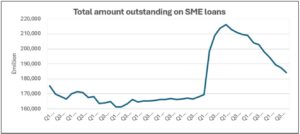

Small- and medium-sized enterprises (SMEs) repaid the document sum of virtually £10bn throughout 2023, in response to Ebury’s SME Borrowing Tracker.

By analysing Financial institution of England knowledge, Ebury discovered that whole excellent debt stood at £184.32bn within the ultimate quarter of 2023, marking a seven per cent or £13.57bn decline in debt when in comparison with the identical interval of 2022 (£197.89bn). It’s also a £25.45bn decline when in comparison with the ultimate quarter of 2021 (£209.77bn).

The ultimate three months of 2023 marked the biggest quarterly change in SME loans excellent for the 12 months as a result of repayments accelerated in the direction of the tip of the 12 months.

The £9.79bn repaid represented a £1.98bn improve from web repayments made in 2022, which stood at £7.81bn, and a £1.64bn improve from the online repayments made in 2021 which was £8.14bn.

Learn extra: SMEs resilient despite increased debt prices, BOE finds

It alerts the biggest annual compensation whole because the covid-19 pandemic in 2020, which noticed web loans of £44bn gathered as companies sought monetary assist to outlive the unprecedented financial restrictions.

With holding rates of interest held at 5.25 per cent since August 2023, SMEs are hurrying to make repayments in a bid to minimise the heightened price of debt.

Whereas the primary fee lower is priced in by markets for August 2024, the price of borrowing for companies is anticipated to stay elevated for a while.

Nearly all of SME lending in the course of the pandemic was offered via the government-backed coronavirus enterprise interruption mortgage scheme (CBILS), of which Ebury was an accredited lender.

By figures from the division for enterprise and commerce and the division for enterprise, power and industrial technique, Ebury discovered that £25.9bn was loaned out to round 100,000 companies below the CBILS scheme. Nevertheless, below a 3rd (30 per cent) of CBILS amenities have been repaid.

Learn extra: Covid loans “hobbling the restructuring area”

That enterprise assist was launched amid a broader package deal of assist together with further loans, the bounce again mortgage scheme, capital compensation holidays, prolonged overdrafts and asset-based finance.

“Whereas the price of borrowing seems to have peaked and is anticipated to start falling this 12 months because the Financial institution of England brings down its base fee, SMEs are nonetheless persevering with to make important repayments,” mentioned Ebury UK nation supervisor Phil Monkhouse.

“Companies have seen important volatility within the financial panorama from the restrictions skilled in the course of the pandemic and surging rates of interest, to geopolitical tensions driving provide chain bottlenecks and a big power shock.

“It has led to a interval of SMEs tightening belts and elevated give attention to bringing down their debt ranges to climate this uncertainty and put themselves in a powerful place for future progress as we hopefully start to go in the direction of calmer instances. Transferring ahead, SMEs might want to stay agile with prepared entry to finance and applicable hedging amenities to capitalise on the alternatives forward.”

Learn extra: SMEs rush to repay Covid loans amid increased rates of interest