TransUnion, one of many huge three credit score bureaus, has launched a brand new information analytics platform referred to as OneTru.

The brand new platform will provide banks and fintechs AI and ML instruments for addressing quite a lot of credit score, anti-fraud and advertising and marketing wants.

There are 4 key layers in OneTru:

1. Information administration layer – offering entry to compliant credit score and non-credit information.

2. Id layer – matches on-line and offline private id fragments.

3. Analytics layer – makes use of AI to generate actionable insights throughout credit score, fraud mitigation and advertising and marketing.

4. Supply layer – leverages a unified information governance framework to make sure regulatory compliance.

This new product leverages the AI platform from Neustar, an organization TransUnion acquired in 2021.

TransUnion made it clear that this new platform is simply the beginning. Tim Martin, Chief International Options Officer, stated, “OneTru offers us with a world chassis upon which we’ll deploy merchandise and share experience internationally in a cheap and compliant means. It’s a game-changer for our clients and for the trade.”

The entire thought is “to drive a extra full and protracted image of a shopper.”

Featured

> TransUnion launches new information analytics platform powered by AI

By Frank Gargano

The credit score bureau’s information analytics portal, OneTru, hosts all beforehand provided merchandise on a hybrid cloud-based platform and makes use of guides powered by synthetic intelligence to streamline question processes.

From Fintech Nexus

> May AI have stopped the SVB crash?

By Tony Zerucha

May AI have prevented the SVB disaster? Possibly not utterly, however shopper sentiment evaluation might have dramatically decreased its affect.

Podcast

Dan Arlotta, Senior Vice President of Garnet Capital Advisors on fintech mortgage portfolio gross sales

The secondary mortgage market has performed an essential function within the historical past of fintech lending. There are few individuals who know extra…

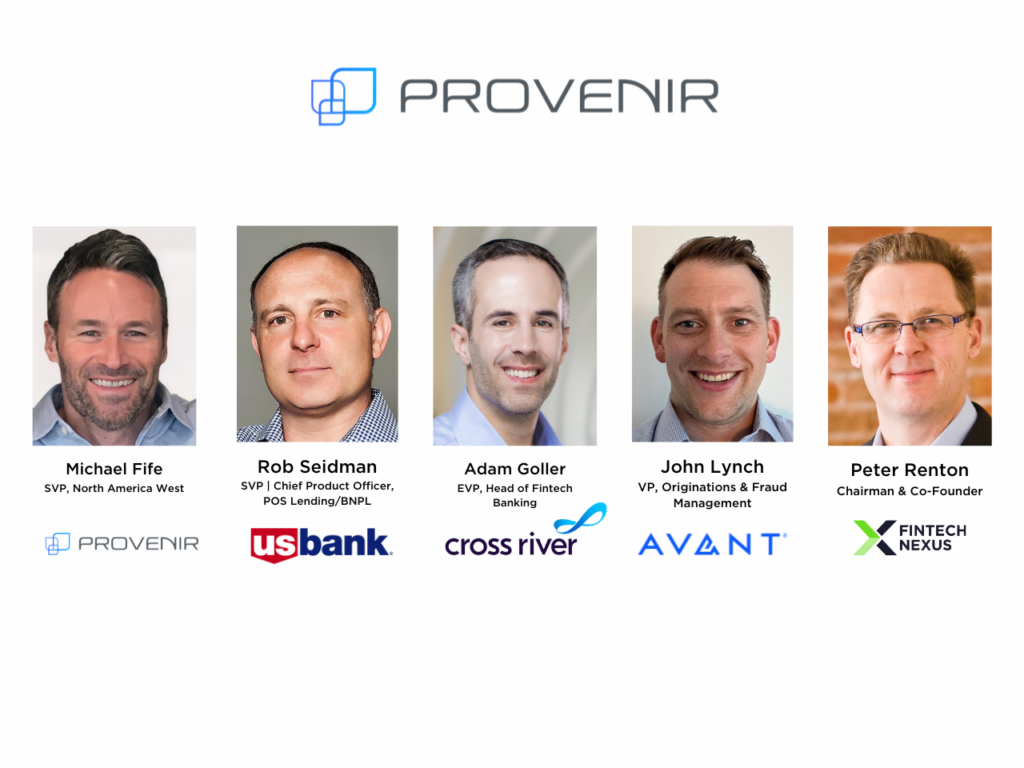

Webinar

How Shopper Lenders Can Cut back Friction With out Compromising on Threat and Fraud Prevention

Mar 21, 2pm EDT

Buyer expertise is extremely essential to in the present day’s discerning customers, whether or not they’re searching for monetary providers…

Additionally Making Information

- USA: FirstBank and Excessive Circle introduce banking for the very rich

FirstBank, a sponsor financial institution with a 118-year historical past rooted in neighborhood banking, has teamed up with Excessive Circle, a two-year-old monetary platform for Excessive Web-worth Entrepreneurs to introduce banking merchandise designed for high-net-worth people and entrepreneurs, leveraging the capabilities of Banking-as-a-Service.

- Europe: GoCardless to purchase Nuapay from EML Funds

GoCardless is making a full-service financial institution funds supplier by the acquisition of open banking enterprise Nuapay from Australia’s EML Funds in a deal price €32.75 million.

- USA: Buyer Is Nonetheless King and Queen of Banking Innovation

In a world the place change is fixed, digitization has turn into one in all life’s certainties. This development is coming to even historically staid sectors like monetary providers and banking, spurring profound transformations.

To sponsor our newsletters and attain 275,000 fintech lovers along with your message, contact us right here.