Analyzing the Highly effective RSI Indicator:

A Dealer’s Tutorial

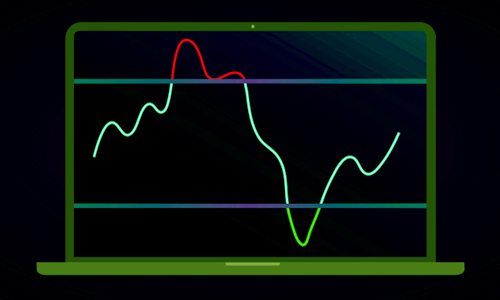

The Relative Power Index (RSI) is a cornerstone software in a dealer’s arsenal. Developed by J. Welles Wilder Jr., the RSI helps gauge an asset’s momentum and determine potential overbought or oversold circumstances. This tutorial will dissect the RSI, discover its mechanics, and delve into how merchants use it, together with professional insights.

Unveiling the Method:

The RSI sits between 0 and 100, reflecting the relative energy of latest value actions. Right here’s the magic underneath the hood:

- Common Achieve/Loss: The RSI considers common good points and losses over a specified interval (usually 14 days). It calculates the Common Achieve (AG) for up days and the Common Loss (AL) for down days.

- Relative Power: To account for value fluctuations, the RSI makes use of the Relative Power (RS) which is the ratio between the AG and the AL smoothed by an element (typically set to 1). The components:

RS = AG / (1 – AL)

- Smoothing the Experience: Uncooked RS will be risky. The RSI applies a smoothing issue to create a extra manageable worth. A typical method is utilizing the prior day’s RSI worth and the present RS to calculate a brand new RSI:

RSI = (Prev RSI) + (1 – (Prev RSI)) * RS

Making use of the RSI:

Now that you just perceive the mechanics, let’s see the RSI in motion:

- Overbought/Oversold Ranges: Historically, readings above 70 counsel an overbought situation, and values beneath 30 point out an oversold situation. These ranges might have adjustment primarily based on the particular asset and market circumstances.

- Divergences: When the worth makes a brand new excessive however the RSI fails to comply with swimsuit (bearish divergence), it could sign a possible reversal. Conversely, a value making a brand new low whereas the RSI doesn’t (bullish divergence) can trace at an upcoming upside transfer.

- Pattern Affirmation: The RSI can be utilized alongside pattern indicators. For instance, throughout an uptrend, the RSI ought to ideally keep above 30 and regularly contact 70. Conversely, in a downtrend, the RSI not often surpasses 70.

Combining RSI with Different Indicators for Stronger Alerts

The RSI is a strong software, however it could profit from getting used alongside different technical indicators. Listed below are some widespread mixture methods to contemplate:

1. RSI and Transferring Averages:

Affirmation of Pattern:

- Mix RSI with a short-term transferring common (e.g., 50-period) and a long-term transferring common (e.g., 200-period).

- In an uptrend, search for the RSI to remain above 50 and the short-term transferring common to cross above the long-term transferring common (bullish crossover). This strengthens the uptrend sign.

- Conversely, in a downtrend, search for the RSI beneath 50 and a bearish crossover (short-term transferring common falls beneath the long-term transferring common).

2. RSI and Assist/Resistance:

Overbought/Oversold at Key Ranges:

- Determine help and resistance ranges on the worth chart.

- If the RSI reaches overbought territory (above 70) close to a resistance stage, it’d point out a stronger likelihood of a value reversal to the draw back.

- Conversely, an oversold RSI (beneath 30) close to a help stage may counsel a possible value bounce.

3. RSI and Divergence:

Figuring out Pattern Reversals:

- This technique focuses on the divergence between the RSI and value motion.

- If the worth makes a brand new excessive however the RSI fails to achieve a brand new excessive (bearish divergence), it suggests weakening bullish momentum and a attainable pattern reversal.

- Conversely, if the worth makes a brand new low however the RSI doesn’t attain a brand new low (bullish divergence), it may sign strengthening bullish momentum and a possible pattern reversal.

4. RSI with Stochastic Oscillator:

Twin Momentum Indicator: Each RSI and Stochastic Oscillator measure momentum. After they each sign overbought (or oversold) circumstances, it strengthens the boldness within the sign.

Bear in mind:

- These are only a few examples, and there are various different mixtures you’ll be able to discover.

- Backtest any technique on historic information earlier than deploying it with actual capital.

The Consultants Weigh In

Whereas the RSI is a invaluable software, right here’s what the specialists should say:

- False Alerts: The RSI can generate false indicators in sturdy traits. Be aware of the prevailing pattern when deciphering RSI readings.

- Not a Standalone Instrument: The RSI ought to be used together with different technical indicators and basic evaluation for a well-rounded buying and selling technique.

- Overbought/Oversold Ranges Aren’t Mounted: These thresholds can range relying on the asset and market context. Backtesting can assist determine probably the most related ranges on your particular technique.

The Backside Line

By understanding the construction, interpretation and limitations of the RSI, merchants can use this highly effective software to make knowledgeable buying and selling choices. Bear in mind, RSI is a invaluable piece of the puzzle, not the entire image, and with correct danger administration practices may be very relevant to any buying and selling technique.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. Please seek the advice of with a professional monetary advisor earlier than making any funding choices.

Completely happy buying and selling

might the pips be ever in your favor!