Information exhibits excessive greed sentiment has made a return among the many Bitcoin traders after the cryptocurrency’s value has damaged above $50,000.

Bitcoin Worry & Greed Index Now Factors In direction of “Excessive Greed”

The “Worry & Greed Index” refers to an indicator that tells us in regards to the common sentiment amongst Bitcoin merchants and broader cryptocurrency sectors.

The metric represents this sentiment utilizing a numerical scale from zero to hundred. Based on Different, its creator, the index calculates this rating utilizing 5 components: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Tendencies.

When the Worry & Greed Index has a price of 54 or larger, the traders now share a sentiment of greed. Then again, values of 46 or much less suggest the presence of concern among the many merchants.

The area between these two ranges (values 47 to 53) corresponds to the territory of “impartial” sentiment. Along with these three core sentiments, “excessive concern” and “excessive greed” happen on the deep ends of the concern and greed ranges.

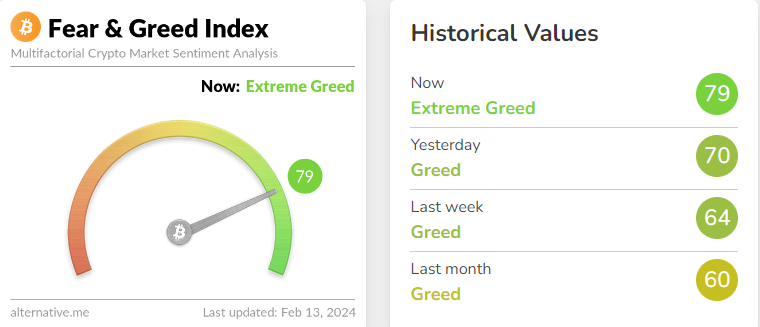

Here’s what the Bitcoin Worry & Greed index seems to be like proper now to see which of those areas the market is in:

Appears like the worth of the metric is 79 in the meanwhile | Supply: Different

As displayed above, the Bitcoin Worry & Greed Index has surpassed the 75 threshold for excessive greed throughout the previous day and has attained a price of 79. The metric was at 70 yesterday, so it has seen a little bit of a leap in simply the final 24 hours.

This surge in sentiment from greed to excessive greed has occurred as cryptocurrency broke previous the $50,000 barrier for the primary time since December 2021.

Traditionally, the acute sentiments have been fairly important for the asset, as main bottoms and tops for the value have occurred in these areas. This relationship between the 2, nevertheless, has been inverse.

Excessive concern has been when bottoms have taken form, whereas excessive greed has been the place tops have shaped. Prior to now, Bitcoin has normally tended to maneuver towards the bulk’s expectations. This expectation is the strongest in these ranges, so it is smart {that a} reversal is the primarily seemingly right here.

Followers of a buying and selling philosophy known as “contrarian investing” exploit this truth to time their shopping for and promoting strikes. “Be fearful when others are grasping, and grasping when others are fearful” is a well-known quote from Warren Buffet that sums up the concept.

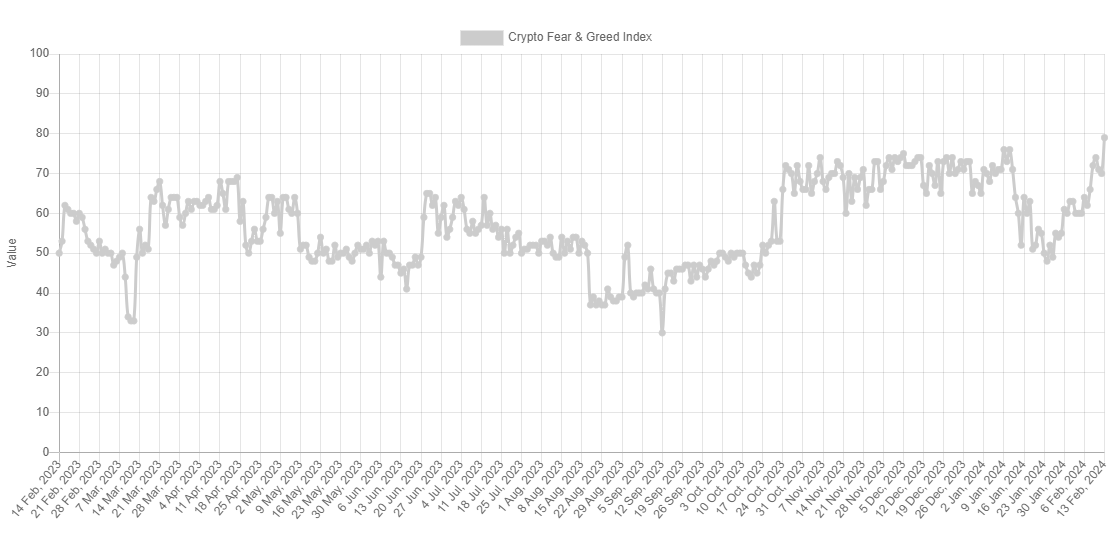

Because the chart beneath exhibits, the final time the Worry & Greed Index attained excessive greed ranges was across the time of the spot ETF approval.

The development within the Worry & Greed Index over the previous yr | Supply: Different

As BTC traders are very nicely conscious, the coin hit a high coinciding with the occasion because the market took to promoting the information. For the reason that sentiment is now again inside excessive greed with its newest surge, one other comparable reversal level could also be shut for its value.

Maybe it’s at a time like this when a contrarian investor would take into account shifting in direction of promoting, going towards the hype and euphoria floating across the market.

BTC Worth

Bitcoin has loved a surge of over 4% up to now day, which has taken its value in direction of the $50,000 mark.

The value of the coin seems to have shot up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Different.me, charts from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site completely at your personal danger.