Most nations’ private earnings taxes have a progressive taxA progressive tax is one the place the typical tax burden will increase with earnings. Excessive-income households pay a disproportionate share of the tax burden, whereas low- and middle-income taxpayers shoulder a comparatively small tax burden.

construction, that means that the taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities providers, items, and actions.

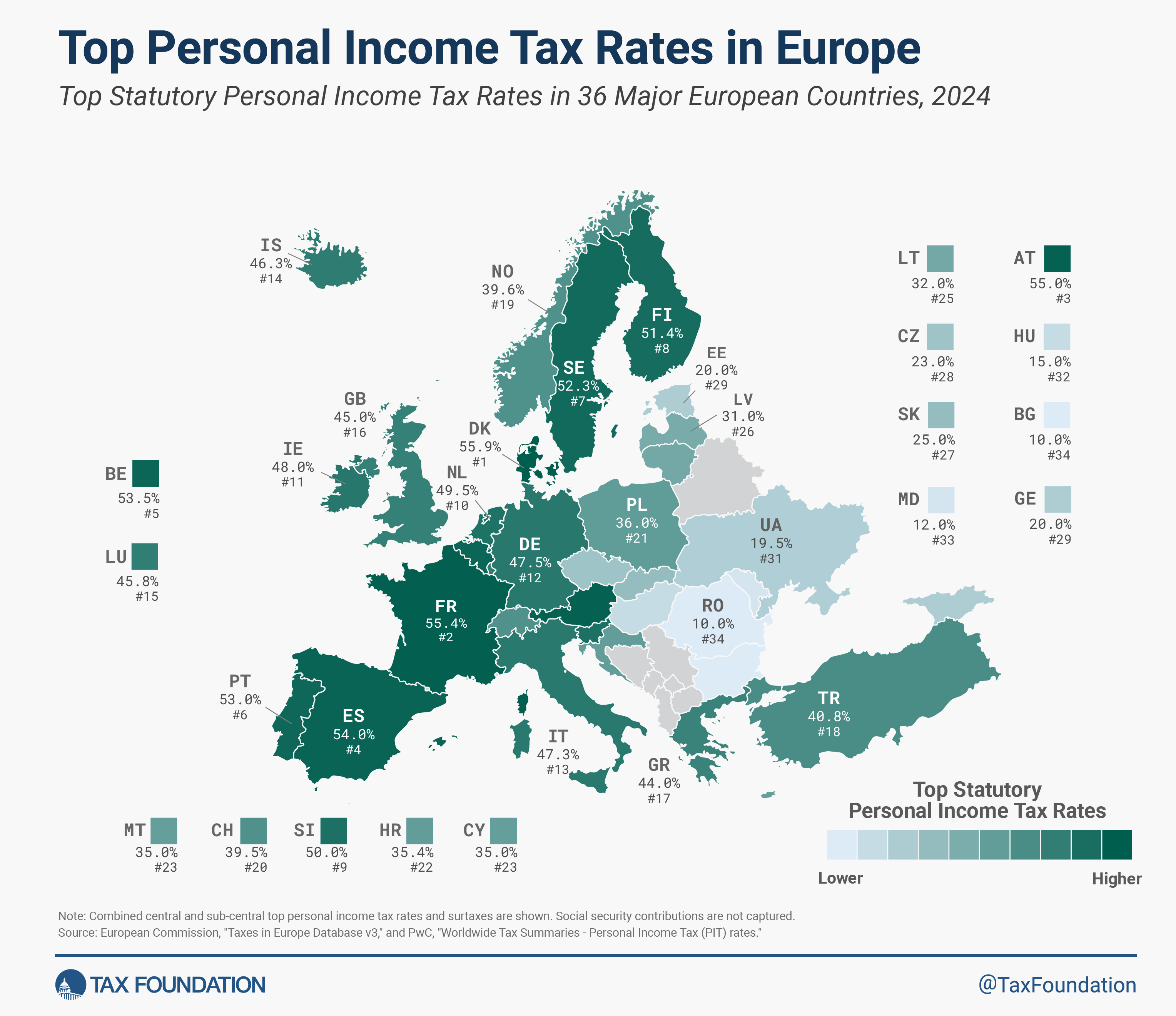

charge paid by people will increase as they earn increased wages. The best tax charge people pay differs considerably throughout European nations.

The highest statutory private earnings tax charge applies to the share of earnings that falls into the very best tax bracketA tax bracket is the vary of incomes taxed at given charges, which generally differ relying on submitting standing. In a progressive particular person or company earnings tax system, charges rise as earnings will increase. There are seven federal particular person earnings tax brackets; the federal company earnings tax system is flat.

. As an illustration, if a rustic has 5 tax brackets, and the highest earnings tax charge of fifty p.c has a threshold of €1 million, every further euro of earnings over €1 million can be taxed at 50 p.c.

Typically, governments can generate income extra effectively by leveraging marginal tax charges on the decrease finish of the earnings distribution than through the use of increased high charges. Larger high charges incentivize individuals over that earnings threshold to earn much less, whereas leaving the income raised from everybody else unchanged. By elevating the speed of a decrease bracket, nonetheless, income is raised from taxpayers in increased brackets with out incentivizing them to scale back their earnings (solely the incomes incentives of people in that decrease bracket are affected).

Amongst European OECD nations, the typical statutory high private earnings tax charge lies at 42.8 p.c in 2024. Denmark (55.9 p.c), France (55.4 p.c), and Austria (55 p.c) have the very best high charges. Hungary (15 p.c), Estonia (20 p.c), and the Czech Republic (23 p.c) have the bottom high charges.

European nations that aren’t a part of the OECD are inclined to function decrease charges and tax private earnings at a single charge. Bulgaria and Romania (10 p.c) levy the bottom charge, adopted by Moldova (12 p.c), Ukraine (19.5 p.c), and Georgia (20 p.c).

For comparability, the typical mixed state and federal high earnings tax charge for the 50 U.S. states and the District of Columbia is 42.32 p.c as of January 2024, with charges starting from 37 p.c in states with no state earnings tax to 50.3 p.c in California.

Some nations in Europe are contemplating altering their high private earnings tax charges within the subsequent few years. Austria is planning to get rid of its highest tax bracket in 2026, lowering its high earnings tax charge from 55 p.c to 50 p.c. Estonia is about to improve its flat earnings tax charge from 20 to 22 p.c in 2025.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Share