KEY

TAKEAWAYS

- Jim Miekka created the Hindenburg Omen after learning the situations current at earlier market peaks.

- The Hindenburg Omen triggered an preliminary sign this week, simply because the S&P 500 lastly closed above 5000 for the primary time.

- If we see a second sign within the subsequent 4 weeks, this might verify a significant bearish sign for shares.

The S&P 500 shall heretofore be often known as an index that has damaged the unimaginable 5,000 stage. That alone is a fairly superb milestone for a benchmark that was down round 3500 simply over a 12 months in the past! However one other vital sign could also be creating as properly, that being the dreaded Hindenburg Omen.

However what’s the Hindenburg Omen, and what does it truly symbolize?

At this time, we’re taking a look at a broad market indicator created years in the past by Jim Miekka, and it primarily appears for situations which might be quite common at main market tops. Does a legitimate sign assure a significant market prime? In fact not. However going again by way of market historical past, only a few main peaks have occurred with out the Hindenburg Omen dropping a bearish sign simply beforehand.

You may break the Hindenburg Omen down into three parts: a bullish market development, an growth in new highs AND new lows, and a bearish rotation in breadth. Let’s overview every of those parts in flip.

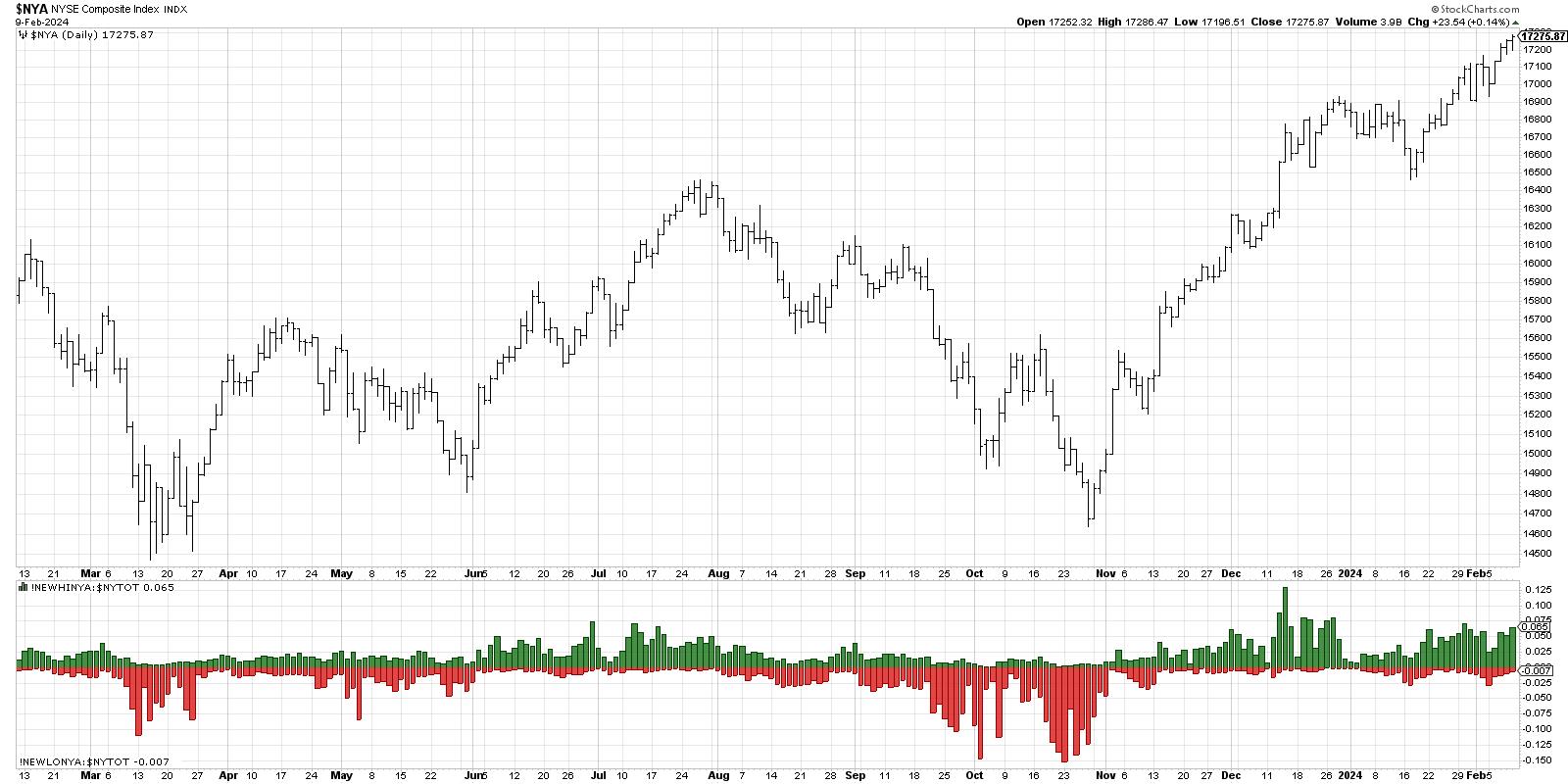

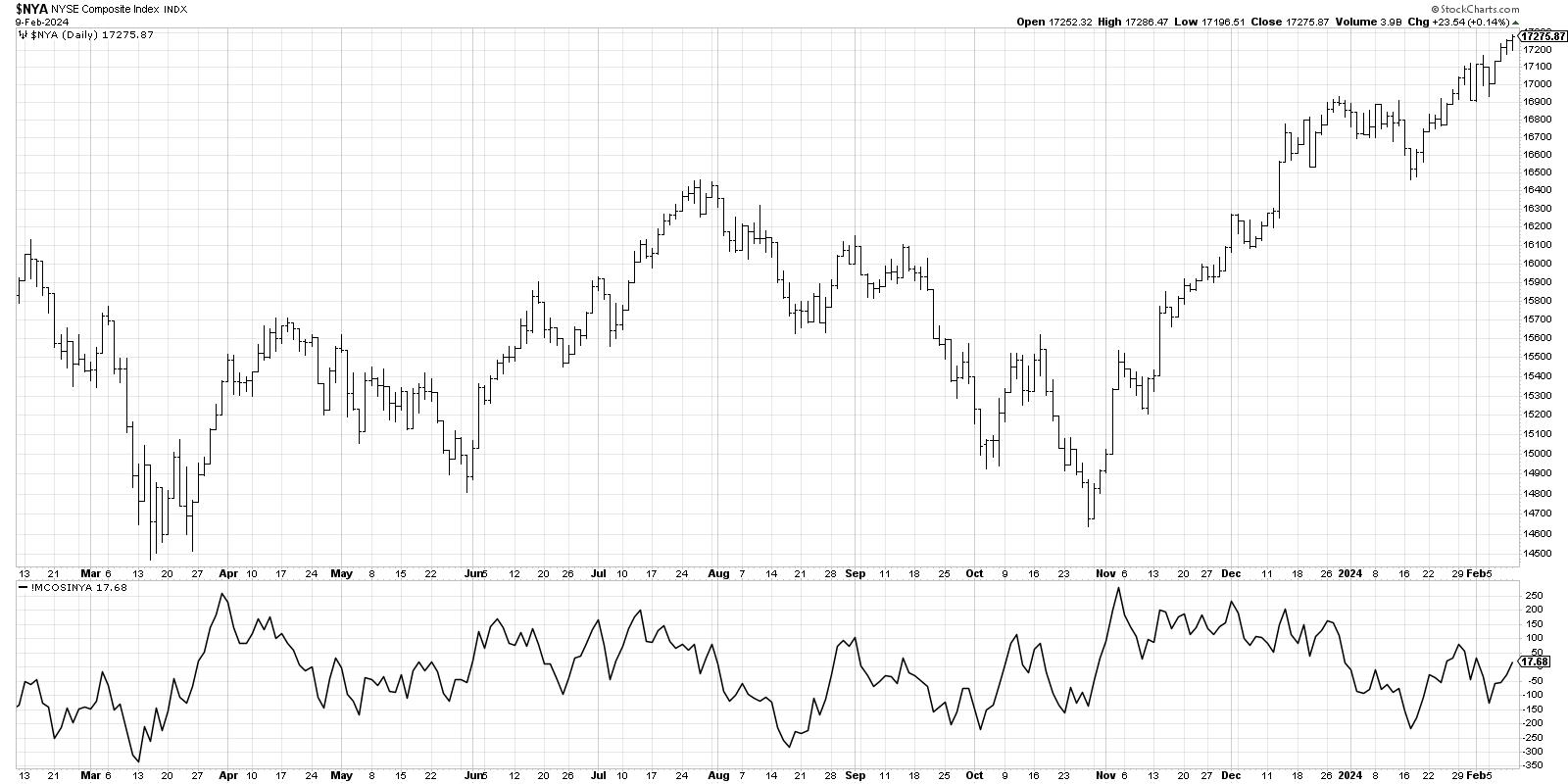

First, we have to verify that the market is in a longtime uptrend, as that is an indicator designed to determine market tops. So we take a chart of the NYSE Composite index ($NYA) and look to be sure that the 50-day fee of change (ROC) is optimistic — i.e., the market is increased than it was ten weeks in the past. In that case, then the primary situation is met.

Subsequent, Miekka seen that, at main market tops, there weren’t solely loads of shares making new 52-week highs, but additionally a bunch of shares making new 52-week lows. This implied a interval of indecision, as shares have been each breaking out and breaking down across the identical time. Technically, we’re on the lookout for no less than 2.8% of NYSE listings making a brand new excessive and a couple of.8% making a brand new low on the identical day. This supplies the second situation of the three.

Lastly, we’re on the lookout for a bearish rotation in market breadth, suggesting that the energy that pushed the benchmarks increased within the bullish section at the moment are beginning to dissipate. Right here we use the McClellan Oscillator on NYSE information, and, when the indicator breaks beneath the zero stage, it constitutes a unfavorable breadth studying.

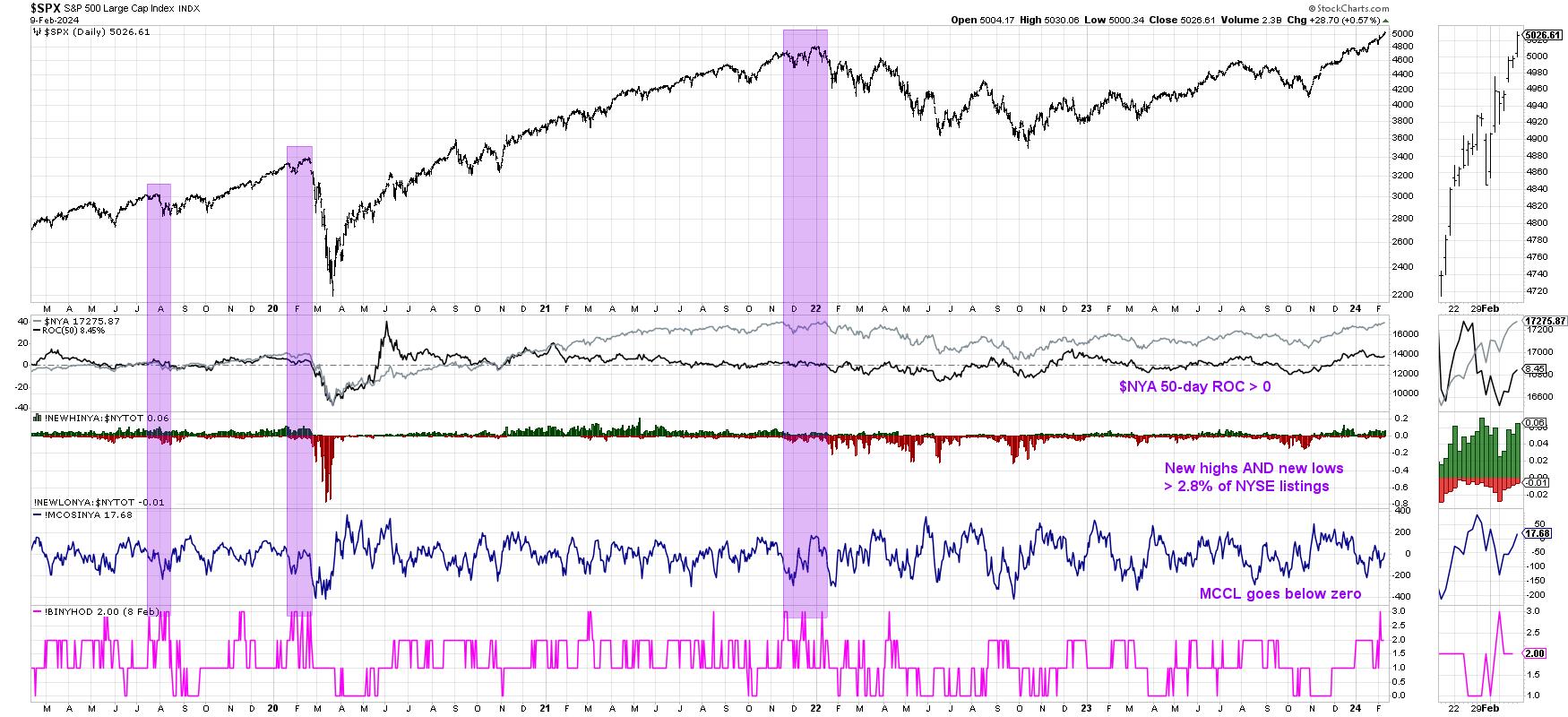

Once we put all three indicators collectively, you get an excellent busy chart like this!

The collection on the backside is a composite indicator that checks for the three situations above. When all three situations have been met, the indicator reveals a price of +3. It is vital to notice that only one sign isn’t sufficient. You want a number of triggers inside a one-month interval to finish a legitimate Hindenburg Omen sign.

In latest market historical past, we have seen three legitimate indicators: August 2019, February 2020, and December 2021. Two of these indicators occurred earlier than vital drawdowns, which is why the preliminary sign we famous this week has us a bit skeptical of additional market upside immediately. If we do see a confirmed Hindenburg Omen sign with one other confluence of triggers over the following couple weeks, then we could also be simply peering over the precipice of a significant market decline.

Indicators just like the Hindenburg Omen do not sign usually, and they’re actually not 100% correct at calling main market tops. However conscious traders know to concentrate when situations look just like earlier market tops. Keep in mind, all massive losses start as small losses!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any method symbolize the views or opinions of another particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders reduce behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor resolution making in his weblog, The Aware Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing threat by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to determine funding alternatives and enrich relationships between advisors and purchasers.

Study Extra