Key Findings

- The TaxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of basic authorities companies, items, and actions.

Cuts and Jobs Act (TCJA), enacted in 2017, presents one instance of supply-side financial policymaking targeted on reducing the price of capital throughout the economic system. - The CHIPS and Science Act (CHIPS) and InflationInflation is when the overall worth of products and companies will increase throughout the economic system, decreasing the buying energy of a forex and the worth of sure belongings. The identical paycheck covers much less items, companies, and payments. It’s generally known as a “hidden tax,” because it leaves taxpayers much less well-off on account of increased prices and “bracket creep,” whereas rising the federal government’s spending energy.

Discount Act (IRA), each enacted in 2022, signify another strategy targeted on giant subsidies for semiconductors and renewable power. - The standard supply-side strategy depends on incentivizing funding throughout the economic system, whereas the economic coverage strategy depends on reallocating funding to particular industries.

- Whereas the approaches differ, they share a reliance on comparable linkages: new capital funding drives productiveness development, which grows the economic system and raises wages for staff.

- The linkages take time to take impact, and it may be troublesome to isolate the consequences of tax coverage on productiveness and wage variables, significantly within the brief time period.

- One easy strategy is to contemplate how funding carried out relative to pre-law baseline projections.

- Following the TCJA, personal nonresidential mounted funding outperformed pre-TCJA expectations. Extra advanced educational analysis to this point has supported the discovering that the TCJA boosted funding.

- Following the IRA and CHIPS Act, combination personal nonresidential mounted funding has roughly adopted pre-law baseline projections, however the subcomponent of producing construction funding has boomed.

- Whereas we must be cautious about drawing too-strong conclusions primarily based on the info to date, there may be loads of purpose to be skeptical of the deserves sector-specific policymaking exemplified in IRA/CHIPS.

Introduction

Over the previous few years, policymakers have regained curiosity in “industrial coverage” in numerous varieties. Advocates distinction the brand new strategy, targeted on protections for American {industry} and authorities incentives reallocating capital between sectors, with a perceived outdated consensus, targeted on broad, impartial incentives for work and funding because the means to develop the economic system.

The brand new push for industrial coverage finally produced the Inflation Discount Act (IRA) and the CHIPS and Science Act (CHIPS), each enacted in 2022. The legal guidelines present substantial assist for the renewable power and semiconductor industries, respectively. Whereas the IRA and CHIPS have coverage targets aside from rising financial development, Biden administration officers see the focused industry-specific incentives as methods to develop the broader economic system, not simply as options to issues like local weather change or strengthening nationwide safety by decreasing overreliance on China.[1]

In the meantime, the Tax Cuts and Jobs Act (TCJA) of 2017 largely represents the outdated strategy. The TCJA was not solely a development invoice—a considerable portion of the regulation’s fiscal value was dedicated to middle-class tax reduction and simplification—however the main company provisions, equivalent to reducing the company tax price from 35 % to 21 % and introducing 100% bonus depreciationBonus depreciation permits companies to deduct a bigger portion of sure “short-lived” investments in new or improved expertise, gear, or buildings within the first yr. Permitting companies to put in writing off extra investments partially alleviates a bias within the tax code and incentivizes corporations to take a position extra, which, in the long term, raises employee productiveness, boosts wages, and creates extra jobs.

for funding in equipment and gear, signify extra conventional supply-side development orthodoxy—particularly, broad enchancment within the tax remedy of enterprise funding throughout the board.

The insurance policies are nonetheless new, particularly IRA and CHIPS. Information to date is proscribed, and isolating the consequences of IRA and CHIPS particularly is difficult because of the post-pandemic financial rebound, related turmoil, and substantial rate of interest hikes by the Federal Reserve. Nevertheless, we are able to examine and distinction the justifications for every coverage and decide easy methods to finest consider whether or not they have reached their targets.

The Coverage Background

The Tax Cuts and Jobs Act was signed into regulation in December 2017.[2] The TCJA was a significant reform of the tax code, considerably altering particular person, company, and worldwide taxation. Whereas the momentary reductions in particular person taxes are partly pro-growth, because the discount in marginal private earnings taxes would quickly improve the labor provide, one may cut up the invoice into “broad tax reduction” and “pro-growth tax reform” buckets. Probably the most pro-growth components of the invoice, on which this paper primarily focuses, have been the company price lower, which lowered the company tax price from 35 % to 21 %, and the momentary reintroduction of 100% bonus depreciationDepreciation is a measurement of the “helpful life” of a enterprise asset, equivalent to equipment or a manufacturing facility, to find out the multiyear interval over which the price of that asset might be deducted from taxable earnings. As a substitute of permitting companies to deduct the price of investments instantly (i.e., full expensing), depreciation requires deductions to be taken over time, decreasing their worth and discouraging funding.

for short-lived belongings.[3] The invoice additionally included new limits to curiosity deductibility, in addition to a number of different small, base-broadening income offsets.

The CHIPS and Science Act was signed into regulation in August 2022. Many of the CHIPS and Science Act just isn’t tax coverage, but it surely contains $24 billion in semiconductor manufacturing funding tax credit.[4] It additionally contains $39 billion in funding for the CHIPS for America Fund and a further roughly $15 billion for a handful of different priorities.[5] These prices are over a 10-year interval, however many of the influence comes earlier within the decade. The “science” a part of the CHIPS and Science Act included $200 billion in authorizations for a collection of scientific initiatives throughout a number of federal companies, however these adjustments have to be appropriated in subsequent laws.[6]

The Inflation Discount Act was additionally signed into regulation in August 2022.[7] A big share of the IRA was dedicated to tax coverage. The regulation launched new credit for inexperienced power, expanded current ones, and continued an growth of Reasonably priced Care Act subsidies for medical health insurance. To pay for the applications, the regulation raised funding for IRS enforcement, instituted controls on drug pricing, and launched two notable new taxes: a company minimal tax primarily based on e book earningsE book earnings is the quantity of earnings firms publicly report on their monetary statements to shareholders. This measure is helpful for assessing the monetary well being of a enterprise however usually doesn’t replicate financial actuality and may end up in a agency showing worthwhile whereas paying little or no earnings tax.

, and a 1 % excise taxAn excise tax is a tax imposed on a selected good or exercise. Excise taxes are generally levied on cigarettes, alcoholic drinks, soda, gasoline, insurance coverage premiums, amusement actions, and betting, and sometimes make up a comparatively small and unstable portion of state and native and, to a lesser extent, federal tax collections.

on inventory buybacks.[8]

In fiscal phrases, the Tax Cuts and Jobs Act was a bigger piece of laws than the CHIPS and Science Act and Inflation Discount Act mixed, however for the needs of evaluating every coverage’s influence on funding within the brief time period, contrasting the laws’s scale is surprisingly advanced.

It makes extra sense to match the prices of the legislative packages over 10 years quite than within the first yr due to timing points. For instance, each 100% bonus depreciation and a tax credit scoreA tax credit score is a provision that reduces a taxpayer’s closing tax invoice, dollar-for-dollar. A tax credit score differs from deductions and exemptions, which cut back taxable earnings, quite than the taxpayer’s tax invoice instantly.

for renewable power manufacturing incentivize funding. Nevertheless, the price of 100% bonus depreciation is introduced ahead, as an organization deducts the total value of their funding instantly as an alternative of spreading the deductions out over the lifetime of the asset. Conversely, the price of the manufacturing tax credit score is pushed later within the funds window. Whereas it incentivizes new funding within the backed power kind, the fiscal value of the manufacturing tax credit score is skewed in direction of the finish of the funds window (e.g., new wind manufacturing would take years to return on-line).

Tax Basis estimated the enterprise and worldwide provisions of the TCJA to value round $373 billion on internet over a decade.[9] In the meantime, the Joint Committee on Taxation estimated they might value round $594 billion over a decade.[10]

The method of narrowing down key supply-side-relevant provisions for the IRA and CHIPS is much less simple. However subtracting out the foremost healthcare provisions of the IRA (although worth controls on medication will cut back pharmaceutical sector R&D funding)[11] and the IRS enforcement growth, the price of the IRA comes out to roughly $110 billion over a decade, in accordance with Tax Basis’s evaluation.[12] In the meantime, CHIPS sums to $79 billion over a decade in accordance with the Congressional Price range Workplace (CBO) and the Joint Committee on Taxation (JCT).[13]

Nevertheless, the CBO lately raised its estimate of the IRA’s value by $428 billion.[14] A part of the change ($224 billion) is expounded to new EPA laws on car emissions, which is able to additional speed up the adoption of EVs and improve utilization of the IRA’s EV tax credit, whereas additionally decreasing gasoline excise tax income. However $204 billion of the change pertains to the a number of different inexperienced power tax credit. Even when setting apart the $224 billion pushed by the EPA regulatory change, including $204 billion to the preliminary value estimates of the business-related provisions of the IRA places it on par with the price of the TCJA’s enterprise provisions. Moreover, different analysis has additionally discovered the IRA will value considerably greater than initially anticipated.[15]

When factoring within the elevated value estimates, the mixed IRA/CHIPS bundle is rather more corresponding to the web value of TCJA’s business-side reforms.

“Orthodox” Provide-Facet Economics versus Industrial Coverage

One commonality between industrial coverage and the extra typical supply-side orthodoxy is that they’re each involved with rising an economic system’s productive capability—in different phrases, the provision facet. Which means technological development, elevated capital inventory, and expanded labor provide. Whereas each typical supply-side and industrial coverage usually embody insurance policies that improve combination demand as effectively, the core justification is enhancing manufacturing quite than goosing spending.

As Dani Rodrik, heterodox economist and main advocate for brand spanking new industrial coverage, wrote in a latest paper, there are a number of challenges to measuring an industrial coverage’s influence.[16] Rodrik and his coauthors outline industrial insurance policies as:

. . . these authorities insurance policies that explicitly goal the transformation of the construction of financial exercise in pursuit of some public purpose. The purpose is usually to stimulate innovation, productiveness, and financial development. However it is also to advertise local weather transition, good jobs, lagging areas, exports, or import substitution.[17]

The supply of essentially the most ambiguity on this definition is “concentrating on the transformation of the construction of financial exercise in pursuit of some public purpose.” As an example, in the middle of the federal government’s operations, it wants workplace provides, equivalent to staplers. It purchases staplers to facilitate the federal government’s provision of a wide range of public companies. By buying staplers, it redirects sources to stapler manufacturing, thus remodeling the construction of financial exercise (in direction of staplers). Thus, authorities procurement is a stapler industrial coverage.

That could be a facetious instance. However there must be some type of differentiation between “industrial coverage” and “authorities coverage.” Broad definitions of commercial coverage may find yourself together with nearly any coverage a authorities enacts, together with deregulation, broad-based tax cuts, or fundamental authorities procurement practices.

One technique to distinguish “authorities coverage” from “industrial coverage” is design. Scott Lincicome of the Cato Institute emphasizes using slender, industry-specific coverage (versus broad, economy-wide coverage) as key to what constitutes industrial coverage, in addition to a give attention to the manufacturing sector and the advance of business market outcomes.[18]

One other technique to distinguish “authorities coverage” from “industrial coverage” is intent. If policymakers argue for a coverage in industrial coverage phrases (selling a selected sector as a way to remodel or develop the economic system), then maybe it is sensible to categorise that coverage as industrial coverage. For instance, policymakers hardly ever discuss concerning the F-35 fighter program as a transformative industrial coverage for the broader economic system, versus an answer to a selected navy want. Nevertheless, if it was bought as a method for advancing American aviation manufacturing at first, then the label would make extra sense.

Which Different Coverage Targets?

Each orthodox supply-side coverage and industrial coverage strategy points past broad financial and wage development. Nevertheless, their approaches are totally different.

The extra orthodox supply-side perspective suggests increased funding will assist handle a collection of different points. In sure circumstances, some issues could be pushed by structural biases in opposition to funding in a specific sector. Lengthy depreciation schedules create substantial disincentives to constructing multifamily housing, so shifting to full expensingFull expensing permits companies to instantly deduct the total value of sure investments in new or improved expertise, gear, or buildings. It alleviates a bias within the tax code and incentivizes corporations to take a position extra, which, in the long term, raises employee productiveness, boosts wages, and creates extra jobs.

will assist handle the housing provide scarcity.[19] Expensing for capital funding would additionally assist with capital inventory turnover within the inexperienced transition, as it could make changing older, dirtier, or much less environment friendly gear and constructions throughout the economic system with newer, cleaner variations marginally cheaper.[20] Nevertheless, simply eliminating tax disincentives which are making an current drawback worse just isn’t a full answer to many issues—within the case of local weather change, as an illustration, simply eliminating funding penalties doesn’t handle the unfavourable externalities of greenhouse fuel emissions.

Then again, IRA and CHIPS are each bought as bigger packages with many distinct coverage targets. CHIPS is as a lot about strategic competitors with and independence from China as it’s about creating a cutting-edge {industry} to drive broader development. The regulation additionally contains some subsidies for childcare on the identical time. The IRA is a local weather regulation first, which additionally seeks to distribute local weather funding geographically to distressed areas and supply them with high-paying, middle-class jobs. It additionally purports to be an environment friendly reallocation of capital in direction of development industries of the long run, though personal capital markets usually carry out this operate fairly effectively and advocates haven’t proven how the coverage would enhance outcomes. The IRA and CHIPS may find yourself succeeding at a few of these targets and failing at others. In accordance with the administration and advocates of the strategy, the targets are harmonious with one another.[21]

Maybe essentially the most salient instance is supplied by Secretary of Commerce Gina Raimondo, who said in September 2023, “CHIPS for America is basically a nationwide safety initiative,” associated to strengthening provide chains for superior applied sciences like semiconductors and stopping superior expertise transfers to unfriendly nations.[22]

Some personal sector industries have specific relevance to nationwide safety. Then again, policymakers have a protracted historical past of abusing nationwide safety as a justification for protectionism.[23] Even when an {industry} might benefit safety for nationwide safety functions, a protectionist measure should show counterproductive, and even a profitable nationwide safety coverage may not be a profitable financial industrial coverage.[24]

In the end, the orthodox view sees broader pro-growth coverage as offering potential spillover advantages in different coverage points, whereas industrial coverage usually sees each idiosyncratic points and broader financial development as instantly entwined.

Which Relative Costs?

The orthodox view is targeted on the worth of funding relative to consumption. Below that view, decreasing marginal tax charges on funding will improve capital funding, and capital funding will spur higher productiveness development and financial development.[25] This view leaves the allocation of funding throughout sectors as much as markets as a lot as potential, trusting markets to know higher than policymakers the place the best investments are.

The commercial coverage view is extra targeted on the relative worth of funding in totally different industries. The core premise on this case is that markets usually are not environment friendly at optimally allocating capital throughout sectors to maximise financial development. As a substitute, authorities coverage ought to push funding in direction of sure sectors with higher development potential.[26] As Nationwide Safety Adviser Jake Sullivan put it, “A contemporary American industrial technique identifies particular sectors which are foundational to financial development, strategic from a nationwide safety perspective, and the place personal {industry} by itself isn’t poised to make the investments wanted to safe our nationwide ambitions.”[27]

For what it’s value, neither supply-siders nor industrial coverage advocates restrict themselves to marginal tax priceThe marginal tax price is the quantity of extra tax paid for each extra greenback earned as earnings. The typical tax price is the overall tax paid divided by complete earnings earned. A ten % marginal tax price signifies that 10 cents of each subsequent greenback earned can be taken as tax.

adjustments (of assorted varieties). For the sake of conceptual symmetry although, the primary a part of this paper will juxtapose broad funding tax cuts with narrower funding tax cuts geared toward particular industries or sectors.

The excellence between the 2 can find yourself blurred in observe. Maybe most significantly, the U.S. tax code just isn’t working from a impartial baseline, the place all industries are handled equally. Tax adjustments that enhance the remedy of funding as a complete profit some industries greater than others as a result of some industries are extra investment-intensive, and/or the established order treats them unfairly.[28] Tax adjustments to funding additionally usually solely give attention to one funding asset class; as an illustration, the TCJA launched 100% bonus depreciation for short-lived belongings, particularly gear and equipment, however not long-lived belongings, particularly constructions.[29] Traditionally, some policymakers have reduce on neutrally pro-investment tax provisions beneath the misguided perception that they supply distinctive, non-neutral assist for some industries.[30] Accordingly, policymakers trying to make broad pro-investment coverage decisions have usually ended up altering the relative worth of funding in several industries.

Conversely, on the economic coverage facet, main incentives to spend money on particular industries additionally cut back the worth of funding (in combination) relative to consumption. Whereas the main target of funding tax credit for particular industries is usually shifting funding to that sector, the tax subsidy additionally adjustments the general worth of funding relative to consumption.

Essential Linkages

An ordinary device economists use to research the productive capability of an economic system is the Cobb-Douglas manufacturing operate. Cobb-Douglas suggests an economic system’s potential output is a operate of the economic system’s labor (L) and capital (Ok), together with an error time period, complete issue productiveness (A). Labor is individuals (particularly, their time spent working), and capital is the instruments and different belongings they use within the manufacturing course of (e.g., buildings, machines, computer systems, mental property, and many others.). Complete issue productiveness is more durable to outline. Technically, it’s how successfully the economic system could make use of labor and capital. In observe, complete issue productiveness is a operate of information, talent, and innovation.

The differing approaches of each TCJA and IRA/CHIPS in producing supply-side development might be seen in how they plan to drive adjustments in A, L, or Ok.

Within the case of the TCJA, the decrease company tax price and momentary 100% bonus depreciation for short-lived belongings cut back the price of capital, thus decreasing the relative worth of funding. This results in elevated funding, which suggests a rise in capital (Ok). Elevated capital makes staff extra productive and will increase demand for staff. This results in each increased total output and better wages for staff.

Industrial coverage is extra advanced, given the multitude of coverage instruments beneath the broader umbrella of commercial coverage and the issues industrial coverage makes an attempt to resolve. However specializing in development and innovation, the economic coverage view holds that totally different industries or sectors have totally different social advantages or development potential in a means that isn’t adequately priced by market forces.

Take a sector-specific funding tax credit score. It reduces the price of capital in that sector relative to the remainder of the economic system and will increase funding within the sector, rising Ok (each by shifting funding from different sectors and shifting consumption to funding). Then, because of the rise in sector funding, the sector develops quicker. This raises sector-level productiveness. If policymakers have accurately recognized a sector with specific development potential, then the coverage will translate to increased complete issue productiveness development than would in any other case have taken place had the federal government maintained a laissez-faire strategy to funding incentives.

When contemplating the orthodox view, reducing the price of capital throughout the board makes numerous tasks throughout the economic system that have been simply barely not value pursuing on a risk-adjusted foundation viable, altering funding selections on the margin. Conversely, within the slender sector- or industry-specific funding tax credit score case, the coverage makes many tasks in that subset of the economic system viable, even ones with anticipated unfavourable returns with out the tax subsidy.

Now, maybe these tasks with unfavourable anticipated (personal) returns have an untapped social profit or potential. But when not, then the sector-specific coverage has dragged funding and sources away from extra productive sectors to the backed sector. The backed sector may nonetheless develop, however its development is coming on the expense of foregone higher development elsewhere within the economic system. One other chance is the rationale the anticipated returns of tasks within the backed sector are unfavourable to start with is that they face some type of onerous constraint past simply the capital value, equivalent to regulatory hurdles or a mismatch with the prevailing workforce, that make funding nonetheless infeasible.

Rodrik et al. describe the view that authorities can successfully goal companies and industries of curiosity because the developmentalist view.[31] Within the idealized industrial coverage case, the federal government acts nearly like a enterprise capital agency, accelerating essentially the most potent areas for technological change.

Rodrik et al. concede two objections to the economic coverage view. The primary is the “inefficacy” objection: authorities seeks to assist development industries however can’t achieve this successfully. Central planners lack the knowledge that tens of millions of decentralized actors unfold throughout the economic system have. Accordingly, it’s uncertain they might have the ability to pinpoint industries with distinctive development potential that these different actors have failed to acknowledge. The traditional F. A. Hayek essay “The Use of Data in Society” is the foundational tract of this critique.[32]

The second is the rent-seeking objection: authorities is captured by particular curiosity teams and is taken with benefitting them, not the general public.[33] Given a system of a collection of discretionary, focused coverage interventions, companies will expend extra sources chasing these preferential policymaking interventions as an alternative of increasing and enhancing manufacturing.[34] As an example, whereas the traditional toddler {industry} argument holds subsidies or protections will lead a brand new home {industry} to grow to be aggressive with worldwide companies, another end result is the home {industry} will spend money on sustaining its unique entry to the home market quite than enhancing its merchandise and processes.

Rodrik et al. acknowledge these critiques however argue for a extra pragmatic strategy targeted on evaluating industrial insurance policies in observe to see if they can overcome these hurdles.

A broad definition of commercial coverage, together with quite a few international locations all over the world and a contemporary time horizon of some centuries, create a wide-ranging set of case research to attract from to argue both for or in opposition to industrial coverage. Some industrial coverage advocates attain again to former Treasury Secretary Alexander Hamilton’s Report on Producers and the American System. All over the world, Latin American nations’ experiences in import-substitution industrialization are a present to industrial coverage critics.[35] Industrial coverage advocates credit score industrial coverage for the fast development of East Asian economies like Japan, South Korea, Taiwan, and China, whereas critics argue broader strikes towards personal markets deserve credit score.[36] Moreover, East Asia gives loads of examples of failed industrial coverage initiatives as effectively.[37]

In How Asia Works, one thing of an industrial coverage Bible, Joe Studwell argues industrial coverage was vital for the event of South Korea, Japan, and Taiwan, over the opposition of overseas mainstream economists who have been, in Studwell’s view, making an attempt to power an financial mannequin that works for rich, developed economies onto comparatively poor, creating economies (as Japan, Taiwan, and South Korea have been within the aftermath of World Conflict II). By the identical token, nonetheless, it may not make sense to attract classes from poor, creating economies (like, say, Nineteen Sixties South Korea) and apply them to the United States.

To keep away from these issues about exterior validity, it is sensible to give attention to more moderen efforts in U.S. coverage. Additional narrowing the search to coverage mechanisms much like the IRA and CHIPS (e.g., sector-specific tax coverage and home content material necessities of assorted varieties) and insurance policies in comparable industries (semiconductors and power), reveals a discouraging monitor file.

The historical past of utilizing tax coverage to reallocate capital throughout sectors within the U.S. gives many cautionary tales to this impact. As referenced earlier, policymakers designing the 1986 tax reform noticed (impartial) accelerated depreciation benefitting producers as a purpose to tug again on accelerated depreciation. A part of their justification was that the producers have been industries of the previous, not industries of the long run.[38] By decreasing the advantages of accelerated value restorationValue restoration is the flexibility of companies to get well (deduct) the prices of their investments. It performs an vital function in defining a enterprise’ tax base and might influence funding selections. When companies can’t totally deduct capital expenditures, they spend much less on capital, which reduces employee’s productiveness and wages.

, the 1986 tax reform penalized the manufacturing sector relative to extra capital-light financial exercise. For many who argue manufacturing is especially vital for financial development, that incident ought to elevate doubts about policymakers’ potential to soundly choose the “proper” industries.

The American metal {industry} has persistently struggled regardless of (or due to) protectionist tariffs (in addition to non-tax commerce obstacles, and “Purchase American” necessities), whereas these insurance policies additionally harm different downstream producers within the course of.[39] Whereas not an industrial coverage per se, the low-income housing tax credit score (LIHTC) gives little reasonably priced housing for its value.[40] Within the power sector, tax credit might have performed a job in creating the photo voltaic {industry}, however credit for different fuels equivalent to ethanol have been probably counterproductive.[41] Moreover, tariffs haven’t preserved or accelerated U.S. photo voltaic producers. Numerous predominantly non-tax measures within the Artificial Fuels Company (created in 1980 within the aftermath of the Nineteen Seventies power crises) additionally failed to provide notable technological enhancements.[42]

Within the case of the semiconductor {industry}, authorities analysis performed an vital function in its growth, however principally on account of unplanned analysis spillovers from navy tasks, quite than a top-down technique to develop the {industry}.[43] Within the Eighties, when policymakers grew to become involved the USA had misplaced its edge in semiconductors to Japan, they established Sematech, a analysis consortium of personal corporations and authorities actors, with the purpose of regaining management. Whereas the U.S. semiconductor {industry} gained floor within the late Eighties and early Nineteen Nineties, it was probably not on account of Sematech, which championed a number of failed corporations and targeted on markets for current reminiscence chips. The U.S. resurgence is generally credited to corporations specializing in cutting-edge logic chips.[44]

In equity to industrial coverage advocates, it’s empirically difficult to show a reform that reallocated capital to a sector drove increased financial development total.[45] However lots of the sector-specific tax insurance policies the U.S. has enacted have didn’t develop a productive sector, not to mention a extra productive economic system within the combination.

What Do the Information Say?

Returning to the massive image, each supply-side tax reform and industrial coverage depend on the linkage between extra funding and extra productiveness development, and that linkage takes time. New plant and gear have to be constructed and put in, after which staff have to be employed and subsequently study or be educated to make use of mentioned gear. On the expertise entrance, technological change doesn’t instantly lead to productiveness development both—the steps from invention to innovation to diffusion can take a number of years.

Consequently, it’s troublesome to guage both supply-side tax reform or industrial coverage within the first few years of enactment. Nevertheless, we are able to at the very least look at how a few of the early units of these linkages (particularly, funding) have fared relative to projections, and contemplate different elements which will predict how the insurance policies will proceed to fare.

One may bounce to funding, development, or wage time collection knowledge and start making conclusions concerning the impacts of the insurance policies. Nevertheless, neither the TCJA, nor CHIPS, nor the IRA have been enacted in vacuums. This paper presents fundamental counterfactual evaluation, evaluating funding conduct following the passage of every legislative bundle to CBO projections previous every bundle’s enactment. Within the case of the TCJA, some extra rigorous evaluation is obtainable.

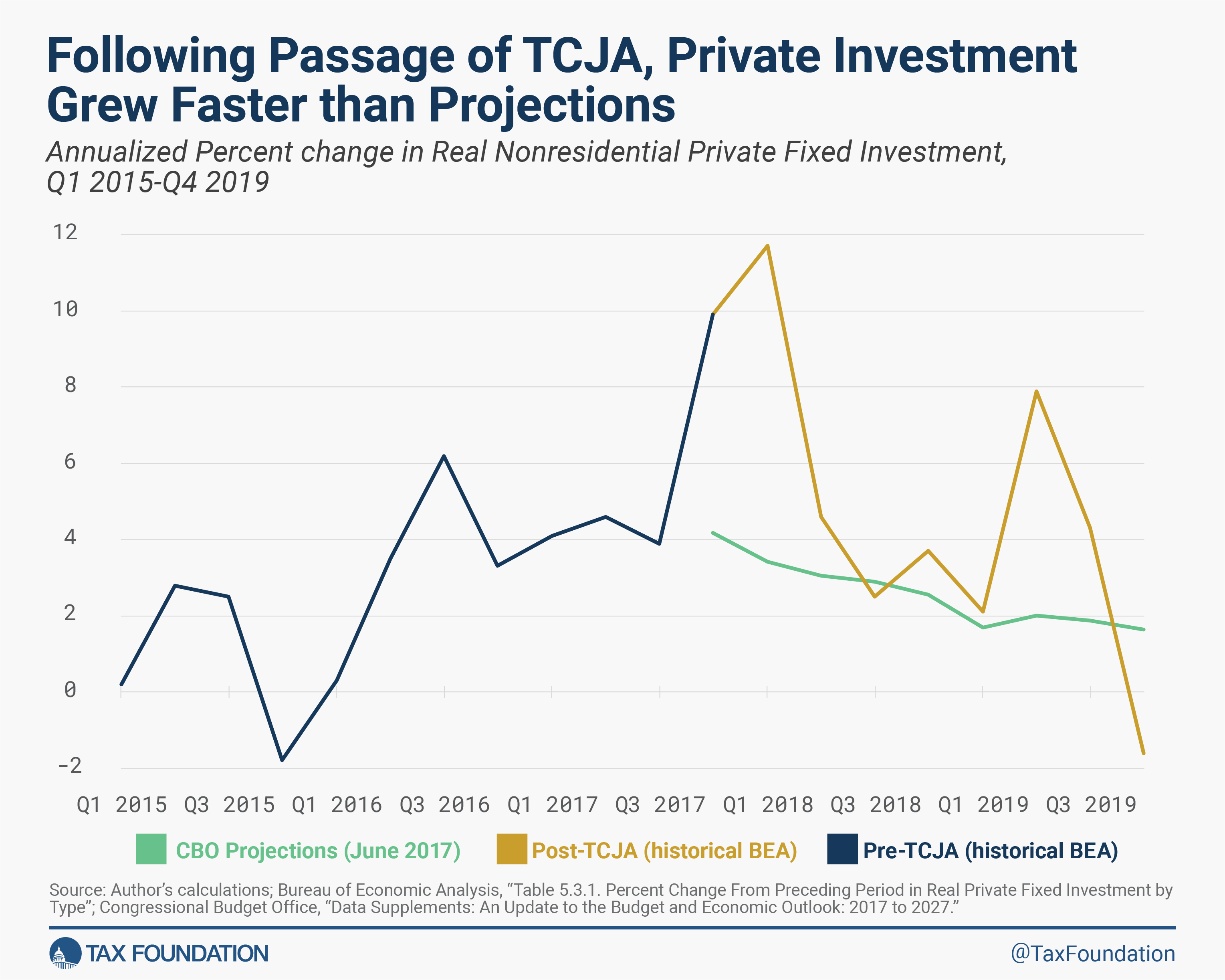

Tax Cuts and Jobs Act

A fundamental strategy to evaluating whether or not the TCJA has stimulated new funding is to contemplate a crude counterfactual of the U.S. economic system had the TCJA not handed. This may be performed by evaluating funding following the act’s passage to funding projections made earlier than the act’s passage. Initially, combination funding considerably outperformed expectations, rising by over 10 % on an annualized foundation within the first quarter of 2018. Funding development slowed again nearer to expectations in subsequent quarters however rallied once more in 2019.

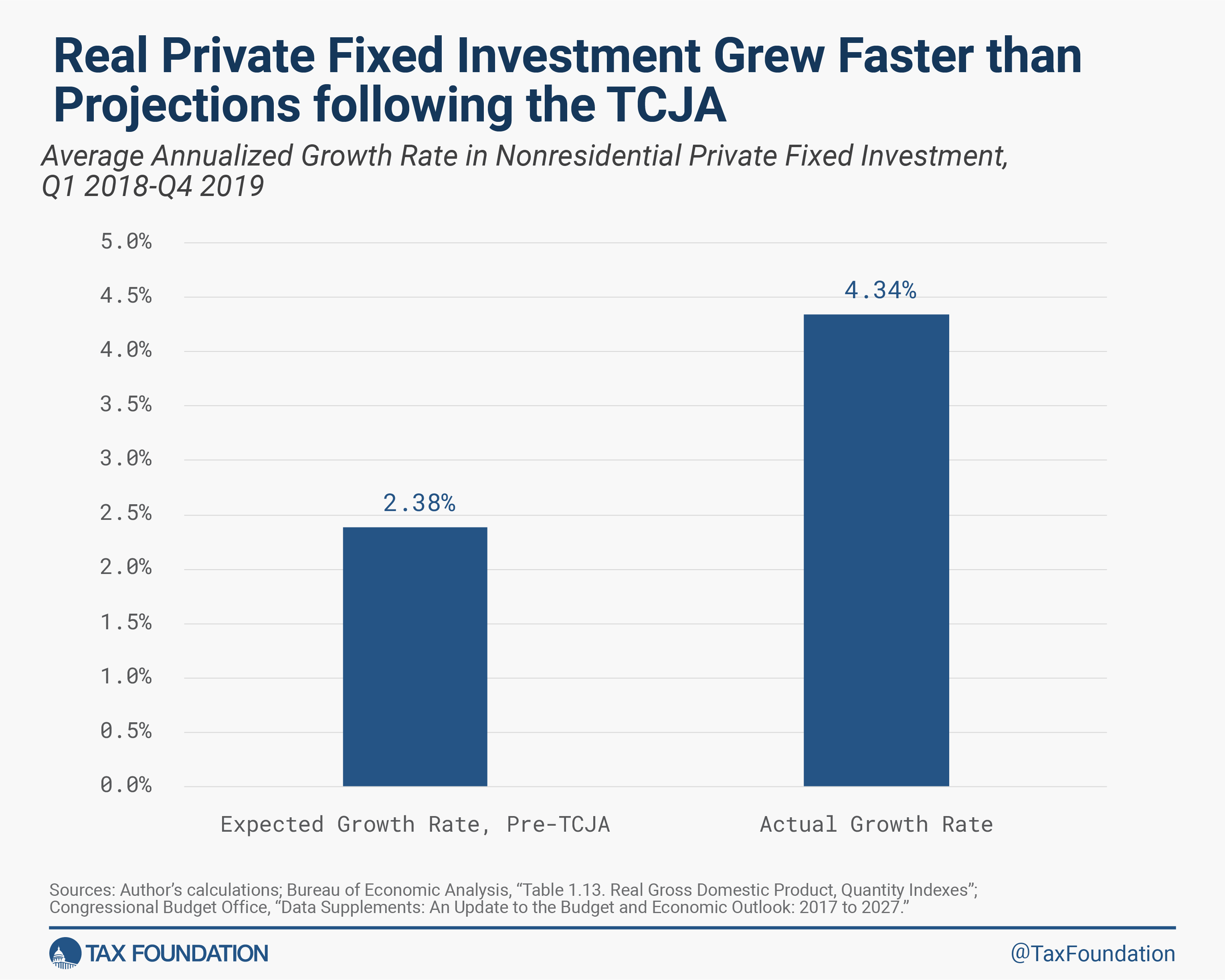

Approached otherwise, within the eight quarters instantly following the passage of the TCJA, actual nonresidential personal mounted funding grew by a mean annual price of 4.3 %, whereas pre-TCJA estimates projected actual nonresidential personal mounted funding to develop by a mean annual price of two.4 %.[46]

Contrasting the precise funding knowledge to the pre-enactment projections just isn’t an entire counterfactual. Different surprising adjustments in coverage, together with surprising adjustments within the financial surroundings, muddy the image. A few of these adjustments put extra upward stress on funding. Maybe most notably, the broad particular person tax cuts from the TCJA, coupled with will increase in authorities spending, elevated combination demand, which might assist funding within the brief time period. Moreover, a rise in oil costs spurred new funding in oil and fuel extraction in 2018, earlier than it subsided in 2019.[47]

Then again, some elements put downward stress a number of months after the TCJA was enacted. The Trump administration initiated a commerce conflict with China, elevating taxes on imports and introducing enterprise uncertainty, significantly for manufacturing companies which are sometimes extra trade-exposed.[48] The Federal Reserve additionally raised rates of interest, though the June 2017 CBO report anticipated will increase within the federal funds price.[49] Additional complicating the image, the COVID-19 pandemic hit roughly two years after the TCJA’s enactment, making knowledge for the next two years troublesome to interpret.

Through the years for the reason that TCJA’s passage, a number of research have examined the consequences of the reform on funding and development, with a number of indicating the TCJA brought on corporations to extend funding in the USA. New analysis from Gabriel Chodorow-Reich, Matthew Smith, Owen Zidar, and Eric Zwick finds the TCJA raised funding by 20 % amongst companies with the imply tax change in comparison with companies with no tax change, and that the regulation elevated long-run equilibrium capital inventory by 7.4 %.[50] Different firm-level research have discovered elevated funding in response to the TCJA, significantly amongst companies with increased prices of capital earlier than the regulation was enacted.[51]

Whereas the constructive influence on funding is obvious, the TCJA’s influence on wages is much less sure. One latest working paper discovered companies with lowered marginal tax charges elevated funding, gross sales, employment, and earnings, however wages didn’t rise in those self same companies throughout the board.[52] Now, actual wage development accelerated within the two years following the Tax Cuts and Jobs Act, however that wage development just isn’t essentially a vindication of the supply-side linkages proposed by the orthodox supply-side concept.[53] Below the supply-side concept, reductions in the price of capital spur funding, which spurs productiveness development, which spurs wage development. Such linkages wouldn’t happen instantly, however quite over a number of years.

Inflation Discount Act and CHIPS Act

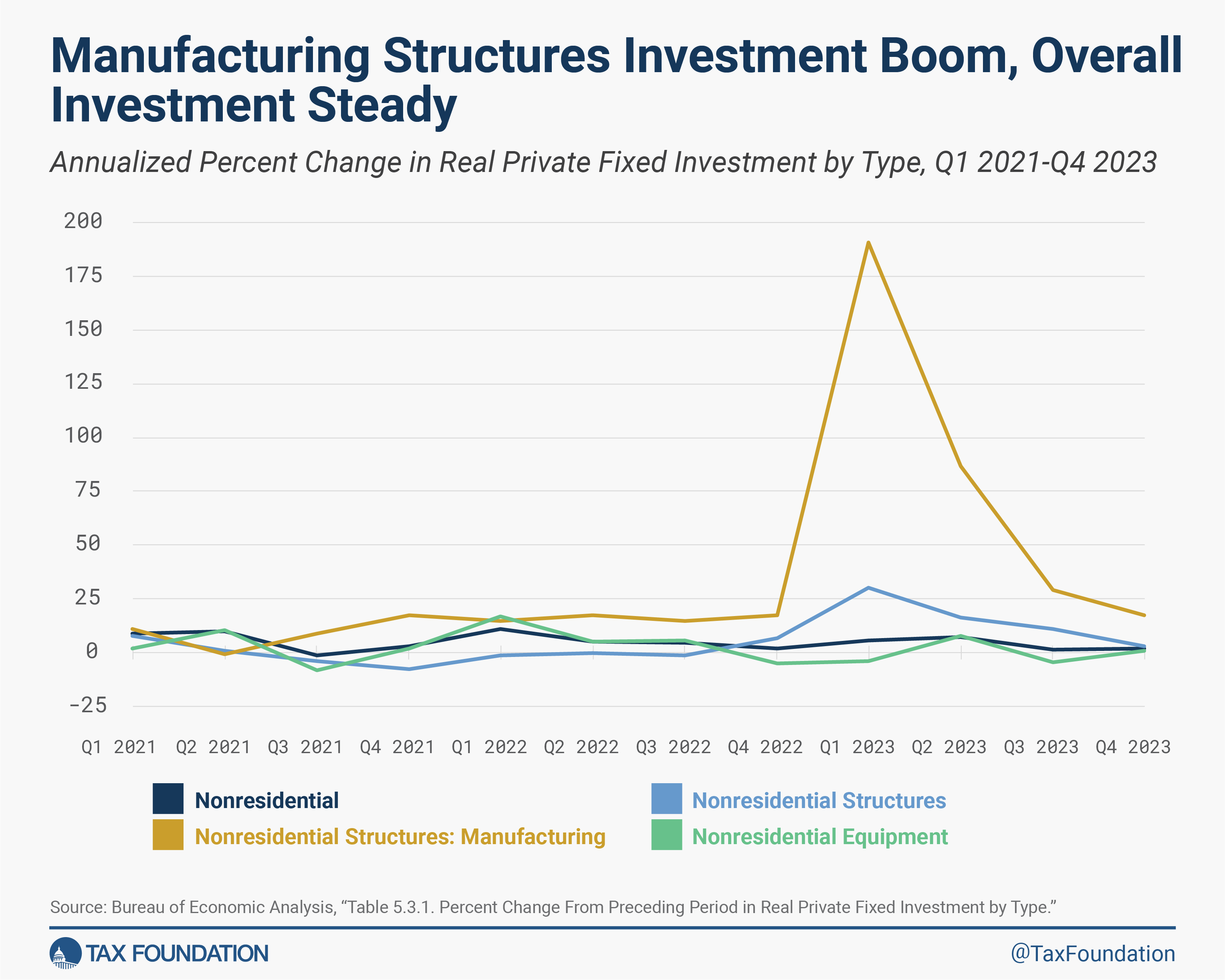

With a shorter time horizon, and extra potential confounding elements, it’s even more durable to pinpoint the influence of the IRA and the CHIPS Act on supply-side financial development. Advocates of the Biden administration’s strategy usually level to 1 knowledge set as proof for the influence of the regulation. Manufacturing building spending has taken off, in actual phrases.[54] This increase in spending has led advocates of IRA and CHIPS to talk of a historic degree of personal funding—which is correct for funding in manufacturing constructions, however not true of personal funding as a complete.[55]

Manufacturing constructions funding grew at an annualized price of simply over 50 % within the six quarters starting in Q3 2022. Nevertheless, manufacturing constructions are a slender share of capital funding—even with manufacturing constructions funding booming in 2023, it solely accounted for 4 % of nonresidential mounted funding. And when wanting on the greater image, the comparatively small function of producing constructions is obvious—nonresidential constructions funding has grown by 11 % on an annualized foundation since Q3 2022, and nonresidential mounted funding has grown by just below 4 %, with funding in gear truly slowing over this era. 4 % development in enterprise funding just isn’t dangerous, by any means, however it’s a far cry from the eye-popping numbers in manufacturing constructions.

Manufacturing building spending has grown quickly, however that doesn’t essentially assure actual building or actual productiveness. California’s high-speed rail mission gives an excessive instance of building spending not translating to productive exercise, with over $10 billion in public cash having been spent to date, but even restricted operations nonetheless a number of years away.[56] In the meantime, China’s ghost cities—overbuilt deliberate cities with out inhabitants—present an instance of accomplished building finally proving to be unproductive.[57]

These are excessive examples of building spending not translating to helpful outputs, however the juxtaposition between spiking manufacturing building funding and widespread main mission delays, such because the repeated delays of the TSMC plant in Arizona, suggests the increase in building spending might not translate to a proportional improve in productive output, productiveness and wages.[58] The allowing challenges related to each the semiconductor vegetation and main clear power tasks are severe constraints that might preserve tasks in limbo.

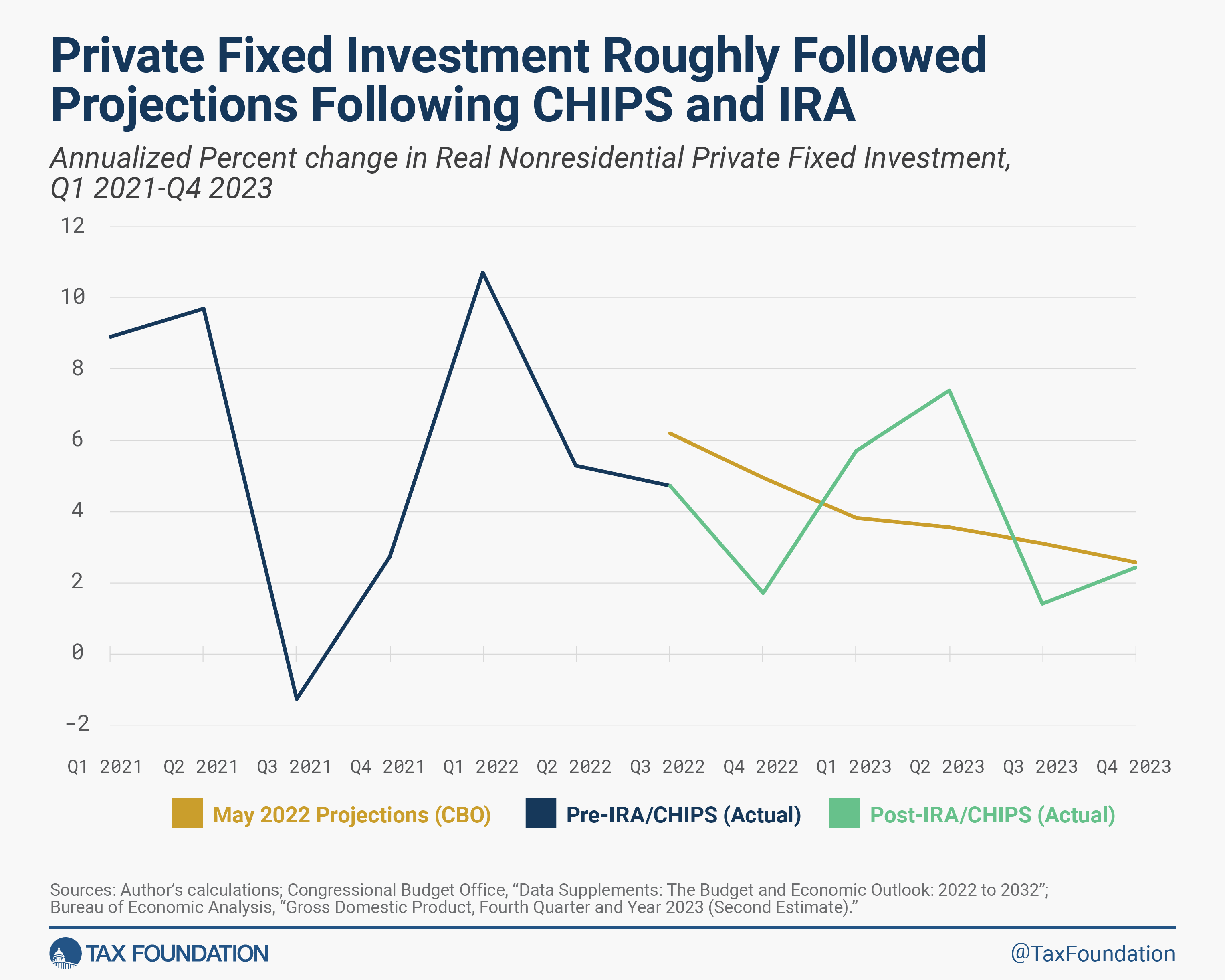

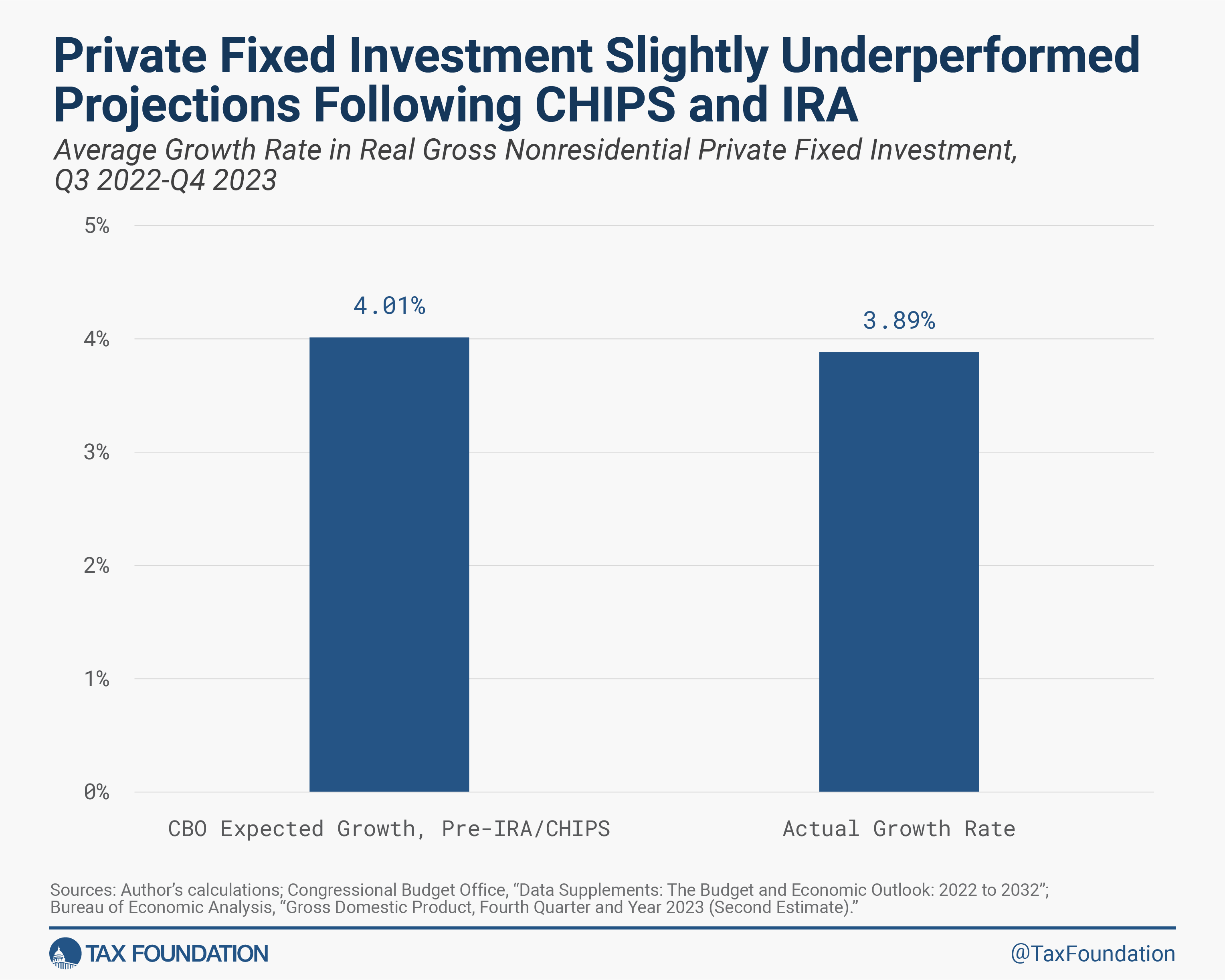

Moreover, relative to the CBO’s projections as of Might 2022, nonresidential personal mounted funding development in combination has not outpaced projections. Whereas development has overperformed in a number of quarters (and underperformed in others), the general image reveals one thing roughly consistent with projections earlier than the legal guidelines have been handed. In Might 2022, CBO projected the common annualized development price of enterprise funding between the beginning of Q3 2022 and the tip of Q4 2023 can be 4.0 %. In actuality, personal mounted funding grew by 3.9 %. This tough counterfactual would recommend CHIPS and IRA haven’t boosted total funding.

Just like the TCJA, different surprising adjustments additionally influenced funding, with some placing downward stress on funding and others placing upward stress on funding. Most notably, rates of interest rose rapidly—quicker and greater than the CBO initially projected, which raised the price of capital and lowered funding.[59] Then again, oil costs rose quicker than anticipated, too, and that put upward stress on power funding.[60] The online influence of those outdoors elements on funding is subsequently unsure.

Equally, outdoors elements additionally influenced the precise increase in manufacturing constructions. An funding increase was already in progress in a few of the backed industries, significantly semiconductor manufacturing. The CHIPS Act was largely a response to provide chain disruptions within the semiconductor {industry} in 2020 and 2021. These disruptions led policymakers to assist onshoring semiconductor manufacturing.

The market agreed. Whereas having all provide chains stored onshore just isn’t a recipe for resiliency, diversification is effective, and personal funding was already shifting in response to the scenario.[61] Semiconductor {industry} gamers Intel, TSMC, and Samsung introduced main investments in 2021 and early 2022.[62] Funding in pc, digital, and electrical manufacturing constructions rose from $11.3 billion within the 12 months previous July 2021 to $41.0 billion within the 12 months previous July 2022. Trade funding continued to develop following the CHIPS Act’s passage, however it’s unclear how a lot of that additional improve was pushed by market situations quite than the tax change.[63]

There are additionally some associated idiosyncratic questions pertaining to wash power funding. Within the case of many renewable power sources, prices have fallen dramatically over the previous twenty years, so some elevated adoption and growth can be anticipated even with out coverage adjustments.[64]

The IRA and CHIPS Act haven’t spurred a rise in funding throughout the economic system, as nonresidential mounted funding is rising barely slower than the CBO projected a number of months earlier than the 2 legal guidelines have been enacted. To date, they haven’t pushed the beginning of a supply-side increase within the extra orthodox sense. Nevertheless, we’ve seen a considerable shift in funding, as manufacturing funding (particularly in constructions) has grown quickly whereas combination funding has been regular.

Different Main Coverage Targets

As talked about earlier than, the IRA and CHIPS weren’t solely bought as development insurance policies. The IRA is a local weather regulation, and CHIPS is a nationwide safety coverage, with extra targets associated to geographic distribution and labor assist. The IRA’s influence on carbon emissions, as an illustration, will take a number of years to return into the image. And moreover, a few of the idiosyncratic targets may come into battle with the broader purpose of elevated financial development.

One pink herring within the debate that each proponents and opponents see as a related metric for the applications’ success is manufacturing employment. The Biden administration (and a few of its fellow vacationers within the industrial coverage area) sees half the manufacturing sector’s function as a secure middle-class jobs machine, and industrial coverage as a way to return to a previous period of broadly-available, well-paying manufacturing jobs for staff with no faculty diploma.[65] Nevertheless, manufacturing as a share of U.S. employment has not budged for the reason that CHIPS Act and IRA have been handed.[66]

Manufacturing employment share is a poor metric for evaluating how the IRA and CHIPS accelerated development and innovation. Superior manufacturing is extremely automated, so cutting-edge industries shouldn’t be labor-intensive. Within the final decade, for instance, Singapore has had a producing renaissance, with its manufacturing sector rising when it comes to output and share of GDP, an outlier relative to different developed economies.[67] However on the identical time, manufacturing employment as a share of complete employment has continued to say no in Singapore.[68] Whereas it might be a discredit to advocates of the coverage packages that they see manufacturing employment as uniquely vital, manufacturing employment share remaining low just isn’t essentially proof the coverage is failing to fulfill its different aims.

Conclusion

Primarily based on each tough counterfactuals and now a rising financial literature, the TCJA brought on a considerable improve in funding, as we might count on. In distinction, the focused subsidies of the IRA and CHIPS Act haven’t led to a broad improve in personal funding outdoors of backed sectors. This outcome to date can also be per what we might count on, though we should always warning that it’s nonetheless very early to guage funding impacts of those legal guidelines handed in August 2022.

However one lesson per these preliminary interpretations of the info is that costs matter (particularly tax costs). The TCJA broadly lowered the price of capital, which drove elevated capital funding all through the economic system. In the meantime, the IRA and CHIPS packages modified the price of capital in several industries, main funding to stream to the newly backed actions. In each circumstances, the early proof signifies funding responded to cost adjustments.

For each coverage baskets, the pass-through of funding to productiveness and wage development ought to take a number of years and shall be troublesome to determine exactly given the noise of confounding elements, together with the pandemic and different coverage developments. Nevertheless, given the monitor file of earlier industrial coverage efforts, there may be purpose to doubt the effectiveness of the IRA and CHIP Act’s strategy over the long term.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

[1] Brian Deese, “Remarks on a Fashionable American Industrial Technique,” White Home, delivered at Financial Membership of New York, Apr. 20, 2022, https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/04/20/remarks-on-a-modern-american-industrial-strategy-by-nec-director-brian-deese/.

[2] Tax Cuts and Jobs Act of 2017, H.R. 1, 115th Congress (2017), https://www.congress.gov/invoice/One hundred and fifteenth-congress/house-bill/1.

[3] Tax Basis, “Preliminary Particulars and Evaluation of the Tax Cuts and Jobs Act,” Dec. 18, 2017, https://taxfoundation.org/analysis/all/federal/final-tax-cuts-and-jobs-act-details-analysis/; Erica York, Garrett Watson, Alex Durante, Huaqun Li, Peter Van Ness, and William McBride, “Particulars and Evaluation of Making the 2017 Tax Reform Everlasting,” Tax Basis, Nov. 8, 2023, https://taxfoundation.org/analysis/all/federal/making-2017-tax-reform-permanent/.

[4] The CHIPS and Science Act of 2022, H.R. 4346, 117th Congress (2022), https://www.commerce.senate.gov/companies/information/CFC99CC6-CE84-4B1A-8BBF-8D2E84BD7965.

[5] Congressional Price range Workplace, “Estimated Price range Results of H.R. 4346, as Amended by the Senate and as Posted by the Senate Committee on Commerce, Science, and Transportation on July 20, 2022,” Jul. 21, 2022, https://www.cbo.gov/system/information/2022-07/hr4346_chip.pdf.

[6] Justin Badlam, Stephen Clark, Suhrid Gajendragadkar, Adi Kumar, Sara O’Rourke, and Dale Swartz, “The CHIPS and Science Act: Right here’s What’s In It,” McKinsey and Firm, Oct. 4, 2022, https://www.mckinsey.com/industries/public-sector/our-insights/the-chips-and-science-act-heres-whats-in-it.

[7] Inflation Discount Act of 2022, H.R. 5376, 117th Congress (2022), https://www.congress.gov/invoice/117th-congress/house-bill/5376/textual content.

[8] Alex Durante, Cody Kallen, Huaqun Li, William McBride, and Garrett Watson, “Particulars and Evaluation of the Inflation Discount Act Tax Provisions,” Tax Basis, Aug. 10, 2022, https://taxfoundation.org/analysis/all/federal/inflation-reduction-act/.

[9] Tax Basis, “Preliminary Particulars and Evaluation of the Tax Cuts and Jobs Act,” Taxes and Progress Mannequin, Dec. 18, 2017, https://taxfoundation.org/analysis/all/federal/final-tax-cuts-and-jobs-act-details-analysis/.

[10] Joint Committee on Taxation, “Estimated Price range Results of the Convention Settlement For H.R.1, The Tax Cuts and Jobs Act,” Dec. 18, 2017, https://www.jct.gov/publications/2017/jcx-67-17/. The $594 billion contains the impacts of the 20 % pass-through deduction and the limitation on pass-through loss deductions, which JCT categorized as particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges improve with earnings. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years outdated, particular person earnings taxes are the largest supply of tax income within the U.S.

adjustments.

[11] Erica York, “Inflation Discount Act’s Worth Controls Are Deterring New Drug Growth,” Tax Basis, Apr. 26, 2023, https://taxfoundation.org/weblog/inflation-reduction-act-medicare-prescription-drug-price-controls/.

[12] Alex Durante, Cody Kallen, Huaqun Li, William McBride, and Garrett Watson, “Particulars and Evaluation of the Inflation Discount Act Tax Provisions,” Tax Basis, Aug. 10, 2022, https://taxfoundation.org/analysis/all/federal/inflation-reduction-act/.

[13] Congressional Price range Workplace, “Estimated Budgetary Results of H.R. 4346, as Amended by the Senate and as Posted by the Senate Committee on Commerce, Science, and Transportation on July 20, 2022,” Jul. 21, 2022, https://www.cbo.gov/system/information/2022-07/hr4346_chip.pdf.

[14] Congressional Price range Workplace, “The Price range and Financial Outlook: 2024 to 2034,” February 2024, https://www.cbo.gov/publication/59710.

[15] John Bistline, Neil Mehrotra, and Catherine Wolfram, “Financial Implications of the Local weather Provisions of the Inflation Discount Act,” Brookings Establishment Papers on Financial Exercise, Spring 2023, https://www.brookings.edu/articles/economic-implications-of-the-climate-provisions-of-the-inflation-reduction-act/.

[16] Réka Juhász, Nathan Lane, and Dani Rodrik, “The New Economics of Industrial Coverage,” Nationwide Bureau of Financial Analysis Working Paper No. 31538, August 2023, https://www.nber.org/papers/w31538.

[17] Ibid.

[18] See as an illustration, Scott Lincicome and Huan Zhu, “Questioning Industrial Coverage: Why Authorities Manufacturing Plans Are Ineffective and Pointless,” Cato Institute, Sep. 28, 2021, https://www.cato.org/white-paper/questioning-industrial-policy.

[19] See Garrett Watson, “Testimony: Tax Coverage’s Position in Increasing Reasonably priced Housing,” Tax Basis, Mar. 7, 2023, https://taxfoundation.org/analysis/all/federal/expanding-affordable-housing/; Alex Muresianu, “Eighties Tax Reform, Value Restoration, and the Actual Property Trade,” Tax Basis, Jul. 23, 2020, https://taxfoundation.org/analysis/all/federal/Eighties-tax-reform-cost-recovery-and-the-real-estate-industry-lessons-for-today/.

[20] See as an illustration, Sean Bray, Daniel Bunn, and Joost Haddinga, “The Position of Professional-Progress Tax Coverage and Non-public Funding within the European Union’s Inexperienced Transition,” Tax Basis, Might 4, 2023, https://taxfoundation.org/analysis/all/eu/eu-green-transition-tax-policy/; Alex Muresianu, “How Expensing for Capital Funding Can Speed up the Transition to a Cleaner Financial system,” Tax Basis, Jan. 12, 2021, https://taxfoundation.org/analysis/all/federal/energy-efficiency-climate-change-tax-policy/.

[21] The White Home, “ICYMI: Specialists Agree: Chips Manufacturing and Nationwide Safety Bolstered by Childcare,” Mar. 8, 2023, https://www.whitehouse.gov/briefing-room/statements-releases/2023/03/08/icymi-experts-agree-chips-manufacturing-and-national-security-bolstered-by-childcare/.

[22] Nationwide Institute of Requirements and Expertise, “Biden-Harris Administration Declares Closing Nationwide Safety Guardrails for CHIPS for America Incentives Program,” Sep. 22, 2023, https://www.nist.gov/news-events/information/2023/09/biden-harris-administration-announces-final-national-security-guardrails.

[23] Dominic Pino, “Why Protection is Totally different,” Nationwide Overview, Dec. 14, 2023, https://www.nationalreview.com/2023/12/why-defense-is-different/; see additionally Scott Lincicome, “Manufactured Disaster: Deindustrialization, Free Markets, and Nationwide Safety,” Cato Institute Coverage Evaluation No. 907, Jan. 27, 2021, https://www.cato.org/publications/policy-analysis/manufactured-crisis-deindustrialization-free-markets-national-security.

[24] The maritime {industry} gives examples for each circumstances. The Jones Act has a believable nationwide safety justification (guaranteeing home crusing and shipbuilding capability) however has finally harmed these safety targets. Conversely, in World Conflict II, the Liberty Ship program was extraordinarily profitable in quickly increasing U.S. maritime transportation capability to assist the conflict effort, but it surely didn’t type the idea for post-war development in home shipbuilding, nor did the Liberty Ships show significantly helpful in peacetime business purposes.

[25] See, as an illustration, Douglas Holtz-Eakin, “Solow and the States: Capital Accumulation, Productiveness, and Financial Progress,” Nationwide Tax Journal 46:4 (December 1993), https://www.journals.uchicago.edu/doi/epdf/10.1086/NTJ41789037.

[26] Oren Cass, “America Ought to Undertake an Industrial Coverage,” Legislation and Liberty, Jul. 23, 2019, https://manhattan.institute/article/america-should-adopt-an-industrial-policy.

[27] Jake Sullivan, “Remarks on Renewing American Financial Management,” Brookings Establishment, Apr. 27, 2023, https://www.whitehouse.gov/briefing-room/speeches-remarks/2023/04/27/remarks-by-national-security-advisor-jake-sullivan-on-renewing-american-economic-leadership-at-the-brookings-institution/.

[28] Kyle Pomerleau and Huaqun Li, “Measuring Marginal Efficient Tax Charges on Capital Revenue Below Present Legislation,” Tax Basis, Jan. 15, 2020, https://taxfoundation.org/analysis/all/federal/measuring-marginal-effective-tax-rates-on-capital-income-under-current-law/.

[29] Ibid.

[30] Alex Muresianu, Alex Durante, and Erica York, “Taxes, Tariffs, and Industrial Coverage: How the U.S. Tax Code Fails Manufacturing,” Tax Basis, Mar. 17, 2022, https://taxfoundation.org/analysis/all/federal/us-manufacturing-tax-industrial-policy/.

[31] Réka Juhász, Nathan Lane, and Dani Rodrik, “The New Economics of Industrial Coverage.”

[32] F. A. Hayek, “The Use of Data in Society,” The American Financial Overview 35:4 (September 1945).

[33] Réka Juhász, Nathan Lane, and Dani Rodrik, “The New Economics of Industrial Coverage.”

[34] See, as an illustration, Gordon Tullock, “The Welfare Prices of Tariffs, Monopolies, and Theft,” Western Financial Journal 5:3 (June 1967), https://cameroneconomics.com/tullockpercent201967.pdf.

[35] See, as an illustration, Eduardo Luzio and Shane Greenstein, “Measuring the Efficiency of a Protected Toddler Trade: The Case of Brazilian Microcomputers,” The Overview of Economics and Statistics 77:4 (November 1995), https://www.jstor.org/secure/2109811; Marta Czarnecka-Gallas, “The Effectivity of Industrial Coverage within the 21st Century? The Case of Brazil,” The Polish Journal of Economics.

[36] Joe Studwell, How Asia Works (Grove Press: New York, 2014); see additionally Arvind Panagariya, “Debunking Protectionist Myths: Free Commerce, the Growing World, and Prosperity,” Cato Institute, Jul. 18, 2019, https://www.cato.org/economic-development-bulletin/debunking-protectionist-myths-free-trade-developing-world-prosperity.

[37] Ibid.

[38] Alex Muresianu, Alex Durante, and Erica York, “Taxes, Tariffs, and Industrial Coverage: How the U.S. Tax Code Fails Manufacturing”; see additionally Jeffrey Birnbaum and Alan Murray, Showdown at Gucci Gulch: Lawmakers, Lobbyists, and the Unlikely Triumph of Tax Reform (New York: Random Home, 1988).

[39] Alex Durante, “How the Part 232 Tariffs on Metal and Aluminum Harmed the Financial system,” Tax Basis, Sep. 20, 2022, https://taxfoundation.org/analysis/all/federal/section-232-tariffs-steel-aluminum/; Erica York, “Trump-Biden Tariffs Harm Home Manufacturing,” Tax Basis, Dec. 1, 2021, https://taxfoundation.org/weblog/trump-biden-tariffs-manufacturing/; Brian Potter, “’No Innovations, No Improvements,’ a Historical past of US Metal,” Building Physics, Dec. 29, 2023, https://www.construction-physics.com/p/no-inventions-no-innovations-a-history.

[40] Alex Muresianu, Alex Durante, and Erica York, “Taxes, Tariffs, and Industrial Coverage: How the U.S. Tax Code Fails Manufacturing,” Everett Stamm, “An Overview of the Low-Revenue Housing Tax Credit score,” Tax Basis, Aug. 11, 2020, https://taxfoundation.org/analysis/all/federal/low-income-housing-tax-credit-lihtc/.

[41] Brian Murray, Maureen Cropper, Francisco C. De La Chesnaye, and John Reilly, “How Efficient are US Renewable Power Subsidies in Reducing Greenhouse Gases?,” American Financial Overview: Papers and Proceedings 104:5 (2014), https://pubs.aeaweb.org/doi/pdfplus/10.1257/aer.104.5.569; see additionally Gary Clyde Hufbauer and Euijin Jung, “Scoring 50 Years of US Industrial Coverage,” Peterson Institute for Worldwide Economics, Nov. 29, 2021, https://www.piie.com/publications/piie-briefings/2021/scoring-50-years-us-industrial-policy-1970-2020.

[42] Ibid.

[43] Chris Miller, Chip Conflict: The Combat for the World’s Most Vital Expertise (Scribner: New York, 2022); see additionally Chris Miller, “Historical past Affords a Information to Successful Our Rising ‘Chip Conflict’ with China,” The Washington Put up, Oct. 4, 2022, https://www.washingtonpost.com/made-by-history/2022/10/04/history-offers-guide-winning-our-growing-chip-war-with-china/.

[44] Ibid.; see additionally Brink Lindsey, “DRAM Rip-off,” Cause, February 1992, https://purpose.com/1992/02/01/dram-scam/.

[45] Nathan Lane, “The New Empirics of Industrial Coverage,” Journal of Trade, Competitors, and Commerce 20 (2020), https://osf.io/preprints/socarxiv/tnxg6.

[46] Bureau of Financial Evaluation, “Desk 5.3.1. % Change From Previous Interval in Actual Non-public Mounted Funding by Sort,” Jan. 25, 2024, https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&classes=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCIxNDEiXV19; Congressional Price range Workplace, “Information Dietary supplements: An Replace to the Price range and Financial Outlook: 2017 to 2027,” June 2017, https://www.cbo.gov/system/information/One hundred and fifteenth-congress-2017-2018/experiences/52801-june2017outlook.pdf. Moreover, contemplating solely these eight quarters might understate the TCJA’s influence on funding, because the bonus depreciation provisions have been made accessible retroactively as of September 27, 2017, which incentivized corporations to e book funding in Q4 2017 so as to deduct the prices in opposition to the outdated 35 % tax price.

[47] Congressional Price range Workplace, “An Replace to the Price range and Financial Outlook: 2019 to 2029,” Aug 21, 2019, https://www.cbo.gov/system/information/2019-08/55551-CBO-outlook-update_0.pdf.

[48] David Altig, Nick Bloom, Steven J. Davis, Brent Meyer, and Nick Parker, “TariffTariffs are taxes imposed by one nation on items or companies imported from one other nation. Tariffs are commerce obstacles that elevate costs and cut back accessible portions of products and companies for U.S. companies and shoppers.

Worries and U.S. Enterprise Funding, Take Two,” Federal Reserve Financial institution of Atlanta, Feb. 25, 2019, https://www.atlantafed.org/blogs/macroblog/2019/02/25/tariff-worries-and-us-business-investment-take-two.

[49] Board of Governors of the Federal Reserve System, “Open Market Operations,” accessed Jan. 4, 2024, https://www.federalreserve.gov/monetarypolicy/openmarket.htm.

[50] Gabriel Chodorow-Reich, Matthew Smith, Eric Zwick, and Owen Zidar, “Tax Coverage and Funding in a World Financial system,” Becker-Friedman Institute Working Paper 2023-141, November 2023, https://bfi.uchicago.edu/wp-content/uploads/2023/11/BFI_WP_2023-141.pdf.

[51] John Bitzan, Yongtao Hong, and Fariz Huzeynov, “Did the Tax Cuts and Jobs Act Stimulate Capital Expenditures? A Agency-Stage Method,” Utilized Economics (2023), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4608729.

[52] Patrick Kennedy, Christine Dobridge, Paul Landefeld, and Jacob Mortenson, “The Effectivity-Fairness Tradeoff of the Company Revenue TaxA company earnings tax (CIT) is levied by federal and state governments on enterprise earnings. Many corporations usually are not topic to the CIT as a result of they’re taxed as pass-through companies, with earnings reportable beneath the particular person earnings tax.

: Proof from the Tax Cuts and Jobs Act,” Nov. 14, 2023, https://patrick-kennedy.github.io/information/TCJA_KDLM_2023.pdf; see additionally Alex Durante, “Don’t Ignore the Lengthy Run When Evaluating Company Tax Cuts,” Tax Basis, Jan. 11, 2024, https://taxfoundation.org/weblog/corporate-tax-cuts-worker-wages/.

[53] John Robertson, “Quickest Wage Progress for the Lowest-Paid Employees,” Federal Reserve Financial institution of Atlanta, Dec. 16, 2019, https://www.atlantafed.org/blogs/macroblog/2019/12/16/faster-wage-growth-for-the-lowest-paid-workers.

[54] Joseph Politano, “America’s Industrial Transition,” Apricitas Economics, Apr. 26, 2023, https://www.apricitas.io/p/americas-industrial-transition.

[55] President Joe Biden, “Investing In America,” up to date Dec. 22, 2023, https://www.whitehouse.gov/make investments/.

[56] Jeniece Pettitt, “California’s Excessive-Pace Rail is Operating Out of Cash, however Progress Has Been Made,” CNBC, Might 17, 2023, https://www.cnbc.com/2023/05/17/why-californias-high-speed-rail-is-taking-so-long-to-complete.html.

[57] See, as an illustration, Shihe Fu, Xiaocong Xu, and Junfu Zhang, “Land Conversion Throughout Cities in China,” Regional Science and City Economics 87 (March 2021), https://www.sciencedirect.com/science/article/abs/pii/S016604622100003X.

[58] Yang Jie and Yuka Hayashi, “One in every of Biden’s Favourite Chip Initiatives is Dealing with New Delays,” The Wall Road Journal, Jan. 18, 2024, https://www.wsj.com/tech/chip-giant-tsmc-foresees-delay-at-second-arizona-plant-22fe1e41.

[59] Board of Governors of the Federal Reserve System, “Open Market Operations”; see additionally Congressional Price range Workplace, “Information Dietary supplements: The Price range and Financial Outlook: 2022 to 2032.”

[60] Congressional Price range Workplace, “Information Dietary supplements: The Price range and Financial Outlook: 2022 to 2032”; see additionally Worldwide Power Company, “World Power Funding: 2023,” Might 2023, https://www.iea.org/experiences/world-energy-investment-2023.

[61] Barthelemy Bonadio, Zhen Huo, Andrei Levchenko, and Nitya Pandalai-Nayar, “World Provide Chains within the Pandemic,” Journal of Worldwide Economics 133 (November 2021), https://www.sciencedirect.com/science/article/pii/S0022199621001148.

[62] See, as an illustration, David Shepherdson and Jane Lee, “Intel’s $20B Ohio Manufacturing unit Might Turn into World’s Largest Chip Plant,” Reuters, Jan. 21, 2022, https://www.reuters.com/expertise/intel-plans-new-chip-manufacturing-site-ohio-report-2022-01-21/; Samsung Newsroom, “Samsung Electronics Declares New Superior Semiconductor Fab Website in Taylor, Texas,” Nov. 24, 2021, https://information.samsung.com/world/samsung-electronics-announces-new-advanced-semiconductor-fab-site-in-taylor-texas; Stephen Nellis, “TSMC Says Has Begun Building at its Arizona Chip Manufacturing unit Website,” Reuters, Jun. 1, 2021, https://www.reuters.com/expertise/tsmc-says-construction-has-started-arizona-chip-factory-2021-06-01/.

[63] U.S. Census Bureau, “Building Spending: Worth of Non-public Building Put in Place,” accessed Feb. 20, 2024, https://www.census.gov/building/c30/historical_data.html; see additionally Joseph Politano, “America’s Industrial Transition.”

[64] Max Roser, “Why did Renewables Turn into So Low cost So Quick?,” Our World in Information, Dec. 1, 2020, https://ourworldindata.org/cheap-renewables-growth.

[65] See, as an illustration, Aurelia Glass and Karla Walter, “How Biden’s American-Model Industrial Coverage Will Create High quality Jobs,” Heart for American Progress, Oct. 27, 2022, https://www.americanprogress.org/article/how-bidens-american-style-industrial-policy-will-create-quality-jobs/.

[66] Bureau of Labor Statistics, “All Staff, Manufacturing [MANEMP],” retrieved from FRED, Jan. 23, 2024, https://fred.stlouisfed.org/graph/?g=cAYh.

[67] Jon Emont, “How Singapore Acquired Its Manufacturing Mojo Again,” The Wall Road Journal, Jun. 22, 2022, https://www.wsj.com/articles/singapore-manufacturing-factory-automation-11655488002; see additionally Scott Lincicome, “Manufactured Disaster: Deindustrialization, Free Markets, and Nationwide Safety.”

[68] Ibid.

Share