Due dates, directions for extensions, automated extensions, and extra for 1040 and 1120 purchasers.

Bounce to:

Preparers with particular person and enterprise purchasers possible discover that submitting tax extensions for Varieties 1040 and 1120 isn’t unusual. Actually, annually hundreds of thousands of taxpayers request an extension to file their taxes. Why?

The explanations for requesting a tax submitting extension range. Maybe a shopper wants extra time to assemble all the obligatory supply paperwork, or they’re coping with an unanticipated occasion like a medical emergency or pure catastrophe, or they skilled a pc system failure. Fortuitously, the IRS acknowledges that occasions occur and typically taxpayers merely want extra time.

To assist preparers navigate a number of the obligatory steps for an extension, this weblog will take a more in-depth have a look at learn how to file an extension for particular person tax returns and C company tax returns. There are a number of vital components to bear in mind.

When are tax return extensions due?

For these purchasers who want extra time to file their taxes, April fifteenth is the deadline to file for each an extension to file a company tax return (Type 1120) and a person tax return (Type 1040).

It is necessary for purchasers to grasp that an extension is just for the submitting of the return. An extension of time to file a return doesn’t grant an extension of time to pay owed taxes. To keep away from potential penalties, purchasers ought to estimate and pay any owed taxes by the common due date.

Automated extensions

It must be famous that there are occasions when purchasers don’t must file an extension request and an automated extension can be utilized.

One such occasion is when a pure catastrophe happens. The IRS signifies that in sure catastrophe areas taxpayers don’t must submit an extension electronically or on paper. The IRS robotically identifies these taxpayers positioned within the coated catastrophe space and applies submitting and fee reduction.

For instance, the IRS introduced earlier this yr tax reduction for people and companies in San Diego County impacted by flooding and extreme storms. These taxpayers now have till June 17, 2024, to file varied federal particular person and enterprise tax returns and make tax funds.

An exception additionally applies to these U.S. residents or resident aliens who’re outdoors of the nation. Sure taxpayers are given an automated two-month extension (normally till June fifteenth) to file their tax return and pay any taxes owed with out requesting an extension if they’re a U.S. citizen or resident alien, and on the common due date of the return they’re both:

- In army or naval service on obligation outdoors of the U.S. and Puerto Rico, or

- Residing outdoors of the U.S. and Puerto Rico, and their major office or publish of obligation is outdoors of the U.S. and Puerto Rico.

The IRS famous that they are going to nonetheless should pay curiosity on any tax not paid by the common due date of the return.

The best way to file a tax extension for particular person tax returns

The IRS permits taxpayers to request as much as a further six months to file their U.S. particular person revenue tax return. As outlined by the IRS, there are 3 ways to request the extension. These strategies are:

- Electronically paying all or a part of their estimated revenue tax due and indicating that the fee is for an extension. If extension is chosen when making their fee, a separate extension type isn’t required they usually’ll obtain a affirmation quantity for his or her data.

- E-filing Type 4868, Software for Automated Extension of Time To File U.S. Particular person Revenue Tax Return. As a way to qualify, correctly estimate the shopper’s tax legal responsibility utilizing the knowledge accessible, enter their complete tax legal responsibility on line 4 of Type 4868, after which file Type 4868 by the common due date of April fifteenth. The IRS can even wish to see the prior yr’s adjusted gross revenue (AGI) quantity for verification goal.

- Submitting a paper Type 4868. Word that fiscal yr taxpayers might file extensions solely by submitting a paper Type 4868.

The best way to file a tax return extension for C corps

Preparers should use Type 7004 to request a six-month extension of time to file sure enterprise revenue tax, data, and different returns, which incorporates Type 1120 purchasers.

In response to the IRS, the extension can be granted if Type 7004 is correctly accomplished, a correct estimate of the tax (if relevant) is made, and Type 7004 is filed by the common due date of the return (and pay any tax that’s due).

Some primary data that the IRS requests when finishing the shape contains, however isn’t restricted to:

- If the group is a company and is the widespread mum or dad of a bunch that intends to file a consolidated return;

- The dates of the calendar and tax years; and

- Whether or not or not the group is a overseas company that doesn’t have an workplace or office within the U.S.

Retransmission of rejected returns

What occurs if a transmitted tax return or extension is rejected? If the rejected tax return or extension was submitted on time, preparers have a particular time period to make corrections and resubmit the varieties.

As an illustration, there’s a five-calendar day perfection interval for rejected e-filed Type 1040 returns, in addition to for extensions.

There’s a 10-calendar day perfection interval for rejected e-filed Type 1120; there’s a five-calendar day grace interval for extensions.

The function of purchasers in submitting tax return extensions

Encouraging purchasers to file tax returns on time is, in fact, very best to allow them to keep away from penalties and curiosity. This includes speaking with purchasers early and infrequently to assist guarantee they perceive all the data wanted to file correct and well timed returns.

That being mentioned, emergencies and different unexpected circumstances do happen and there are occasions when requesting an extension is critical. Due to this fact, it’s important that purchasers are conscious that extensions can be found if wanted.

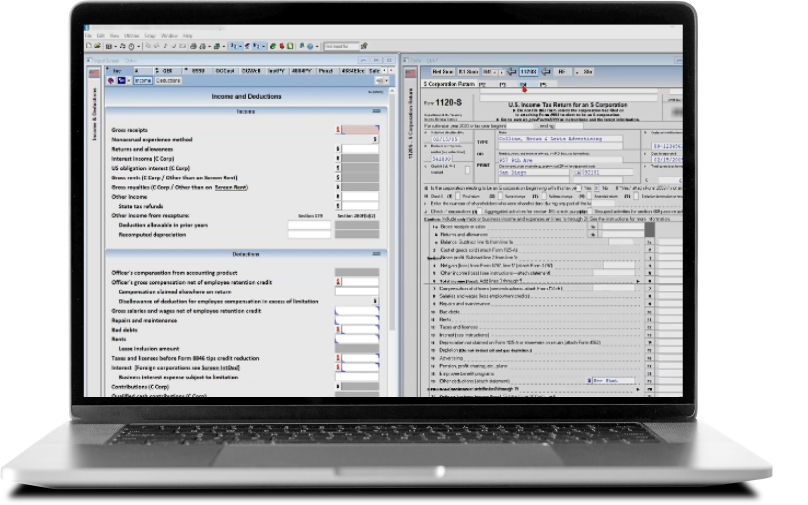

To make e-filing tax return extensions straightforward for Type 1040 and Type 1120 purchasers, flip to a options supplier like Thomson Reuters. Thomson Reuters UltraTax CS simplifies submitting returns and extensions so preparers can save time and increase productiveness throughout the busy tax season.

With the combination of SurePrep TaxCaddy, tax professionals can use the shopper collaboration software program to streamline communication, collect paperwork, questionnaires, and e-signatures, ship tax returns, and extra for 1040 purchasers.

|

DemoLearn the way UltraTax CS can scale back your tax workflow time and enhance your productiveness with a personalized demo. |