KEY

TAKEAWAYS

- Vitality sector displaying relative energy in three timeframes

- The sector is nearing a heavy resistance space

- A protracted-term turnaround in relative energy seems to be underway

Vitality Bettering in Three Time Frames

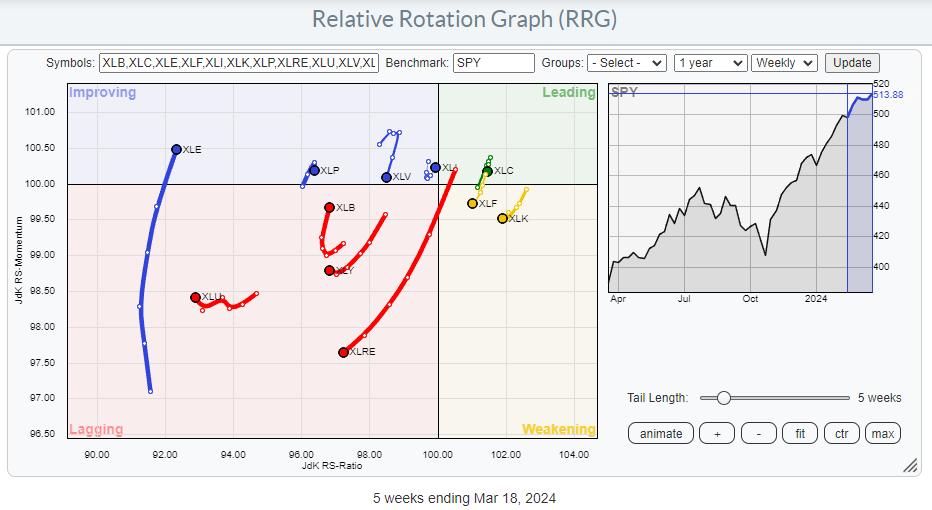

Watching the sector rotation initially of this week reveals a continued enchancment for the Vitality sector (XLE). Though XLE has the bottom studying on the JdK RS-Ratio scale, it has a protracted tail, and has simply entered the enhancing quadrant.

This may occur after a really lengthy rotation and at very low RS-Ratio ranges, however, once I mix this rotation with the XLE tails on the day by day and month-to-month RRGs, it turns into attention-grabbing.

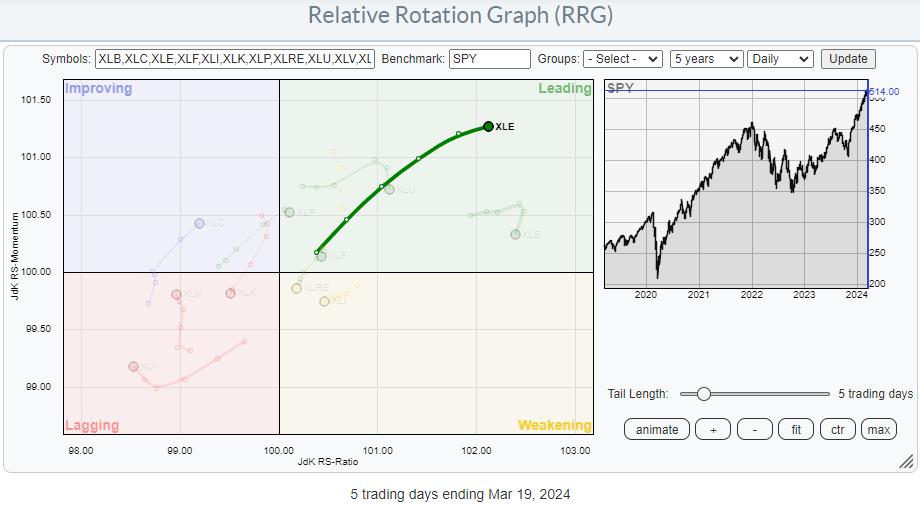

On the day by day RRG, you possibly can see the tail is effectively contained in the main quadrant and nonetheless pushing greater on robust momentum. The RRG-Heading has slowed barely, however remains to be inside 0-90 levels.

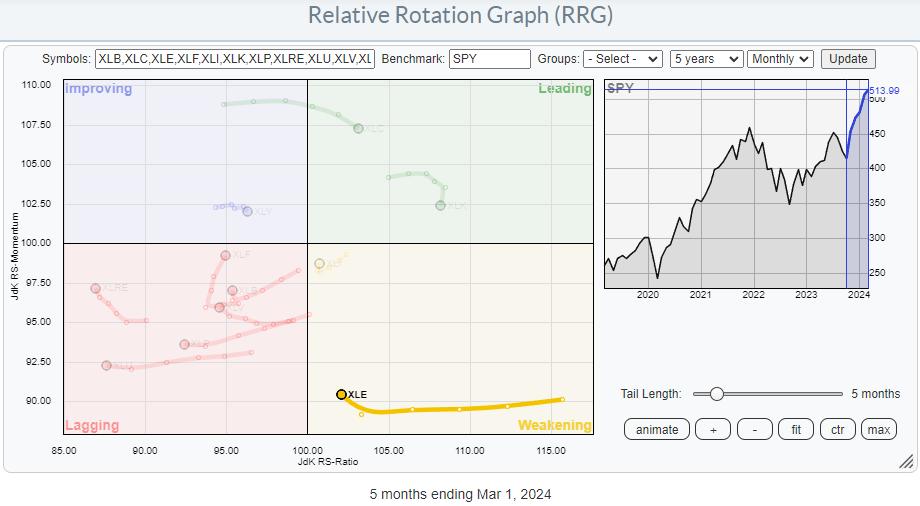

On the month-to-month RRG, the XLE tail remains to be contained in the weakening quadrant and is beginning to hook again up. That is attention-grabbing, because it alerts the potential begin of a brand new up-leg within the already present relative uptrend.

All in all, this implies we now have optimistic developments for the vitality sector in all three timeframes.

Getting Near Main Overhead Resistance Space

And the development is just not solely relative. On the worth chart, XLE is now transferring in the direction of overhead resistance supplied by 4 main highs since 2022, which have been all set just under 95.

Watch out; with the massive rallies which have taken place in main markets and sectors, it’s straightforward to assume that breaking that 95 barrier in XLE would imply a break to new all-time-highs. Nevertheless, that’s NOT the case for the vitality sector, as you possibly can see on the month-to-month chart beneath.

The 95 space is undeniably an vital resistance stage and, as soon as damaged, would definitely gas (pun supposed) an additional rally in the direction of the all-time-high stage for XLE, which is at 101.52 in June 2014. That is nearly ten years in the past!

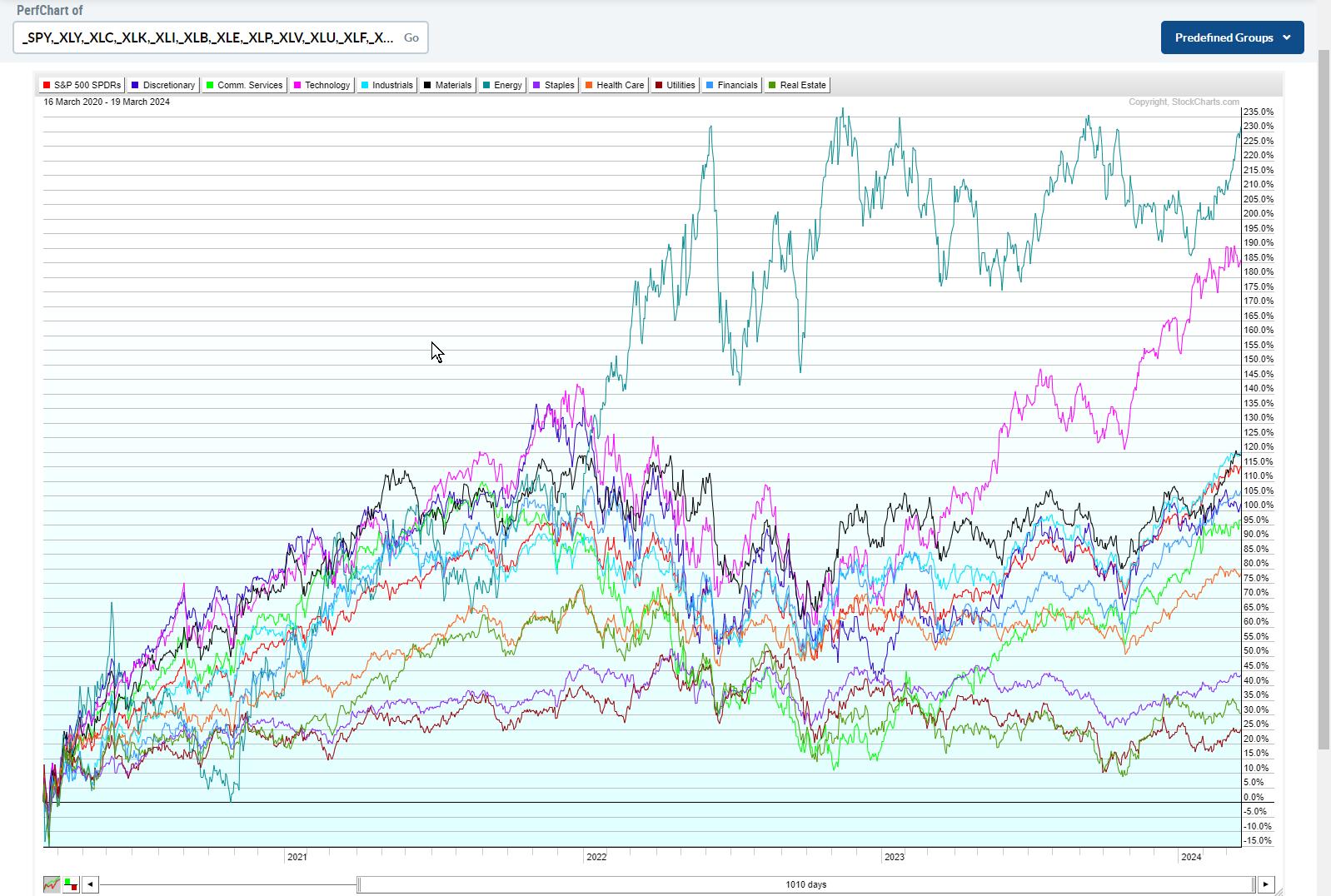

What can also be attention-grabbing to see is that XLE examined help coming from lows relationship again so far as 1999 and 2002 round 20, solely 4 years in the past in 2020. Out of that low, a 475% rally emerged, taking XLE from 26 to 95 — greater than every other sector in the identical time interval.

This PerfChart reveals the efficiency for all sectors because the March 2020 low. The teal line on the prime is XLE. Solely XLK in purple comes near the efficiency of XLE, and solely due to the rally that began in October 2022.

Lengthy-Time period Turnaround within the Making

It’s this big outperformance that has saved the XLE tail on the month-to-month RRG on the fitting hand facet of the graph for therefore lengthy, and the current relative enchancment is inflicting this month-to-month tail to begin curling up once more.

As , the standard message in case of a hook again up contained in the weakening quadrant is for beginning a brand new up-leg inside an already rising relative development. Wanting on the month-to-month chart of XLE together with the RRG-Strains and uncooked RS above, that’s precisely what appears to be occurring. And it’s occurring after an preliminary rally that ended a relative downtrend of XLE that began again in 2008.

When the uncooked RS worth of Vitality vs. SPY climbs above 0.25, an acceleration in relative energy and a a lot additional rally in favor of Vitality is probably going.

–Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to each message, however I’ll definitely learn them and, the place moderately attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Be taught Extra