you possibly can see, I’ve ticked off the US Progress and US Worth indexes, as they cowl your complete market (all measurement segments) and the DJ US index, the benchmark on this graph.

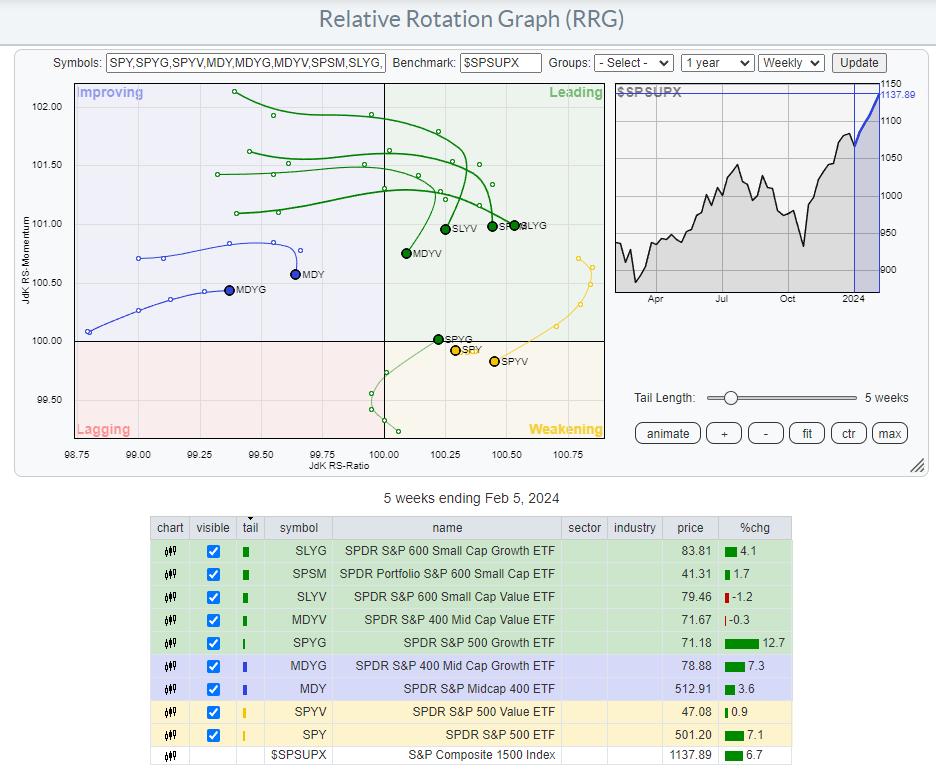

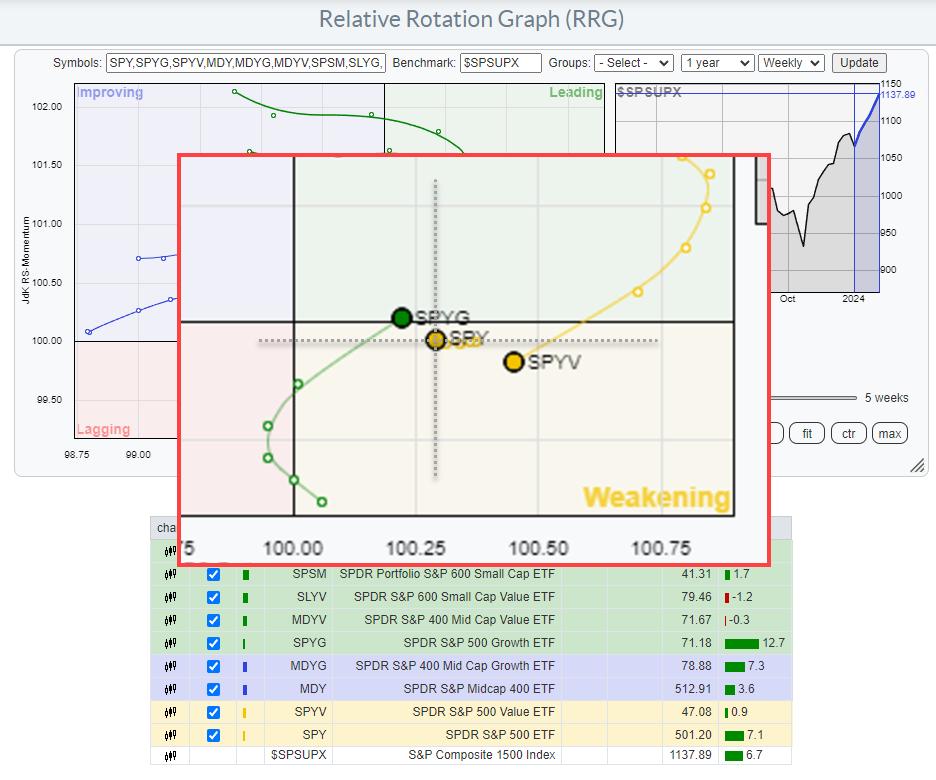

That is the RRG for the market components utilizing the identical underlying ETFs because the Market Components panel.

The RRG is linked (simply click on the picture) to a stay model on the location, which you’ll then save as a bookmark in your browser for later retrieval. I can even add this to the group of pre-defined universes.

The benchmark for this group is the S&P Composite 1500 index ($SPSUPX).

Similar Strategy, Totally different Pictures

Taking a look at these two RRGs, you possibly can see that they’re fairly completely different from one another however, within the greater image, ship an analogous message.

The variations are primarily brought on by the completely different universes. The DJ teams maintain 153 shares within the large-cap index, 314 within the mid-cap index, and 610 within the small-cap index. So, particularly within the large- and mid-cap segments, the S&P teams are a lot broader, which might have vital results on the conduct of the indexes.

I exploit these “Large Image RRGs” from a really excessive degree. This implies I pay way more consideration to the final rotations of the varied tails vis-a-vis one another than to their precise areas on the RRG.

One statement that I discovered fairly fascinating on the Market Components Panel RRG is the placement of the cluster of SPYG, SPY, and SPYV.

What you possibly can be taught from this cluster of tails is their positioning on the RRG and the relative positioning among the many three of them.

To start with, these are all S&P 500, so large-cap indices, and they’re positioned to the best of the benchmark (S&P 1500) and thus in a relative uptrend. You can too see that contained in the S&P 500 phase, progress is quickly bettering in opposition to worth. The choice began to show round some 5 weeks in the past, when the expansion and worth tails began to curve.

Very like the DJ model, albeit in a unique location on the RRG, what you additionally see is that the mid- and small-cap teams for each the expansion and worth segments have began to roll over, a few of them already at a adverse heading. The one group nonetheless at a optimistic heading is large-cap Progress, and perhaps mid-cap progress, although the latter is debatable as this tail continues to be contained in the bettering quadrant, however on flat momentum on the lowest RS-Ratio studying within the universe.

That is one thing to ponder over the weekend, because it signifies that, as soon as once more, the muse of the rally is getting narrower after an try of the mid- and small-cap teams to begin taking part. This try appears to fail, whereas the market continues to climb….. a “Wall of Fear?” Solely time will inform, however I consider there’s purpose sufficient to get extra cautious, and danger is rising each day.

#StayAlert and have an incredible weekend. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels below the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to answer every message, however I’ll actually learn them and, the place fairly potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative power inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Study Extra