Observe: This put up is a part of a sequence on Portugal’s taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities providers, items, and actions.

coverage, analyzing the way it compares internationally, offering an evaluation of present coverage, and discussing pathways towards reform. See right here, right here, and right here. For an entire evaluation of this and different tax reform choices in Portugal, obtain our Portuguese-language primer.

Portugal ranks 29th out of 38 OECD international locations within the particular person tax class of the Worldwide Tax Competitiveness Index 2023. The principle perpetrator for this unfavorable score is the nation’s excessive high revenue tax levied solely on a slim set of earnings, which raises income with a excessive effectivity value. On high of this, the Portuguese revenue tax system options advanced tax credit that undermine the revenue tax baseThe tax base is the entire quantity of revenue, property, property, consumption, transactions, or different financial exercise topic to taxation by a tax authority. A slim tax base is non-neutral and inefficient. A broad tax base reduces tax administration prices and permits extra income to be raised at decrease charges.

whereas distorting financial conduct and growing compliance prices, in addition to a tax-relief scheme for returning tax residents that units ambiguous incentives for emigration and return.

Portugal would do higher to draw expertise and enhance earnings incentives by setting a ceiling for social contributions and decreasing revenue tax charges extra broadly, as a substitute of granting particular tax credit or returnee tax-relief. Closing the value-added tax (VAT) hole and eliminating particular tax credit would permit room to both scale back the tax burden on labor or pursue different reforms that will enhance labor productiveness and actual wages.

Excessive Prime Fee and Threshold

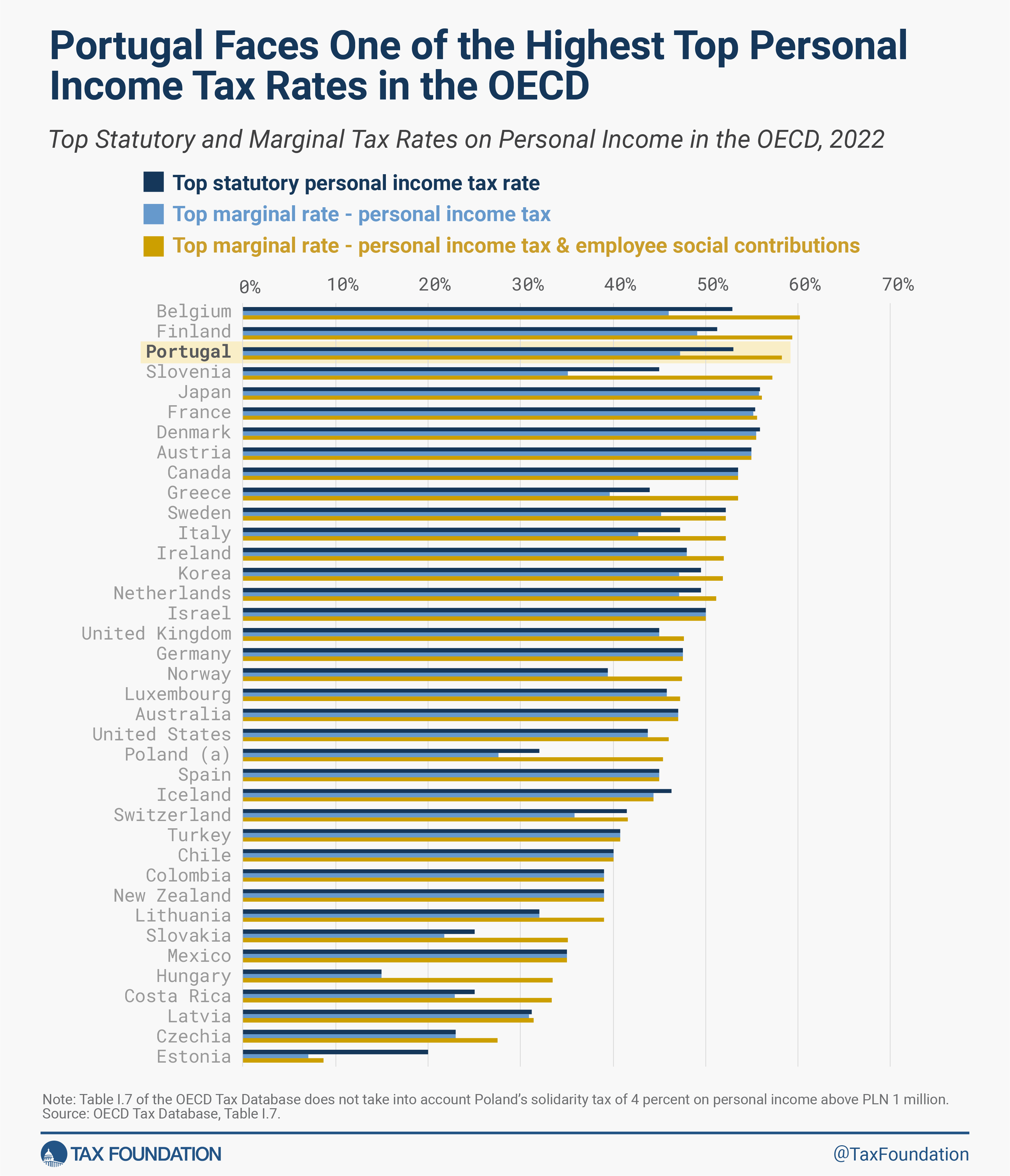

Portugal’s private revenue tax system levies excessive tax charges on an unusually slim set of excessive earners, putting a poor stability between earnings incentives and income contributions. Private revenue is topic to 11 completely different tax brackets, together with two brackets for added solidarity charges. The nation’s high revenue tax charge is 53 p.c (together with the 5 p.c solidarity tax charge).

Moreover, Portugal’s social system doesn’t characteristic a normal ceiling for social contributions, growing the marginal tax wedgeA tax wedge is the distinction between complete labor prices to the employer and the corresponding web take-home pay of the worker. It’s also an financial time period that refers back to the financial inefficiency ensuing from taxes.

for high-income employees above that of its European neighbors with equally excessive high statutory charges. Portugal’s high revenue tax charge inclusive of worker social contributions is 58.2 p.c, the third-highest within the OECD (behind solely Belgium and Finland).

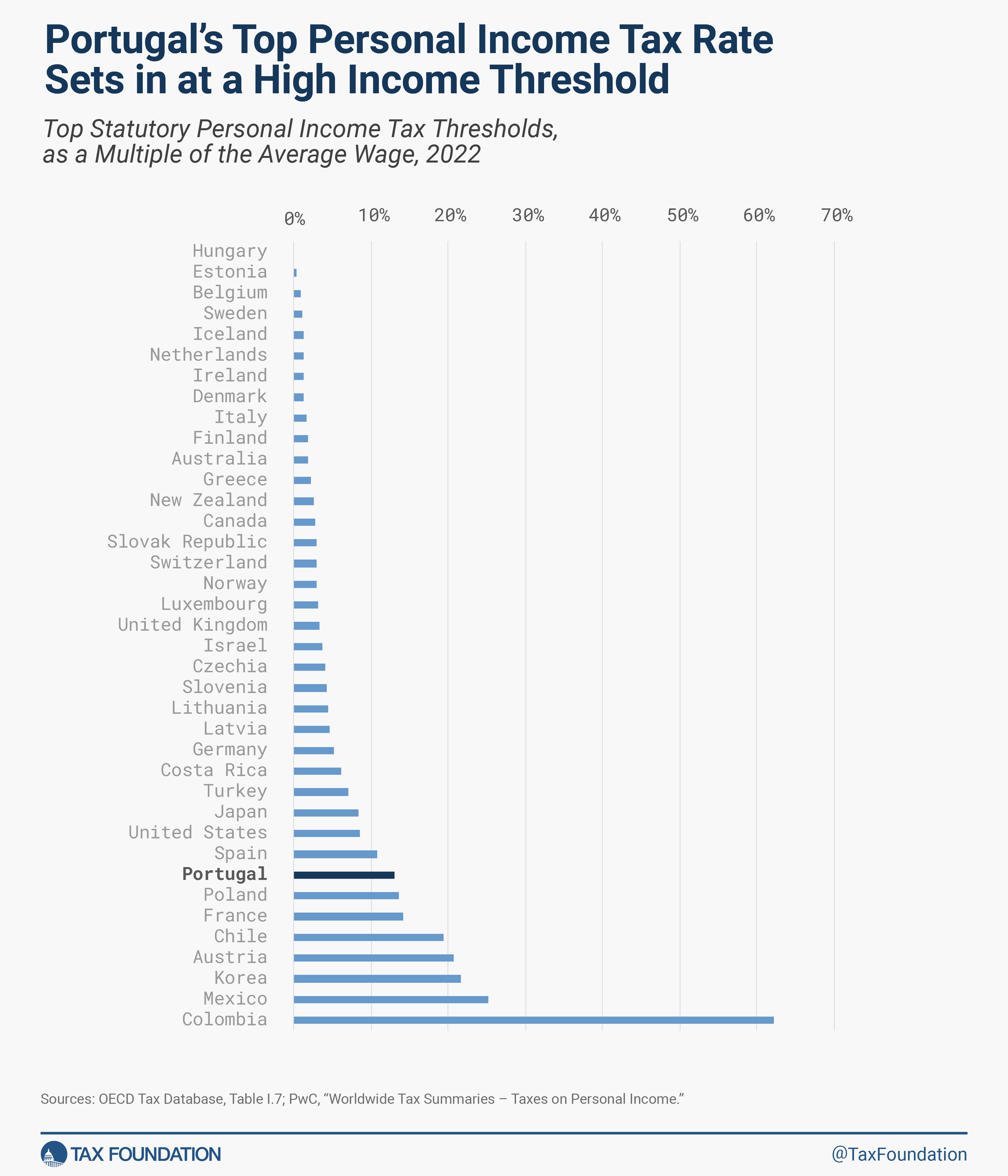

Moreover, Portugal’s high revenue tax charge units in at an unusually excessive threshold of EUR 250,000 in annual revenue, 13 occasions the typical wage in 2022. Within the OECD, the typical threshold of the highest charge is round half of this, with simply seven different OECD international locations making use of high revenue tax thresholds larger than Portugal.

Imposing excessive high marginal tax charges at elevated earnings thresholds is an inefficient option to increase authorities income. Greater high charges incentivize individuals over that revenue threshold to earn much less, whereas leaving the income raised from everybody else unchanged. By elevating the speed of a decrease bracket, nevertheless, income is raised from taxpayers in larger brackets with out incentivizing them to scale back their earnings (solely the incomes incentives of people in that decrease bracket are affected). Excessive high charge thresholds scale back the variety of taxpayers whose incomes incentives are negatively affected by the highest private revenue tax charge but in addition the quantity of income that may be raised by it.

Base Erosion from Distortive Tax Credit

One issue that erodes Portugal’s private revenue tax base is its intensive system of tax credit. The tax credit apply to a big number of consumption items, leisure actions, and membership charges for commerce unions, introducing distortions to consumption conduct and growing compliance prices. Typically, private tax deductions must be restricted to funding prices that enhance taxpayers’ taxable revenueTaxable revenue is the quantity of revenue topic to tax, after deductions and exemptions. For each people and firms, taxable revenue differs from—and is lower than—gross revenue.

or forestall them from falling into the welfare web. To the extent that a few of these credit are motivated by distributive issues, direct transfers and charge cuts signify a extra environment friendly and focused manner to supply help for low-income households.

Time-Inconsistent Emigrant Tax Aid

In recent times, the federal government pursued an emigrant tax aid coverage that excludes 50 p.c of employment revenue from revenue tax to Portuguese emigrants within the first 5 years after their return. This system creates an incentive for these already dwelling and dealing overseas to return. Nonetheless, it additionally builds expectations to realize from such schemes sooner or later that may gas out-migration. This makes preferential tax aid applications a dangerous gamble if Portugal’s authorities is trying to retain younger and expert taxpayers.

In the long term, policymakers can positively affect their residents’ places by decreasing authorities spending and the entire tax burden on labor. An alternative choice could be to increase labor productiveness and gross wages in Portugal by attracting funding by means of company tax reform and making it simpler for residents to relocate to raised jobs.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share