This put up is the third of the three that relate to the financial concepts underpinning the Taxing Wealth Report 2024. The primary was on tax and cash within the political financial system. The second was on the nationwide debt.

This observe is a bit more utilized and demonstrates diagrammatically how cash seems to maneuver across the financial system after a authorities has created it to fund its expenditure and the ensuing tax and financial savings flows that rise in consequence. It additionally demonstrates how these flows are impacted by QE, however extra importantly, by the suggestions made within the Taxing Wealth Report 2024.

I have been requested for a diagrammatic illustration of this kind for a while, however I’ve at all times held again as a result of, to be candid, getting ready these diagrams was not an easy train, and a few of them went via plenty of iterations. I additionally thought that 4 diagrams would suffice till, on evaluation, the second and third diagrams had been requested, and I realised that including them made full sense.

This put up is lengthy, with a complete of virtually 7,000 phrases in all. A PDF model is accessible right here and is likely to be simpler to learn for many individuals.

There are lots of conclusions that may be drawn from the diagrams on this paper, however a quantity seem significantly vital.

One is that the federal government might borrow much more successfully and at a decrease price if it inspired the individuals of the UK to avoid wasting with it straight.

One other makes clear that the federal government’s dependency on monetary markets isn’t just fictional however is a fiction that the federal government itself has created.

Some figures are additionally very noticeable. One is that the estimated whole price of tax abuse since 2010 is, based on HM Income & Customs, £435 billion, though it may very well be a lot larger than that attributable to deficiencies of their methodologies.

The opposite is the entire £800 billion price of pension tax aid given since 2010.

These two numbers, collectively, clarify greater than 85% of UK authorities borrowing since 2010. Regardless of that, virtually no consideration is given to them in debates on tax, debt and financial points. Highlighting such deficiencies within the high quality of debate is without doubt one of the functions of the Taxing Wealth Report 2024.

I hope that this paper is of use. Feedback made in good religion might be welcome.

Temporary Abstract

This observe is a part of the background supplies that search to elucidate the idea for the suggestions made within the Taxing Wealth Report 2024.

On this paper the cash flows created by authorities expenditure, and the ensuing demand by a authorities for funds, are defined via a sequence of six diagrams.

The intention is to indicate how the Taxing Wealth Report 2024 seeks to:

- Maximise the fiscal multiplier results ensuing from authorities spending of recent funds into the financial system.

- Maximise the fiscal multiplier results arising from the only option of tax charges, that means that these on low incomes ought to have low total efficient tax charges and that these on excessive incomes ought to have larger total tax charges, which delivers this final result.

- Present cause why the federal government ought to encourage extra direct saving within the financial savings merchandise that it makes obtainable for this objective that collectively are sometimes described because the nationwide debt however which is likely to be significantly better regarded as nationwide financial savings.

- Clarify the price of tax abuse to the federal government when it comes to extra borrowing that it has to tackle in consequence, which has amounted to not lower than £435 billon since 2010.

- Display the associated fee to the federal government of pension saving subsidies that may have price £800 billion since 2010, or fifty-five per cent of the so-called nationwide debt incurred in that interval.

- Maximise the fiscal multiplier results from saving in order that new funding will be generated from this exercise which has not been the case for a lot of many years within the UK, with a resultant enhance to our financial system, employment, and development in addition to to the creation of the capital infrastructure wanted to deal with local weather change and different social points within the UK.

Within the course of the paper additionally hopes to develop understanding of the character of the money flows ensuing from authorities expenditure and to slay among the myths generally informed about that difficulty.

This paper means that the proposals within the Taxing Wealth Report 2024 could have bigger optimistic multiplier results than the present tax system does.

Background

Because the part of the Taxing Wealth Report 2024 on economics, cash, tax and their intimate relationship demonstrates, a lot of what’s true with regard to those issues is counter-intuitive to what’s nonetheless commonplace understanding, significantly amongst politicians, financial commentators, journalists extra typically, and tax specialists.

As that part makes clear:

- Authorities expenditure should precede the elevating of taxation revenues or there could be no cash obtainable to pay taxation liabilities.

- The cash spent by the federal government into the financial system is newly created for it by the Financial institution of England each time that expenditure takes place. Most significantly, tax funds obtained are by no means concerned in that course of, that means that they’ll by no means be a constraint on spending.

- The cash created because of authorities spending financed by the Financial institution of England is withdrawn from circulation within the financial system to forestall inflation happening by the use of taxes being charged and by what is usually known as authorities borrowing, however which might be way more precisely described as authorities deposit-taking from savers searching for a protected place for his or her funds.

- Authorities created cash is known as base cash. It’s not, nonetheless, the one cash in circulation throughout the financial system. Business banks can even create cash, which they do by making loans to prospects. Importantly, simply as the federal government doesn’t use tax revenues to fund its expenditure, nor do industrial banks use funds deposited with them to make loans to their prospects. As an alternative, each mortgage that they make creates new cash which is in flip cancelled when that mortgage is repaid, simply as authorities created cash is cancelled when taxes are paid.

To completely perceive the position of tax within the financial system, and the way in which by which the Taxing Wealth Report 2024 seeks to take advantage of that understanding to enhance the well-being of individuals throughout the UK by each altering who pays tax and the way in which by which tax incentivised financial savings preparations work throughout the UK financial system, the cash flows that authorities spending and tax (which actually are the flip aspect of one another) create inside that financial system should be understood. A sequence of diagrammatic representations of these cash flows might be used for these functions.

The next ought to be famous with regard to those diagrams:

- These diagrams is likely to be solely incomprehensible to some readers, and if that’s the case, merely skip this chapter. A lot of the Taxing Wealth Report 2024 will be understood with out them, however it’s hoped that these diagrams will help understanding for some individuals.

- Diagrams, like maps, are representations of actuality however will not be actual in themselves. They, inevitably, simplify issues to keep away from extreme complication. You will need to recognize that this has been achieved within the diagrams that comply with.

- Crucially, the diagrams that comply with are solely supposed to symbolize the flows arising from authorities expenditure and the federal government’s consequent calls for for taxation income and financial savings flows to the federal government. Flows primarily or solely related to industrial financial institution cash will not be proven within the diagrams. It’s accepted that this may very well be a foundation for criticism of them, however there are two causes for accepting this compromise:

- Firstly, the diagrams would virtually actually be incomprehensible if in addition they mirrored industrial cash flows.

- Business cash flows are, in actuality, not possible to distinguish from these created as a consequence of the usage of base cash inside our financial system, a minimum of once we come to make funds via our personal financial institution accounts. To summary base cash flows in the way in which achieved in these diagrams just isn’t, then, a hindrance, however really serves to focus on one thing that’s in any other case not obvious.

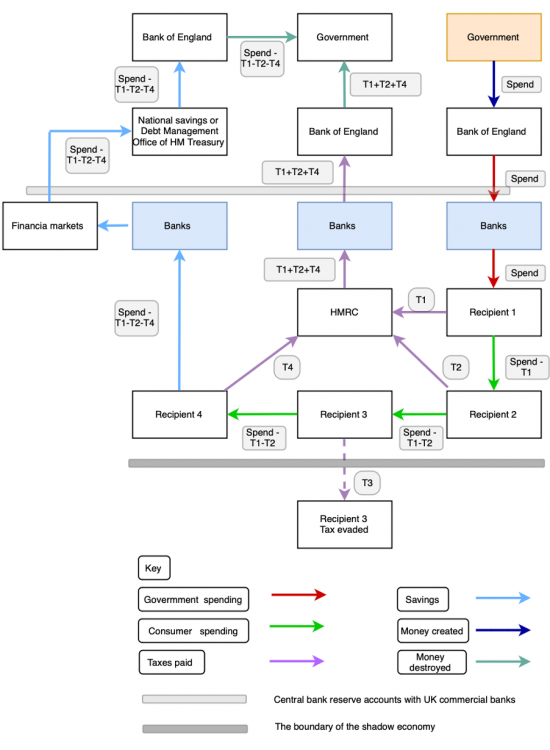

First diagram – the important tax, spending and financial savings flows ensuing from authorities spending

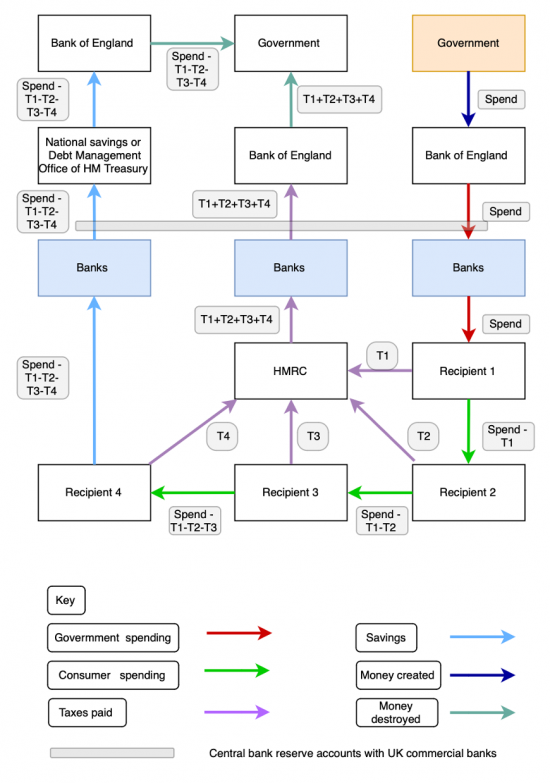

The primary of the diagrams that explains these cash flows units the sample for all of the diagrams that comply with, by which it’s at all times embedded as they develop in complexity:

The method which the diagram portrays begins within the prime proper nook, with the federal government (indicated on this case by a field highlighted in pale orange) deciding to spend, as a consequence of which it instructs the Financial institution of England to make a fee. The Financial institution of England creates the cash for the federal government to take action.

The Financial institution of England then routes this fee through the central financial institution reserve accounts[3] (indicated all through the next diagrams by the gray line crossing the flows proven) to a industrial financial institution, highlighted in blue.

That industrial financial institution does, then, in accordance with the instruction that it has obtained from the Financial institution of England make fee to the primary recipient of the funds from the federal government, successfully creating industrial cash with the backing of the bottom cash fee from the Financial institution of England within the course of[4].

The id of the primary recipient of funds from the federal government doesn’t significantly matter. It may very well be a industrial organisation receiving fee in respect of companies equipped to the federal government, or it is likely to be a trainer, civil servant, or NHS worker in respect of wages due, or it may very well be the beneficiary of a state pension or different state profit. The vital level to notice is that they determine to undertake two transactions upon receipt of the funds.

One is to pay the tax due on the funds obtained, which it’s assumed represents earnings of their arms, with that fee going to HMRC, and being described as T1 on the diagram.

The second fee that they make is to Recipient 2, from whom the primary recipient buys items or companies to the worth of the fee made to them, internet of tax owing, to them by the federal government.

Recipients 2 and three then repeat the transactions undertaken by Recipient 1, besides that the worth that they’ll obtain is lowered in every case by the quantity of tax paid by earlier recipients, in order that, for instance, Recipient 3 pays tax on the sum that they’ve obtained which is equal to the gross worth obtained by Recipient 1 much less the tax paid by Recipients 1 (T1) and a pair of (T2). Recipient 3 then additionally pays tax (T3).

Recipient 4 breaks the sample of spending following the receipt of funds. They make settlement of their tax legal responsibility (T4) however then saves the entire internet stability of funds that they’ve obtained and does so by putting this internet sum on deposit with a authorities company. That company is likely to be Nationwide Financial savings and Investments (NS&I), or it may very well be the Debt Administration Workplace of HM Treasury because of them shopping for authorities gilts. For the needs of this train, it doesn’t matter which. The important level is that the funds that they’ve saved move again via their financial institution and onward via the central financial institution reserve accounts to the consolidated fund of the Financial institution of England, and in flip, due to this fact, to the federal government’s accounts. Cash is cancelled in consequence.

As can even be observed, HM Income & Customs additionally acquire the assorted tax funds made to it in a industrial financial institution (it normally makes use of Barclays for this objective) which in flip then remits these funds via the central financial institution reserve accounts again to the Financial institution of England, and so as soon as extra to the federal government, the place the cash in query is cancelled.

The illustration is, in fact, simplified. It is rather unlikely that every recipient will spend all the cash that they’ve obtained with a single additional recipient. Recipients 2, 3 and 4 can on this case be seen as typifying all of the potential beneficiaries of the funds obtained by Recipient 1. Every of those would possibly nonetheless, nonetheless, have taxation liabilities that might be settled.

It additionally needn’t be the case that no saving takes place till funds attain Recipient 4. There may very well be saving by every earlier recipient, however this might solely complicate the diagram.

Lastly, it’s, in fact, the case that some funds is likely to be saved with industrial banks or different entities, however this might then require that industrial financial institution created cash be mirrored within the diagram as a result of it could then be industrial financial institution created cash that will be redirected into financial savings with the federal government if, as the federal government at all times now does, it seeks to fulfill any deficits between its spending and taxation receipts by issuing bonds, Treasury Payments, or by attracting financial savings to NS&I.

These factors having been made, the simplified diagram does symbolize the substance of the flows which can be created by a single fee by the federal government to a recipient, for no matter cause it’d come up.

The next factors would possibly then be made:

- As might be obvious, the tax generated by the federal government as a consequence of the fee that it makes just isn’t restricted to the tax fee owing by the preliminary recipient. It’s, as an alternative, dependent upon the variety of recipients of the online proceeds of the fee that there are till such time as these internet proceeds are saved, and due to this fact taken out of circulation throughout the financial system. Maximising the variety of occasions that the online proceeds are spent will increase the tax yield. The purpose of the Taxing Wealth Report 2024 is, due to this fact, to maintain these funds in use for so long as potential to extend the online tax restoration from the fee made in methods famous under.

- Growing the tax charges on those that are most certainly to avoid wasting the online proceeds of the preliminary fee after they obtain it, each on the time of that receipt and after they obtain the earnings that they derive from doing so, gives some compensation for the failure of these individuals to keep up the multiplier impact that may in any other case exist, and within the course of gives compensatory tax yield due to their failure to cross these proceeds on throughout the lively financial system. This explains the will within the Taxing Wealth Report 2024 to extend tax charges on financial savings.

- Reflecting these contrasting tax positions is without doubt one of the key underpinning financial logics of the Taxing Wealth Report 2024. By redistributing tax funds due from these on low pay to these on excessive pay the worth of internet proceeds circulated within the financial system by these with excessive marginal propensities to spend (the decrease paid, in different phrases) will increase the probability that total taxes payable because of authorities expenditure into the financial system will finally rise, while rising taxes on these with excessive pay on each that earnings and their financial savings earnings is a recurring theme of the Taxing Wealth Report 2024 as a result of doing so compensates for the low multiplier impact ensuing from extra of their earnings being saved.

This chart is likely to be comparatively easy nevertheless it permits these important factors to be made.

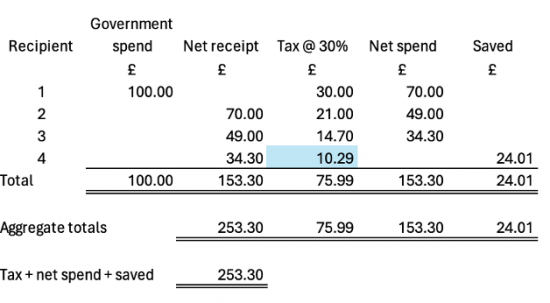

What the chart additionally makes clear is how a single fee can have affect a lot higher than is initially obvious. For instance, assuming that every of the recipients famous on the diagram pays tax at an total charge of 30% and the funds move as indicated, after which assuming that the preliminary fee was of £100, the ensuing move of funds could be as follows:

The full earnings recorded throughout the financial system as a consequence of the preliminary expenditure of £100 by the federal government could be £253.30. Whole tax paid might be £75.99 and the stability of the preliminary spend could be represented by £24.01 that will flowback into authorities sponsored financial savings merchandise of 1 kind or one other.

If it was then assumed that recipient 4 had a tax charge of 60% as a result of they loved a better total stage of earnings that permitted them to avoid wasting your entire proceeds of their labour, then the above famous desk would change within the following approach:

The tax paid by Recipient 4 would on this scenario have doubled from £10.29 to £20.58, with a consequent discount of their stage of saving. Whole tax paid would now have elevated to £86.28 with the online stability of the preliminary £100 expenditure by authorities now being compensated for by lowered financial savings of £13.72. The dimensions of presidency borrowing is lowered as a consequence of the usage of acceptable charge tax charges that replicate the relative incomes of the individuals on this course of.

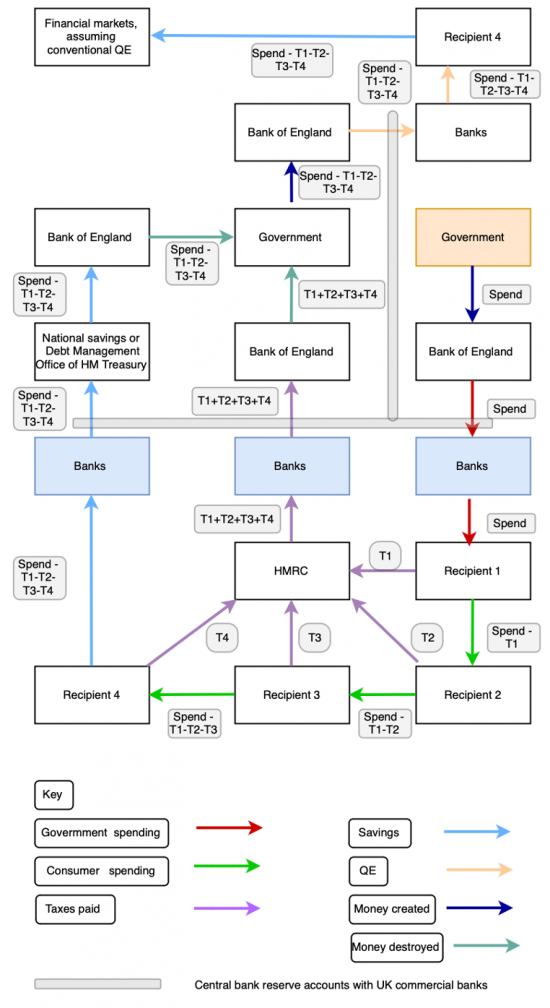

Second diagram

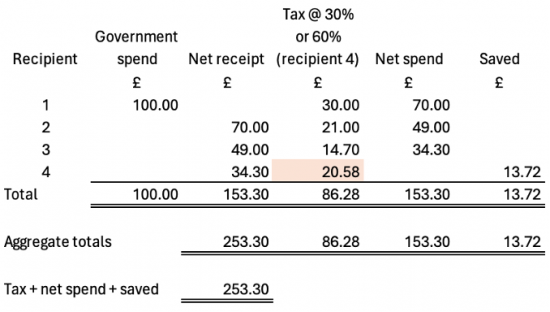

The second diagram on this sequence is a straightforward variant on the primary. The one change is in the usage of Recipient 4’s financial savings. As an alternative of those now going from Recipient 4’s financial institution straight to Nationwide Financial savings and Investments or right into a gilt holding which Recipient 4 then holds in their very own identify these funds are as an alternative diverted into monetary markets, the place they’re saved.

This then creates a scenario the place the federal government is wanting money move, because it is not going to borrow on its Methods and Means Account with the Financial institution of England. As a consequence, an obvious dependency on monetary markets on the a part of the Debt Administration Workplace of HM Treasury appears to be created because it seems from the flows credited by Recipient 4 that the Debt Administration Workplace now must borrow from monetary markets. It doesn’t in fact: it’s only conference that calls for that this borrowing happen. The diagram does, nonetheless, present that this borrowing does happen.

This diagram reveals that:

- This borrowing from monetary markets wouldn’t be crucial if the federal government, through the Debt Administration Workplace, was prepared to borrow direct from the general public. As it’s lower than 0.2 per cent of UK authorities bonds are owned by the general public, which makes virtually no sense in any respect[5].

- The price of authorities borrowing may very well be lowered if extra use was product of direct borrowing from the general public. NS&I pays lower than Financial institution of England base charge on the accounts it gives, and fewer than the price of gilt choices most often. It might increase charges and nonetheless pay lower than the price of gilt choices while being aggressive in financial savings markets. To encourage the usage of these accounts would, due to this fact, make full sense.

- If the general public held extra gilts in their very own names they might make a higher return than doing so through monetary intermediaries who cost for arranging such holdings. It might be straightforward for the federal government to make this facility obtainable, nevertheless it chooses not to take action.

- The parable of dependency in monetary markets has, then, been created by governments: it’s not true that it really exists. Borrowing from monetary markets just isn’t crucial in any respect, and if borrowing is required there are different methods to safe funds.

The apparent conclusion is that the federal government just isn’t minimising the price of its borrowing by structuring its borrowing because it does. As importantly, it’s not borrowing in a approach supposed to swimsuit the wants of those that want to save securely inside its personal inhabitants. Within the course of it has created an financial fantasy about its dependency on monetary markets. It’s laborious to keep away from the sensation that that is deliberate.

Third diagram

The third diagram is a variant on the second, for comfort.

The change proven on this diagram is that the third recipient of funds, Recipient 3, doesn’t pay their tax and as an alternative diverts their earnings and the tax that ought to have been paid on it into the shadow financial system, because it made clear on the backside of the diagram:

This doesn’t imply that the cash T3 receives can’t be spent: a lot of it’d properly move via a checking account within the seemingly professional financial system e.g. T3 is likely to be a firm that seems to be appropriately buying and selling however by no means declares that reality to HM Income & Customs. They merely improve their very own efficient buying energy by not paying the taxes that they owe. In any case, why else would somebody tax evade?

Their doing so signifies that Recipient 4 would possibly obtain greater than they could have achieved because of T3 not paying their tax. It may very well be argued that the tax legal responsibility that Recipient 3 ought to have paid is solely handed on to be paid by Recipient 4 in consequence, however that isn’t the case. If Recipient 3 obtained £49 (as famous within the instance within the dialogue on Diagram One) and will have paid £14.70 of tax on that, however didn’t, then Recipient 4 would possibly obtain £49 and pay tax of £14.70 however the tax that they might in any other case have paid of £10.29 on the web receipt that they need to have loved if T3 had settled their tax legal responsibility is misplaced, completely.

The consequence of Recipient 3’s tax evasion is that whole tax paid is lowered and the sum saved by Recipient 4 is elevated by the identical quantity, fairly legitimately on their half.

Total, nonetheless, the tax evasion leaves the federal government extra uncovered to borrowing if it needs to stability its budgets.

Since 2010 HM Income & Customs recommend that the UK tax hole has totalled roughly £435 billion, assuming that the 2 most up-to-date years for which estimates will not be but printed proceed to have tax gaps on the charge of the final printed 12 months[6]. The Workplace for Funds Accountability has instructed that nationwide debt over that very same interval has elevated by about £1,450 billion[7]. In different phrases, virtually precisely thirty per cent of all UK authorities borrowing over the interval from 2010 to 2024 arose due to the failure to shut the UK tax hole. Due to the weaknesses within the UK’s tax hole estimates[8] the precise tax hole could be a minimum of twice the quantity that HM Income & Customs estimate. The proof that enormous elements of the UK’s nationwide debt have arisen due to the failure to gather tax owing as a result of underfunding of HM Income & Customs could be very sturdy.

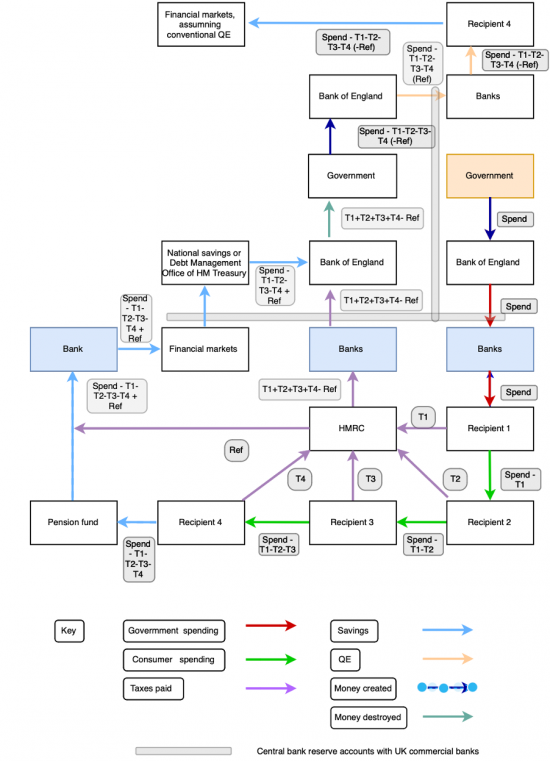

Fourth diagram

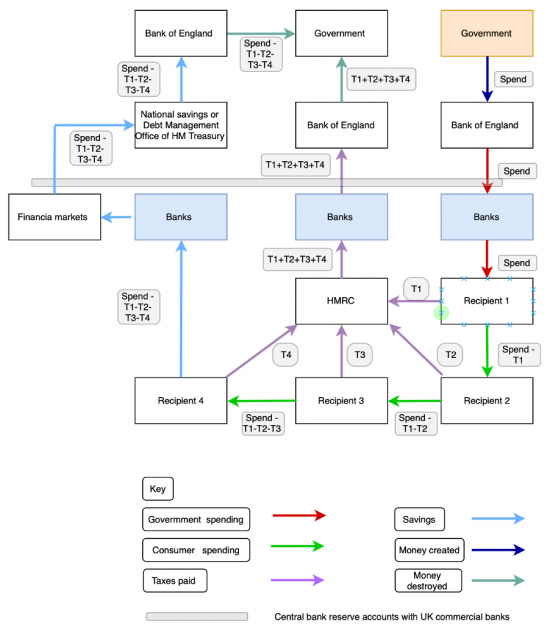

The fourth diagram on this sequence relies on the primary diagram with the flows being expanded as follows:

As ought to be obvious, aside from 4 extra packing containers on the prime of the diagram, every thing is far the identical as in Diagram One. Nonetheless, on this diagram it’s assumed that quantitative easing (QE) is happening. Consequently, the government-backed merchandise financial savings bought by Recipient 4 within the earlier diagram are actually repurchased from them with new cash created for that objective. The Financial institution of England is successfully funded to take action by the Treasury, which has to present specific consent for this motion to happen[9]. The Financial institution of England then makes a fee to the industrial financial institution that Recipient 4 makes use of to settle this legal responsibility (in consequence increasing the worth of its central financial institution reserve account, with the gray line representing the boundary between base and industrial cash that the central financial institution reserve accounts symbolize being prolonged to symbolize this transaction). Recipient 4, now being denied the chance to avoid wasting with the federal government, which has successfully lowered the worth of its product providing because of QE, has to as an alternative save within the non-public sector monetary markets, whose liquidity and worth will increase in consequence, as was at all times the acknowledged intention of QE.

The flows clearly recommend that QE:

- Reduces the worth of presidency debt as a result of that half beforehand owned by Recipient 4 is now not obtainable on the market, and is now owned by, and is successfully cancelled, by the federal government.

- QE has elevated the liquidity of the monetary sector, successfully by creating new reserves, which is what inflated central financial institution reserve accounts symbolize.

The sums saved in monetary markets are handled as being outdoors the lively financial system proven on the backside of the diagram as a result of that’s what the financial savings course of does: it removes cash from use within the lively financial system. Consequently quantitative easing was largely used to fund hypothesis and to not fund helpful financial exercise within the UK financial system, to its total price.

Fifth diagram

The fourth diagram can now be developed once more on this fifth diagram of flows:

What has been added to the diagram listed below are pension contributions. It’s assumed that Recipient 4 now decides that as an alternative of saving in government-based financial savings accounts (gilts, or NS&I merchandise) that they’ll as an alternative be motivated by the tax incentive that the federal government gives to them to avoid wasting the online proceeds of the receipt that they take pleasure in right into a tax authorized pension association.

The entire of the online proceeds that Recipient 4 enjoys are actually proven as going to a pension fund quite than to a nationwide financial savings product. Nonetheless, due to the tax incentives supplied for pension saving, HM Income & Customs now gives a refund of tax paid by Recipient 4 to the pension fund which flows with the contribution that Recipient 4 has made via a checking account and into monetary markets, the place it’s saved.

What’s now obvious is that there are a selection of prices to the federal government from this pension financial savings association. One is, very clearly, that the price of the tax refund made on the pension contribution reduces the tax flows from HM Income and Customs to the federal government through the Financial institution of England.

One other consequence is that financial savings beforehand held with the federal government are actually held in monetary markets. For comfort, it’s assumed that these saved funds are then returned from monetary markets to the Debt Administration Workplace to be invested in gilts, so balancing the federal government’s money account, however what is evident is that these tax incentives are prone to scale back direct saving with the federal government in the way in which that they’re provided at current.

QE preparations are nonetheless, nonetheless, proven as happening. That’s as a result of these will not be essentially dependent upon repurchasing bonds issued to savers within the present interval, however can be utilized to buy bonds put into circulation in earlier intervals.

The elemental level made is, nonetheless, that this tax incentive supplied to pensions is a subsidy to monetary markets that may probably affect the federal government’s personal monetary place by decreasing income and by decreasing sums saved straight with it. The federal government is then compelled to borrow the price of the subsidy it has supplied to monetary markets again from these markets if it needs to stability its money flows, paying for the privilege of doing so. If the federal government thinks itself financially constrained this demonstrates the very actual social price of the £70 billion price of this pension subsidy.

The price of subsidies which were supplied to these financial savings in pension funds since 2010 have amounted to roughly £800 billion. The rise within the so-called nationwide debt over that very same interval has been roughly £1,450 billion. Roughly fifty-five per cent of all authorities borrowing since 2010 has been necessitated by the price of pension subsidies supplied to these utilizing such amenities, most of whom had been already rich sufficient to avoid wasting.

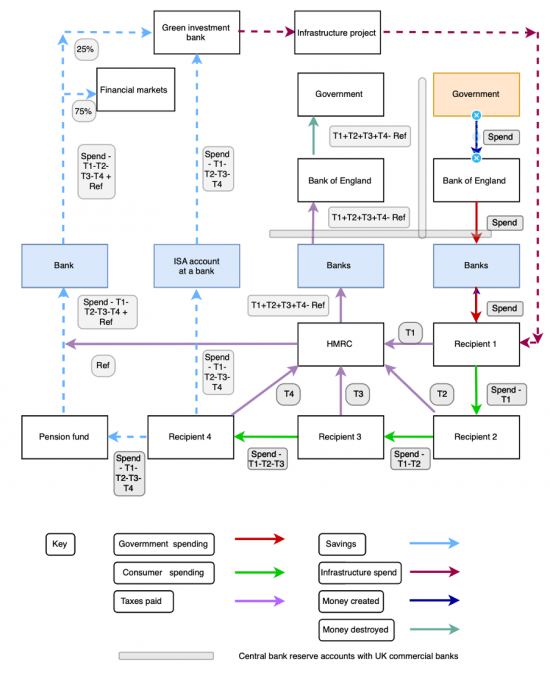

Sixth diagram

A ultimate iteration of this diagram will be provided to elucidate among the adjustments to the tax incentives for financial savings made within the Taxing Wealth Report 2024.

On this ultimate diagram on this sequence, plenty of new assumptions are made.

The primary is that typical quantitative easing has been cancelled, eradicating these elements of the diagram that referred to this.

Secondly, it’s assumed that Recipient 4 now saves in one among two methods (or splits their saving in two methods: this needn’t be particular for the needs of the diagram and clarification of it). Half is saved in a pension fund the place, as is recommended within the Taxing Wealth Report 2024, twenty-five per cent is invested in a approach that creates new infrastructure funding within the UK financial system. For these functions, it’s assumed that these funds don’t go to monetary markets however do as an alternative go to a inexperienced funding financial institution. Monetary markets obtain the remaining seventy-five per cent of the funds saved by Recipient 4, together with their tax refund.

Thirdly, one other a part of Recipient 4’s financial savings are positioned in an ISA account at a financial institution, with these funds then being utilized by a inexperienced funding financial institution for the needs of infrastructure funding within the UK financial system, as once more instructed as a requirement for ISA saving within the Taxing Wealth Report 2024.

As is clear from the diagram, the adjustments to the required funding of funds saved if tax aid is to be loved have a big affect on the financial system. Typical saving, whether or not in money or in traded monetary merchandise, has the impact of withdrawing funds from lively use within the financial system.

That is by definition the case when saving takes place in money deposits, as a result of they’re by no means used to fund loans.

That’s virtually invariably the case with funds saved in monetary markets as a result of these markets very hardly ever present new capital to companies for funding functions, however do as an alternative commerce belongings already in existence, equivalent to quoted shares already in circulation or buildings which have already been constructed. Funds saved on this approach are, due to this fact, proven on this diagram as being faraway from circulation within the lively financial system.

In distinction, funds saved in tax incentivised financial savings preparations within the methods proposed within the Taxing Wealth Report 2024 are as an alternative routed into new infrastructure tasks, because the diagram makes clear.

In apply, though sums saved in ISA accounts don’t take pleasure in the identical tax advantages as pensions, that means the entire sum saved in an ISA by Recipient 4 is smaller than it could be in a pension as a result of no quick tax aid is obtained, as a result of solely a part of pension financial savings are directed in direction of inexperienced and infrastructure funding and all of ISA financial savings are directed to be used in that approach within the suggestions made by the Taxing Wealth Report 2024, the precise profit to the financial system from ISA financial savings is likely to be higher than from pension financial savings if the suggestions on this report had been adopted.

The consequence of saved funds getting used as capital for infrastructure funding is that extra spending has to happen into the financial system to safe the service of those that will work on these tasks. The exact sum concerned can’t be recognized given the choices obtainable within the diagrammatic illustration proven, and due to this fact dashed strains are used for these functions. Nonetheless, what is evident is that these funds when saved on this approach return from the financial savings financial system into the lively financial system as proven by the road on the right-hand aspect of the chart.

Recipient 1, which might simply as simply be an organization as a person on this diagrammatic illustration, sees their earnings rise because of the spending on new capital tasks. Consequently, the entire strategy of fiscal multipliers described when discussing Diagram One, above, begins once more as a consequence of this new enter into the financial system, which has not directly arisen as a consequence of the change to the foundations on tax reliefs related to financial savings merchandise. As such, as an alternative of these tax aid now getting used as an efficient subsidy to each wealth and the monetary companies trade, they’re now as an alternative getting used to advertise financial exercise within the nation that then generates wealth and earnings. Fiscal multiplier results outcome that amplify that achieve. These multiplier results will not be, nonetheless, proven individually on this diagram as a result of it could grow to be too sophisticated.

Conclusion

Topic to the plain limitations required when simplifying a fancy system into diagrammatic kind, these diagrams do display plenty of the important thing financial concepts that underpin the proposals made within the Taxing Wealth Report 2024, all of which have been designed with the intention of making increasingly socially helpful financial exercise throughout the financial system.

For instance, in Diagram One the significantly vital level is the existence of multiplier results. The conventional illustration, generally made by politicians, is that authorities expenditure is the equal of cash being poured right into a black gap. Multiplier results clarify that this not the case. That’s as a result of authorities expenditure is, as should at all times be the case inside any macroeconomy, another person’s earnings. That earnings is then taxable, virtually invariably creating an instantaneous return to authorities, which reality can also be virtually by no means referred to when dialogue on the way in which by which authorities is to fund its spending takes place.

As that diagram additionally makes clear, along with expenditure by a authorities creating new earnings for its first recipient, on which taxes are paid, that recipient can then create extra earnings for different individuals as they, in flip, spend the online proceeds that they’ve obtained after making settlement of the tax that they owe. This course of then continues till saving takes place, which strategy of saving stops the multiplier impact working any additional, assuming that the funds saved are then deposited in financial savings mechanisms that don’t give rise to new funding exercise.

That mentioned, if that saving is in a authorities sponsored account then that return of funds to the federal government, which is what saving on this approach does, achieves the obvious holy grail of presidency funding, which is of it balancing its money move, with tax receipts and borrowing equating to tax spending. The obvious advantage of saving in authorities sponsored accounts, which is usually known as funding the nationwide debt, is demonstrated in consequence. If these accounts are in use, and correctly promoted, no authorities ought to ever be capable of declare that its books don’t stability.

The second and subsequent diagrams develop this fundamental thought to think about varied commonplace features of present authorities financing.

Diagram Two demonstrates that there’s a price to each the federal government and savers because of the federal government not encouraging individuals to avoid wasting straight with it. Savers pay charges to monetary market individuals after they might keep away from these by saving straight. The federal government, by not appropriately selling Nationwide Financial savings and Investments (NS&I) would possibly properly pay an excessive amount of for its borrowing. On the identical time a fantasy of market dependency is created. None of this is smart.

Diagram Three makes clear that there’s a very actual price to then authorities from tax abuse. Since 2010 this may need amounted to £435 billion, or thirty per cent of whole authorities borrowing over that interval. On condition that the tax hole is prone to be significantly underestimated by HM Income & Customs, this price is likely to be a lot larger than that. Failing to spend money on HM Income & Customs straight fuels the expansion of presidency borrowing. Once more, this is unnecessary.

Diagram 4 considers the implications of quantitative easing. What it reveals are three issues.

The primary is that when quantitative easing is in use it does, in impact, deny shoppers the selection of saving in authorities sponsored financial savings amenities, with them being compelled as an alternative to make use of various commercially obtainable accounts. That is sub-optimal when it’s recognized that cash-based deposits with banks don’t fund loans, and due to this fact don’t create new funding within the financial system, while monetary market based mostly saving is sort of solely associated to speculative exercise, and never new capital creation. As such, this diversion of funds denies funding to the lively financial system.

Concurrently, and secondly, as a result of governments-based financial savings accounts are withdrawn from the financial system, stress from the supposed incurrence of presidency cash-flow deficits arises in consequence. New cash should essentially be injected into the financial system as a consequence, which is represented by an inflation within the central financial institution reserve accounts. These sums are then, in flip, mirrored in a rise in financial savings in monetary companies sector financial savings accounts, with all the implications famous above. On condition that curiosity is paid on the central financial institution reserve account balances this doesn’t make sense.

Thirdly, though it’s not specific throughout the diagram, the plain conclusion will be drawn that whether it is fascinating to extend the amount of presidency created cash within the financial system, and there have clearly been events when that’s the case, doing so by rising direct spending into the financial system with out searching for to get better these sums, a minimum of for a time period, via taxation could be a way more direct and efficient technique of doing in order this boosts the lively financial system in a approach that boosting monetary companies sector saving doesn’t. The federal government ought to run an overdraft with its central financial institution as a part of fiscal coverage, in different phrases, and keep away from quantitative easing in consequence.

Diagram 5 incorporates pension saving into the flows. That is acceptable as a result of the price of subsidising these financial savings in tax phrases is likely to be round £70 billion a 12 months based on the evaluation introduced within the Taxing Wealth Report 2024. Given this distinctive price you will need to perceive the implications of this, which Diagram 5 demonstrates.

The consequence of this subsidy is that pension financial savings and the extra tax refunds supplied to spice up them by the federal government move out of the lively financial system and into the monetary companies sector the place these funds are misplaced from use in that lively financial system for the explanations famous above. As a consequence, the federal government does both have to hunt financial savings from the monetary companies sector to stability its money flows, which is unnecessary when it could be significantly better for these financial savings to be positioned with it individually by these whom that sector serves, or it has to run elevated money move deficits, which it is not going to do. The result’s that this tax subsidised diversion of financial savings from the federal government to the monetary companies sector, coupled with the federal government’s personal illogical refusal to run an overdraft in its Methods and Means Account with the Financial institution of England, creates the looks of the dependence by the federal government on funding from the Metropolis of London when no such dependence exists.

Since 2010 it’s doubtless that the entire price of tax subsidies to pensions, and so to the monetary companies sector of the financial system, has amounted to roughly £800 billion while so-called authorities debt has grown by £1,450 billion. The connection between the 2 just isn’t coincidental.

Lastly, Diagram Six appears to be like at what would possibly occur if the federal government was to reform the tax reliefs related to each ISA and pension financial savings as advisable within the Taxing Wealth Report 2024. It demonstrates that if the tax aid made obtainable to subsidise financial savings had situations connected to them in order that some (within the case of pension financial savings) and all (within the case of ISA financial savings) had been required for use to offer capital for funding in new infrastructure tasks supporting a local weather transition then important sums, which the TWR suggests may very well be greater than £100 billion a 12 months, may very well be made obtainable for this objective, with these funds then being returned from financial savings into the lively financial system the place they might start the method of making fiscal multipliers once more.

In different phrases, this straightforward change to the tax incentives connected to financial savings might basically alter the funding obtainable to deal with local weather change within the UK while concurrently offering a powerful optimistic fiscal multiplier impact from doing so, which the present tax aid doesn’t. In truth, present tax reliefs have a damaging multiplier impact on this regard, as a result of they outcome within the withdrawal of funds from use within the lively financial system by diverting them into monetary hypothesis or money deposits, neither of which lead to new capital formation. It’s for these causes that these adjustments to the tax guidelines related to financial savings merchandise are promoted within the Taxing Wealth Report 2024.

Placing these varied factors collectively, what the Taxing Wealth Report 2024 seeks to do is:

- Maximise the fiscal multiplier results ensuing from authorities spending of recent funds into the financial system.

- Maximise the fiscal multiplier results arising from the only option of tax charges, that means that these on low incomes ought to have low total efficient tax charges and that these on excessive incomes ought to have larger total tax charges, which delivers this final result.

- Present cause why the federal government ought to encourage extra direct saving within the financial savings merchandise that it makes obtainable for this objective which can be normally collectively known as the nationwide debt, however which is likely to be higher described as nationwide financial savings.

- Clarify the price of tax abuse to the federal government when it comes to extra borrowing that it has to tackle in consequence, which has amounted to not lower than £435 billon since 2010.

- Display the associated fee to the federal government of pension saving subsidies that may have price £800 billion since 2010, or fifty-five per cent of the so-called nationwide debt incurred in that interval.

- Maximise the fiscal multiplier results from saving in order that new funding will be generated from this exercise which has not been the case for a lot of many years within the UK, with a resultant enhance to our financial system, employment, and development in addition to to the creation of the capital infrastructure wanted to deal with local weather change and different social points within the UK.

Footnotes

[1] N/A on this model

[2] Multiplier results measure the quantity by which nationwide earnings is elevated or decreased because of extra spending inside an financial system. If a multiplier impact is larger than one then the extra spending produces a rise in earnings of higher than its personal quantity, and vice versa.

[3] See https://www.taxresearch.org.uk/Weblog/glossary/C/#central-bank-reserve-accounts for a proof of those the position of those accounts.

[4][4] See https://www.taxresearch.org.uk/Weblog/glossary/B/#base-money for a proof of base cash

[5] https://www.dmo.gov.uk/media/xl5bo4as/jul-sep-2023.pdf

[6] https://www.gov.uk/authorities/statistics/measuring-tax-gaps/1-tax-gaps-summary

[7] https://obr.uk/obtain/public-finances-databank-november-2023/?tmstv=1707402181

[8] See https://taxingwealth.uk/2023/09/19/the-taxing-wealth-report-2024-the-uk-needs-better-estimation-of-its-tax-gap-to-prevent-the-illicit-accumulation-of-wealth/

[9] See the letter establishing the Financial institution of England Asset Buy Facility (APF) by which it was made clear {that a}) the Financial institution of England would act underneath course from the Chancellor of the Exchequer and b) the Financial institution of England could be indemnified for any beneficial properties and losses that it made because of endeavor exercise on behalf of HM Treasury and c) observe the truth that as a consequence the accounts of the APF will not be consolidated into these of the Financial institution of England as a result of it’s not a subsidiary underneath its management. https://www.bankofengland.co.uk/-/media/boe/recordsdata/letter/2009/chancellor-letter-290109