So, you have got a pleasant work setup at dwelling. Does that imply you get to jot down it off in your taxes? In case you’re new to working remotely or working a small enterprise from dwelling, it’s comprehensible that you’ve some questions on how that impacts your taxes and which deductions you is likely to be entitled to.

Sadly, for distant employees, the shift to earn a living from home–whether or not compelled or optionally available–doesn’t qualify for a tax write-off of their workspace as a house workplace. However for self-employed people, the house workplace deduction may very well be an amazing alternative to benefit from.

Earlier than you begin gathering all these invoices for tech, utilities, and different dwelling workplace bills, it’s vital to be sure to qualify.

We’ve laid out the fundamentals and totally different necessities that can assist you decide in case you can benefit from the house workplace deduction. Let’s dive in.

What’s the dwelling workplace tax deduction?

The house workplace tax deduction permits certified taxpayers to jot down off sure dwelling bills associated to their enterprise use of their dwelling after they file their taxes. To say the house workplace deduction in your tax return, taxpayers should solely and often use a part of their houses or a separate construction on their property as their important and first administrative center.

Previous to the Tax Cuts and Job Act (TCJA) handed in 2017, staff might deduct unreimbursed worker enterprise bills, together with deductions for the house workplace. Nevertheless, for the tax years 2018 to 2025, these deductions for worker enterprise bills have been suspended.

So, in case you’re an worker working remotely for an employer relatively than a enterprise proprietor, self-employed, or 1099 contractor, you possible don’t qualify for the house workplace tax deductions.

What are the primary standards for the house workplace deduction?

Determining whether or not you qualify for this deduction can appear overwhelming, nevertheless it’s really fairly simple when you have a look at the necessities individually.

Typically, to qualify for this tax deduction, the area you’re making an attempt to assert as a house workplace should meet one of many following standards:

Unique & common use

This implies you could use a portion of your home, house, cellular dwelling, condominium, boat, or comparable construction for what you are promoting frequently. This additionally consists of constructions in your property, akin to an unattached:

- Barn

- Studio

- Greenhouse

- Storage

This doesn’t embody any a part of a taxpayer’s property that’s getting used solely as a resort, motel, inn, rental, or comparable enterprise.

Unique & common assembly area

An unique and common assembly area, often known as a principal administrative center, means your private home workplace have to be used often, be a principal location of what you are promoting, or a spot the place you often meet with:

- Sufferers

- Clients

- Purchasers

That is frequent for some docs or advisers who’ve small practices, however there are some exceptions. Daycare and storage services don’t apply. The IRS supplies an instance of an lawyer who often makes use of a room to arrange his work however can also be a den for the household, which suggests it doesn’t qualify for the deduction.

Separate, unattached construction

Unique & common use of a separate, unattached construction from your private home the place you keep commerce or enterprise.

For instance, if your private home workplace is in a separate, unattached construction–like a craftsman working in his indifferent storage turned workshop–you don’t have to satisfy the principal-place-of-business or the deal-with-clients take a look at. You possibly can qualify for the IRS dwelling workplace deduction so long as you go the unique and common use checks.

Unique & common use for storage, rental, or daycare

The common and unique use of space for storing for stock or product samples being utilized in your commerce or enterprise of promoting merchandise at retail or wholesale, so long as your private home is the only real mounted location of such enterprise or commerce for rental use or as a daycare facility.

Exceptions to the exclusivity rule embody storage getting used for samples or objects on the market, and for daycare facility operations. For these, it’s the ‘common’ element that’s required to be confirmed.

What qualifies as a enterprise?

Whether or not your endeavors qualify you for a house workplace deduction is determined by the regular-use take a look at. The extra substantial the actions, akin to effort and time invested and generated earnings, the extra possible you’re to go the take a look at.

For the needs of a house workplace tax deduction, revenue isn’t the one standards, though making a living out of your efforts is a prerequisite.

For instance, in case you use your front room solely to maintain your private funding portfolio, then you’ll be able to’t declare deductions for a house workplace as a result of your actions as an investor don’t qualify as a enterprise. Taxpayers who use a house workplace solely to handle rental properties could qualify for dwelling workplace deduction however as a property supervisor relatively than an investor.

What qualifies as a house workplace?

A house workplace have to be both the principal location of what you are promoting or a spot the place you often meet with shoppers, sufferers, or clients. To qualify for the IRS dwelling workplace deduction, you could solely use the world for enterprise.

An instance the IRS provides in regards to the severity of the exclusive-use requirement is a house workplace used for full-time enterprise that’s labored ten hours a day, seven days every week. In case you let your kids use the workplace to do their homework, this violates the exclusive-use requirement and forfeits the prospect for a house workplace deduction.

What all are you able to deduct?

Deductible bills for enterprise use of your private home embody the enterprise portion of:

- Actual property taxes

- Mortgage curiosity

- Hire

- Casualty losses

- Utilities

- Insurance coverage

- Depreciation

- Upkeep

- Repairs

Typically, you’ll be able to’t deduct bills for elements of your private home that aren’t used for enterprise, for instance, garden care or a exercise room.

In case you’re contemplating commonplace vs. itemized deductions, figuring out in case you qualify for a house workplace write-off is vital.

How a lot are you able to deduct for a house workplace?

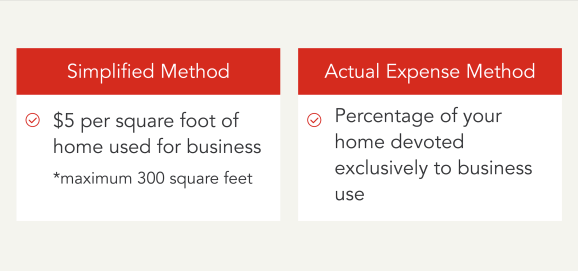

Determining how a lot you’ll be able to deduct for a house workplace isn’t as difficult because it sounds. Taxpayers who qualify could select one in all two strategies to calculate their dwelling workplace deduction.

Precise expense technique

Taxpayers utilizing the precise expense technique (required for tax years 2012 and prior) as an alternative of the simplified technique should decide the precise bills of their dwelling workplace. These bills could embody:

- Mortgage curiosity

- Insurance coverage

- Utilities

- Repairs

- Depreciation

When utilizing the precise expense technique to deduct dwelling workplace bills, you base it on the share of your private home devoted solely to enterprise use. So, for the room used for conducting what you are promoting, you’ll want to determine what share of your private home that quantities to.

For instance, let’s say you utilize a room that’s 200 sq. toes for enterprise operations. If your home is 1,500 sq. toes, the share of your private home devoted to enterprise use can be roughly 13%.

Which means that you could write off 13% of bills like your mortgage curiosity and utilities, among the many others, as enterprise bills. Utilizing an instance of a complete of $4,500 for the above-mentioned bills, that may be a write-off of about $585.

Let’s break down that math actually shortly:

% enterprise bills x whole bills = dwelling workplace bills

.13 x $4500 = $585

Simplified technique

The simplified technique can considerably scale back the burden of recordkeeping by permitting a professional taxpayer to multiply a prescribed price by the allowable sq. footage of the workplace as an alternative of figuring out precise bills.

The simplified choice has a price of $5 per sq. foot for enterprise use of the house. The utmost measurement for this selection is 300 sq. toes and has a most deduction of $1,500.

So, for instance, let’s say you utilize 200 sq. toes of your private home for enterprise operations. The house workplace deduction utilizing the simplified technique can be $1,000.

Whereas, on this instance, the simplified technique ends in a bigger deduction, that’s not at all times the case. It’s going to rely in your particular bills and which really apply to the world of your private home used for what you are promoting. For instance, you’ll be able to’t embody repairs that have been executed to a different a part of the home.

Vital concerns

Whatever the technique used, when submitting for deductions in your dwelling workplace, it’s vital to notice that you could’t deduct enterprise bills in extra of the gross earnings limitation.

It’s additionally vital to contemplate the {qualifications} for a house workplace deduction when assessing what you are promoting use of your private home. You’ll wish to think about depreciation and be sure to’ve stored detailed data, as eligibility would possibly change from one 12 months to the following.

3 responses to “Can I Take the Dwelling Workplace Deduction?”