The Taxing Wealth Report 2024 is revealed in its ultimate, full type, this morning. It seeks to reply the query that each journalist likes to ask of each politician, which is ‘how are you going to pay for it?’, no matter ‘it’ could be.

What we all know is that each one our main political events, and Labour most particularly, are appearing as in the event that they nonetheless consider Liam Byrne’s declare, made in 2010, that ‘there isn’t any cash left’.

The Taxing Wealth Report reveals that by making as much as thirty comparatively easy adjustments to present UK taxes, as much as £90 billion of latest tax income might be raised a 12 months, totally from those that are nicely off or who’re straightforwardly rich. Solely these within the high 10% of revenue earners needs to be affected.

A abstract of the proposals made within the report is obtainable right here.

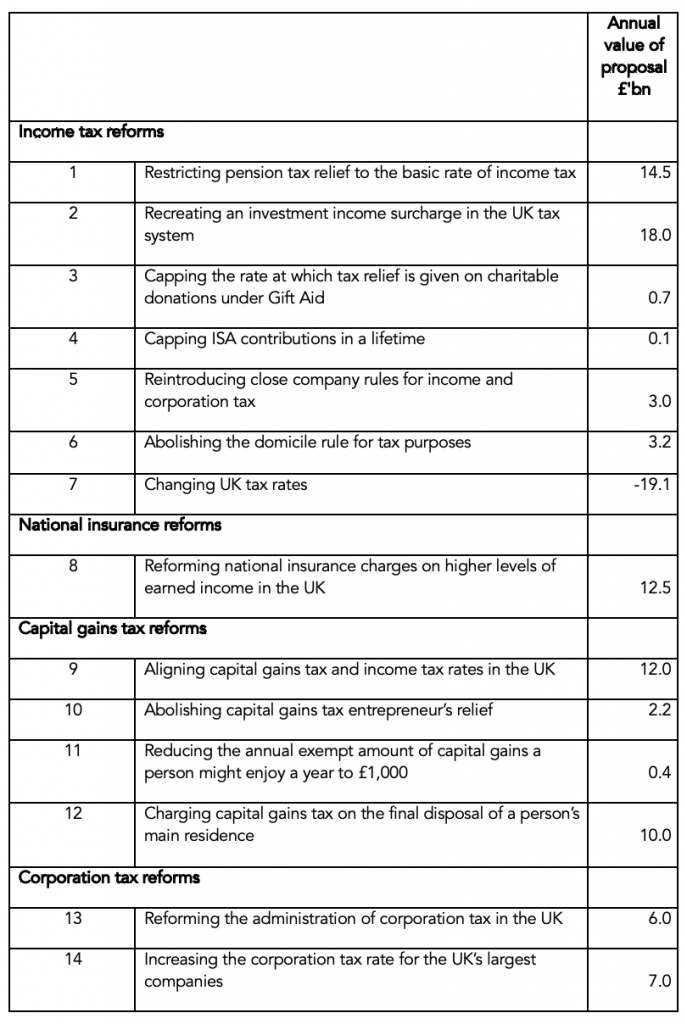

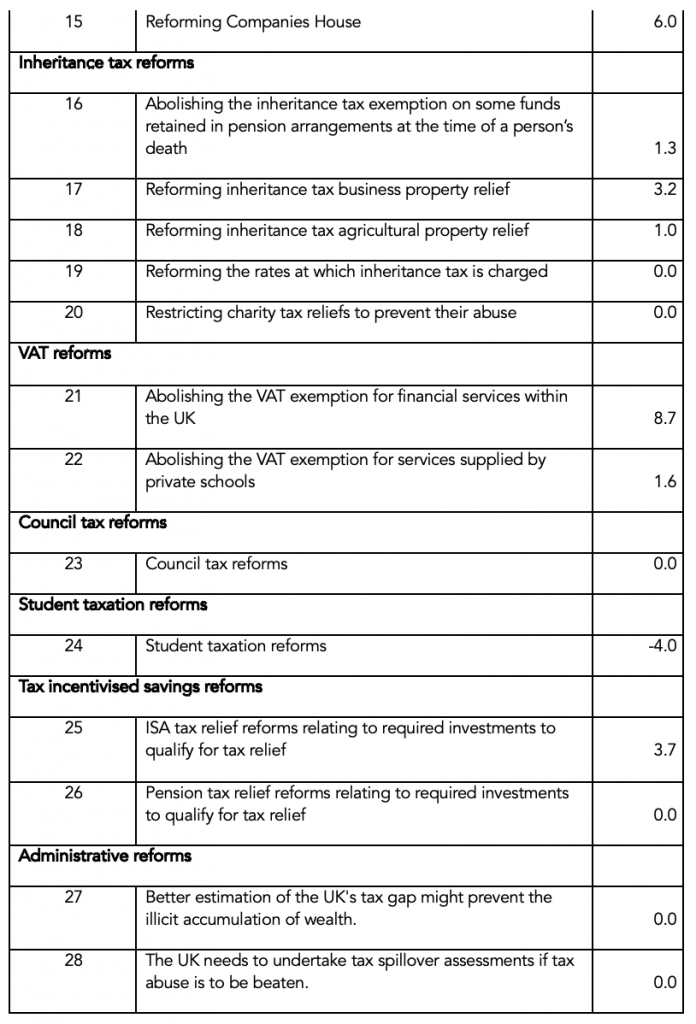

A few of the strategies made, and the quantities that they may increase in further tax, are as follows:

1) Charging capital positive aspects to tax on the similar charge as revenue tax would increase £12 billion of additional tax each year.

2) Limiting the speed of tax reduction on pensions to the essential charge of revenue tax, no matter tax charge an individual pays, would increase £14.5 billion of additional tax each year.

3) Charging VAT on the availability of monetary companies, that are inevitably consumed by one of the best off, may increase £8.7 bn of additional tax each year.

4) Charging an funding revenue surcharge of 15% on revenue earned from curiosity, dividends, rents, and different sources would possibly increase £18 bn of additional tax each year. Decrease charges may, in fact, be charged. This estimate assumes no such cost on the primary £5,000 of such revenue a 12 months, with a better allowance for pensioners.

5) Charging nationwide insurance coverage on the similar charge on all earned revenue, no matter its quantity above the prevailing minimal, would possibly increase as much as £12.5 bn of additional tax each year.

6) Investing £1 billion in HMRC in order that it’d accumulate all tax owing by the UK’s 5 million or so corporations when 30% of that sum goes unpaid at current would possibly increase £12 billion each year.

As well as, the report means that if the tax incentives for saving in ISAs and pensions have been modified so that each one new ISA funds and 25% of all new pension contributions have been required to be saved in ways in which would possibly assist fund new infrastructure tasks within the UK, together with these linked to local weather change, then as much as £100 billion of funds could be made accessible for that objective a 12 months.

The good concern amongst many individuals within the UK at current is that Labour would possibly type a brand new authorities this 12 months however is not going to change something due to their dedication to harsh fiscal guidelines that seem to vow extra austerity. The Taxing Wealth Report 2024 reveals that this austerity shouldn’t be needed. The prevailing tax system solely must be made a bit fairer and the funding required to rework our society could be accessible.

Obtain the report

The report is obtainable in three lengths (click on to obtain the model you need):

Hyperlinks

Why wealth is severely undertaxed within the UK

The Taxing Wealth Report weblog

Abstract of the proposals

The tax and financial savings impacts of the suggestions made within the Taxing Wealth Report 2024 are as follows: