The 118th Congress returns to Washington this week with a serious taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of basic authorities companies, items, and actions.

elephant within the room—a lot of the 2017 tax reform legislation will expire after the tip of subsequent yr. If lawmakers enable full expiration to happen, most People will see their private tax payments rise and incentives for working and investing worsen. Extending the whole tax reform, nonetheless, would include a $3.7 trillion price ticket at a time when the nation’s fiscal outlook is already bleak.

Lawmakers ought to use the yr forward to totally evaluation and debate lasting, elementary tax reform and prioritize insurance policies that finest enhance work and funding incentives in a fiscally accountable method.

The 2017 tax legislation made wide-ranging reforms to the particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges improve with earnings. The Federal Earnings Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years outdated, particular person earnings taxes are the largest supply of tax income within the U.S.

code and minimize taxes for the overwhelming majority of American taxpayers. Broadly talking, extending the 2017 tax legislation would entail 11 separate tax cuts:

- Altering tax charges and brackets

- Increasing the commonplace deductionThe usual deduction reduces a taxpayer’s taxable earnings by a set quantity decided by the federal government. It was almost doubled for all courses of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers to not itemize deductions when submitting their federal earnings taxes.

- Increasing the kid tax credit scoreA tax credit score is a provision that reduces a taxpayer’s remaining tax invoice, dollar-for-dollar. A tax credit score differs from deductions and exemptions, which scale back taxable earnings, relatively than the taxpayer’s tax invoice immediately.

- Retaining the brand new 20 p.c deduction for noncorporate companies

- Repealing the Pease limitation on itemized deductions

- Decreasing the choice minimal tax (AMT)

- Permitting full expensingFull expensing permits companies to instantly deduct the complete price of sure investments in new or improved expertise, tools, or buildings. It alleviates a bias within the tax code and incentivizes firms to take a position extra, which, in the long term, raises employee productiveness, boosts wages, and creates extra jobs.

for enterprise funding in tools - Permitting full expensing for analysis and growth (R&D) prices

- Retaining present charges for worldwide tax provisions

- Retaining the EBITDA limitation for enterprise curiosity expense

- Decreasing the property taxAn property tax is imposed on the web worth of a person’s taxable property, after any exclusions or credit, on the time of dying. The tax is paid by the property itself earlier than property are distributed to heirs.

by rising the exemption thresholds

Altogether, we estimate the 11 tax cuts would cut back federal tax income by $6.7 trillion from 2024 via 2033, earlier than factoring within the 2017 tax legislation’s base broadeners and tax offsets that partially pay for the tax cuts.

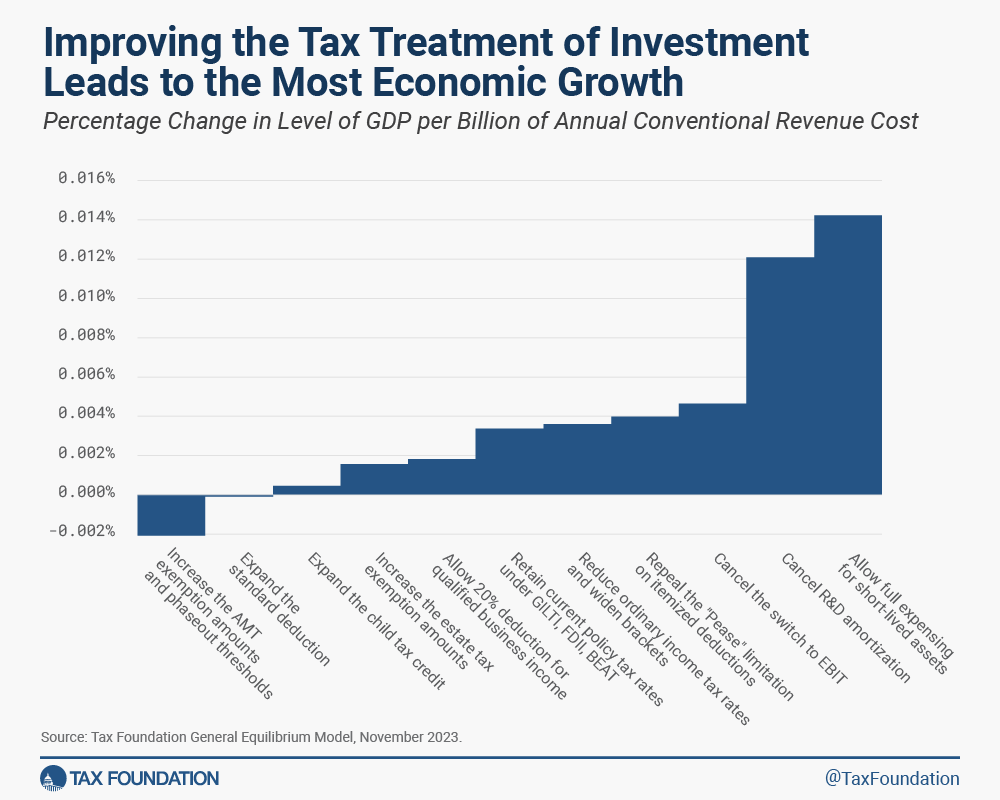

The 11 tax cuts differ extensively in how they might have an effect on folks’s choices to work and make investments. Some tax cuts create a bigger financial enhance than others. One indicator is to check the estimated change in long-run GDP to the estimated change in annual tax income within the remaining yr of the finances window. Utilizing the final yr of income is a proxy for the continuing, long-run price of a coverage change.

Probably the most highly effective provision beneath that metric is full expensing for enterprise funding in tools, adopted by expensing for analysis and growth prices. On the different finish, some tax cuts counterintuitively scale back financial output due to their interactive results with marginal tax charges. Different tax cuts have middling results, bettering incentives to work or make investments however not as powerfully as full expensing.

One other indicator to check provisions is the best way the tax adjustments affect debt-to-GDP. A extra pro-growth tax minimize will improve debt-to-GDP to a smaller diploma than a equally sized however much less environment friendly tax minimize.

As an illustration, the debt-to-GDP impact of reducing the tax charges and widening the tax brackets falls by about 40 p.c dynamically in comparison with conventionally. The distinction of a much less pro-growth tax change, resembling increasing the usual deduction, is simply 1.4 p.c. Then again, the debt-to-GDP impact of full expensing reverses; the lower in long-run income could be very small in comparison with the rise in long-run financial output such that full expensing reduces the long-run debt-to-GDP ratio by 0.3 share factors.

To make sure, no single metric can convey all of the trade-offs of a given tax coverage. As an illustration, Tax Basis modeling doesn’t contemplate how administrative and compliance prices or behaviors like tax planning would change beneath numerous insurance policies. Whereas our modeling illustrates how eliminating the AMT, for instance, will increase marginal tax charges, it doesn’t seize the compliance price financial savings generated by eliminating the coverage.

Insurance policies can even differ of their distributional results. Moreover, if tax cuts improve the deficit, the upper deficit would require the federal authorities to extend curiosity funds to foreigners, decreasing American incomes in comparison with the change in American output. Given the trade-offs, lawmakers ought to embrace provisions that simplify the tax code, scale back compliance prices, and have a comparatively robust bang for the buck.

Although lawmakers might not handle the looming expirations this yr, they need to put together for the upcoming expirations by weighing the trade-offs of every change the 2017 tax legislation made. The expirations present lawmakers an opportunity to rewrite the tax code. That rewrite ought to prioritize the very best provisions of the 2017 tax legislation, or higher but, construct on them with internationally confirmed tax reforms. For instance, Tax Basis analysis has proven how the Estonian tax system may very well be a mannequin for the United States and would improve development, increase further income, and simplify the submitting course of for taxpayers. Finally, lawmakers ought to cement into legislation a tax code that promotes development and alternative with out worsening U.S. debt.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share