The S&P 500 (SPY) continues to impress on this current bull run. But the extent of 5,000 is almost 50% above the bear market lows and lots of worth buyers are saying that shares are getting costly. So will shares race above 5,000 or will this degree show to be a protracted crimson mild? 43 12 months funding veteran Steve Reitmeister shares his views within the commentary under together with a preview of this prime 12 shares to purchase right now.

There is no such thing as a shock that the market is flirting with 5,000 for the S&P 500 (SPY). Simply too enticing of a degree to not attain right now.

The issue is that it is a very hole rally like we noticed for almost all of 2023 the place nearly all of the beneficial properties have been accruing to the Magnificent 7 mega cap tech shares.

Sadly, the overwhelming majority of shares are literally within the crimson which may greatest appreciated by the loss for the Russell 2000 index within the new 12 months.

Let’s talk about what this implies for the market outlook and the way we nonetheless chart a course to outperformance within the days and weeks forward.

Market Commentary

Thursday provided the primary try for shares to interrupt above 5,000. Actually, the index bought to 4,999.89 late within the session earlier than resistance kicked in.

Friday was a lot the identical floating slightly below that 5,000 degree. Taking little photographs right here or there. But on the shut it fell quick as soon as once more.

In the long term shares will climb properly above 5,000 as most bull markets final over 5 years and we’re nonetheless on the very early levels of this bullish section. That isn’t the present contemplation. Quite it’s about how lengthy it should take to breakout above 5,000?

I explored this idea in my earlier article: Are Shares Caught til Summer season?

The reply to the above query is YES…I feel that 5,000 will show to be a stable lid on inventory costs till the Fed begins reducing charges.

No…I’m not calling for a correction like some commentators. Maybe a 3-5% pullback ensues then we play in a variety of 4,800 to five,000 till we get a inexperienced mild from the Consumed decrease charges. That is what would give buyers a superb motive to step on the fuel pedal attaining new highs above 5,000.

Proper now, I sense we’ll simply be idling at a crimson mild. Altering the radio station. Sneaking a fast peek at our telephones. Watching individuals in different vehicles. And so on.

However as soon as the Fed lowers charges it means extra charge cuts are to observe which will increase financial progress > earnings progress > inventory costs. On prime of that decrease bond charges makes shares the extra enticing funding by comparability.

This chain of occasions is the clear inexperienced mild for shares to race forward. Till then I feel that many can be fearful about how lengthy the Fed will sit on their arms. Many are already stunned they’ve waited this lengthy.

Then once more, if you take a look at the Fed’s long run monitor document the place 12 of 15 charge hike regimes have resulted in recession, then you definitely begin to admire that these guys typically overstay their welcome with charge hikes.

Let’s not overlook that there are additionally 6-12 months of lagged results on their insurance policies so even when the economic system appears OK on the time that charges are minimize it’s nonetheless potential for a recession to kind.

That isn’t my base case right now. I do sense that this Fed has a greater appreciation of historical past and is managing the twin mandate of average inflation and full employment fairly properly. That means that I think a delicate touchdown is the probably end result, adopted by acceleration of the economic system…company earnings…and sure, share costs.

The purpose is that the Fed insurance policies are on the middle of funding equation right now. And the important thing to understanding what the Fed will do is keeping track of financial developments. Specifically, inflation and employment metrics.

Proper now, employment is sort of wholesome…possibly too wholesome for the Fed’s liking. Not simply the surprisingly excessive 353,000 jobs added final month, but in addition the eerily excessive wage inflation readings that spiked as much as 4.5% 12 months over 12 months.

Little doubt the Fed shouldn’t be keen on this sticky type of wage inflation and want to see extra easing of that stress earlier than they begin reducing charges. The subsequent studying of wage inflation can be on Friday March 7th.

Earlier than that point, we’ll get the following spherical of CPI (2/13) and PPI (2/16) inflation readings. These have been transferring in the fitting path for a while. Actually, PPI is the main indicator for the extra broadly adopted CPI, was all the way in which right down to 1% inflation charge finally months studying.

For nearly as good as that’s, the Fed shouldn’t be as keen on CPI and PPI as merchants are. They like readings from the PCE inflation studying which does not come out til 2/29.

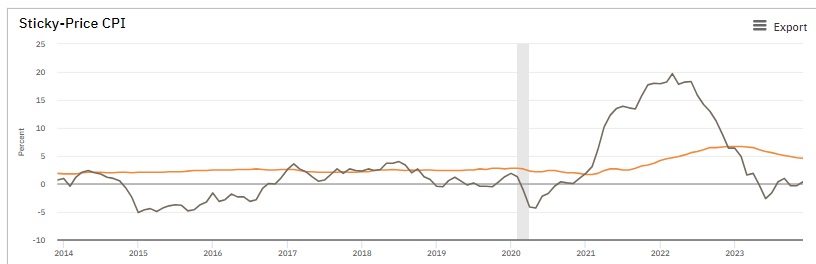

However actually they’ve much more subtle methods of studying inflation which may higher be appreciated by the Sticky-Value CPI monitoring accomplished by the Atlanta Fed.

Because the chart under exhibits, Sticky Inflation (orange line hovering round 5%) is, properly, too darn sticky right now. That means that lecturers and economists on the Fed are doubtless involved that inflation remains to be too persistent and that extra endurance is required earlier than reducing charges.

To sum it up, I think that 5,000 will show to be some extent of stiff resistance for some time. This could result in an prolonged buying and selling vary interval with buyers awaiting the inexperienced mild from the Fed to begin reducing charges.

Sure, it’s all the time potential for shares to race forward with out this clear go forward by the Fed. That’s the reason its sensible to remain in a bullish posture to benefit from the beneficial properties at any time when they unfold.

I’m saying to only not be that stunned if we do not proceed to rise given 3 straight months of very bullish circumstances coupled with dealing with an apparent place of stiff psychological resistance at 5,000.

At this stage the Magnificent 7 have had their enjoyable. I would not be stunned if some earnings are taken there and shifted to smaller shares. What you would possibly name a sector rotation or change in management. There was some good indicators of that beginning to be the case on Thursday because the Russell 2000 rose +1.5% on the session whereas the big cap targeted S&P 500 hovered round breakeven.

Additionally, I think there can be a better eye in direction of worth as many market watchers are declaring that earnings progress is muted and thus at this degree the general market is fairly totally valued. That’s very true for the Magnificent 7 that no worth investor might abdomen their exorbitant multiples.

This too requires a rotation to new shares which can be extra deserving of upper costs. It’s exactly these sorts of “beneath the radar” progress shares buying and selling at affordable costs that I cherish.

To find which of them I’m recommending in my portfolio now, then learn on under…

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Scores mannequin. (Almost 4X higher than the S&P 500 going again to 1999)

This contains 5 beneath the radar small caps just lately added with large upside potential.

Plus I’ve 1 particular ETF that’s extremely properly positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and all the things between.

If you’re curious to be taught extra, and need to see these fortunate 13 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares rose $1.33 (+0.27%) in premarket buying and selling Friday. Yr-to-date, SPY has gained 5.12%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Steve Reitmeister

Steve is best identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit 5,000 Inexperienced or Crimson Gentle for Shares??? appeared first on StockNews.com