When taxpayers promote their capital property, like actual property or their shares in an organization, web earnings on these gross sales (capital good points) are typically topic to taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of basic authorities companies, items, and actions.

, and web losses on these gross sales (capital losses) can typically be deducted from revenue when calculating revenue tax legal responsibility.

One main shortcoming of present coverage, nonetheless, is that when calculating the capital acquire from the sale of an asset, the unique buy worth (tax foundation) is expressed in nominal phrases when subtracted from the promoting worth. As a result of no inflationInflation is when the overall worth of products and companies will increase throughout the economic system, decreasing the buying energy of a foreign money and the worth of sure property. The identical paycheck covers much less items, companies, and payments. It’s typically known as a “hidden tax,” because it leaves taxpayers much less well-off on account of larger prices and “bracket creep,” whereas rising the federal government’s spending energy.

adjustment is made to the unique buy worth, capital good points taxes are utilized to nominal, not actual, will increase in wealth, which means taxpayers are taxed on what is often a mixture of actual and fictitious revenue (though the tax code does present a number of lodging, equivalent to for qualifying gross sales of owner-occupied properties and properties transferred to an inheritor). In some circumstances, this lack of inflation indexingInflation indexing refers to automated cost-of-living changes constructed into tax provisions to maintain tempo with inflation. Absent these changes, revenue taxes are topic to “bracket creep” and stealth will increase on taxpayers, whereas excise taxes are susceptible to erosion as taxes expressed in marginal {dollars}, fairly than charges, slowly lose worth.

of the tax foundation ends in taxpayers paying taxes on what seems on paper to be a capital acquire however, on account of inflation, is, in actual phrases, a web loss.

The federal tax code acknowledges this shortcoming with a essential, albeit imperfect, answer. Lengthy-term capital good points, outlined as web good points on property held for a couple of 12 months, are taxed beneath a charge schedule that differs from the one utilized to odd revenue, with decrease charges than are utilized to odd revenue. Particularly, relying on a taxpayer’s total taxable revenueTaxable revenue is the quantity of revenue topic to tax, after deductions and exemptions. For each people and firms, taxable revenue differs from—and is lower than—gross revenue.

, a charge of both 0 %, 15 %, or 20 % applies to all their taxable long-term capital good points.

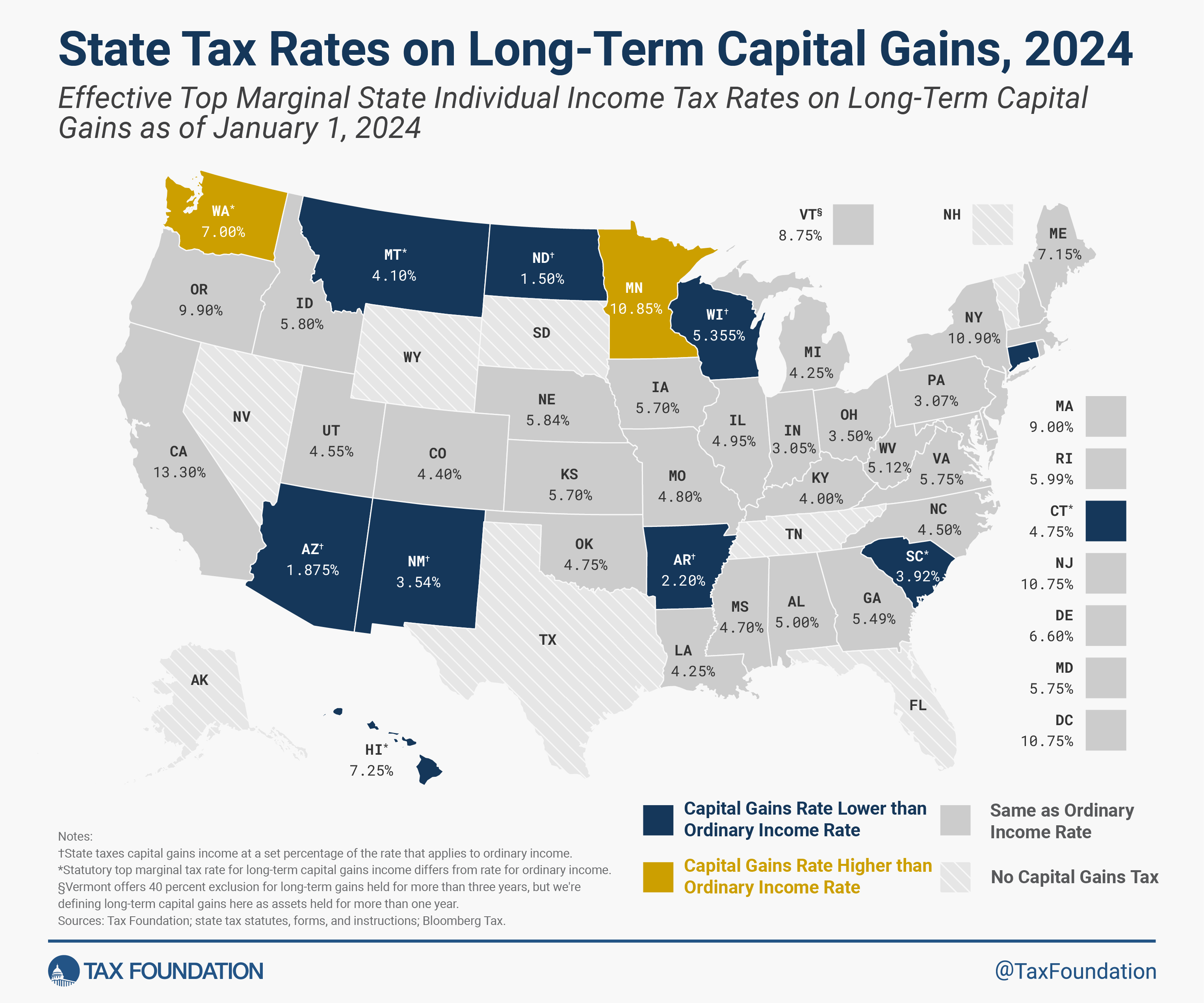

Comparable lodging for the results of inflation are presently far much less frequent on the state stage. Thirty-one states and the District of Columbia overtax capital good points revenue just by subjecting capital good points to the identical charge schedule that applies to odd revenue. Additional, two states—Minnesota and Washington—expose some capital good points to larger charges than apply to odd revenue. Particularly, Minnesota taxes most capital good points at odd charges however levies a further 1 proportion level tax on web funding revenue exceeding $1 million. Washington imposes a 7 % tax on capital good points revenue exceeding $250,000, however the state doesn’t tax odd revenue.

Solely 9 states, just like the federal authorities, apply decrease efficient particular person revenue taxA person revenue tax (or private revenue tax) is levied on the wages, salaries, investments, or different types of revenue a person or family earns. The U.S. imposes a progressive revenue tax the place charges improve with revenue. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years outdated, particular person revenue taxes are the largest supply of tax income within the U.S.

charges to long-term good points than to odd revenue, both by making use of decrease statutory charges or by providing an exclusion for a portion of in any other case taxable capital good points. In the meantime, seven states keep away from this dilemma by forgoing a person revenue tax altogether, and New Hampshire, uniquely, presently taxes curiosity and dividends revenue however doesn’t tax odd revenue or capital good points revenue.

On the state stage, making use of decrease charges to long-term capital good points revenue is an efficient first step to assist compensate for the truth that capital good points taxes apply to nominal, not actual, capital good points. As such, extra states ought to take into account becoming a member of the 9 that presently apply decrease efficient charges to long-term capital good points, both by making use of a decrease charge to long-term capital good points revenue or offering an exclusion for a sure proportion of in any other case taxable capital good points. Moreover, states must also guarantee they supply sturdy and well timed deductions for capital losses.

You will need to take into accout, nonetheless, that even when decrease charge schedules or exclusions are granted, capital good points taxes are however a type of double taxationDouble taxation is when taxes are paid twice on the identical greenback of revenue, no matter whether or not that’s company or particular person revenue.

. As an instance this, think about a person who decides to save lots of for the longer term by buying inventory in an organization. Generally, these shares are bought by means of tax-advantaged funding accounts, like a 401(ok) or IRA, guaranteeing a taxpayer’s invested revenue is taxed solely as soon as, both on the way in which in (Roth accounts) or on the way in which out (conventional accounts).

Oftentimes, nonetheless, buyers buy inventory utilizing odd wage or wage revenue that has already been taxed beneath the usual federal and state particular person revenue tax charge schedules. Below favorable circumstances, over time, a taxpayer’s preliminary funding will develop. However most development is the results of company earnings that may have already been topic to company revenue taxes by the point they attain the investor within the type of curiosity or dividends revenue, so these returns to the investor will probably be smaller than they’d have been within the absence of federal and state company revenue taxes. Years or a long time later, when the investor sells their shares and realizes their good points, that revenue will probably be taxed once more, based mostly on its nominal, fairly than actual, development. Whereas making use of decrease charges to realized capital good points helps offset a number of the results of inflation that occurred between when these capital property had been purchased and offered, it doesn’t change the truth that, normally, the earnings obtained by the taxpayer could have already been diminished by the company revenue taxA company revenue tax (CIT) is levied by federal and state governments on enterprise earnings. Many corporations are usually not topic to the CIT as a result of they’re taxed as pass-through companies, with revenue reportable beneath the particular person revenue tax.

.

At face worth, decrease charges on long-term capital good points revenue can appear like a type of preferential tax remedy, however when inflation and different layers of taxes are considered, it’s straightforward to see why that notion is misguided. When evaluating the tax remedy of funding revenue, state policymakers ought to take into account all layers of taxes on these earnings, together with company revenue taxes, and perceive how the failure to inflation index the tax foundation, mixed with most states’ failure to regulate charges accordingly, ends in the widespread overtaxation of capital good points revenue within the United States.

Financial savings and funding are important actions, each for people’ and households’ monetary safety and for the well being of the nationwide economic system as an entire. As such, policymakers ought to take into account how they may also help mitigate—fairly than add to—tax codes’ biases towards saving and funding.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share