Observe to the reader: That is the fourth in a sequence of articles I am publishing right here taken from my guide, “Investing with the Development.” Hopefully, you’ll discover this content material helpful. Market myths are typically perpetuated by repetition, deceptive symbolic connections, and the entire ignorance of info. The world of finance is stuffed with such tendencies, and right here, you will see some examples. Please remember that not all of those examples are completely deceptive — they’re typically legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are straight associated to investing and finance. Get pleasure from! – Greg

Threat and Uncertainty

Is volatility threat? (Right here we go once more.)

Within the sterile laboratory of contemporary finance, threat is outlined by volatility as measured by commonplace deviation. Nevertheless, that assumes the vary of outcomes is a standard distribution (bell curve). Hardly ever do the markets yield to regular.

When an investor opens his or her brokerage assertion, it reveals the next portfolio knowledge for the final 12 months:

- Normal Deviation = .65

- Loss for the 12 months =.35 %

Which one do you suppose will catch their consideration? I significantly doubt any investor goes to name his or her advisor and complain about a typical deviation of .65. Nevertheless, the .35 % loss will get their consideration. Even buyers who don’t have any data of finance or investments know what threat is—it’s the lack of capital.

Threat will not be volatility; it’s drawdown (lack of capital). Nevertheless, within the brief time period, volatility is an effective proxy for threat, however over the long term, drawdown is a significantly better measure of threat. Volatility does contribute to threat, however it additionally contributes to market good points.

Threat and uncertainty are not the identical factor.

Threat could be measured. Uncertainty can’t be measured.

A jar incorporates 5 crimson balls and 5 blue balls. Within the previous days we known as it an urn as a substitute of a jar. Blindly pick a ball. What are the percentages of selecting a crimson ball? There are 5 crimson balls and the entire variety of balls is 10. Due to this fact the percentages of selecting a crimson ball are 5/10 =.5 or 50 %.

That’s Threat! It may be calculated.

Suppose you weren’t advised the variety of crimson or blue balls within the jar. What are the percentages of selecting a crimson ball? That’s Uncertainty!

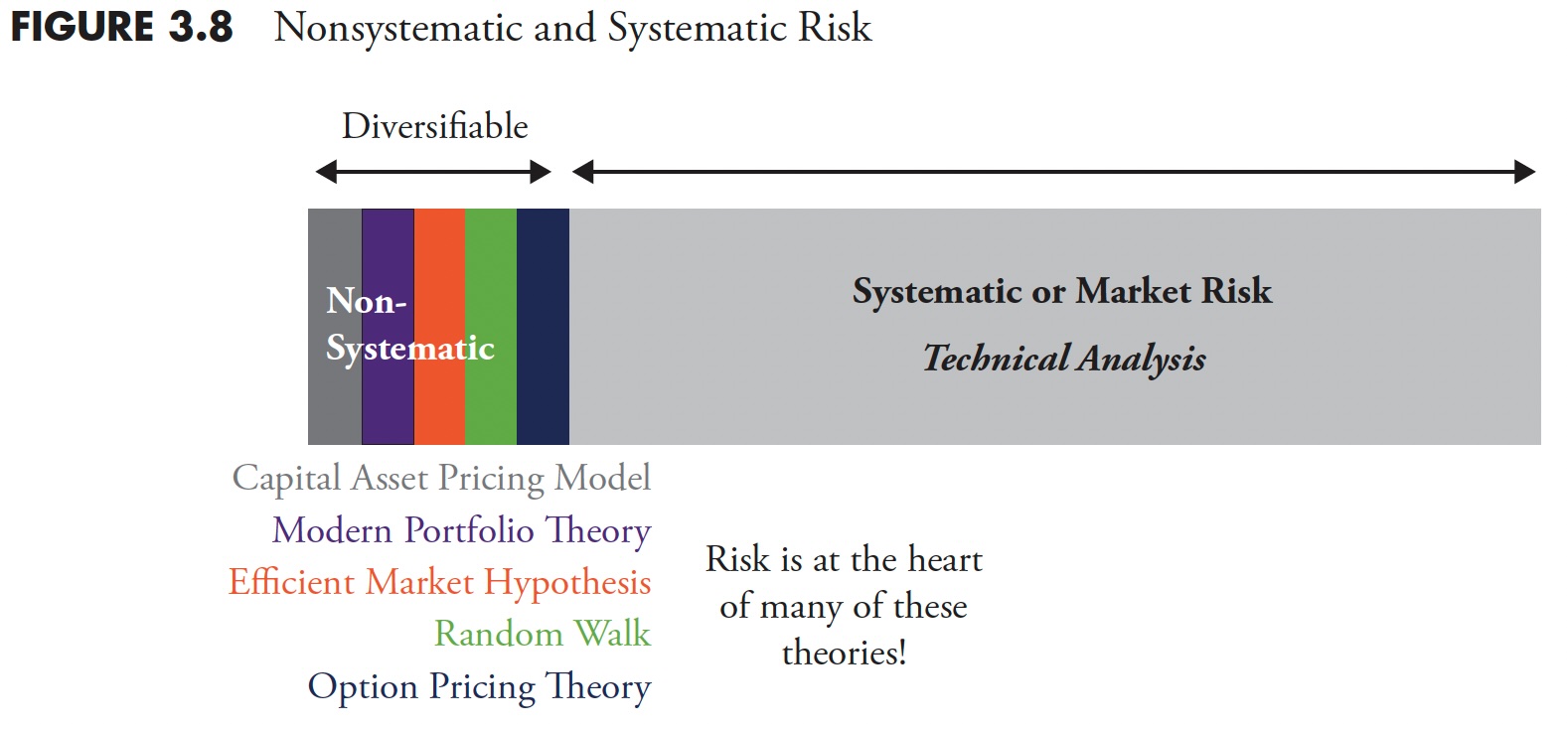

Determine 3.8

Determine 3.8

Determine 3.8 is an try to visualise how fashionable finance is targeted on threat, however have you ever ever puzzled or considered which aspect of threat they take care of? Truly they do an important job of analyzing threat; threat is on the coronary heart of all of the theories of Fashionable Portfolio Concept (Capital Asset Pricing Mannequin, Environment friendly Market Speculation, Random Stroll, Choice Pricing Concept, and so on.). The danger that they try to discourage.mine is named nonsystematic threat, or you might have heard it as diversifiable threat. Diversification is a free lunch and may by no means be ignored. The world of fi nance is targeted on diversifiable or nonsystematic threat. Nevertheless, there’s a a lot bigger piece of the danger pie, and that’s known as systematic threat. Upon getting adequately diversified, then it appears that you’re solely coping with systematic threat. Systematic threat is what technical evaluation makes an attempt to take care of. It’s also generally known as drawdown, lack of capital, and in sure conditions as a bear market.

Again to the Unique Query: Is Volatility Threat?

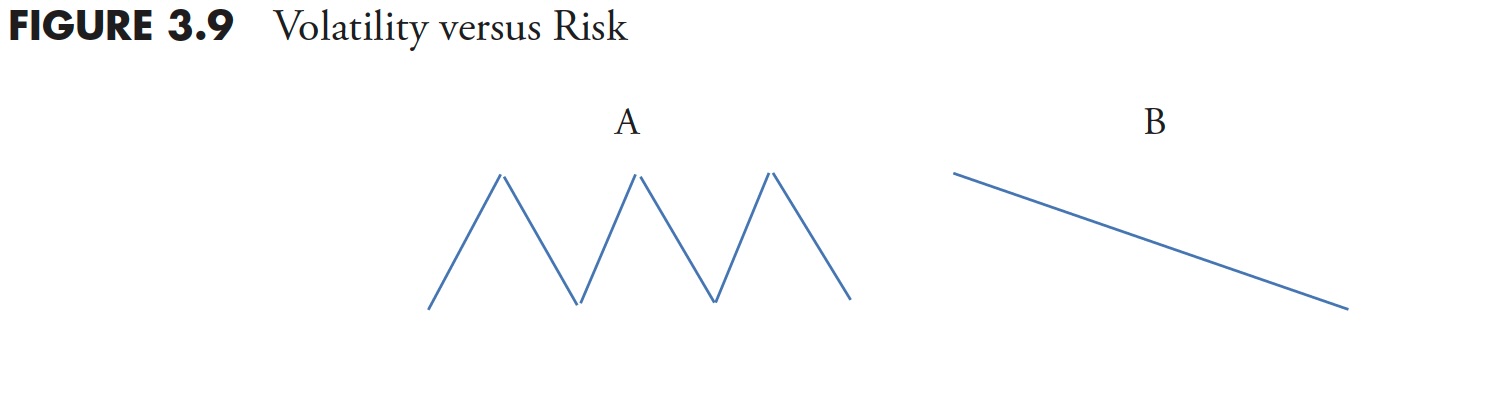

Two easy worth actions are proven in Determine 3.9 ; which represents extra threat, instance A or instance B?

Determine 3.9

Determine 3.9

Fashionable finance would have you ever imagine that A is riskier due to its volatility. Nevertheless, you possibly can discover from this overly easy instance that the value ended up precisely the place it started; subsequently, you didn’t become profitable or lose cash. B, based mostly on the idea of volatility as threat, has no threat in accordance with idea; nevertheless, you misplaced cash within the course of. I feel it’s apparent which is threat and which is barely idea.

Is Linear Evaluation Good Sufficient?

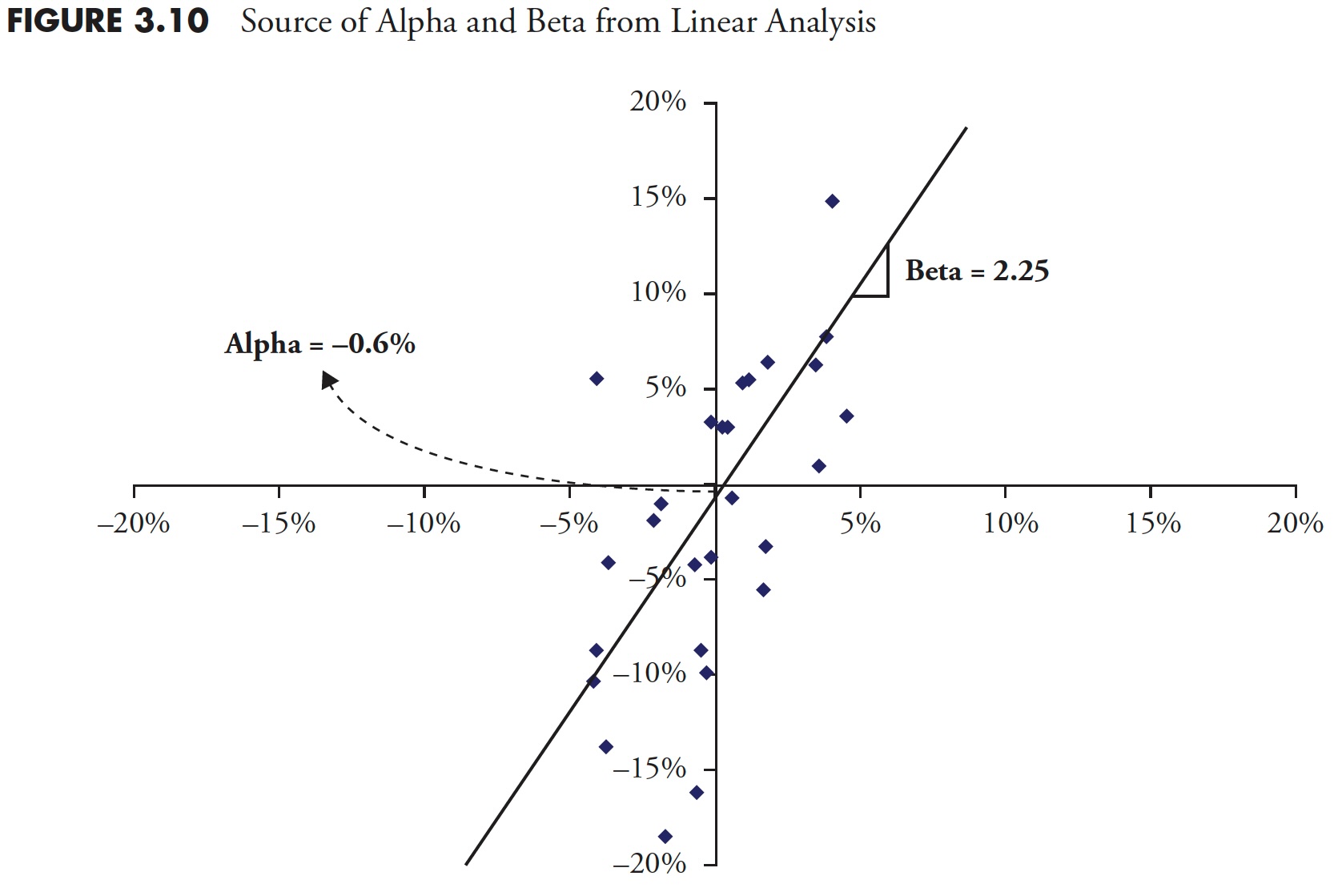

Determine 3.10 is named a Cartesian coordinate system, typically known as a scatter diagram, used typically to check two points and derive relationships between them. The returns of 1 are plotted on the X-axis (abscissa/horizontal) and the returns of the opposite are plotted utilizing the Y-axis (ordinate/vertical). These small diamonds are the information factors. An idea generally known as regression is then utilized by calculating a least-squares match of the information factors. That is the straight line that you just see under. Then, a bit of highschool geometry is used on the equation for a straight line, which is y=mx+b, the place m is the slope of the road and b is the the place the road crosses the Y axis (a.okay.a. the y–intercept). So upon getting the linearly fitted line, you possibly can measure the slope and y–intercept, and this will provide you with the beta (slope) and alpha (y-intercept).

Determine 3.10

Determine 3.10

The next statistical parts can all be derived from easy linear evaluation.

- Uncooked Beta

- Alpha

- R^2 (Coefficient of Dedication)

- R (Correlation)

- Normal Deviation of Error

- Normal Error of Alpha

- Normal Error of Beta

- t-Check

- Significance

- Final T-Worth

- Final P-Worth

Linear Regression Should Have Correlation

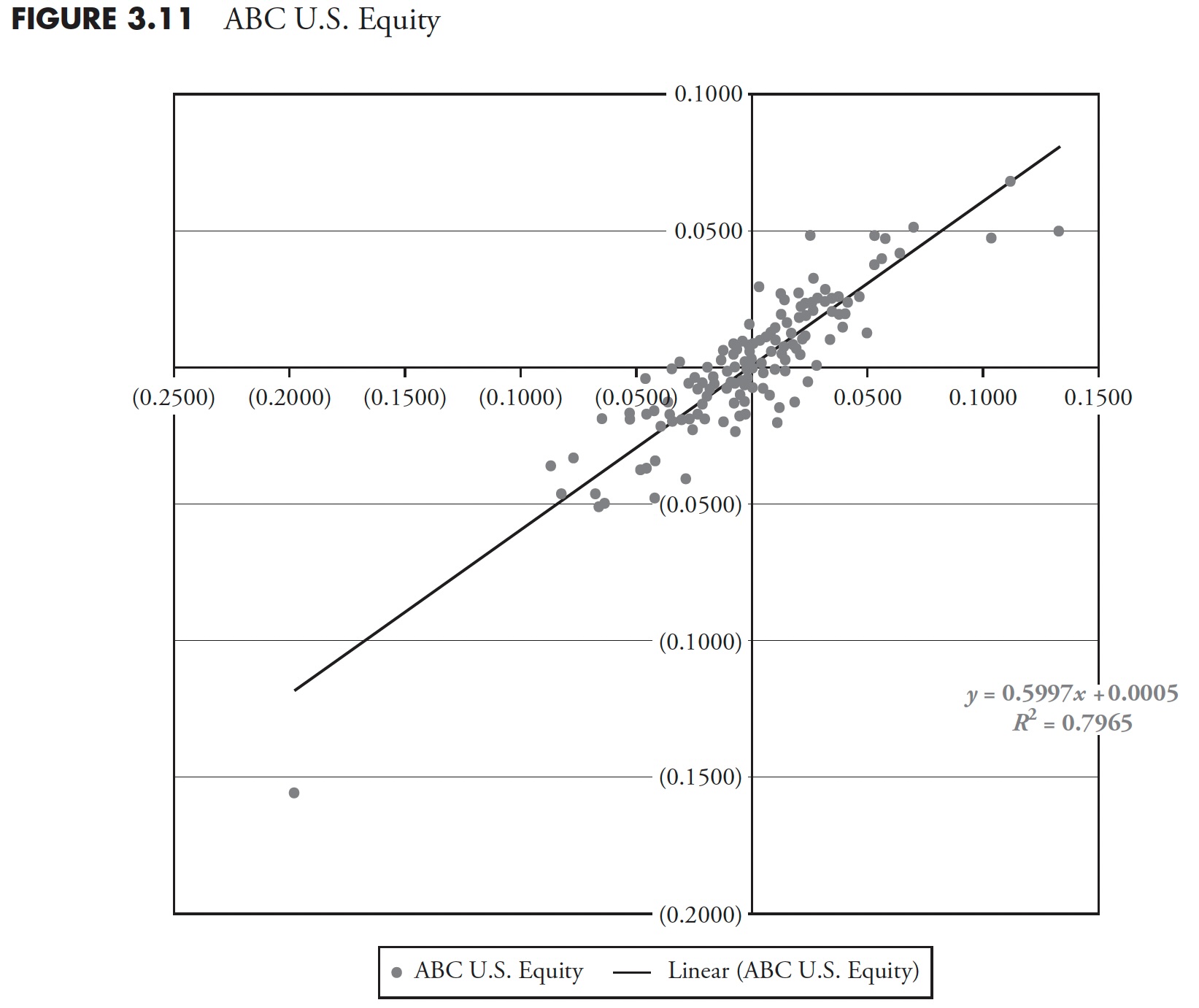

Determine 3.11 is a scatter plot of a fictional fund ABC (Y-axis) plotted in opposition to the S&P 500 (X-axis).

Determine 3.11

Determine 3.11

The least-squared regression line is plotted and the equation is proven as:

Y = 0.5997x + 0.0005, which implies the slope is .5997 and the y-intercept is 0.0005.

A slope of 1.0 would imply that the Beta of the fund was the identical in comparison with the index, and the road on the plot can be a quadrant bisector (if the plot have been a sq., the road can be transferring up and to the best at 45 levels). So, a slope of 0.5997 means the fund has a decrease beta than the index. The y-intercept is a constructive quantity, though barely, however which means the fund outperformed the index.

R^2 is the Coefficient of Dedication, also called the goodness of match. Now, I perceive that coping with constructive numbers has some benefits, however, normally, R^2 can also be lowering the quantity of data. Let me clarify. We all know that R is correlation, the statistical measure that reveals the connection between two datasets and the way intently they’re aligned. That’s not the textbook reply for correlation, however will suffice for now. Correlation ranges from +1 (completely correlated) to -1 (inversely correlated), with 0 being non-correlated. Good data to know; is the fund correlated to the market, inversely correlated to the market, or not correlated in any respect? Squaring correlation will provide you with an at all times constructive quantity (keep in mind least squares?), however why take away the details about the extent of correlation? R^2 won’t let you know whether it is correlated or inversely correlated. Truly, I feel it’s the social science’s concern of detrimental numbers. Nevertheless, in equity, R^2 will present the % dependency of 1 variable over the opposite—in idea.

The R^2 in Determine 3.11 is 0.7965, which implies there’s a honest diploma of correlation, we simply do not know whether it is constructive correlation or inverse correlation. To get correlation, merely take the sq. root of 0.7965 to get R=0.8924684 (sure, an try at humor), which implies R is also -0.8924684. Anyway, hopefully you get my level.

Lastly, discover how the information factors are all clustered pretty intently to the least squares line, which visually reveals you that this fund is pretty well-correlated to the index.

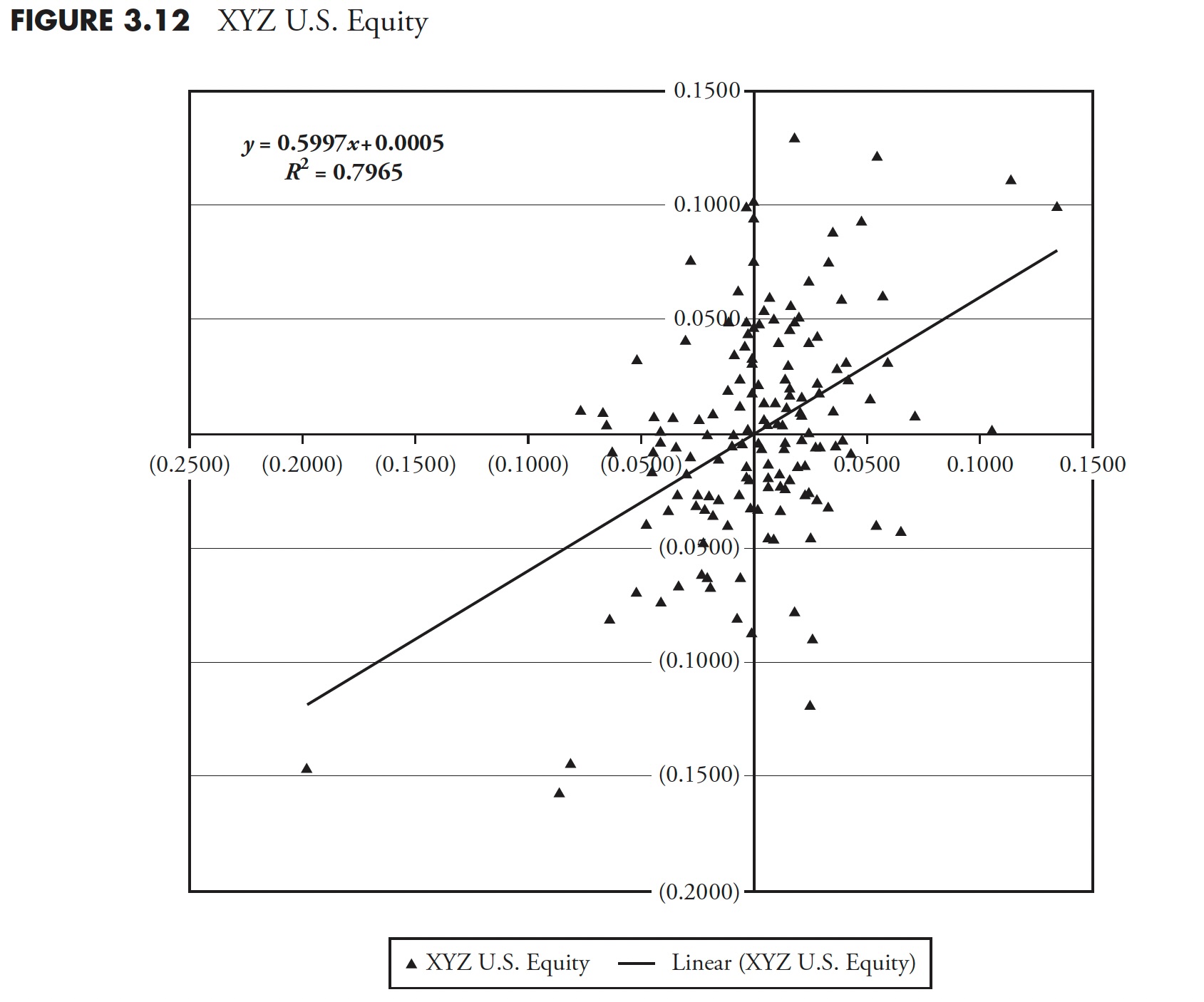

Determine 3.12 reveals fund XYZ plotted in opposition to an index. Discover that the linear least-squared match equation (y = 0.5997x + 0.0005) is strictly the identical because the earlier instance. Nevertheless the worth of R^2 is 0.2051, which is significantly totally different than the earlier instance. Visually, you possibly can see that the information factors are extra scattered than within the earlier instance, so, simply based mostly on the visible remark, you recognize this fund will not be practically as correlated because the earlier fund ABC. But we discover that the least squares regression line is oriented precisely the identical, so the values of alpha and beta are the identical for this fund (XYZ) as they have been for fund (ABC) above.

Determine 3.12

Determine 3.12

So what is the distinction, you’re hopefully asking? The distinction is that one fund will not be practically as correlated as the opposite. We all know that they’re each positively correlated from visible examination, however except the worth of R (correlation) is proven, we do not know any extra concerning the correlation. This is among the horrible shortcomings of this sort of evaluation. Right here is the message: if it is not correlated, then the values derived for alpha and beta are completely meaningless. But I see publications rating funds and exhibiting R^2, alpha, and beta, however by no means a point out of R. Disgrace on them!

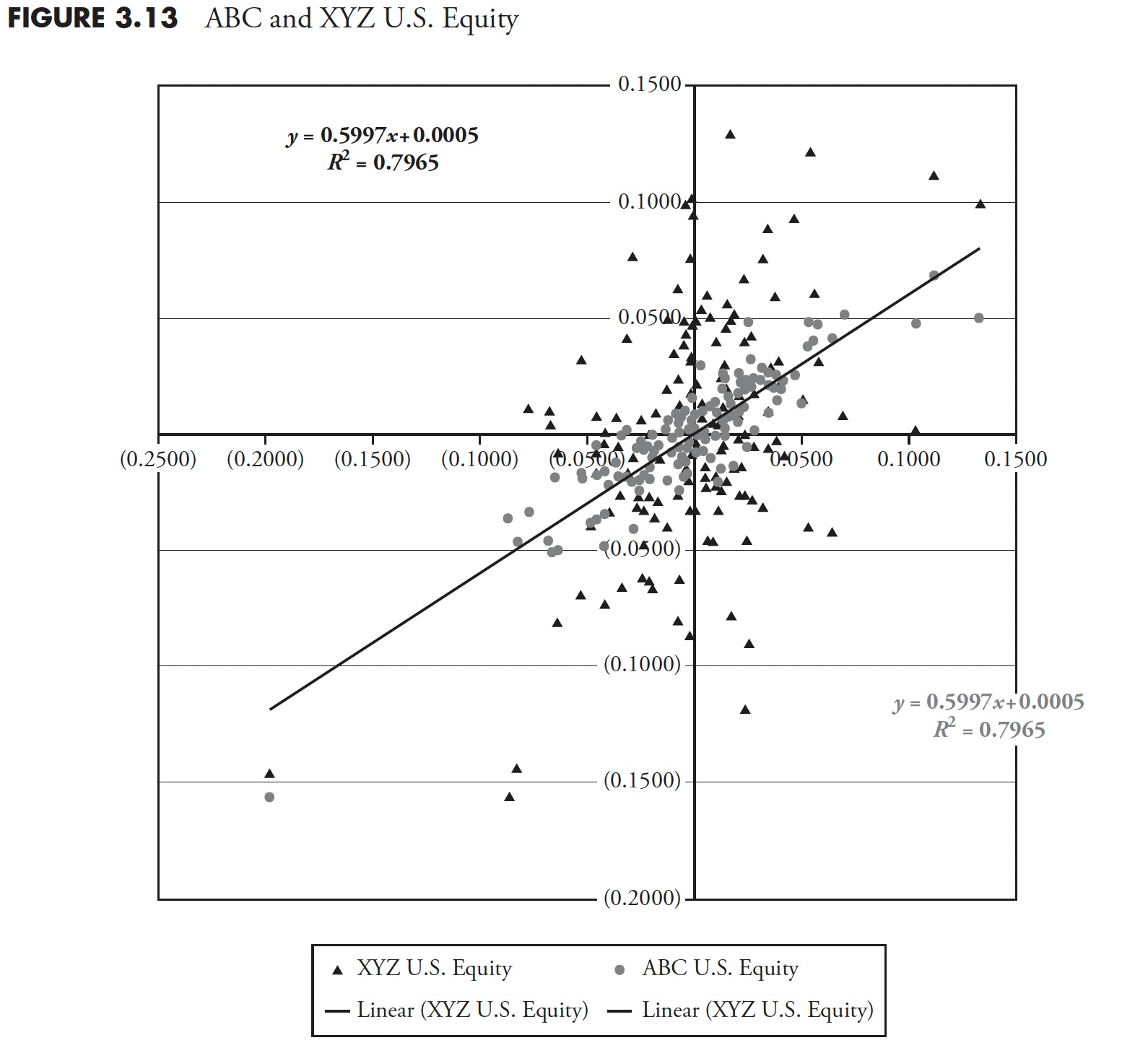

Determine 3.13

Determine 3.13

The scatterplot in Determine 3.13 reveals each funds plotted with the index. You may clearly see that fund XYZ (triangles) will not be practically as correlated as fund ABC (circles). But the linear statistics of contemporary finance doesn’t delineate a distinction between the 2. My solely remark to them is: Keep out of aviation.

The 60/40 Fantasy Uncovered

It’s nearly not possible to see any efficiency comparisons that not solely present a benchmark, but additionally a mixture of 60% fairness and 40% mounted earnings, generally known as 60/40 within the fund business. The environment friendly frontier is a type of phrases that got here from a idea developed a long time in the past on threat administration. Fashionable finance seems at a plot of returns versus threat, and, in fact, by threat, it means commonplace deviation. That is the primary mistake made with this idea. Then it plots quite a lot of totally different asset courses on the identical plot and derives the environment friendly frontier, which reveals you the extent of threat you’re taking for the asset courses you need to spend money on. Determine 3.14 reveals the environment friendly frontier curve from 1960 to 2010 (an intermediate bond element was used).

Subsequent, in the event you draw a line that’s tangent with the curve and have it cross the vertical return axis on the degree for assumed threat free, then the purpose of tangential is the correct mixture of fairness and bonds. I didn’t try to do that right here, because the dedication of the danger free fee to make use of over a 50-year interval presents an excessive amount of subjectivity. From 1960 to current, that blend of shares and bonds is about 60/40.

Determine 3.14

Determine 3.14

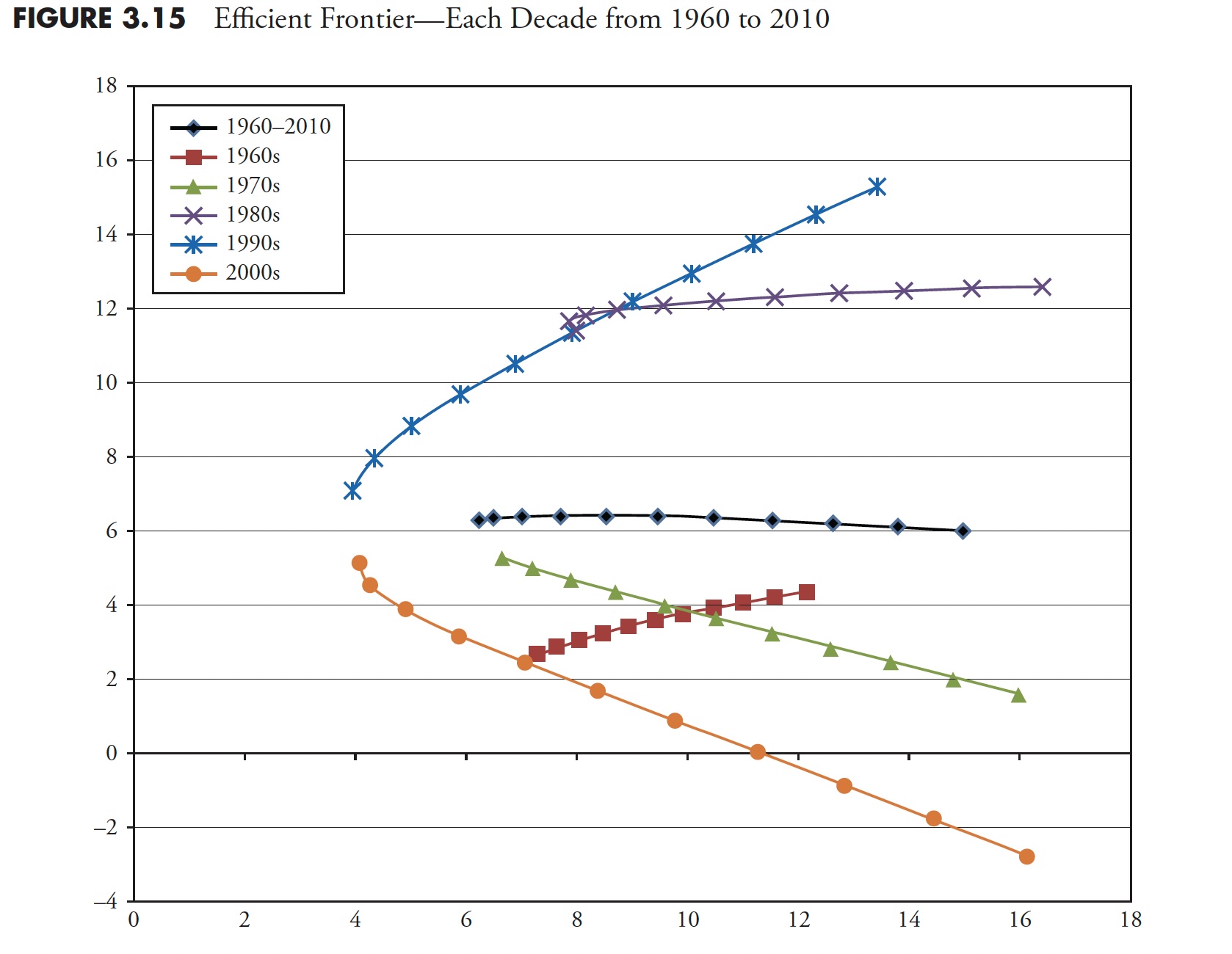

The ever-present 60/40 ratio of shares to bonds, which reveals up in most efficiency comparisons, gleans the message that, for over 50 years of knowledge, nothing has modified. Does anybody truly imagine that? Determine 3.15 is a chart exhibiting the environment friendly frontier for every particular person decade within the 1960 to 2010 interval. Clearly, every decade has its personal environment friendly frontier and its correct mixture of fairness and bonds. But the world of finance nonetheless sticks to the customarily incorrect mixture of 60/40. It could very nicely be mixture of belongings, however the knowledge says it’s dynamic and ought to be reviewed on a periodic foundation. Discover that the a long time of 1970 and 2000 confirmed related downward curves, that means that shares weren’t practically nearly as good as bonds. Conversely the a long time of 1980 and 1990 have been the other.

Determine 3.15

Determine 3.15

In an interview with Jason Zweig on October 15, 2004, Peter Bernstein mentioned {that a} inflexible allocation coverage like 60/40 is one other means of passing the buck and avoiding selections. Did you need to be 40 % invested in bonds through the Seventies when rates of interest soared? Did you need to solely be invested 60 % in equities within the interval from 1982 to 2000, which was the best bull market in historical past? After all not! Markets are dynamic, and funding methods ought to be too. Lastly, some evaluation will present {that a} 60/40 portfolio is extremely correlated to an all-equity portfolio.

Discounted Money Movement Mannequin

When learning fashionable finance, and after years of listening to concerning the discounted money move (DCF) mannequin, I’ve this to say concerning the discounted money move mannequin. To begin with, you have to resolve on six values concerning the future. They’re proven under. In case you have learn this guide this far, you most likely know what’s coming subsequent.

Low cost Charge

- Value of Fairness, in valuing fairness

- Value of Capital, in valuing the agency

Money Flows

- Money Flows to Fairness

- Money Flows to Agency

Development (to get future money flows)

- Development in Fairness Earnings

- Development in Agency Earnings (Working Earnings)

The inputs (above) to the DCF course of should all be appropriate or the mannequin fails fully. The chances of efficiently developing with appropriate (guesses) inputs are extraordinarily low, but that is utilized in fashionable finance routinely. This jogs my memory of the Kenneth Arrow story on forecasting in Chapter 5. When requested concerning the discounted money move mannequin, I liken it to the Hubble Telescope; transfer it an inch and swiftly you’re looking at a unique galaxy.

The purpose of this chapter, on the very minimal, is to trigger you to problem what fashionable finance has offered. I apologize for beating some ideas with a stick, however typically a number of approaches to indicate one thing are higher within the hope that one will stay with the reader. There was sufficient math to scare the common particular person; Half 4 focuses on the huge use of the time period common. The purpose is to indicate that utilizing long-term averages could be completely inappropriate for many buyers.

Thanks for studying this far. I intend to publish one article on this sequence each week. Cannot wait? The guide is on the market right here.