Streamline compliance, mitigate dangers, enhance productiveness, and innovate your tax apply with AI.

Bounce to:

It’s a transformational time for companies as synthetic intelligence (AI) more and more impacts how corporations of all industries function and serve their clients. The accounting occupation isn’t any exception. The truth is, a rising variety of accounting corporations and companies are taking a more in-depth take a look at AI and the way it may also help them hold tempo with tax legislation modifications and guarantee tax regulatory compliance.

To shed extra gentle on the facility of AI, the Thomson Reuters Way forward for Professionals report explores how modern expertise may also help enhance operational efficiencies and productiveness in an ever-changing regulatory setting.

|

Way forward for Professionals ReportHow AI is the Catalyst for Reworking Each Facet of Work

|

The impression of AI on enterprise safety

Mitigating threat and staying on high of the most recent tax legislation modifications to guard the welfare of the enterprise has lengthy been critically very important for the occupation. Failure to take action may end up in hefty fines and penalties, in addition to a tarnished status and lack of clientele. Nevertheless, staying abreast of change and making certain tax regulatory compliance isn’t at all times simple, particularly in a dynamic and world market. Underscoring this level, the Way forward for Professionals survey of greater than 1,200 people working within the tax and accounting, authorized, world commerce, threat, and compliance fields discovered that 90% of respondents imagine that an more and more regulated world could have both a transformational, high-impact, or reasonable impression on their occupation over the following 5 years.

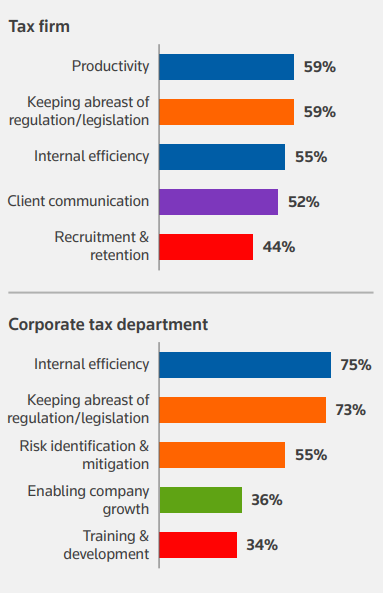

Given these findings, it’s no shock that staying on high of tax rules and laws, in addition to threat identification and mitigation, ranked as among the many high priorities for each tax corporations and company tax departments.

Extra particularly, the report revealed that properly over half (59%) of tax corporations cited maintaining abreast of tax rules and laws as a high precedence. For a lot of company tax departments and the state of it, defending the welfare of the enterprise by maintaining abreast of rules and laws was the dominant precedence (73%). Threat identification and mitigation ranked among the many high three priorities for company features (55%).

Enter synthetic intelligence (AI). The advantages of AI and the position it will probably play in staying on high of tax legislation modifications and defending the enterprise have gotten more and more evident. Largely, survey respondents throughout corporations, companies, and governments imagine that the capabilities of AI may also help them hold tempo with tax regulation and laws and help in risk-related work. For example, inside tax features, AI may also help scale back tax audits and penalties by way of improved knowledge high quality and the identification of tendencies in switch pricing. Likewise, AI can detect patterns that establish potential dangers of losses that would happen primarily based on evaluation of huge quantities of information, together with contracts.

Stated one survey respondent, “AI can help with figuring out shopper wants and impacts of fixing rules and laws a lot sooner than we’ve been in a position to establish these wants and impacts by way of guide practices.”

Nevertheless, that’s to not say that corporations and companies mustn’t heed warning given the potential dangers that may consequence from the usage of AI. As a result of it’s newer expertise, particularly generative AI, there are possible some dangers which have but to be found. Given the danger components, it is very important set up correct AI insurance policies and pointers to deal with such considerations as transparency, privateness, and knowledge safety.

Navigating the shifted give attention to consulting

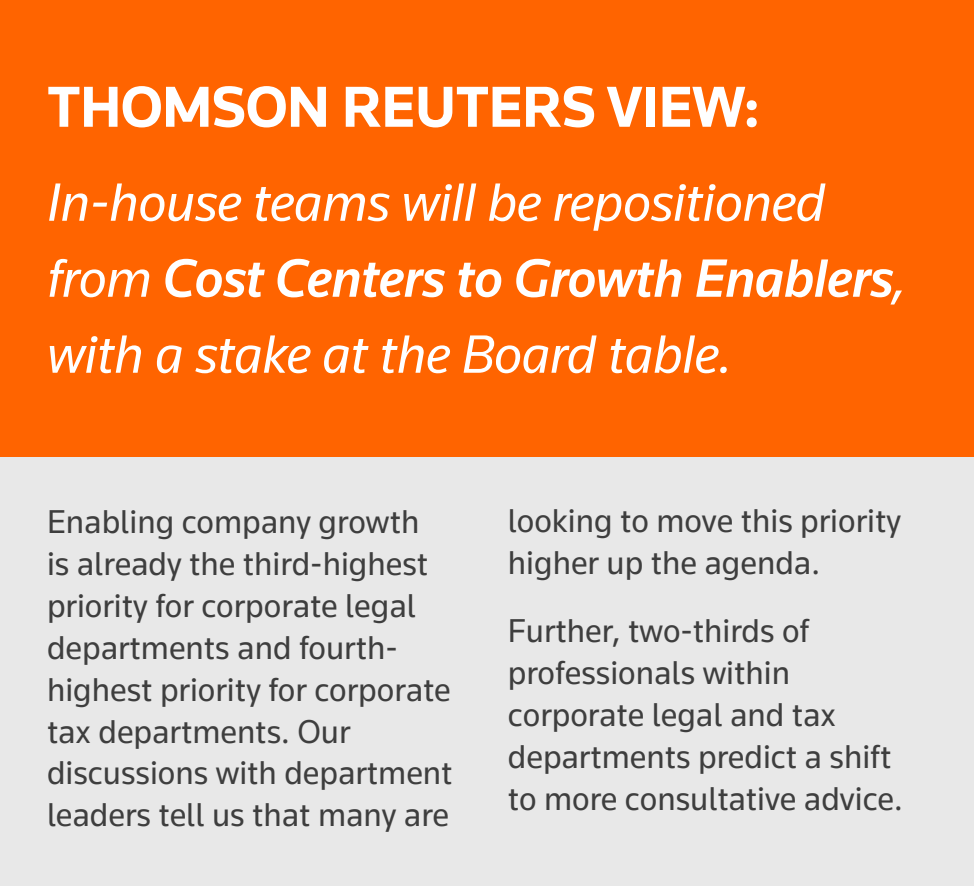

In in the present day’s more and more advanced legislative and regulatory setting, purchasers are inserting a better premium on higher enterprise planning and strategic recommendation. Subsequently, the shift towards offering extra higher-value, higher-margin consulting providers continues to brush the occupation.

You will need to be aware that AI may also help corporations higher appeal to and retain expertise. Bettering operational efficiencies and eliminating mundane duties provides workers extra time to spend with purchasers and the power to give attention to extra significant and satisfying work like strategic consulting. Moreover, rising areas of legislation and regulation, together with AI itself, are opening up new profession pathways for expertise.

“This reality has a number of potential downstream implications for expertise with probably the most primary one being that purchasers will want exterior recommendation on these new areas and the legal guidelines, and corporations will want professionals to have this experience,” the survey said.

Underscoring this level, 41% of survey respondents predict that, as AI more and more turns into a fixture within the office, new profession paths will change into obtainable. For instance, as famous within the report, new roles to function on the multinational or worldwide organizational degree may emerge to align the regulatory panorama of AI throughout jurisdictions.

As extra corporations give attention to driving development by way of strategic consulting providers and rising expertise, the time and labor spent on compliance-based work and monitoring tax legislation modifications might be supplanted by AI. This implies improved efficiencies and larger productiveness.

Automating the standard technique

The facility of automation is to not be taken frivolously. Staying on high of the most recent tax legislation modifications has traditionally been a time-consuming course of that includes looking for related, authoritative sources, making use of the outcomes of the analysis to the shopper’s particular scenario, after which formulating the conclusion to current to the shopper. Leveraging AI with tax compliance and automating conventional analysis strategies can show game-changing.

With AI-powered tax analysis software program, professionals can get focused search leads to much less time. This makes staying on high of tax legislation modifications simpler and sooner. Corporations can then dedicate extra sources to higher-margin providers and professionals can extra confidently look at all angles of a problem with ease.

For example, the tax provision stage is a key a part of managing knowledge associated to taxes. It includes fastidiously determining what an organization owes in taxes, which could be a difficult process on account of frequent modifications in tax legal guidelines and the corporate’s personal altering make-up. By using AI, tax provision instruments are in a position to produce exact tax legal responsibility estimates and scale back the probabilities of errors. If you make the method of tax provision extra environment friendly, it not solely helps an organization meet authorized necessities but in addition saves time, will increase productiveness, and enhances the corporate’s method to tax technique and planning.

AI-powered expertise can even lengthen past tax analysis to assist simplify and streamline bookkeeping processes, accounting workflows, authorized paperwork, tax codes, and real-time notifications.

AI has the power to shortly course of huge quantities of information and analytics, which not solely helps enhance an organization’s decision-making capabilities however can even assist in anomaly detection and fraud prevention. Once more, this implies larger efficiencies, improved productiveness, and, finally, extra profitability.

Double-check outcomes

Whereas the advantages of AI aren’t ignored, it stays vital that corporations and companies double-check AI outcomes to safeguard the enterprise. This may increasingly appear redundant and time-consuming however it’s crucial to make sure accuracy and to assist enhance worker information and skillsets whereas AI continues to impression the tax and accounting occupation.

The truth is, as famous within the report, the shortage of belief and unease in regards to the accuracy of AI outcomes is without doubt one of the foremost the reason why professionals see the necessity for the regulation of AI in any respect ranges. Considerations about utilizing the AI output as recommendation with no human double-checking for accuracy are actual and spotlight the necessity for enhanced ethics packages to mitigate dangers.

So who ought to regulate AI? The vast majority of tax corporations and companies imagine that the tax occupation ought to be the one to manage AI, in keeping with the survey, however some respondents stated they’re in favor of regulation at a number of ranges.

Said one respondent, “I imagine that AI will (and will) be regulated by each the federal government and by my occupation. That stated, inevitably it’s going to want self-regulation by its suppliers and extra regulation by the opposite professions using it as properly.”

In a extremely regulated occupation like tax and accounting, the facility of AI and the position it will probably play in serving to professionals keep on high of tax legislation modifications and assist guarantee tax regulatory compliance is to not be underestimated. For extra data, make sure to discover the Way forward for Professionals report.