Nvidia and Amazon Net Providers, the profitable cloud arm of Amazon, have a shocking quantity in frequent. For starters, their core companies emerged from a contented accident. For AWS, it was realizing that it may promote the interior providers — storage, compute and reminiscence — that it had created for itself in-house. For Nvidia, it was the truth that the GPU, created for gaming functions, was additionally properly suited to processing AI workloads.

That ultimately led to some explosively rising income in current quarters. Nvidia’s income has been rising at triple digits, transferring from $7.1 billion in Q1 2024 to $22.1 billion This autumn 2024. That’s a fairly wonderful trajectory, though the overwhelming majority of that progress was within the firm’s information middle enterprise.

Whereas Amazon by no means skilled that form of intense progress spurt, it has persistently been an enormous income driver for the e-commerce large, and each corporations have skilled first market benefit. Through the years, although, Microsoft and Google have joined the market creating the Large Three cloud distributors, and it’s anticipated that different chip makers will ultimately start to realize significant market share, too, even because the income pie continues to develop over the subsequent a number of years.

Each corporations had been clearly in the best place on the proper time. As internet apps and cell started rising round 2010, the cloud supplied the on-demand sources. Enterprises quickly started to see the worth of transferring workloads or constructing functions within the cloud, moderately than working their very own information facilities. Equally, as AI took off over the past decade, and enormous language fashions extra just lately, it coincided with the explosion in the usage of GPUs to course of these workloads.

Through the years, AWS has grown right into a tremendously worthwhile enterprise, at the moment on a run charge near $100 billion, one which even separate from Amazon can be a extremely profitable firm. However AWS progress has begun to decelerate, at the same time as Nvidia’s takes off. It’s partly the legislation of enormous numbers, one thing that may ultimately have an effect on Nvidia, too.

The query is whether or not Nvidia can maintain that progress to turn out to be a long-term income powerhouse like AWS has turn out to be for Amazon. If the GPU market begins to tighten, Nvidia does produce other companies, however as this chart reveals, these are a lot smaller income mills which can be rising way more slowly than the GPU information middle enterprise at the moment is.

Picture Credit: Nvidia

The short-term monetary outlook

Because the above chart notes, Nvida’s income progress has been astronomical in current quarters. And based on each Nvidia and Wall Avenue analysts, it’s set to proceed.

In its current earnings report overlaying the fourth quarter of its fiscal 2024 (the three months ending January 31, 2024), Nvidia instructed its traders that it anticipates $24 billion value of income in its present quarter (Q1 FY25). In comparison with its year-ago first quarter, Nvidia expects to submit progress of round 234%.

That’s merely not a quantity we regularly see from mature public corporations. Nonetheless, given the corporate’s large income ramp in current quarters, its progress charge is anticipated to say no. From a 22% income acquire from the third to fourth quarter of its just lately concluded fiscal 12 months, Nvidia anticipates a extra modest 8.6% progress charge from the ultimate quarter of its fiscal 2024 to the primary of its fiscal 2025. Actually, on a year-over-year comparability and never a glance again at simply three months, Nvidia’s progress charge stays unimaginable for the present interval. However there are different progress declines on the horizon.

For instance, analysts anticipate Nvidia to generate $110.5 billion value of income in its present fiscal 12 months, up simply over 81% from its year-ago outcomes. That’s dramatically decrease than the 126% acquire it posted in its just lately concluded fiscal 2024.

To which we ask: So what? For a minimum of the subsequent a number of quarters, Nvidia is anticipated to proceed scaling its income previous the $100 billion annual run charge mark, spectacular for a corporation that in its year-ago interval in the present day noticed complete revenues of simply $7.19 billion.

Briefly, analysts, and to a extra modest diploma Nvidia, see big buckets of progress forward for the corporate, even when a number of the eye-popping income progress figures will gradual this calendar 12 months. It’s unclear what occurs on a barely longer timeframe.

Momentum forward

Plainly AI might be the present that retains on giving for Nvidia for the subsequent a number of years, at the same time as extra competitors from AMD, Intel and different chipmakers begins to emerge. Very similar to AWS, Nvidia will face stiffer competitors ultimately, however it controls a lot of the market proper now, it will probably afford to cede some.

Taking a look at it purely on the chip stage, not at boards or different adjacencies, IDC reveals Nvidia firmly in management:

Picture Credit: IDC

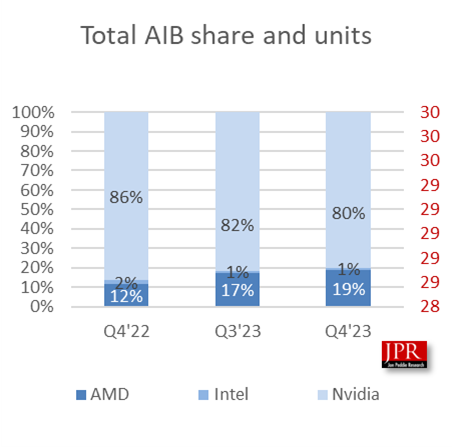

When you have a look at the board stage with these market share numbers from Jon Peddie Analysis (JPR), a agency that tracks the GPU market, whereas Nvidia nonetheless dominates, AMD is approaching stronger:

Picture Credit: Jon Peddie Analysis

C Robert Dow, an analyst at JPR, says a few of these fluctuations must do with when new merchandise are launched. “AMD positive aspects proportion factors right here and there relying on cycles available in the market — when new playing cards are launched — and stock ranges, however Nvidia has been in a dominant place for years, and that may proceed,” Dow instructed TechCrunch.

Shane Rau, an IDC analyst who follows the silicon market, additionally expects the dominance to proceed, at the same time as developments shift and alter. “There are developments and countertrends, the markets by which Nvidia participates are large and getting larger, and progress will proceed, a minimum of for an additional 5 years,” Rau stated.

A part of the rationale for that’s Nvidia is promoting extra than simply the chip itself. “They’ll promote you boards, techniques, software program, providers and time on considered one of their very own supercomputers. So any of these markets are large and rising and Nvidia is hooked up to all of them,” he stated.

However not everybody sees Nvidia as an unstoppable drive. David Linthicum, a longtime cloud guide and creator, says that you just don’t all the time want GPUs, and firms are starting to understand that. “They are saying they want GPUs. I have a look at it, do a number of the again of the envelope math, they usually don’t want them. CPUs are completely positive,” he stated.

As this occurs, he thinks Nvidia will start to decelerate and competitors will loosen its stronghold available on the market. “I believe that we’re going to see Nvidia morph right into a weaker participant over the subsequent couple of years. And we’re going to see that as a result of there’s too many substitutes which can be being constructed on the market.”

Rau says different distributors can even profit as corporations develop AI use instances with Nvidia merchandise. “What I believe you’ll see going ahead is rising markets that’ll create tailwinds for Nvidia. However then there’ll be different corporations that additionally comply with in these tailwinds that may profit from AI significantly.”

It’s additionally attainable that some disruptive drive will come into play and that will be a optimistic final result to maintain one firm from changing into too dominant. “You nearly hope disruption will occur as a result of that’s the best way markets and capitalism work greatest, proper? Somebody will get an early lead, different suppliers comply with, the market grows. You get established gamers, who’re ultimately disrupted by a greater strategy to do the identical factor inside their market or inside adjoining markets which can be crossing into theirs,” Rau stated.

In truth, we’re starting to see that occuring at Amazon as Microsoft positive aspects floor through its relationship with OpenAI and Amazon is pressured to play catch-up with regards to AI. No matter occurs to Nvidia in the long term, it’s firmly within the driver’s seat proper now, making a living hand over fist, dominating a rising market and having nearly every part going its manner. However that doesn’t imply it is going to all the time be this fashion or that there gained’t be extra aggressive stress down the street.