SBI SimplyClick Credit score Card is without doubt one of the only a few bank cards in India that has fairly good reward fee on common spends for freshmen.

Whereas it was once probably the most wanted entry-level bank card prior to now due to the 10X rewards, it’s nonetheless a very good decide in it’s present type. Right here’s all the pieces it is advisable know in regards to the SBI SimplyClick Credit score Card.

Overview

| Sort | Cashback Credit score Card |

| Reward Charge | 0.20% – 2% |

| Annual Charge | 499 INR+GST |

| Greatest for | On-line spends upto 2 Lakhs a yr |

| USP | Milestone advantages |

SBI SimplyClick Credit score Card has been the one greatest entry-level bank card till the launch of SBI Cashback Credit score Card.

Whereas SBI Cashback Credit score Card is primarily meant for on-line spends with the opportunity of getting devalued anytime, SBI SimplyClick Credit score Card is evergreen and will get you a good reward fee of over 2% on annual spends of two Lakhs, because of the milestone profit, which we’ll see shortly.

Charges & Costs

| Becoming a member of Charge | 499 INR+GST |

| Welcome Profit | 500 INR Amazon eVoucher |

| Renewal Charge | 499 INR+GST |

| Renewal Profit | – |

| Renewal Charge waiver | Spend 1 Lakh |

Whereas Amazon voucher takes care of the charge for 1st Yr, annual spend of simply 1 Lakh is ample for the renewal charge to be waived off, which is simple for many cardholders within the phase.

Design

SBI SimplyClick Bank card might be one of many few entry-level playing cards that additionally seems good when it comes to design.

Earlier it was once in matt end and now it’s being issued with a shiny entrance face that appears extra interesting.

Rewards

| SPEND TYPE | CASHBACK % |

|---|---|

| On-line Spends | ~1% |

| Offline Spends | ~0.20% |

| Choose retailers (10X) | ~2% |

Notice that the purpose worth on SBI SimplyClick Credit score Card has dropped from 25ps to 20ps just lately.

However the good factor is that we are able to redeem factors for Amazon Pay eVouchers which is nearly money equal.

10X Rewards

- 10X Rewards = 10 * 0.20 = 2% Reward Charge

The SBI SimplyClick Credit score Card was fairly widespread prior to now due to it’s 10X rewards particularly on Amazon for apparent causes however that it not accessible.

Whereas the present companions are respectable, the drop in level worth additional makes it much less enticing than it was once.

Milestone

| SPEND REQUIREMENT | MILESTONE BENEFIT | VOUCHER TYPE |

|---|---|---|

| 1 Lakh | 2,000 INR | Cleartrip/Yatra |

| 2 Lakh | 2,000 INR | Cleartrip/Yatra |

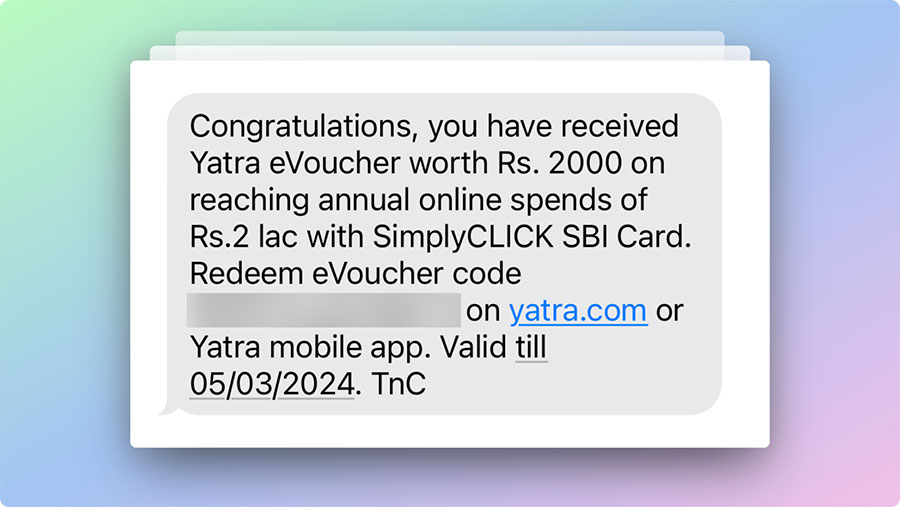

- Yatra Voucher: Might be redeemed for flights/accommodations

- Cleartrip Voucher: Might be redeemed just for flights

- Voucher Validity: 4 months

- Voucher is often triggered in ~2 weeks of reaching the milestone.

It is a neat and easy profit which is helpful for travellers. Whereas they used to have solely Cleartrip Voucher prior to now, it appears they’re now providing Yatra Vouchers.

So by reaching the milestone by means of typical on-line spends, one might simply get a candy reward fee of three% which is nice for this phase.

My Expertise

I used to be utilizing SBI SimplyClick Credit score Card prior to now, earlier than shifting to SBI Prime for few years after which to Aurum.

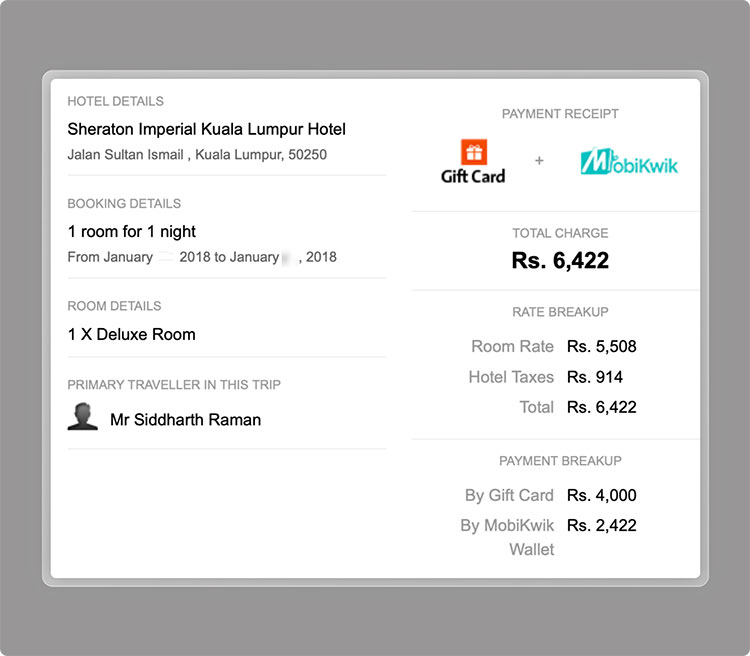

Again in time I received the Cleartrip vouchers which I used for a keep in Malaysia. The redemption was fast and easy.

And I just lately downgraded my Aurum to Simplyclick as soon as once more to primarily retain the credit score restrict on the cardboard.

And for the milestone spends, this time I received the Yatra Vouchers. Hope the redemption is so simple as it was once on Cleartrip.

Whereas I haven’t used the Yatra voucher, from t&c it seems to be a simple course of to redeem them as properly.

How you can Apply?

SBI SimplyClick Credit score Card might be utilized on-line which makes use of the most recent dash utility system for faster processing.

In the event you’re new to the dash utility course of, this text might assist: SBICard Dash Credit score Card Software Course of.

Bottomline

The SBI SimplyClick Credit score Card is nice for freshmen who don’t spend so much, whether or not they’re buying in shops or on-line.

In case your annual spends are over 2 Lakhs and in the event that they’re primarily on-line then it is best to as an alternative go for the SBI Cashback Credit score Card that gives profitable 5% Cashback on on-line spends.

Whereas the Cashback Card is the recent decide for freshmen since 2022, it could anytime go for the following spherical of devaluation.

However, SBI SimplyClick Credit score Card additionally serves as an answer to carry the credit score restrict till the following premium bank card arrives.

Do you maintain SBI SimplyClick Credit score Card? Be happy to share your ideas within the feedback under.