points and discover the world by the lens of tax coverage. Study extra about taxes with TaxEDU.

In his State of the Union handle, President Biden made clear his plans to boost taxes on the wealthy so that they “lastly pay their justifiable share.” The unstated argument: the wealthy don’t pay their justifiable share already.

Whereas two-thirds of Individuals would agree, what do the info say?

The information can’t reply the query, however they will help inform the query. They’ll inform us who pays and the way a lot, revealing whether or not the U.S. tax system privileges the rich . . . or depends on them.

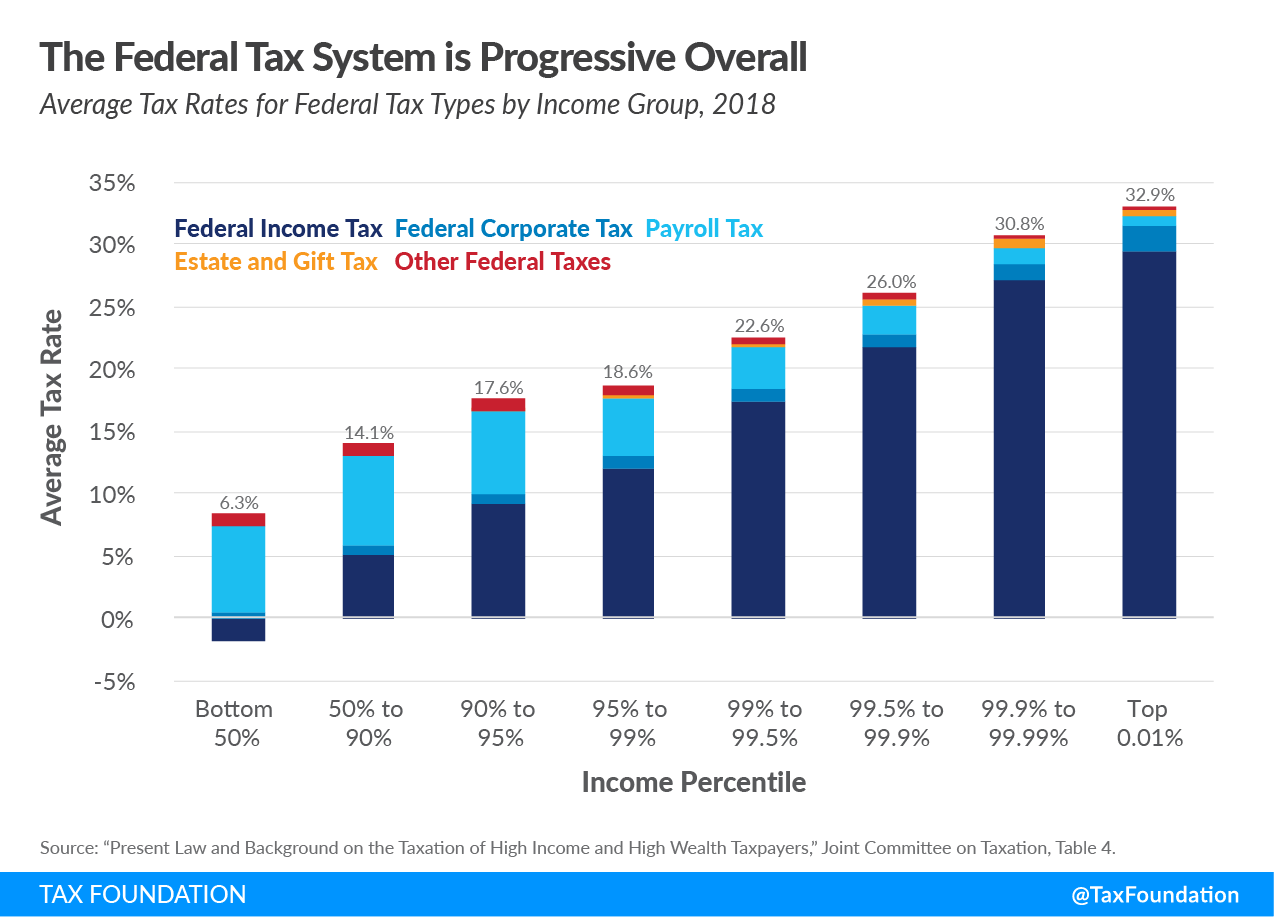

The Total Federal Tax System Is Progressive

The federal tax system consists of particular person, company, payroll, excise, and property taxes. Some tax sorts are progressive (which means individuals with increased incomes pay increased charges) whereas others are regressive (individuals with decrease incomes pay increased charges). However taken collectively, the general federal tax system is progressive.

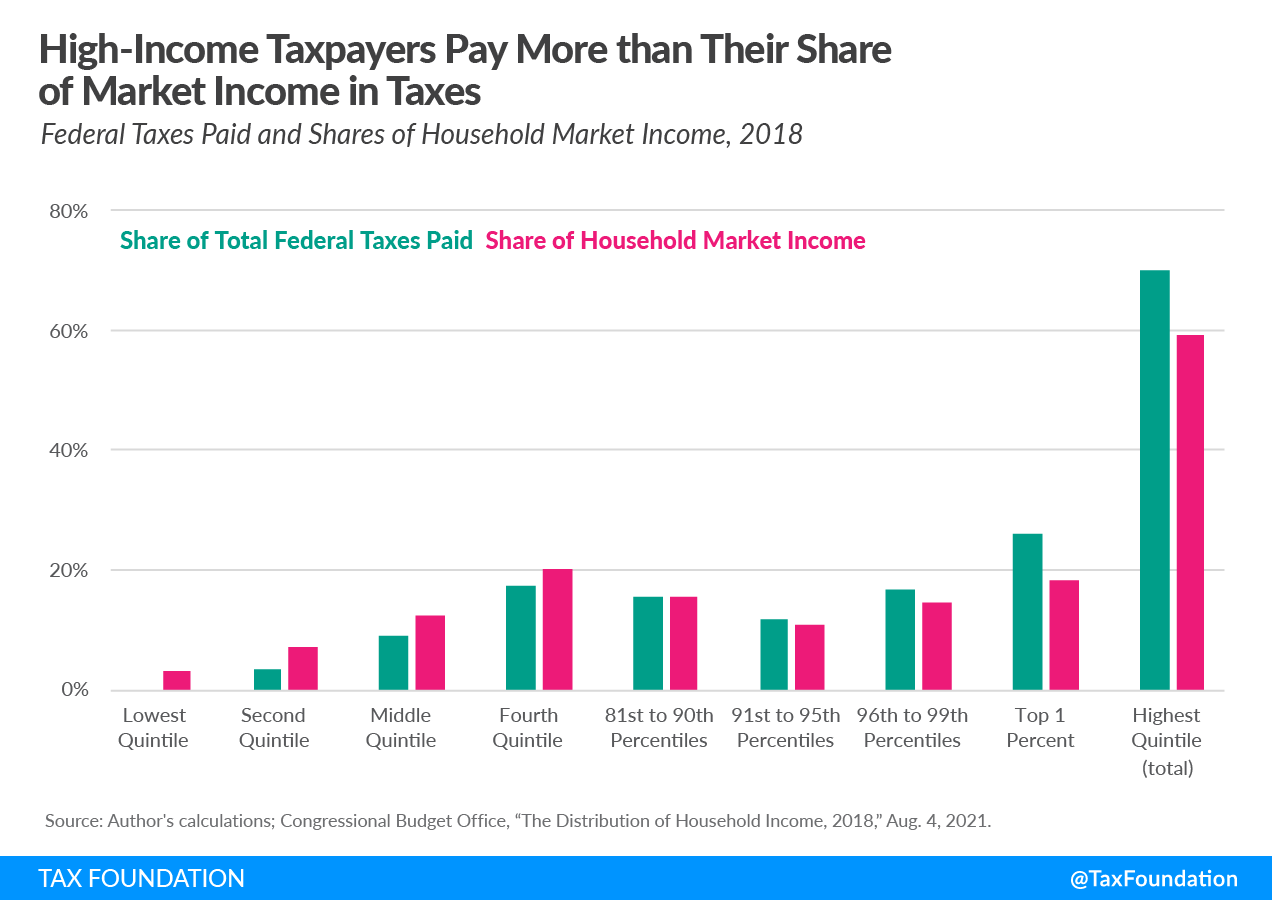

It is because the wealthy have extra of the nation’s revenue, proper? Not precisely. Excessive earners truly pay extra in taxes than their share of the nation’s revenue and are topic to increased tax charges on their revenue.

For instance, in 2018, the prime 1 % of earners took residence 18.3 % of market revenue however paid 25.9 % of all federal taxes. Equally, the highest 20 % of earners acquired 59.1 % of market revenue but paid 68.9 % of federal taxes. Their slice of the tax pie exceeded their slice of the revenue pie.

What’s the Pattern?

The U.S. federal tax system has gotten extra progressive over the previous few many years, however particularly so in the previous few years. Through the pandemic, the federal authorities handed aid insurance policies to get individuals by robust occasions, however these applications additionally elevated the tax and switch system’s progressivity. The underside one-fifth of earners, for instance, noticed their common tax priceThe common tax price is the full tax paid divided by taxable revenue. Whereas marginal tax charges present the quantity of tax paid on the following greenback earned, common tax charges present the general share of revenue paid in taxes.

fall by 17 proportion factors, whereas the highest fifth’s common price decreased by lower than one proportion level.

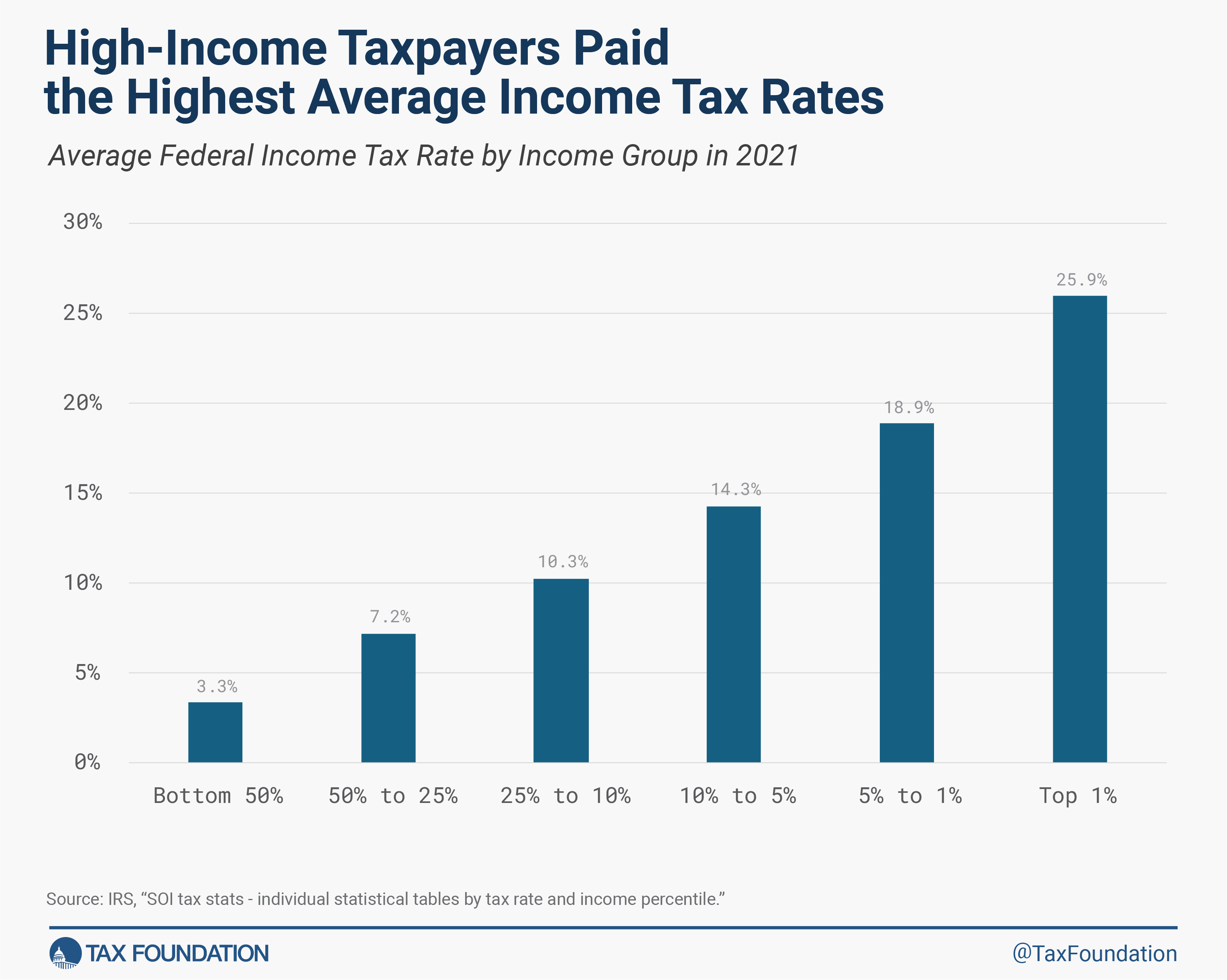

What Drives the Federal Tax Code’s Progressivity?

The federal revenue tax drives the tax code’s progressivity. In 2021, taxpayers with increased incomes paid a lot increased common revenue tax charges than taxpayers with decrease incomes.

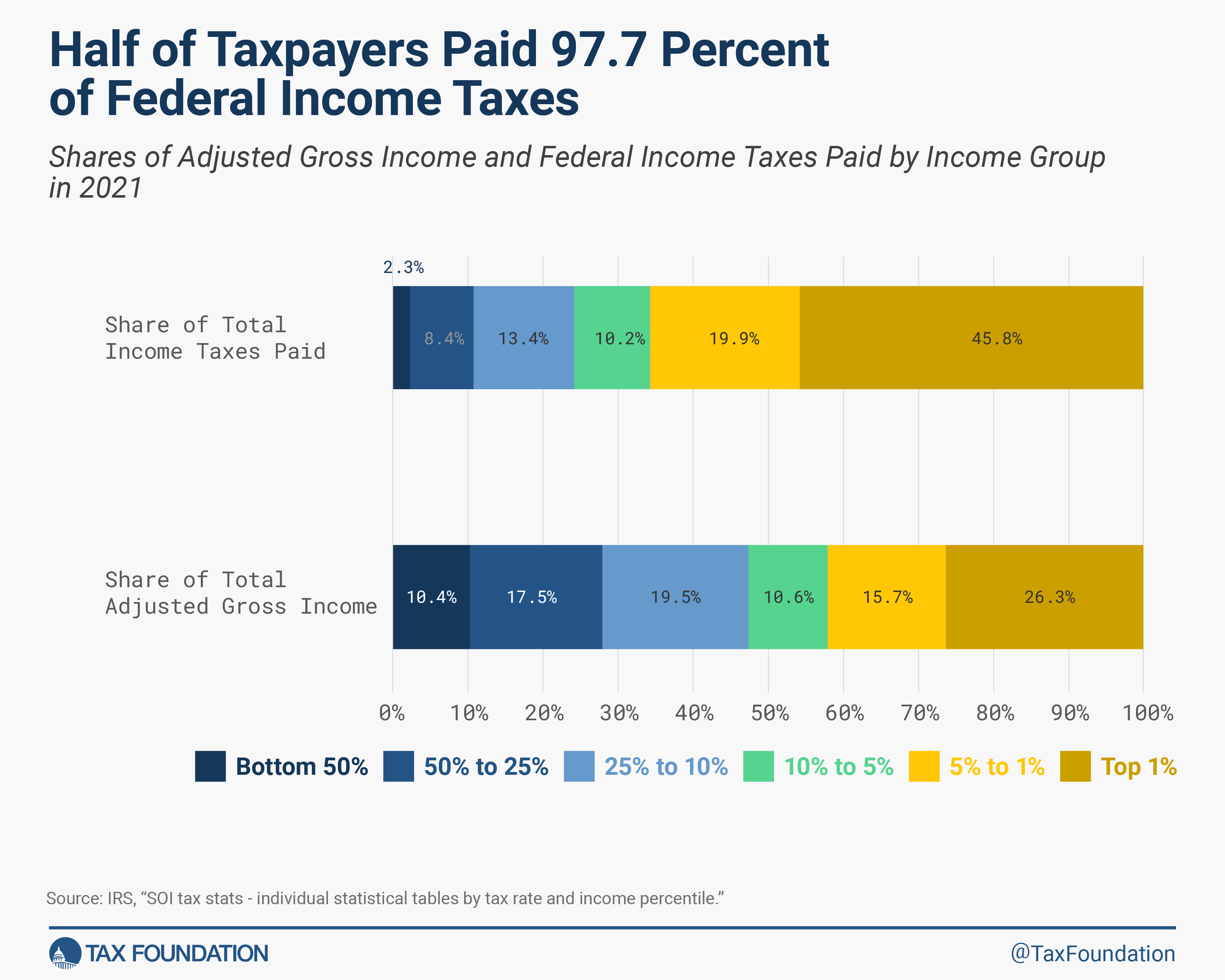

And, just like the system total, excessive earners’ slice of the revenue tax pie exceeded their slice of the revenue pie.

In 2021, the highest 1 % paid 45.8 % of all federal revenue taxes, but their share of the nation’s revenue was 26.3 %. The highest 50 % of all taxpayers paid 97.7 % of all federal particular person revenue taxes, whereas the underside 50 % paid the remaining 2.3 %.

Execs and Cons of a Progressive TaxA progressive tax is one the place the common tax burden will increase with revenue. Excessive-income households pay a disproportionate share of the tax burden, whereas low- and middle-income taxpayers shoulder a comparatively small tax burden.

Code

A progressive tax system tries to align taxes with individuals’s spending energy (i.e., their capacity to pay). Somebody making $1 million per 12 months, for instance, can afford to pay extra in taxes than somebody making $50,000 per 12 months.

A progressive tax system, subsequently, reduces the burden on individuals who can least afford it. It additionally tends to gather extra in taxes than both flat or regressive taxA regressive tax is one the place the common tax burden decreases with revenue. Low-income taxpayers pay a disproportionate share of the tax burden, whereas middle- and high-income taxpayers shoulder a comparatively small tax burden.

methods, which means extra money to fund authorities providers and administration.

However a progressive tax code comes with trade-offs, probably the most distinguished being decrease financial development. Increased marginal tax charges change the incentives to work, make investments, and innovate, which may negatively affect jobs, wages, and folks’s requirements of residing.

Keep up to date on the newest academic sources.

Stage-up your tax information with free academic sources—primers, glossary phrases, movies, and extra—delivered month-to-month.

Share