In 2024, the banking sector is witnessing a pivotal transformation pushed by superior applied sciences like AI and cloud computing, evolving buyer calls for, and altering regulatory landscapes.

This evolution displays the dynamic shift seen 1 / 4 century in the past with the Digital Age, difficult the normal banking mannequin and echoing Invoice Gates’ well-known phrases, “The world wants banking, but it surely doesn’t want banks.”

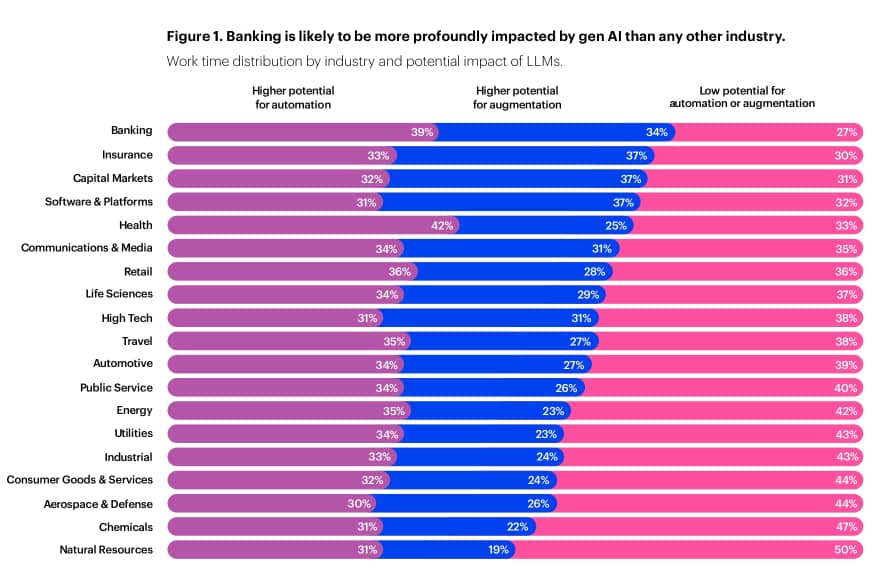

Accenture’s “Banking Prime 10 Developments” report for this yr highlights this transformative journey. It outlines varied developments, such because the adoption of generative AI, providing each challenges and alternatives.

To remain related, banks should embrace these developments, reinventing their operations and enterprise fashions to ship revolutionary, customer-centric providers.

On this quickly altering atmosphere, adaptability is essential for achievement. Banks that may agilely reply to the “Banking Prime 10 Developments” will in all probability emerge as leaders, defining the way forward for banking in an period more and more formed by technological developments.

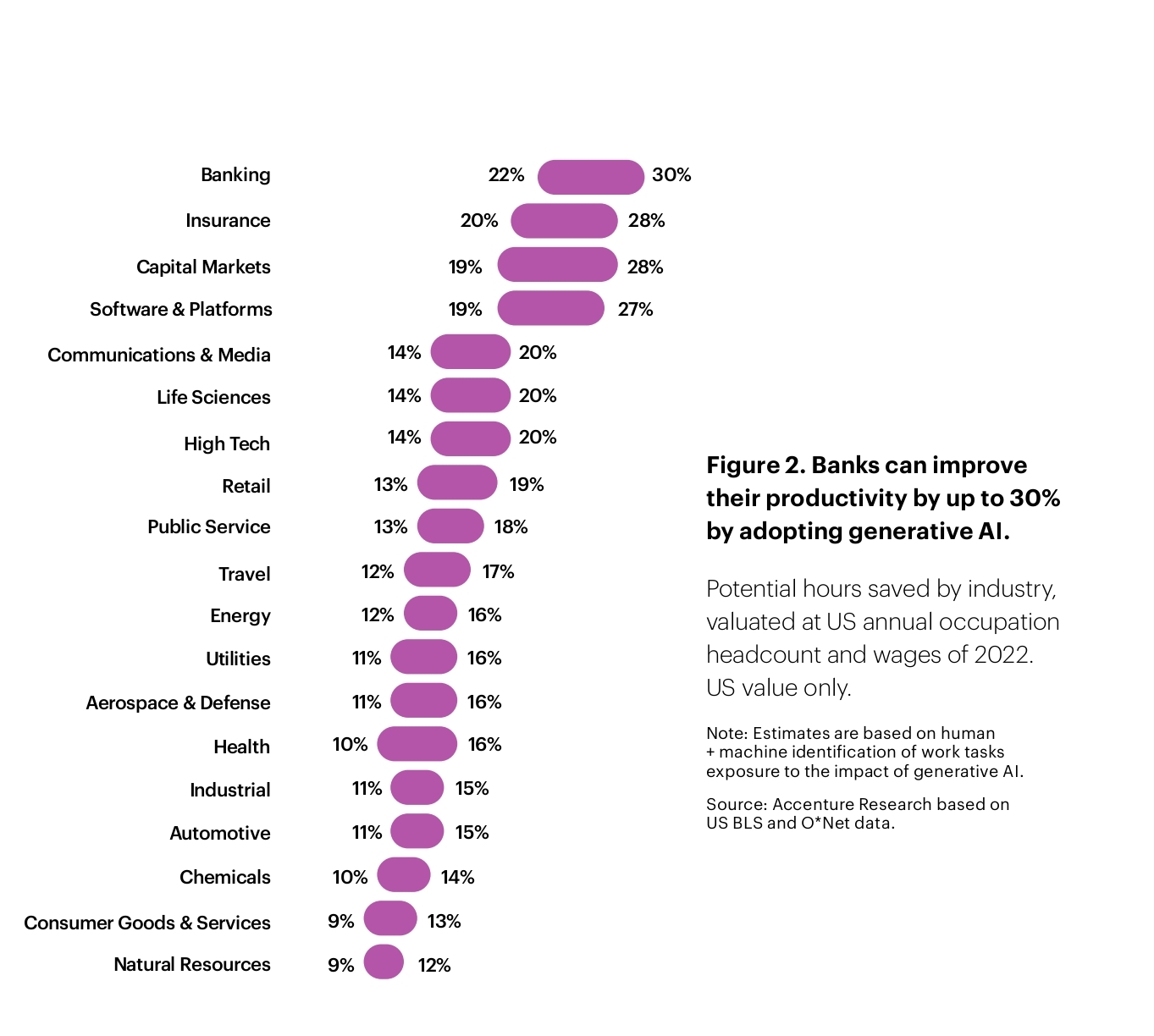

Generative AI supercharges banking.

Generative AI will present the banking business with unparalleled benefits. Operational effectivity evaluation suggests the potential to spice up productiveness by 22-30 p.c, and research present that income might enhance by 6 p.c.

To understand these beneficial properties, banks should successfully leverage the cloud and information and, crucially, rethink their method to work and expertise.

Inside a yr of its launch, ChatGPT and generative AI discovered widespread adoption inside the banking sector. Banks are actually implementing generative AI methods and reporting spectacular outcomes.

Generative AI affords many functions in banking, from enhancing due diligence and threat administration to streamlining authorized contract era and code writing.

Nonetheless, its most vital monetary impression will likely be enhancing gross sales and advertising efforts, high quality of buyer interplay, and product utility processes.

Past gross sales and advertising, different features like threat administration, compliance, know-how, human sources, and authorized can even obtain consideration as generative AI reshapes banking.

Capturing the digital dividend with AI

Whereas banks have made substantial progress in digitalisation, the main focus has typically centred on servicing fairly than fostering significant buyer interactions.

AI holds the potential to unlock the true worth of digital channels, enabling banks to have substantive conversations with clients throughout digital platforms.

In 2022, information confirmed that financial institution clients nonetheless regularly utilised branches for varied providers. Nonetheless, solely a small proportion of banks provided complete rewards for patrons who elevated their engagement with the financial institution.

In 2024, a rising variety of banks will leverage buyer information, superior analytics, and AI to maneuver past primary demographic segmentation, adopting a “lifecentric” method.

This technique encourages buyer loyalty and permits banks to interact with clients proactively, providing tailor-made recommendation and related affords.

Unseen dangers within the banking sector

In 2024, banks face varied acquainted dangers and fewer predictable dangers. These embrace cybersecurity threats fuelled by generative AI, excessive mortgage charges and inflation challenges, and potential business actual property market disruptions. Banks should proactively plan and adapt to mitigate these dangers successfully.

Whereas banks have invested closely in cybersecurity, generative AI has launched new vulnerabilities, comparable to deep fakes and complex phishing assaults.

Banks might want to shift their methods from prevention to resilience, utilizing AI to detect assaults and improve state of affairs planning and response.

Excessive mortgage charges and inflation pose a threat of pressured clients defaulting on their mortgages, probably inflicting authorities interventions. Banks should assess their readiness to deal with curiosity rate-related dangers and potential financial challenges.

The business actual property market additionally faces uncertainty due to shifting work patterns and financial situations. Banks, insurance coverage corporations, and pension funds should put together for and punctiliously monitor this threat.

Moreover, the rise in shadow banking poses questions in regards to the true extent of threat within the monetary system.

Banks maintain lower than 50 p.c of monetary property, and the share of non-bank mortgage origination has surged. Monitoring and addressing this threat are important for stabilising banks, insurance coverage corporations, and pension funds.

China’s rising involvement in international economies and dangers in its residential property sector calls for scrutiny. Regardless of regulatory efforts, the excessive leverage on this sector and the potential bubble might have extreme repercussions for international banks and economies if not adequately addressed.

A brand new period of the banking workforce

Banks are on the point of a radical shift of their workforce dynamics, aligning with the highest developments in banking. As AI and generative applied sciences change into integral to banking operations, new expertise, mindsets, and approaches will likely be important.

In contrast to earlier shifts, this transformation goes past recruitment; it requires a basic reimagining of banking professionals’ work.

Competitors for technical expertise will intensify in 2024 as each monetary establishment goals to capitalise on AI, cloud, and information analytics.

Whereas some banks make investments closely of their IT organisations, the demand for experience will doubtless outstrip provide. Essentially the most proficient people will search profession paths resulting in management roles.

Singapore’s OCBC Financial institution offers an instance of this transformation. It not too long ago accomplished a profitable six-month trial of an clever chatbot, now rolled out to its 30,000 staff. This chatbot accelerates duties like writing, translating, researching, and innovating, with individuals reporting 50 p.c quicker work completion, together with verification.

A earlier trial boosted productiveness in areas like code improvement and doc summarisation.

The financial institution employs AI for over 4 million each day choices in threat administration, customer support, and gross sales and expects to succeed in 10 million by 2025.

Optimising pricing with AI

In 2024, one of many prime developments in banking is the business’s concentrate on optimised pricing, recognising its vital impression on their backside strains.

Banks are taking a brand new method by combining instinct with generative AI and complete information to reinforce state of affairs planning and transfer nearer to personalised pricing.

A 1 p.c enhance in income interprets to a big enchancment in pre-tax ROE for banks, making pricing optimisation essential. Historically, banks struggled to precisely predict the impression of value adjustments on income.

AI will allow banks to think about 1000’s of variables quickly, figuring out the perfect value for every buyer, product, and channel.

Embracing a cloud-first method

The banking business’s adoption of cloud know-how is likely one of the prime developments in 2024. This marks a big change in how banks function and utilise know-how. Banks are recognising the potential of cloud know-how to leverage information, generative AI, and rising applied sciences.

Consequently, they’re transferring away from conventional on-premise fashions and embracing a extra dynamic, cloud-centric framework. This transition necessitates comprehensively reevaluating processes, structure, expertise, and company tradition.

Beforehand, cloud adoption was primarily IT-driven, however now, it’s more and more led by enterprise leaders who see the cloud as greater than only a information storage answer. It represents a brand new means of working, demanding flexibility, agility, and openness to innovation.

Regulation recalibrated

The banking business has grappled with an ever-expanding quantity of laws because the 2008/9 Monetary Disaster.

Nonetheless, many of those laws haven’t immediately addressed the basis causes of financial institution failures. In 2024, we count on elevated collaboration between banks, central banks, and regulators to develop simpler regulatory approaches.

Whereas the regulatory panorama has expanded considerably, it has not addressed the important thing elements resulting in banking failures, comparable to credit score threat and liquidity.

The compliance burden on banks has grown considerably, with rising working prices, as new laws proceed to emerge.

Shifting from know-how administration to engineering

A refined but profound shift is happening in main banks—transitioning from a know-how administration mindset to an engineering method.

Banks recognise the significance of constructing with know-how fairly than merely managing it. This shift encompasses all points of banking, from IT to the C-suite.

One of many prime developments in banking is that this transformation in direction of adopting an engineering method.

A working example is J.P. Morgan, which has embraced this shift by referring to its crew of 40,000 pc scientists and technologists as engineers. In each instances, the roles have advanced from mere know-how administration to energetic involvement in its design and building.

Whereas bankers could not usually view themselves as engineers, their shift in focus from upkeep to design and improvement represents a constructive change that holds vital long-term development potential for the financial institution.

This shift impacts IT and permeates each degree and performance inside the banking sector.

Unlocking the legacy core

For years, banks have grappled with outdated core techniques, hindered by tens of millions of strains of COBOL code which can be outdated and poorly documented.

Modernising these techniques has been daunting, typically requiring years and vital monetary funding.

Nonetheless, generative AI is now rising as a game-changer. It will probably reverse-engineer and untangle COBOL code, making it simpler and quicker to modernise legacy techniques.

This know-how can considerably scale back prices, minimise disruptions, and improve regulatory compliance.

Past Six Sigma – inventive price discount

Banks have lengthy sought methods to cut back prices and enhance effectivity, typically by way of methodologies like Six Sigma. Nonetheless, in 2024, there’s a shift in direction of a extra inventive method to price discount.

Banks are reimagining their operations, merchandise, and buyer experiences. They’re leveraging generative AI to reinforce productiveness and reshape the enterprise.

Banks are combining basic Six Sigma rigour with design-led considering and AI-powered instruments, positioning themselves to deal with previous challenges in new methods.

This method permits them to attain short-term efficiencies and long-term worth for patrons and shareholders.

Banking’s transformation in 2024

Generative AI stands on the forefront of the banking business’s transformation, providing a disruptive potential that guarantees to usher in a brand new period of enterprise intelligence.

Based on Accenture’s Know-how Imaginative and prescient examine, 95 p.c of C-level executives foresee advances in generative AI delivering constructive returns on AI initiatives.

2024 will likely be a pivotal second for the banking sector, with generative AI driving the highest 10 developments that can reshape the business.

Banks that adeptly harness this know-how and undertake strategic approaches will emerge as leaders within the trendy banking panorama, marking 2024 as a yr of exceptional progress and transformation.

Featured picture credit score: Edited from Freepik