Would you want to observe the aggression between Patrons and Sellers, minute by minute? Now you possibly can! Welcome to the Aggression Monitor FX!

The Aggression Monitor FX indicator was developed for these markets that don’t present REAL information Quantity, i.e. like Forex.

We developed a means to make use of 1-minute Tick Quantity information generated by Foreign exchange (and different) Brokers and manipulate it into “aggression” data in a really visible histogram with extra evaluation strains. And it labored! (however hey! you do not have to consider us, you possibly can check our completely free demonstration model for your self into your charts – directions beneath).

And likewise, it’s NOT just for Foreign exchange, since this indicator additionally has the choice to change it to Actual Quantity, the place accessible!

However Does the Tick Quantity is As Good As Actual Quantity?

In keeping with Caspar Marney – a veteran Foreign exchange Dealer, you possibly can verify his profile on Linkedin – carried out a examine printed on the FX Dealer Journal, April-June 2011, with the title of “Are value updates a great proxy for precise traded quantity in FX?“, and he discovered that the correlation between the 2 is within the vary of 90% or extra!

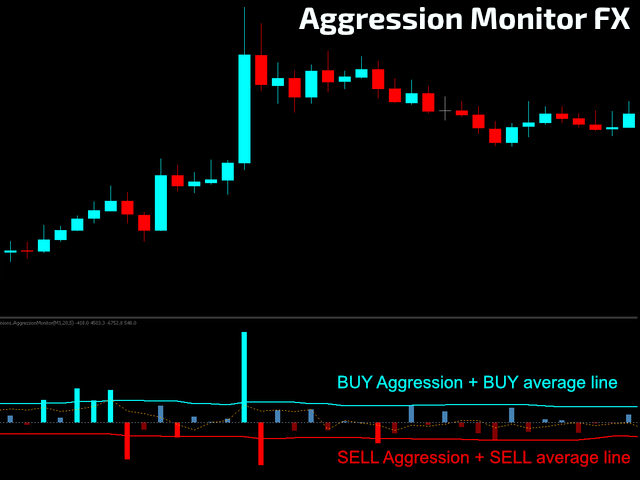

HOW TO “READ” THIS INDICATOR

- Utilizing classical Technical Evaluation you already know, you possibly can affirm a number of patterns and confluences with the Aggression Monitor FX.

- Wyckoff followers will take pleasure in this extra Quantity data.

- Scalpers can use this indicator to search out exhaustion and continuation factors (M5 timeframes and above).

- It is a non-lagging indicator (nicely, it’s a little bit since it’s paced on the 1-minute frequency) you should use to help and make sure all of your technique selections.

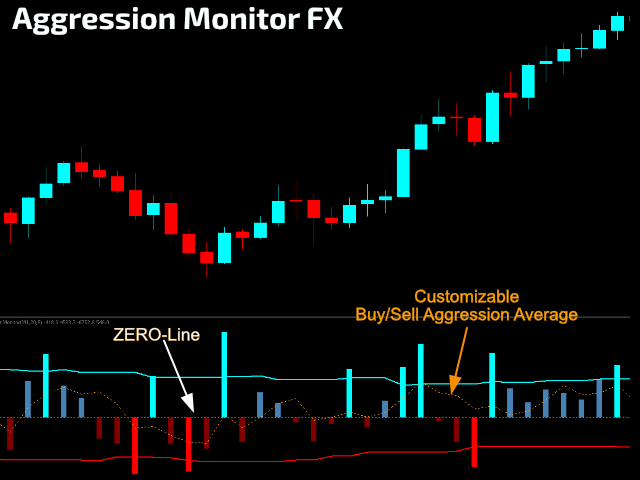

- There are 2 remoted common strains: one for the BUY stress and one other for the SELL stress. When the aggression quantity surpasses the common, the histogram will gentle up.

- There’s additionally a 3rd common line that represents the BUY/SELL stress Delta, which you should use as a thermometer of Quantity Path. You need to use it as a reference of energy when it’s Above/Under the indicator Zero-Line. You possibly can shorten or broaden its interval of study to seize information on your ENTRY/EXIT methods.

- It may very well be additionally very helpful for creating Cease Loss methods.

SETTINGS

- Quantity Sort To Use – Actual Quantity or Tick Quantity

- Interval for use for Scanning Quantity Information – Select your required timeframe accordingly, ALWAYS Lower than the present Timeframe getting used. The smaller the Timeframe, the better the granularity of the amount Information.

- Interval for Every Aggression Common (BUY & SELL) – Transferring common will likely be utilized on the BUY and on the SELL aspect on the Quantity histogram.

- Interval for the Common Between the BUY/SELL Delta Quantity – Select the interval for the Delta evaluation.

- Cover Indicator Title on the Sub-Window?

- Present Success/Fail suggestions messages within the Log Window (EXPERTS tab)