Imply Reversion:

A Navigational Instrument for Foreign exchange Merchants

The overseas change market, with its fixed ebb and movement, can really feel like a tempestuous sea. However beneath the floor, a guideline exists: the concept of imply reversion. This idea posits that, over time, costs are likely to gravitate again in the direction of their long-term common. For foreign exchange merchants, understanding imply reversion could be a worthwhile software for navigating market volatility and figuring out potential buying and selling alternatives.

The Idea in Motion

Imply reversion is a statistical idea utilized to monetary markets, suggesting that costs are likely to gravitate again in the direction of their historic common over time. Think about a forex pair fluctuating round a central axis, like a pendulum. The bigger the swing in a single path, the stronger the pull again in the direction of the middle.

Think about a forex pair like EUR/USD. Over the previous decade, it could have averaged a price of 1.20. A sudden surge propels the value to 1.30. In response to imply reversion, this excessive deviation turns into unsustainable, and the value has a better probability of correcting itself and returning nearer to 1.20 sooner or later.

The Attract of Imply Reversion

For foreign exchange merchants, imply reversion gives a strategic benefit. By figuring out when a forex pair has deviated considerably from its historic common, merchants can capitalize on the potential for a reversal. This will contain:

- Shopping for Undervalued Currencies: When a forex falls far under its historic common, it is likely to be a shopping for alternative. The expectation is that the value will finally appropriate itself and rise in the direction of the imply.

- Promoting Overvalued Currencies: Conversely, if a forex surges previous its historic common, it might be an excellent time to promote brief, anticipating a decline again in the direction of the imply.

Technical Indicators: Instruments of the Commerce

A number of technical indicators can support merchants in figuring out imply reversion alternatives:

- Transferring Averages: These technical indicators depict the common value over a selected interval. A value considerably above or under its transferring common suggests a possible imply reversion commerce. As an example, shopping for a forex buying and selling effectively under its 200-day transferring common displays the concept the value could also be oversold and due for a correction upwards.

- Bollinger Bands: These channel indicators depict value volatility. When costs breach the higher band, it implies overbought territory, and a possible reversion downwards. Conversely, costs hugging the decrease band counsel oversold situations and a potential upswing.

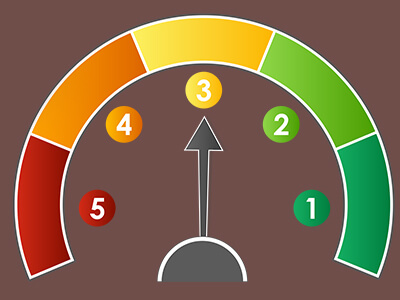

- Relative Energy Index (RSI): This indicator measures value momentum. An RSI worth exceeding 70 suggests overbought situations, whereas values under 30 point out oversold territory. Merchants can use these extremes as entry factors for imply reversion trades.

The Actuality Examine: Limitations and Dangers

Whereas imply reversion gives a compelling framework, it’s essential to acknowledge its limitations:

- Time Horizon: Imply reversion doesn’t assure a particular timeframe for value corrections. Traits can persist longer than anticipated, resulting in losses if exit methods aren’t in place.

- Market Fundamentals: Vital financial occasions or coverage shifts can essentially alter a forex’s worth, doubtlessly rendering historic averages irrelevant.

- False Indicators: Technical indicators can generate false alerts, particularly in risky markets. Combining imply reversion with different technical evaluation instruments may help refine entry and exit factors.

Professional Opinions Weigh In: Weighing the Proof

Foreign exchange consultants supply numerous views on imply reversion:

- Technical analysts usually emphasize imply reversion as a core buying and selling precept. They advocate for utilizing it along side different technical evaluation instruments for a extra sturdy buying and selling technique.

- Kathy Lien, Foreign exchange Strategist at BK Asset Administration: “Imply reversion could be a great tool for short-term merchants, nevertheless it’s essential to mix it with different technical and basic evaluation.“

- John Maynard Keynes, a famend economist, believed imply reversion held true in the long run. Nevertheless, he cautioned in opposition to its short-term applicability.

- “Imply reversion is a strong idea, nevertheless it’s a software, not a assure,” cautions foreign exchange analyst Lisa Jones. “Strong danger administration and a wholesome dose of skepticism are important when using this technique.”

- “The important thing lies in figuring out currencies with a well-established historic common and making use of imply reversion in periods of range-bound buying and selling,” advises veteran dealer Michael Chen.

- Adam Chodos, Chief Funding Strategist at Interactive Brokers: “Whereas imply reversion holds true over the long run, short-term tendencies will be very robust, and ignoring them can result in missed alternatives or losses.”

The Takeaway: A Strategic Ally, Not a Holy Grail

Imply reversion is a worthwhile idea for foreign exchange merchants. It offers a framework for understanding value actions and figuring out potential buying and selling alternatives. Nevertheless, it ought to be used along side different evaluation methods and a wholesome dose of skepticism. By understanding its strengths and limitations, merchants can leverage imply reversion as a strategic ally of their quest for foreign exchange market success.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. Please seek the advice of with a professional monetary advisor earlier than making any funding choices.

Glad buying and selling

might the pips be ever in your favor!