A brand new report highlights the demand for startups constructing open supply instruments and applied sciences for the snowballing AI revolution, with the adjoining knowledge infrastructure vertical additionally heating up.

Runa Capital, the enterprise capital (VC) agency that upped sticks from Silicon Valley and moved its HQ to Luxembourg in 2022, has printed the Runa Open Supply Startup (ROSS) Index for the previous 4 years, shining a light-weight on the fastest-growing business open supply software program (COSS) startups. The corporate publishes quarterly updates, nonetheless final 12 months it produced its first annual report taking a top-down view of the entire of 2022 — one thing it’s repeating now for 2023.

Tendencies

Knowledge is intently aligned with AI as a result of AI depends on knowledge for studying and making predictions, and this requires infrastructure to handle the gathering, storage, and processing of that knowledge. And these tangential tendencies collided on this report.

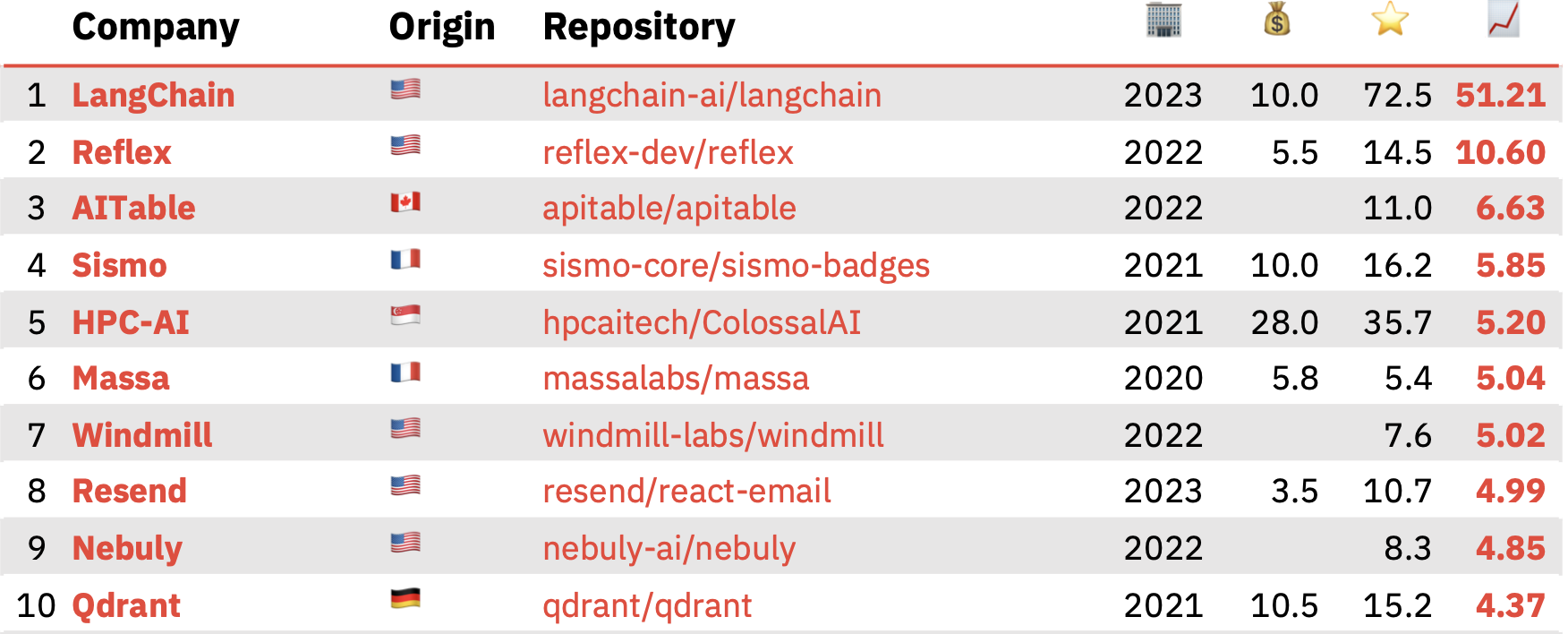

Hitting top-spot within the ROSS Index for final 12 months was LangChain, a two-year-old San Francisco-based startup that has developed an open supply framework for constructing apps primarily based on giant language fashions (LLMs). The corporate’s major venture handed 72,500 stars in 2023, with Sequoia happening to lead a $25 million Sequence A spherical into LangChain simply final month.

Prime 10 COSS startups within the ROSS Index for 2023 Picture Credit: Runa Capital

Elsewhere within the high 10 is Reflex, an open supply framework for creating net apps in pure Python, with the corporate behind the product just lately securing a $5 million seed funding; AITable, a spreadsheet-based AI chatbot builder and one thing akin to an open supply Airtable competitor; Sismo, a privacy-focused platform that enables customers to selectively disclose private knowledge to purposes; HPC-AI, which is constructing a distributed AI improvement and deployment platform in a push to grow to be one thing just like the OpenAI of Southeast Asia; and open supply vector database Qdrant, which just lately secured $28 million to capitalize on the burgeoning AI revolution.

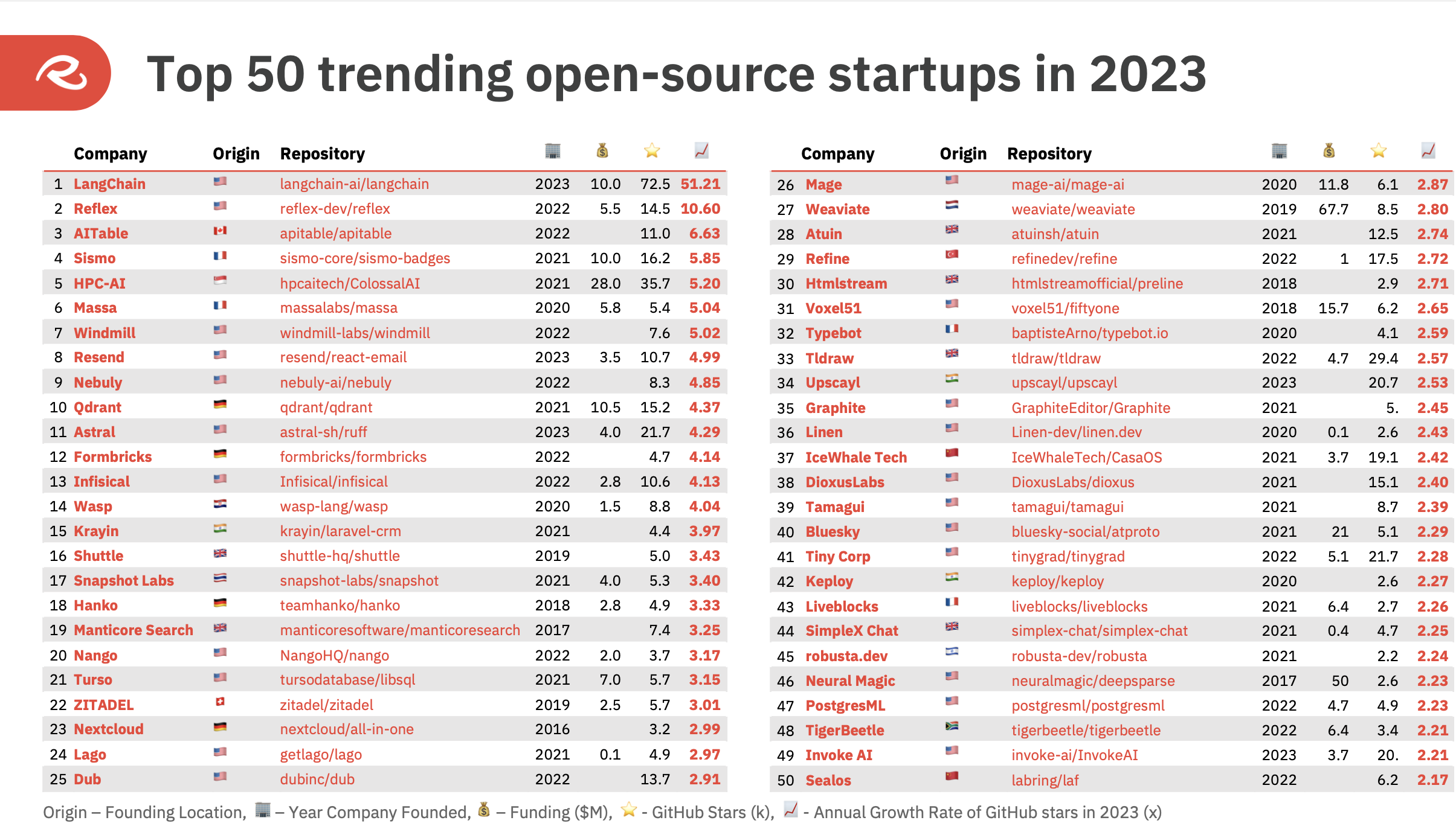

A broader take a look at the “high 50 trending” open supply startups final 12 months reveals that greater than half (26) are associated to AI and knowledge infrastructure.

Prime 50 COSS startups within the ROSS Index for 2023 Picture Credit: Runa Capital

It’s troublesome to correctly examine the 2023 index with the earlier 12 months from a vertical perspective, due largely to the truth that companies typically pivot or change their product-positioning to go well with what’s sizzling in the present day. With the ChatGPT hype practice going full throttle final 12 months, this will have led earlier-stage startups to change their focus, and even simply place higher emphasis on the prevailing “AI” component of their product.

However as generative AI’s breakthrough 12 months, it’s simple to see why demand for open-source componentry may skyrocket, as corporations of all sizes look to maintain apace with proprietary AI juggernauts similar to OpenAI, Microsoft, and Google.

Geographies

Open supply software program has additionally at all times been very distributed, with builders from all around the world contributing. This ethos typically interprets into business open supply startups which could not have a standard middle of gravity anchored by a brick-and-mortar HQ.

Nonetheless, the ROSS Index goes a way towards bringing geography into the image, reporting that 26 corporations on the record have an HQ within the U.S., although 10 of those corporations originated elsewhere and nonetheless have founders or workers primarily based in different locales.

In whole, the highest 50 hailed from 17 separate international locations, with 23 of the businesses integrated in Europe — a 20% rise on the earlier 12 months’s index. France counted probably the most COSS startups with seven, together with Sismo and Massa that are within the high 10, whereas the U.Okay. soared from only one startup in 2022 to 6 in 2023, putting it in second place from a European perspective.

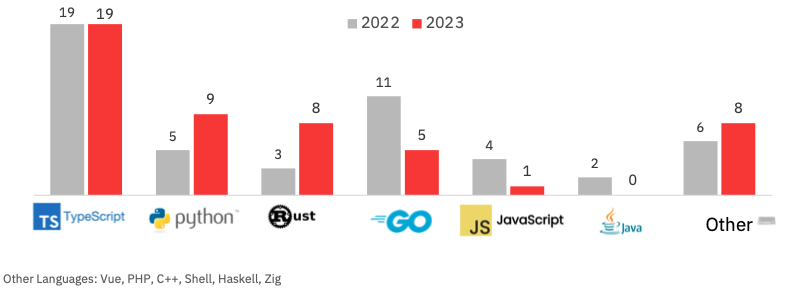

Different notable tidbits to emerge from the report embrace programming languages — the ROSS Index recorded 12 languages utilized by the highest 50 final 12 months, versus 10 in 2022. However Typescript, a JavaScript superset developed by Microsoft, remained the preferred, utilized by 38% of the highest 50 startups. Each Python and Rust grew in reputation, with Go and JavaScript dropping.

ROSS Index: Trending programming languages. Picture Credit: Runa Capital

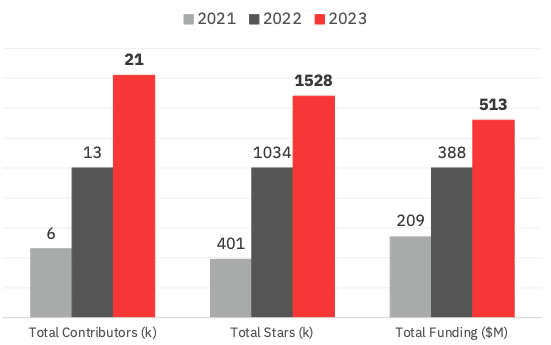

The highest 50 ROSS Index members collectively gained 12,000 contributors in 2023, whereas the general GitHub star-count elevated by practically 500,000. The index additionally reveals that funding into the highest 50 COSS startups final 12 months hit $513 million, a rise of 32% on 2022 and 145% on 2021.

ROSS Index: Contributors, stars, and funding Picture Credit: Runa Capital

Methodology & context

It’s price wanting on the methodology behind all this — what elements affect whether or not an organization is taken into account “high trending”? For starters, all corporations included will need to have no less than 1,000 GitHub stars (a GitHub metric much like a “like” in social media) to be thought-about. However star-count alone doesn’t inform us a lot about what’s trending, provided that stars are accrued over time — so a venture that has been on GitHub for 10 years is more likely to have accrued extra stars than one which has existed for 10 months. As an alternative, Runa measures the relative progress of the celebs over a given interval utilizing an annualised progress fee (AGR) — this seems on the star worth now versus a earlier corresponding interval to see what has grown most impressively.

A level of guide curation is concerned right here, too, provided that the purpose is to eke out open supply “startups” particularly — so the Runa funding crew pulls out tasks that belong to a “product-focused business group,” and it has to have been based fewer than ten years in the past with lower than $100 million in identified funding.

Defining what constitutes “open supply” has its personal inherent challenges too, as there’s a spectrum of how “open supply” a startup is — some are extra akin to “open core,” the place most of their main options are locked behind a premium paywall, and a few have licenses that are extra restrictive than others. So for this, the curators at Runa determined that the startup should merely have a product that’s “reasonably related to its open-source repositories,” which clearly entails a level of subjectivity when deciding which of them make the minimize.

There are additional nuances at play too. The ROSS Index adopts a very liberal interpretation of “open supply” — for instance, each Elastic and MongDB deserted their open supply roots for licenses which can be “supply obtainable,” to guard themselves from being taken benefit of by the most important cloud suppliers. In accordance with the ROSS Index’s methodology, each these corporations would qualify as “open supply” — though their licenses should not formally authorized as such by the Open Supply Initiative, and these particular instance corporations not discuss with themselves as “open supply.”

Thus, based on Runa’s methodology, it makes use of what it calls the “business notion of open-source” for its report, relatively than the precise license the corporate attaches to its venture. Which means restricted source-available licenses like BSL (enterprise supply license) and SSPL (server facet public license), which MongoDB launched as a part of its transition away from open supply in 2018, are very a lot on the menu so far as business corporations within the ROSS Index is anxious.

“Such licenses keep the OSS spirit — all its freedoms, aside from barely restricted redistribution, which doesn’t have an effect on builders however grants unique distributors a long-term aggressive edge,” Konstantin Vinogradov, Runa Capital’s London-based basic companion, defined to TechCrunch. “From a VC perspective, it’s simply an advanced playbook for precisely the identical sort of corporations. The open supply definition applies to software program merchandise, not corporations.”

There are different notable filters in place too. As an illustration, corporations which can be principally targeted on offering skilled providers, or side-projects with restricted energetic help or with no business component, should not included within the ROSS Index.

For comparative functions, there are different indexes and lists on the market that give a steer on the “whats sizzling” within the open supply panorama. One other VC agency known as Two Sigma Ventures maintains the Open Supply Index, as an example, which has similarities in idea to Runa’s, besides it spans all method of open supply tasks (not simply startups) and has further filters in place, together with the power to view by GitHub’s “watchers” metric, which some argue offers a extra correct image of a venture’s true reputation.

GitHub itself additionally publishes a trending repositories web page, which much like Two Sigma Ventures, doesn’t concentrate on the enterprise behind the venture.

So the ROSS Index has emerged as a helpful complementary software for determining which open supply “startups” particularly are price maintaining tabs on.