Word: The next is the testimony of Daniel Bunn, President & CEO of TaxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities companies, items, and actions.

Basis, earlier than the U.S. Home Methods & Means Subcommittee on Tax listening to on March 7, 2024, titled, “OECD Pillar 1: Guaranteeing the Biden Administration Places People First”

Chairman Kelly, Rating Member Thompson, and distinguished members of the Subcommittee on Tax, thanks for the chance to testify on the Organisation for Financial Co-operation and Improvement’s (OECD) Pillar One challenge. I’m Daniel Bunn, President & CEO of Tax Basis.

Tax Basis has monitored the event of Pillar One since its origin 5 years in the past. My appraisal of the challenge again in 2019 concluded with an evaluation of the potential complexities, new uncertainties, and the necessity to get rid of discriminatory digital companies taxes (DSTs).[1]

As we speak, these complexities and uncertainties are nonetheless current, and whether or not Pillar One will get rid of digital companies taxes and different related unilateral measures continues to be unclear.

The draft multilateral tax treaty beneath Pillar One, Quantity A would rearrange the rights to tax the most important multinational firms’ income. In accordance with the OECD, taxing rights on about $200 billion in income could be shifted to jurisdictions totally different from the place the income are at the moment being taxed. On account of tax variations in present vs. proposed jurisdictions, the modifications would result in a tax enhance between $17 billion and $32 billion, based mostly on 2021 information. This tax enhance will affect many massive firms, however solely sure international locations will obtain further income.

Particularly, the OECD’s evaluation factors to income positive factors in low- and middle-income international locations and losses primarily in jurisdictions sometimes called tax havens.[2]

There was continued bipartisan help for eliminating DSTs as a result of they discriminate towards U.S.-based firms. Nonetheless, even with Quantity A, international locations might hold their DSTs.

Alternatively, if Pillar One, Quantity A isn’t agreed to, then DSTs will doubtless grow to be much more frequent around the globe. And the United Nations will doubtless search to fill the hole in multilateral tax policymaking. As a result of the UN depends on a one-country-one-vote method to selections (whereas the OECD has aimed for consensus), and it has but to set a transparent coverage agenda, its coverage designs are tough to foretell.

Work finished by members of this committee on H.R. 3665 reveals the need for stronger instruments to retaliate towards extraterritorial and discriminatory overseas taxes.[3] Members must be cautious about utilizing such instruments. The specter of a brand new tax and commerce conflict with Europe may be very actual, with financial damages on either side of the Atlantic. Retaliation doesn’t assure the U.S.’s desired final result—specifically, the removing of discriminatory insurance policies—however it is going to carry further escalation and financial damages. The EU can put tariffs on U.S. exports simply as simply because the U.S. can put tariffs on French wine.

The place there are alternatives to resolve disputes utilizing both multilateral tax negotiations or leaning on the World Commerce Group, policymakers ought to prioritize these alternatives over retaliation.

My testimony will cowl key objects for policymakers to think about within the design of Pillar One, Quantity A and the present scenario for digital companies taxes.

Digital Providers Taxes

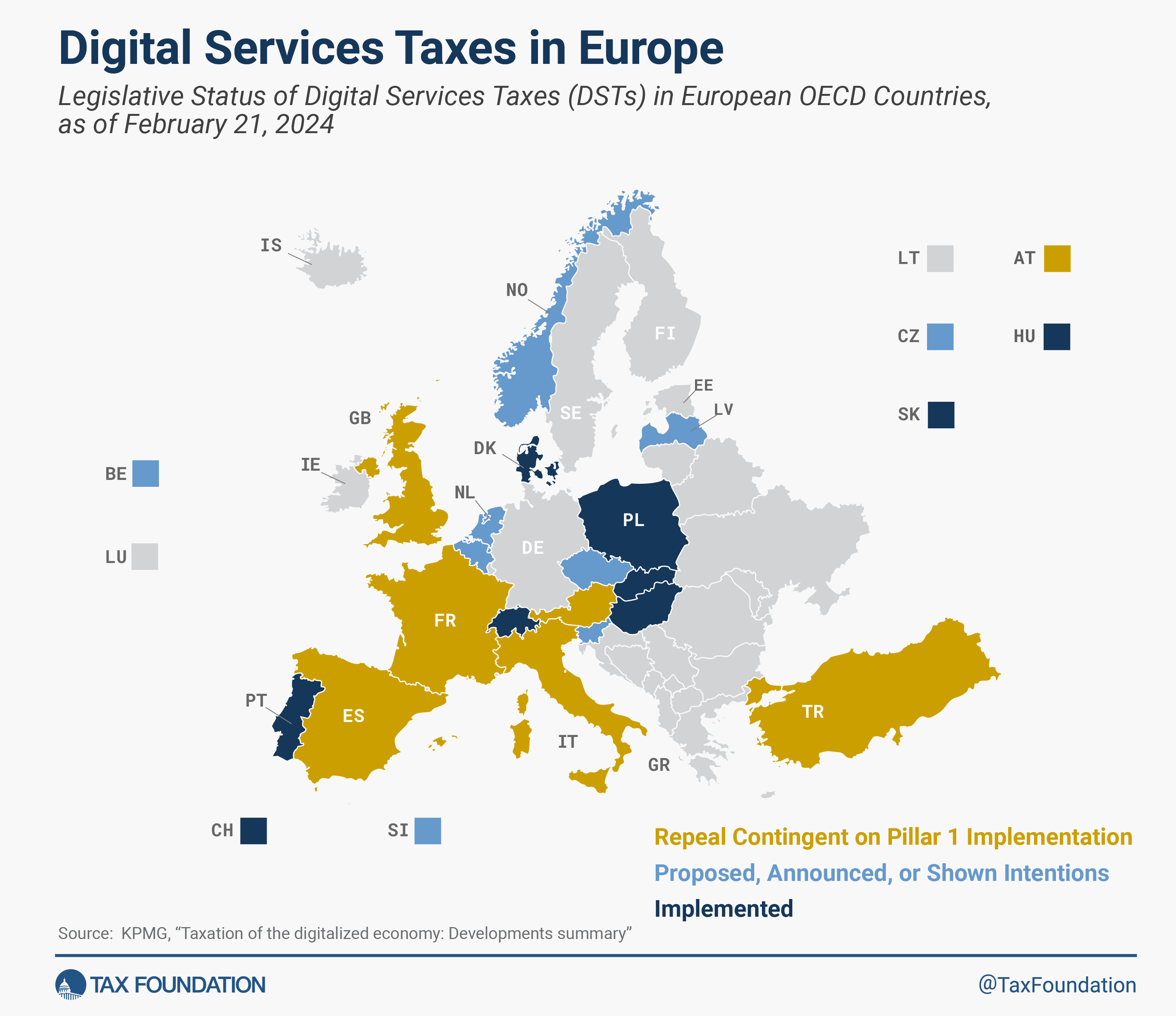

Since 2018, many international locations have sought to make use of novel instruments to tax the income of huge multinational firms within the digital sector. The commonest of those instruments has been the digital companies tax. These insurance policies normally apply a single-digit tax price to the revenues of a big firm.

These insurance policies are problematic for 2 causes.

First, they’re discriminatory. One frequent mannequin is to set a income threshold excessive sufficient that almost all companies impacted by the tax are firms not headquartered within the implementing jurisdiction (mostly, U.S.-based firms). Moreover, the insurance policies are focused at particular enterprise traces (comparable to on-line streaming companies, digital promoting, and the sale of person information). This violates the precept of neutrality.

Second, they tax firms on gross revenues relatively than earnings. Because of this the tax shall be owed no matter whether or not a specific digital service is worthwhile within the jurisdiction levying the tax. Gross income taxation may also create tax pyramidingTax pyramiding happens when the identical ultimate good or service is taxed a number of occasions alongside the manufacturing course of. This yields vastly totally different efficient tax charges relying on the size of the provision chain and disproportionately harms low-margin companies. Gross receipts taxes are a main instance of tax pyramiding in motion.

as prices for digital companies taxes might hit an organization’s worth chain at a number of factors with out the chance for recouping these prices.[4]

As a result of the United States is house to a lot of the firms impacted by these DSTs, U.S. lawmakers have constantly argued towards the insurance policies, together with very just lately in a letter from Senate Finance Chairman Sen. Wyden (D-OR) and Rating Member Sen. Crapo (R-ID) about Canada’s proposed DST.[5]

One clear aim for U.S. policymakers has been to get rid of DSTs both by a multilateral settlement or by commerce threats and a possible commerce conflict. In 2020, the Trump administration introduced 25 % tariffs on $1.3 billion price of commerce with the European Union in response to the French DST.[6] These tariffs had a delayed implementation date and are at the moment nonetheless on maintain.

Canada is the latest entrant into the DST scene with a 3 % price on revenues from on-line marketplaces, social media platforms, sale and licensing of person information, and on-line adverts with at the least EUR 750 million (USD 812 million) in complete annual worldwide revenues and Canadian revenues of CAD 20 million (USD 14.7 million).

The tax could be calculated on Canadian in-scope revenues for any calendar 12 months that exceeds CAD 20 million. The coverage has been adopted however has not but been applied.

Design of Pillar One, Quantity A

Partially in response to DSTs, international locations have been negotiating on the OECD on a multilateral answer.

Pillar One, Quantity A modifications the foundations for the place firms pay taxes. At the moment, firms typically pay taxes on their income based mostly on the place these income are generated by staff, laboratories, manufacturing, or distribution services. Quantity A entails a sequence of formulation to shift a portion of taxable income away from jurisdictions the place income are booked at the moment—that’s, the place they’re produced—and transfer them to jurisdictions the place gross sales are made to ultimate shoppers.

The foundations would initially affect firms with international revenues above EUR 20 billion (USD 21.6 billion at latest trade charges) and profitability above a ten % margin. The income threshold could be reduce in half after a evaluation within the seventh 12 months of the coverage.

The foundations take 25 % of income above a ten % margin and allocate that share to jurisdictions in accordance with the share of gross sales in jurisdictions around the globe.

The foundations embrace approaches for figuring out ultimate shoppers even when an organization is promoting to a different enterprise in an extended provide chain. The foundations additionally enable firms to make use of macroeconomic information on ultimate consumption expenditure to allocate taxable income when the situation of ultimate prospects can’t be recognized.

The foundations outline each the place taxable income are moved to, and the place taxable income are shifted from.

The jurisdictions that can quit taxable income are break up into totally different tiers in accordance with the totally different ratios of income to depreciationDepreciation is a measurement of the “helpful life” of a enterprise asset, comparable to equipment or a manufacturing facility, to find out the multiyear interval over which the price of that asset could be deducted from taxable earnings. As a substitute of permitting companies to deduct the price of investments instantly (i.e., full expensing), depreciation requires deductions to be taken over time, decreasing their worth and discouraging funding.

and payroll. This method ensures that jurisdictions with the very best ranges of profitability (in comparison with depreciation and payroll) would be the first to surrender taxable income to the advantage of jurisdictions the place ultimate gross sales are made.

These guidelines are extremely complicated, and it’s tough to see how they are often complied with or administered with out a lot uncertainty and disputes over implementation.

Pillar One, Quantity A Impacts

The U.S. tax baseThe tax base is the entire quantity of earnings, property, belongings, consumption, transactions, or different financial exercise topic to taxation by a tax authority. A slender tax base is non-neutral and inefficient. A broad tax base reduces tax administration prices and permits extra income to be raised at decrease charges.

could be impacted instantly by these guidelines. U.S. Treasury Secretary Janet Yellen has beforehand written that she believes Quantity A could be roughly income impartial for the U.S.[7] For this to be true, the U.S. would want to gather vital income from overseas firms or from U.S. firms that promote to U.S. prospects from overseas workplaces. Additionally, Pillar Two, the worldwide minimal tax, would have to be considerably ineffective at altering the conduct of U.S. firms to place (or hold) precious mental property within the U.S. relatively than inserting it offshore.

Extra just lately, Sec. Yellen has stated that “vital disagreements” make figuring out the fiscal affect tough.[8]

Quantity A creates clear winners and losers when it determines which jurisdictions get to tax the income in scope. If a jurisdiction has a big market, then it is going to doubtless win out from the Quantity A guidelines. If a jurisdiction has enterprise entities with very excessive revenue margins, then it is going to doubtless lose taxable income.

The U.S. has each a big market and is house to many multinationals with excessive revenue margins.

If Pillar One Quantity A will get adopted, then it is going to coexist with the worldwide minimal tax. The minimal tax will, over time, change the place companies find their high-value belongings, significantly intangible property.

By many accounts, U.S. firms will bear the brunt of Quantity A. What which means for the U.S. tax base is much less clear.

At the moment, the U.S. runs a major commerce surplus in prices for the usage of mental property (royalties). In accordance with information from the Bureau of Financial Evaluation, that surplus has averaged $76 billion per 12 months from 2017 to 2022. The general commerce surplus in companies was $2.3 billion in 2023.[9] Moreover, year-over-year progress in non-public fastened funding in mental property (IP) merchandise has averaged 8.7 % because the starting of 2017.[10]

These information are indicative of the U.S.’s robust place for buying and selling companies, a lot of which (significantly mental property companies) are excessive worth and have excessive revenue margins. The U.S. Treasury would doubtless increase much less cash from these firms exporting high-value companies from a U.S. base if Quantity A is adopted.

Moreover, if Pillar Two works as meant (and the U.S. stays a gorgeous place to spend money on IP), then new, precious IP that stays within the U.S. and leads to vital gross sales to overseas prospects would additional strengthen U.S. service exports and even probably make the U.S. a internet donor within the Quantity A framework.

Alternatively, the U.S. may even see some income advantages from Quantity A. Some U.S.-headquartered firms which have modest revenue margins inside the U.S. have very excessive revenue margins around the globe (usually as a consequence of IP that they maintain in offshore jurisdictions). In some circumstances, the IP can be developed offshore. An honest share of these firms’ prospects could also be within the U.S. So, when the income are moved to the shoppers’ location, the U.S. tax base for that firm may develop as a result of essentially the most worthwhile jurisdictions (relative to depreciation and payroll) would be the ones giving up the tax base.

Policymakers ought to analyze these interactions. The difference-maker could be U.S. firms with excessive revenue margins in overseas jurisdictions and a big portion of their gross sales made to U.S. prospects. Even when these firms are paying tax to the U.S. by way of the inclusion of world intangible low-taxed earnings (GILTI), the speed distinction between GILTI and the U.S. federal price will enhance tax income from these firms.

The Way forward for Pillar One, Quantity A

Pillar One, Quantity A has been negotiated by almost 140 jurisdictions around the globe, and it will require a multilateral treaty to be applied.

This multilateral tax treaty has not but been finalized for a few causes. First, the U.S. Treasury wished to get public enter on the draft treaty. And second, a number of international locations have expressed objections to the draft proposal.

Brazil, Colombia, and India object to a number of provisions, together with one that implies present taxes utilized in market international locations ought to scale back the brand new alternative to tax income allotted beneath Quantity A. This can be a query of double dipping. If a rustic already has the correct to tax a enterprise on its exercise in a rustic through the use of withholdingWithholding is the earnings an employer takes out of an worker’s paycheck and remits to the federal, state, and/or native authorities. It’s calculated based mostly on the quantity of earnings earned, the taxpayer’s submitting standing, the variety of allowances claimed, and any further quantity of the worker requests.

taxes, and Quantity A would allocate new taxing rights, ought to the brand new proper be a gross allocation or a internet allocation? For my part, Quantity A shouldn’t duplicate present taxation that’s occurring in market jurisdictions.

Brazil, Colombia, and India appear to agree that Quantity A must be a gross allocation with no offset for present taxes owed. Different international locations look like aiming for a internet allocation the place the Quantity A taxing proper is lowered by present rights to tax in a market jurisdiction.

As of final October, these variations had not but been resolved.

The draft treaty has a scoring system that determines when the treaty has achieved sufficient signatories to be applied.[11] The important thing threshold for a number of provisions is 600 factors, and 999 factors can be found. The USA has been attributed 486 factors. Because of this the 600-point threshold can’t be achieved with out america.

Subsequently, the query of U.S. ratification will decide the treaty’s future.

The Destiny of Digital Providers Taxes

A significant justification for the negotiations resulting in Pillar One, Quantity A was the potential of eliminating DSTs. Nonetheless, even with Quantity A, international locations might hold their DSTs anyway.

One key ingredient of the draft treaty launched final fall is Annex A, the place one can discover a checklist of insurance policies that shall be eliminated as soon as the treaty is adopted. Included in that checklist are the DSTs of eight international locations.[12] The checklist isn’t totally inclusive of all discriminatory digital tax insurance policies. However the draft treaty additionally eliminates the Quantity A allocation to international locations that don’t take away insurance policies that match inside the draft treaty’s definition of DSTs and related comparable measures:[13]

- The tax is pushed by the situation of consumers or customers.

- It’s typically a tax on overseas companies.

- It’s not a tax on earnings and is past agreements to keep away from double taxationDouble taxation is when taxes are paid twice on the identical greenback of earnings, no matter whether or not that’s company or particular person earnings.

.

The inducement to take away a DST aside from these already specified will doubtless depend upon whether or not a rustic sees a greater tax income final result from Pillar One, Quantity A. In flip, these income numbers will depend upon how the remainder of Quantity A will get negotiated.

Additionally, it appears unlikely that these rules will lead to “all” DSTs being eliminated as agreed in October 2021.[14] There may be room for governments to work across the rules above. A DST may probably get previous the second precept by making use of to each home and overseas companies in a considerably balanced method.

5 European international locations have an settlement with america to scale back tax funds beneath Pillar One, Quantity A in reference to the quantity of taxes paid beneath a DST. This settlement is time-limited and can expire on June 30, 2024, until prolonged additional.[15]

Conclusion

With Pillar One, Quantity A, little or no is really sure. It’s unsure whether or not a strong system for allocating income is achievable. And even whether it is, it could not consequence within the removing of all DSTs. The restricted checklist and the choice to retain such insurance policies run opposite to the objectives set out on a bipartisan foundation by members of Congress. One factor that’s extra sure, nevertheless, is that if a multilateral answer to take away the DSTs isn’t agreed to, then DSTs will proceed to unfold and mutate with destructive impacts on a number of the most revolutionary firms on the earth.

Multilateralism is best than a number of rounds of a tax and commerce conflict. As different international locations lean towards unilateral approaches, although, it’s price recalling the unilateral U.S. method to redefine the place firms pay taxes, specifically the border-adjusted tax proposal from 2016.[16]

As talked about, the UN is constructing its personal function in multilateral tax negotiations. In that discussion board, america and likeminded nations will doubtless have much less leverage as a result of procedural variations from the OECD.

In any case, the mess of multilateral tax coverage will doubtless proceed for a while.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

[1] Daniel Bunn, “Response to OECD Public Session Doc: Secretariat Proposal for a ‘Unified Strategy’ beneath Pillar One,” Tax Basis, Nov. 11, 2019, https://taxfoundation.org/analysis/all/international/response-to-oecd-public-consultation-document-secretariat-proposal-for-a-unified-approach-under-pillar-one/.

[2] OECD/G20 Base Erosion and Revenue ShiftingRevenue shifting is when multinational firms scale back their tax burden by transferring the situation of their income from high-tax international locations to low-tax jurisdictions and tax havens.

Venture, “Worldwide tax reform: Multilateral Conference to Implement Quantity A of Pillar One,” October 2023, https://www.oecd.org/tax/beps/multilateral-convention-to-implement-amount-a-of-pillar-one.htm.

[3] Defending American Jobs and Funding Act, H.R. 3665, 118th Congress (2023), https://www.congress.gov/invoice/118th-congress/house-bill/3665.

[4] Tax Basis, “Tax Pyramiding,” TaxEDU, https://taxfoundation.org/taxedu/glossary/tax-pyramiding/.

[5] Letter to Ambassador Tai from Senate Finance Committee Chairman and Rating Member, Oct. 10, 2023, https://www.finance.senate.gov/imo/media/doc/20231010wydencrapolettertoustroncanadadst.pdf

[6] Daniel Bunn, “Digital Taxes, Meet Purse Tariffs,” Tax Basis, Jul. 10, 2020, https://taxfoundation.org/weblog/us-french-tariffs/.

[7] Letter to Senator Mike Crapo from Treasury Secretary Janet Yellen, Jun. 4, 2021, https://mnetax.com/wp-content/uploads/2021/06/Yellen_letter_to_Crapo_on_OECD_tax_negotiations920.pdf.

[8] Isabel Gottlieb, “International Deal Disputes Stop Precise Income Estimate, Yellen Says,” Bloomberg Tax, Mar. 10, 2023, https://information.bloombergtax.com/daily-tax-report-international/global-deal-disputes-prevent-exact-revenue-estimate-yellen-says.

[9] “Worldwide Transactions, Worldwide Providers, and Worldwide Funding Place Tables, Desk 2.1 U.S. Commerce in Providers by Sort of Service,” Bureau of Financial Evaluation, information final revised Jul. 6, 2023, https://apps.bea.gov/iTable/?reqid=62&step=9&isuri=1&6210=4#eyJhcHBpZCI6NjIsInN0ZXBzIjpbMSw5LDZdLCJkYXRhIjpbWyJQcm9kdWN0IiwiNCJdLFsiVGFibGVMaXN0IiwiMjQ1Il1dfQ==. The commerce surplus may very well be a lot greater, nevertheless. In recent times, BEA information and Eurostat information have disagreed on the commerce of mental property companies; Eurostat has proven a lot greater commerce surpluses for the U.S. with European Union Member States than the Bureau of Financial Evaluation. For instance, the U.S. royalties commerce surplus with Eire was almost €100 billion ($110 billion) in 2022, in accordance with “Steadiness of funds by nation – quarterly information (BPM6),” Eurostat, information final up to date Oct. 13, 2023, https://ec.europa.eu/eurostat/databrowser/view/bop_c6_q__custom_8779444/default/desk.

[10] “Nationwide Revenue and Product Accounts, Desk 5.6.6. Actual Personal Mounted Funding in Mental Property Merchandise by Sort, Chained {Dollars},” Bureau of Financial Evaluation, information final revised Sep. 29, 2023.

[11] OECD/G20 Base Erosion and Revenue Shifting Venture, “The Multilateral Conference to Implement Quantity A of Pillar One,” Desk 2. Annex I, October 2023, https://www.oecd.org/tax/beps/multilateral-convention-to-implement-amount-a-of-pillar-one.pdf#web page=212.

[12] OECD/G20 Base Erosion and Revenue Shifting Venture, “The Multilateral Conference to Implement Quantity A of Pillar One,” Annex A, October 2023, https://www.oecd.org/tax/beps/multilateral-convention-to-implement-amount-a-of-pillar-one.pdf#web page=91.

[13] OECD/G20 Base Erosion and Revenue Shifting Venture, “The Multilateral Conference to Implement Quantity A of Pillar One,” Half VI – Remedy of Particular Measures Enacted by Events, October 2023, https://www.oecd.org/tax/beps/multilateral-convention-to-implement-amount-a-of-pillar-one.pdf#web page=77

[14] OECD/G20 Base Erosion and Revenue Shifting Venture, “Assertion on a Two-Pillar Answer to Deal with the Tax Challenges Arising from the Digitalisation of the Financial system,” Oct. 8, 2021, https://www.oecd.org/tax/beps/statement-on-a-two-pillar-solution-to-address-the-tax-challenges-arising-from-the-digitalisation-of-the-economy-october-2021.pdf#web page=3.

[15] U.S. Treasury, “The USA, Austria, France, Italy, Spain, and the United Kingdom Announce Extension of Settlement on the Transition from Current Digital Providers Taxes to New Multilateral Answer Agreed by the G20/OECD Inclusive Framework,” Feb. 15, 2024, https://house.treasury.gov/information/press-releases/jy2098.

[16] Kyle Pomerleau, “Understanding the Home GOP’s Border Adjustment,” Tax Basis, Feb. 15, 2017, https://taxfoundation.org/analysis/all/federal/understanding-house-gop-border-adjustment/.

Share