Working your corporation might be extremely fulfilling.

Creating progressive merchandise, figuring out the trail your corporation takes, and being a kickass entrepreneur on the day by day.

However on the subject of the numbers, issues aren’t fairly so enjoyable.

These pesky numbers.

Any enterprise proprietor will let you know that maintaining with all the executive necessities can get fairly irritating after some time.

One admin job that always slips below the radar regardless of its significance is your organization’s revenue and loss assertion.

Right here, we are going to dive deeper into what your P and L assertion ought to appear like when it is best to submit it and all the things in between.

Brief on time? Listed below are the important thing takeaways

- A P and L assertion is a monetary assertion that covers your organization’s revenues, bills and prices on a quarterly foundation.

- P and L statements should be submitted by a public firm.

- You’ll be able to put together a P and L assertion utilizing a money or accrual methodology.

What Is a Revenue and Loss (P and L) Assertion?

Let’s dive straight in, lets?

In easy phrases, a P and L assertion is a monetary assertion that will get submitted every quarter, outlining income, value, and bills throughout that interval.

This assertion gives an perception into an organization’s profitability and is commonly proven as a money determine.

Corporations and their traders typically confer with these P and L statements to determine how financially wholesome an organization is.

Don’t Skip: The Finest Revenue Margin Formulation for Your Enterprise

How Revenue and Loss (P and L) Statements Work

As talked about, P and L statements are submitted quarterly, alongside an annual topline as properly. They’re accompanied by a separate money move assertion and steadiness sheet.

You would possibly’ve seen the time period P and L earlier than with out even realizing it, as it may well typically get referred to in all kinds of how, together with:

- Revenue assertion

- Earnings assertion

- Assertion of revenue and loss

- Assertion of operations

“Your earnings assertion might be one of the strategical statements that it is best to actually take a look at and perceive.” – Alexa von Tobel

“Your earnings assertion might be one of the strategical statements that it is best to actually take a look at and perceive.”

A P&L might be ready in two distinct methods, both as a money assertion or by way of the accrual methodology.

Money Assertion

The money methodology is the only approach to produce a P and L assertion, bearing in mind when money goes out and in of your corporation.

This methodology is right for smaller corporations or freelancers who wish to be accountable for their funds.

The Accrual Methodology

The opposite possibility is the accrual methodology, which data income when it’s earned. Which means accounting for cash your corporation expects to obtain sooner or later.

Now, that doesn’t imply you’ll be able to run a loss, solely to imagine that in some unspecified time in the future Elon Musk will see your fervent efforts and make investments an informal $1M (could be good, although, wouldn’t it?).

No, what this refers to is when your organization gives a services or products at an agreed value and continues to be awaiting that contractually agreed cost. The identical would additionally go for any future bills.

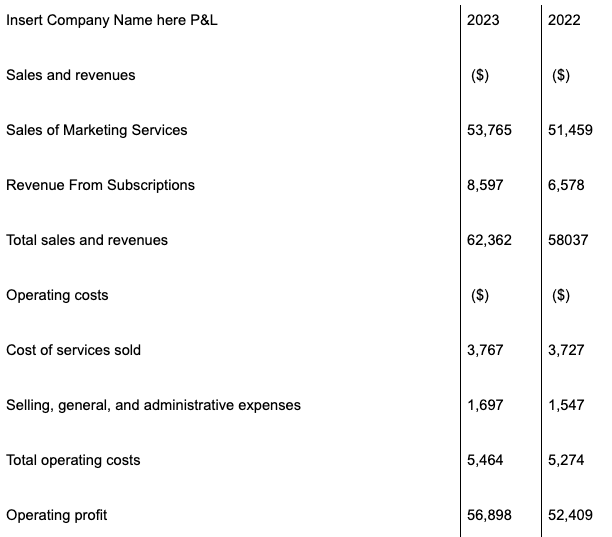

Revenue and Loss (P and L) Assertion Template

Now, that’s numerous info to digest in a single sitting!

So, to make issues a bit of simpler, beneath is a fundamental P and L Template so that you can observe to assist add a visible to the knowledge above. For extra superior statements (which can be required in some cases), try Amazon’s P and L or Walmart’s P and L, each of which Alexa von Tobel covers in nice element as a part of our Finance for Founders coaching.

Right here’s the P and L template in Google Types.

Why Are Revenue and Loss (P and L) Statements Vital?

Now, all that info is nice, however why is a P and L assertion so necessary? In any case, if the enterprise is worthwhile, and you’ve got tracked incomings and outgoings accordingly, why do it’s worthwhile to spend the extra time placing all that into a press release?

Properly, for starters, if you happen to run a publicly traded firm, it’s required by legislation. This legislation ensures any potential regulators, traders, or analysts can evaluation your figures and make sure you’re maintaining all the things above board.

Secondly, it’s an effective way to achieve a visible illustration of how your corporation is rising or the place potential cash pits are growing 12 months after 12 months. Working your individual enterprise is hectic at the most effective of occasions, so having a transparent and concise prime line that permits you to evaluate to prior months and years is an effective way to maintain all the things on observe.

And lastly, you’ll sometimes want to supply a P and L assertion if you’re pitching to traders, as they’ll require this degree of element earlier than contemplating your model.

In any case, any investor not solely desires to get full readability over your present profitability, however in addition they wish to see that you’re extremely organized {and professional}, and take your corporation severely.

Hold Studying: Annual Recurring Income – Calculate Your Subscription Income

Take Your Enterprise to the Subsequent Stage

P and L statements are only one factor of your corporation that it’s worthwhile to familiarize yourself with. Happily, we’ve obtained all of the solutions you want inside our catalog of free coaching.

Say goodbye to complications and confusion, and hi there to readability and productiveness.