KEY

TAKEAWAYS

- Wednesday’s broad inventory market rally exhibits that traders are nonetheless keen to take probabilities within the inventory market

- Despite the fact that the inventory market rallied, Communication Providers and Expertise have been the worst performing S&P 500 sectors on Wednesday

- Gold costs have been on a tear after transferring sideways for a number of years

In the present day’s inventory market motion uncovered some uncommon exercise. Whereas the broader inventory market indexes rose—the S&P 500 hit a report shut, and the Dow Jones Industrial Common snapped a three-day shedding streak—it was fascinating that Communication Providers and Expertise have been the worst-performing S&P 500 sectors.

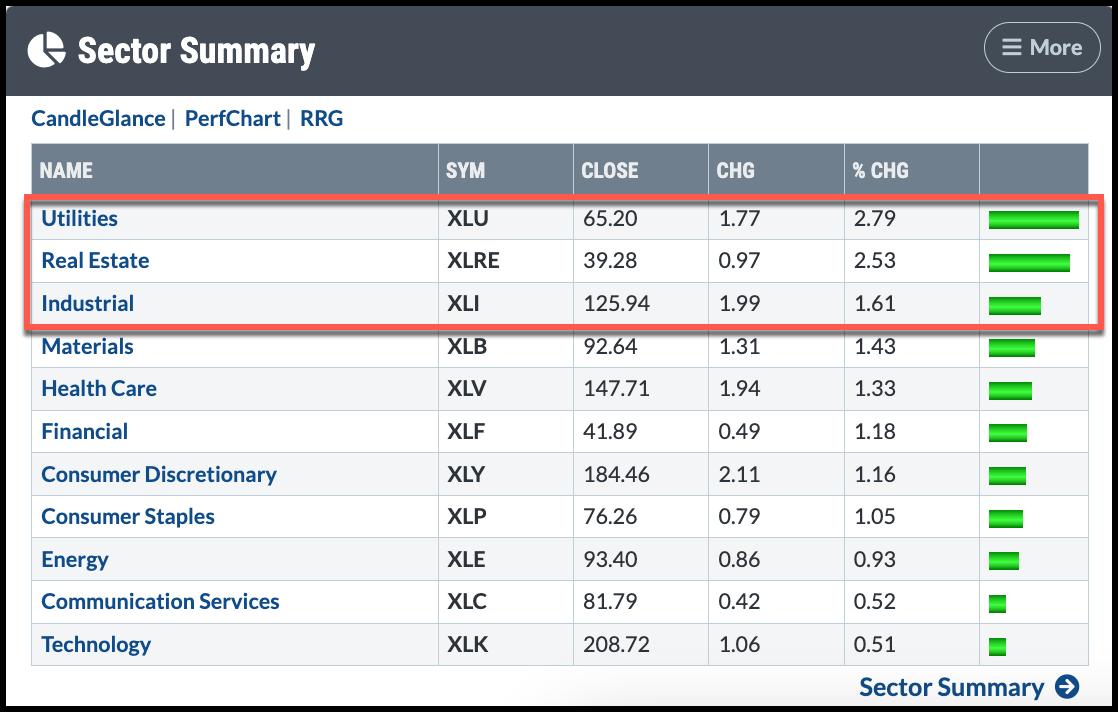

The Sector Abstract beneath exhibits that every one 11 S&P 500 sectors have been inexperienced on the shut on Wednesday. Nevertheless, Utilities, Actual Property, and Industrials have been the highest three main sectors. Sooner or later would not make a development; nonetheless, if it continues, it will point out that traders are getting extra snug with the general market and usually are not afraid to diversify their investments amongst totally different asset varieties.

CHART 1. SECTOR SUMMARY FOR WEDNESDAY, MARCH 27. All S&P 500 sectors are optimistic, however Communications Providers and Expertise fell to the underside.Chart supply: StockCharts.com. For academic functions.

A Broad Rally

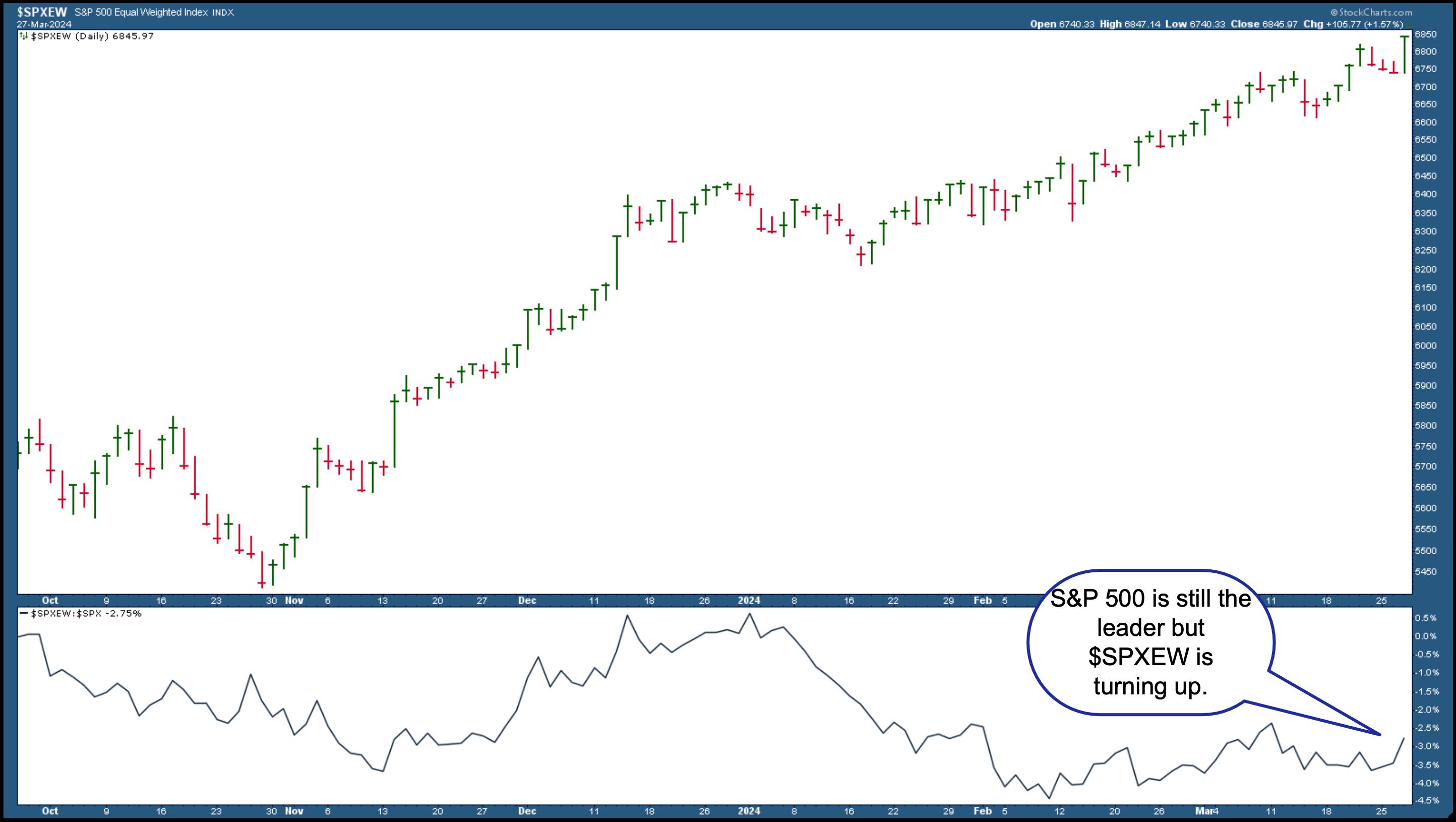

In case you run the New All-Time Highs scan, one of many scans within the StockCharts Pattern Scan Library, there have been over 40 shares and exchange-traded funds representing totally different sectors and market caps. The S&P 500 Equal-Weighted Index ($SPXEW) closed larger (see chart beneath), confirming that Wednesday’s rally was broad.

CHART 2. THE S&P 500 EQUAL WEIGHTED INDEX CLOSES HIGHER.

Keep watch over this chart to see if $SPXEW continues to development up. When evaluating the efficiency of $SPXEW to the S&P 500 ($SPXEW:$SPX), which is displayed within the backside panel, it is clear $SPXEW remains to be underperforming the S&P 500 by a large margin, however $SPXEW is beginning to flip larger. If it continues in that path, there might be growing market participation from traders.

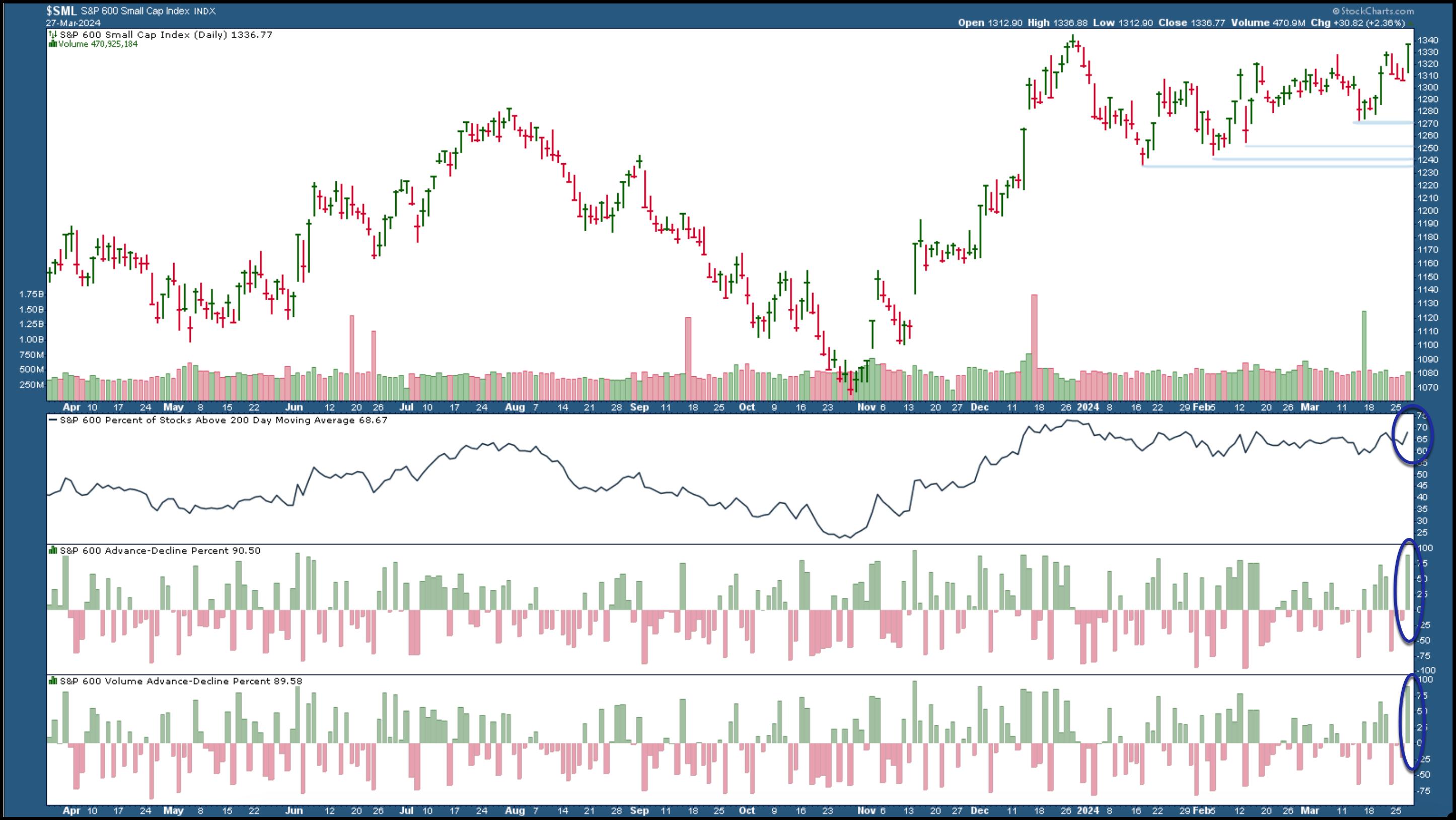

Small- and mid-caps additionally noticed robust breadth. The S&P 600 Small Cap Index ($SML) closed larger and exhibits robust market breadth (see chart beneath).

CHART 3. S&P 600 SMALL CAP INDEX CLOSES HIGHER. A breakout above the December 2023 excessive might be a sign of additional power in small-cap shares. Market breadth in small caps can also be robust.Chart supply: StockCharts.com. For academic functions.

The proportion of S&P 600 shares buying and selling above their 200-day transferring common is nearly 70%, with advancers far larger than declines. In case you introduced up a chart of the S&P 400 Mid Cap Index ($MID), you may see it hit an all-time excessive with market breadth just like that of $SML.

Gold Soars

One other space to not ignore is gold. Gold costs have been on a tear. The month-to-month chart of gold futures ($GOLD) beneath exhibits that gold’s value has damaged above its buying and selling vary and is now above $2212 per ounce.

CHART 4. GOLD PRICES SURGE. This might be a short-term rally, however gold costs may rise a lot larger if there may be momentum. Chart supply: StockCharts.com. For academic functions.

Gold continues to hit new highs, which is fascinating as a result of traders often flip to gold as a hedge. However why hedge when inflation is cooling? It is onerous to say. Maybe gold merchants felt left behind and thought it was time to get within the highlight. So, it could be a short-term rally, but when the momentum stays, you may benefit from the rally by investing in an ETF like GLD.

Meme Inventory Craze

Gold merchants aren’t the one ones who’re feeling overlooked. Some components of meme inventory mania present its presence within the inventory market. Two shares which have gained vital investor consideration after a number of days of buying and selling are Reddit (RDDT) and Fact Social (DJT).

Is that this an indication that traders are snug with the place the inventory market is now and need to make fast positive aspects? It is doable that we may see extra investor participation as traders develop into extra complacent. However the sort of manic motion also can signify a market reaching its peak. This does not imply there will be a inventory market crash. It does imply, although, that when there is a shift in investor sentiment, it is time to have your antennas up.

The Backside Line

Whereas a broad market rally is encouraging, it doesn’t suggest it is best to get complacent. Commerce with a threat administration technique and carefully monitor the totally different sectors and asset courses. Seeing a big-picture view of the inventory market lets you navigate the inventory market strategically to be able to see your funding returns develop.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your private and monetary state of affairs or consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra