Latest improvements in alcohol manufacturing have created a boon for alcoholic beverage shoppers. Nonetheless, taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities companies, items, and actions.

coverage has lagged behind the quickly altering product surroundings. Now we have beforehand detailed how newer merchandise like exhausting seltzers and ready-to-drink cocktails (RTDs) straddle the historic product categorical strains used to delineate tax coverage, leading to non-neutral and sometimes counterintuitive tax coverage. Our ideas had been to both eradicate the tax classes and tax all alcoholic merchandise primarily based on their alcohol content material or to create new tax classes that higher match the present product panorama. A brand new Maryland invoice reveals that neutrality will be improved by decreasing taxes on some merchandise.

Maryland Home Invoice 0663 would set up a brand new tax class for RTDs. Home Invoice 663 defines an RTD as a beverage containing a distilled spirit, blended with a nonalcoholic beverage and probably containing wine, containing 12 % or much less alcohol by quantity, and which is contained in authentic packaging consisting of a metallic container or can that isn’t greater than 12 ounces.

Maryland HB 663 would scale back the speed utilized on RTDs to $0.40 per gallon, which is the same as the speed utilized to wine.

At present, Maryland applies a tax price for distilled spirits of $1.50 per gallon, plus an extra $0.015 per gallon for every 1 proof over 100 proof. For comparability, the excise taxAn excise tax is a tax imposed on a selected good or exercise. Excise taxes are generally levied on cigarettes, alcoholic drinks, soda, gasoline, insurance coverage premiums, amusement actions, and betting, and sometimes make up a comparatively small and unstable portion of state and native and, to a lesser extent, federal tax collections.

price for wine is $0.40 per gallon and the excise tax price for beer and mead is $0.09 per gallon. Maryland additionally fees a 9 % gross sales and use tax to alcoholic beverage gross sales and extra taxes will be added primarily based on place of manufacturing, measurement of container, or place bought.

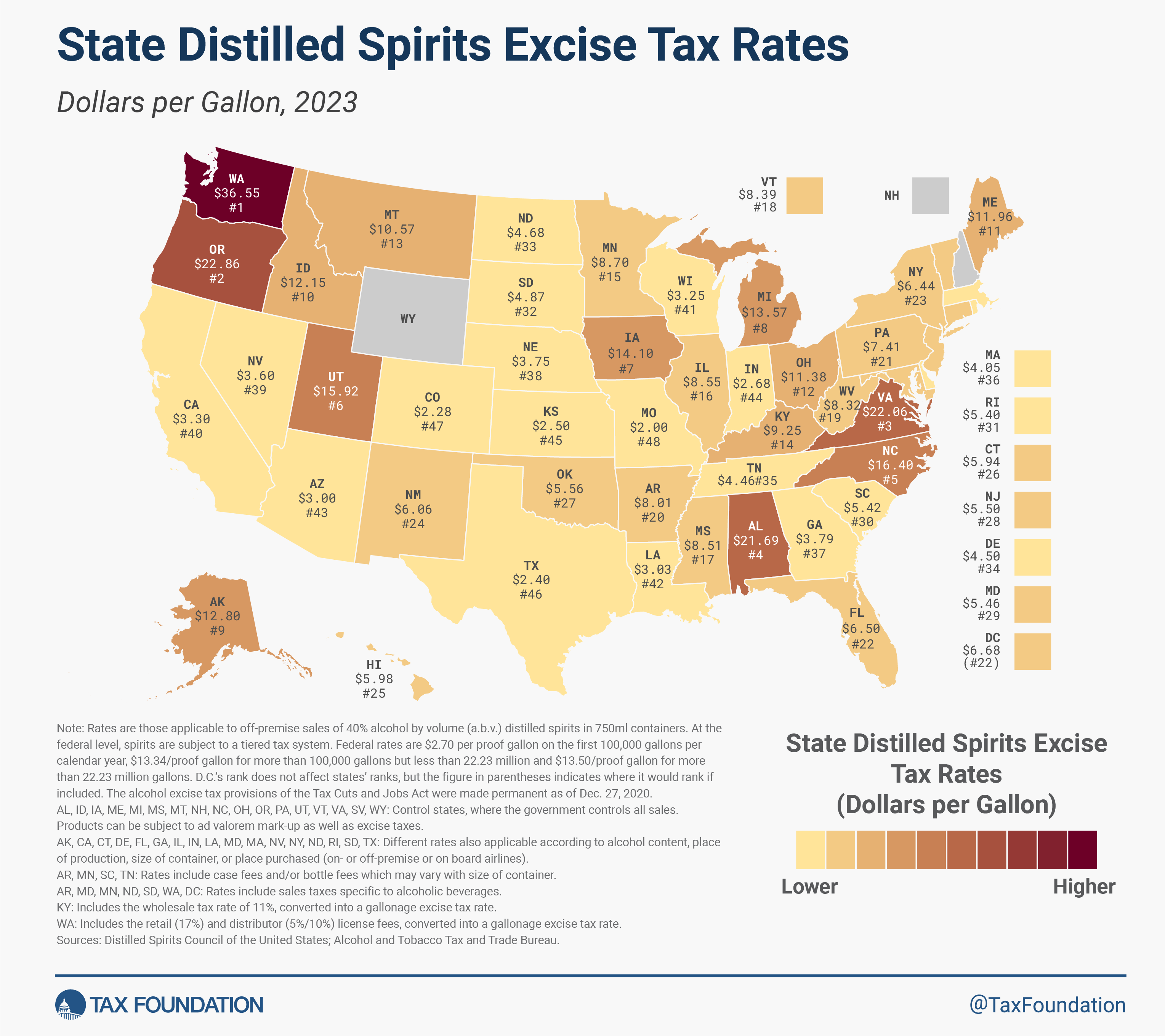

We estimate the mixed tax on the sale of distilled spirits is $5.46 per gallon—the 29th-highest price within the nation.

Spirits have traditionally been taxed extra closely than beer or wine. When categorical taxes had been initially applied, the classes had been clearly delineated. Beer, wine, and spirits had been very completely different merchandise, every having a considerably completely different alcohol content material. Even as we speak, wines have 10-16 % alcohol content material, most beers have an alcohol content material of round 5 %, and spirits are inclined to have round 40 % alcohol by quantity. With differing alcohol contents and corresponding dangers for alcohol abuse and exterior harms, greater tax charges on clearly delineated classes of merchandise could be a sensible strategy.

A categorical system doesn’t work as properly in a quickly altering product surroundings, nevertheless. By together with the mixer (e.g. the Coca-Cola in a Jack and Coke) within the prepackaged drink product, the alcohol content material in an RTD is commonly a lot nearer to that of beer or wine than a bottle of liquor. Regardless of the lowered alcohol content material, many RTDs and different merchandise are nonetheless taxed on the greater spirits tax price.

On the federal stage, for instance, spirits are taxed extra closely even throughout merchandise containing the identical alcohol content material. Take into account three “customary drinks,” every containing 0.6 ounces of alcohol: a 12-ounce beer containing 5 % alcohol, a cocktail made with 1.5 ounces of 40-proof spirits, and a 5-ounce glass of wine with 12 % alcohol content material. Though the alcohol content material of every beverage is similar, the federal taxes utilized to the cocktail are greater than thrice the speed utilized to wine and greater than double the speed utilized to beer.

A tax primarily based on alcohol content material could be probably the most impartial, simple technique of elevating income from alcohol. However since such a tax would represent a redesign of your entire alcohol tax system at each the state and federal ranges, the subsequent finest strategy is to create extra classes for brand spanking new merchandise.

Maryland’s HB 663 begins the method of making new classes for brand spanking new merchandise by giving RTDs their very own tax price similar to the speed the state fees wine. The state may have extra classes sooner or later, or to overtake your entire system primarily based on alcohol content material, however HB 663 would make alcohol taxes in Maryland extra impartial than they at present are.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share