The common direct deposit tax refund was near $3,100 final tax season, and with tax season properly underway, it’s no shock that the commonest tax season-related query we’re now listening to is: “The place’s my refund?”

The time it takes the IRS to course of your tax refund relies on the way you selected to file your tax return – both e-file or by mail.

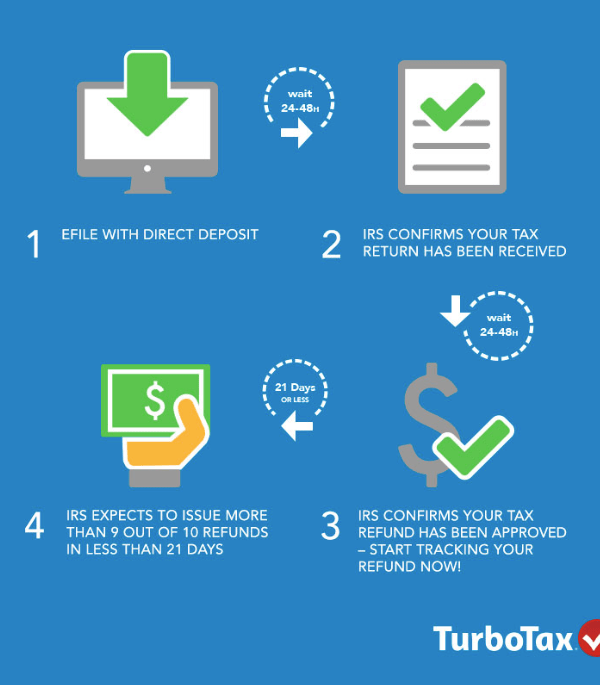

- E-filed tax returns with direct deposit: E-file with direct deposit is the quickest solution to get your federal tax refund. Sometimes, the IRS expects to concern 9 out of 10 tax refunds inside 21 days after acceptance if there aren’t any points.

- Mailed paper returns: Avoiding a paper return is extra essential than ever to keep away from refund delays. The IRS cautions when you want your refund rapidly don’t file on paper. Normally, the IRS says to permit 4 weeks earlier than checking the standing of your refund, and that refund processing can take 6 to eight weeks from the date the IRS receives your return.

Tax Refund Processing

- Begin checking standing 24 – 48 hours after e-file: Upon getting e-filed your tax return, you possibly can verify your standing utilizing the IRS The place’s My Refund? device. You will want your Social safety quantity or ITIN, your submitting standing, and your actual refund quantity.

- Return Acquired Discover inside 24 – 48 hours after e-file: The IRS The place’s My Refund? device will present “Return Acquired” standing as soon as they start processing your tax return. You will want the next data when checking refund standing: Social safety quantity or ITIN, your submitting standing, and your actual federal tax refund quantity proven on the tax return. You’ll not see a tax refund date till the IRS finishes processing your tax return and approves your tax refund.

- Standing change from “Return Acquired” to “Refund Permitted”: As soon as the IRS finishes processing your tax return and confirms your tax refund is authorized, your standing will change from “Return Acquired” to “Refund Permitted.” The change in standing can take just a few days, and a tax refund date won’t be supplied in The place’s My Refund? till your tax return is processed and your tax refund is authorized.

- The place’s My Refund? device exhibits refund date: The IRS will present a customized refund date as soon as your standing strikes to “Refund Permitted.”

- The place’s My Refund? exhibits “Refund Despatched”: If the standing in The place’s My Refund? exhibits “Refund Despatched,” the IRS has despatched your tax refund to your monetary establishment for direct deposit. It may take 1 to five days in your monetary establishment to deposit funds into your account. When you opted to obtain your tax refund by way of mail, it might take a number of weeks in your verify to reach.

You may expertise delays in receiving your tax refund in case your return:

- Contains errors – The IRS has indicated that your refund might be delayed if the knowledge you supplied in your tax return doesn’t match the IRS information.

- Is incomplete – When you didn’t have all your paperwork and filed an inaccurate return

- Wants additional assessment usually

- Is affected by id theft or fraud

- Contains Earned Earnings Tax Credit score or an Further Baby Tax Credit score – Below the Path Act, the IRS can not concern a refund involving the Earned Earnings Tax Credit score or Further Baby Tax Credit score earlier than mid-February.

- Features a Type 8379, Injured Partner Allocation PDF, which might take as much as 14 weeks to course of

Tax Refund Standing FAQ

Will I see a date immediately once I verify the standing in “The place’s My Refund”?

The IRS The place’s My Refund? device won’t provide you with a date till your tax return is acquired, and processed, and your tax refund is authorized by the IRS.

It’s been longer than 21 days because the IRS has acquired my tax return, and I’ve not acquired my tax refund. What’s occurring?

Some tax returns take longer than others to course of relying in your tax state of affairs. A number of the causes it might take longer embody incomplete data, an error, or the IRS might have to assessment it additional.

I requested my cash be mechanically deposited into my checking account, however I used to be mailed a verify. What occurred?

The IRS is limiting the variety of direct deposits that go right into a single checking account or pay as you go debit card to 3 tax refunds per 12 months. Your restrict might have been exceeded. As well as, for a small variety of returns, the IRS decides there could also be indications that the checking account on the return is suspicious they usually might resolve to concern a verify as a substitute.

2,008 responses to “The place’s My Tax Refund? The way to Examine Your Refund Standing”