If you happen to filed your taxes by the April 15th deadline, you’re most likely relieved to return to your day by day routine with out considering an excessive amount of about earnings taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of basic authorities providers, items, and actions.

funds, types, and submitting obligations till subsequent 12 months. Tax season is a dreaded time for a lot of, largely because of the complexity concerned in submitting. In a current ballot performed by the Tax Basis’s instructional program, TaxEDU, and Public Coverage Polling, 88 % of respondents indicated they imagine the U.S. tax code is both overly advanced or considerably advanced. However the complexity individuals complain about is the complexity individuals know about. Loads of tax complexity exists that the majority Individuals aren’t even conscious of. Among the many tax guidelines Individuals perceive the least—and in addition adjust to the least—are nonresident earnings tax submitting legal guidelines.

Only a few Individuals understand that almost half the states technically require people to file nonresident particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges enhance with earnings. The Federal Earnings Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years outdated, particular person earnings taxes are the largest supply of tax income within the U.S.

returns in the event that they work for even a single day inside that state. And even when extra Individuals had been conscious of those obligations, only a few would go to the hassle of submitting earnings tax returns in each single state through which they work for a day or reply some emails whereas on trip. That is very true in states the place employer withholding legal guidelines are extra lenient than nonresident worker submitting legal guidelines, which is commonly the case. And since taxpayers can declare a credit score for taxes paid to different states in opposition to their house state earnings tax legal responsibility, short-term journey has a negligible influence, if any, on a taxpayer’s whole state tax legal responsibility.

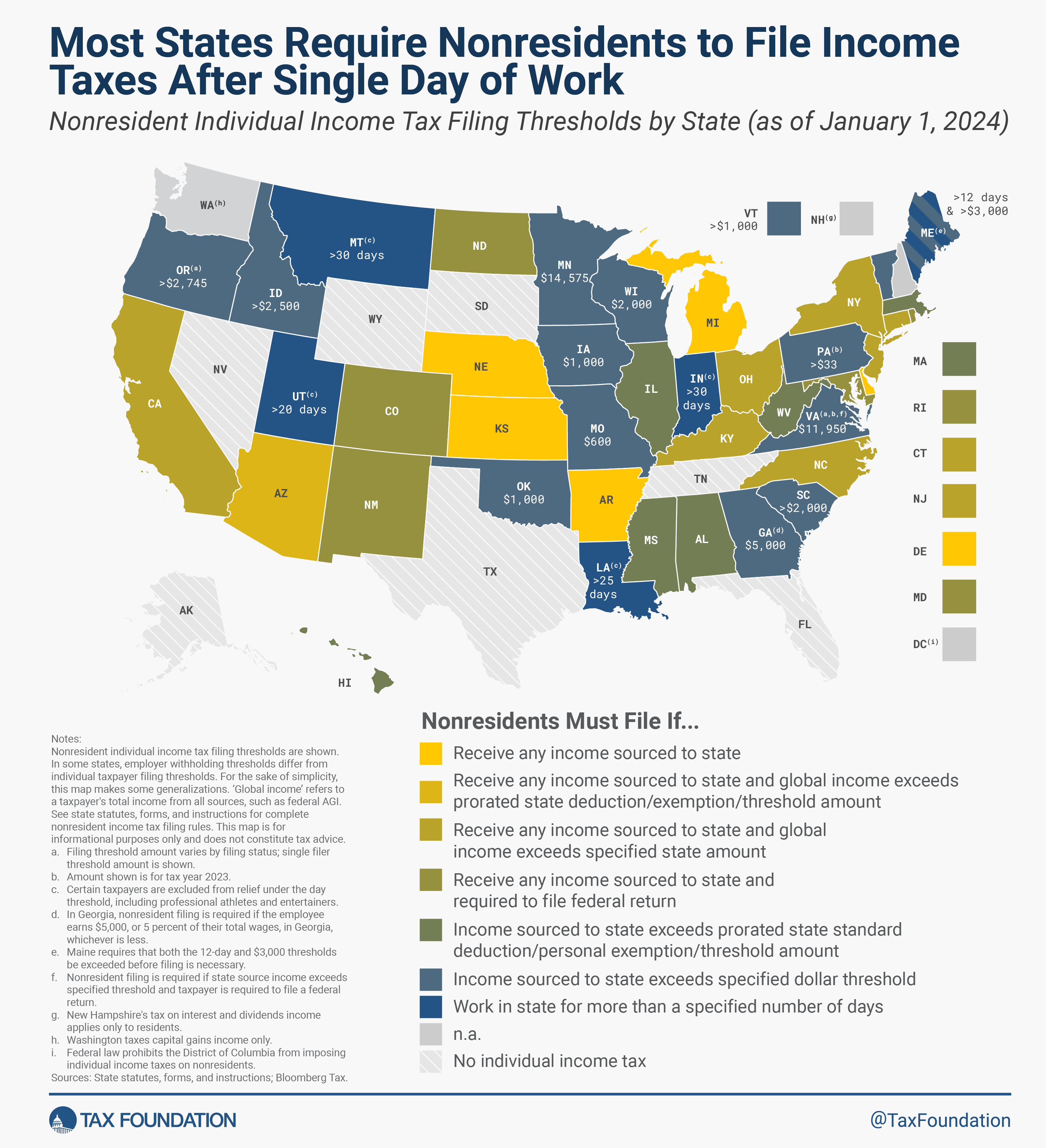

In every of the 24 states proven in yellow on the map, nonresidents are prone to incur earnings tax submitting obligations by working only a single day within the state. In the meantime, the states in blue have thresholds in place that defend nonresidents from having to file in the event that they work solely a brief period of time (or earn solely a small quantity of earnings) within the state.

The strictest nonresident submitting obligations are present in Arkansas, Delaware, Kansas, Michigan, and Nebraska, the place nonresidents are required to file a return in the event that they earn any earnings within the state. Different states, like Colorado, Maryland, New Mexico, North Dakota, and Rhode Island, require nonresidents to file in the event that they earn any earnings within the state and earn sufficient whole earnings to be required to file a federal return. (Normally, people are required to file a federal return if their gross earnings exceeds the customary deductionThe usual deduction reduces a taxpayer’s taxable earnings by a set quantity decided by the federal government. It was practically doubled for all lessons of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers to not itemize deductions when submitting their federal earnings taxes.

for his or her submitting standing, which in tax 12 months 2024 is $14,600 for single filers and $29,200 for married {couples} submitting collectively, that means most staff are required to file.)

Equally, different states tie their nonresident submitting obligations as to if the taxpayer’s whole federal earnings exceeds a specified quantity aside from the federal customary deduction. (These state-specified quantities typically differ by the taxpayer’s submitting standing and generally by their age, however in all circumstances, these thresholds are so low as to usually present submitting aid solely to part-time staff who’re much less prone to journey for work anyway.)

In Alabama, Hawaii, Illinois, Massachusetts, Mississippi, and West Virginia, nonresidents should file if their state-sourced earnings exceeds the state customary deduction and/or private exemption quantity, however deductions and exemptions should be prorated primarily based on the ratio of the taxpayer’s state-sourced earnings to their federal earnings. In consequence, a nonresident’s prorated customary deduction and/or private exemption is often so low that it’s going to not often negate a taxpayer’s submitting obligation. Uniquely, Arizona requires nonresidents to file in the event that they earn any earnings in Arizona and their whole gross earnings exceeds the prorated state customary deduction, capturing the overwhelming majority of nonresidents who do any work within the state.

Importantly, the states proven in blue on the map have established statutory nonresident earnings tax submitting thresholds designed to stop nonresidents from having to file and pay earnings taxes after they conduct solely minimal work within the state. Eleven states have standardized earnings thresholds, whereby nonresidents are relieved from submitting obligations in the event that they earn lower than a de minimis quantity of earnings within the state. These states are Georgia, Idaho, Iowa, Minnesota, Missouri, Oklahoma, Oregon, Pennsylvania, South Carolina, Virginia, and Wisconsin. In the meantime, 4 states have day thresholds, whereby nonresidents are relieved of submitting obligations in the event that they work for lower than a sure variety of days throughout the state. Indiana and Montana permit nonresidents to work throughout the state 30 days earlier than nonresident submitting obligations are triggered, whereas Louisiana permits as much as 25 days, and Utah permits as much as 20 days. (It’s value noting that, in every of those states, sure high-income and/or high-profile people aren’t eligible for submitting and cost aid, together with skilled athletes {and professional} entertainers.) Lastly, one state, Maine, is exclusive in specifying that nonresident submitting is barely required after a person has earned greater than $3,000 within the state and has labored within the state for greater than 12 days.

These nonresident earnings tax submitting thresholds are a prudent means for states to scale back tax compliance burdens for individuals who spend solely a minimal period of time working in a state. Notably, these insurance policies additionally scale back the fee to the state of processing tax returns which have low or no earnings tax legal responsibility related to them.

A lot of the overly stringent nonresident earnings tax submitting legal guidelines that stay on the books at present are the product of a bygone period, when most individuals labored from one location, and work journey was much less widespread. These days had lengthy since handed even earlier than the pandemic, however that’s very true now, in an period when so many individuals can—and do—work from anyplace with web entry. As we speak, these outdated state legal guidelines match uncomfortably inside a contemporary financial system, as evidenced by completely low ranges of each compliance and enforcement. As such, the states that haven’t but adopted cheap nonresident submitting thresholds ought to prioritize doing so.

Whereas a de minimis earnings threshold is much better than nothing, the quantity of taxable earningsTaxable earnings is the quantity of earnings topic to tax, after deductions and exemptions. For each people and companies, taxable earnings differs from—and is lower than—gross earnings.

earned in a state may be troublesome to find out since every state has its personal definitions, exclusions, and calculations for what constitutes taxable earnings. This may end up in taxpayers being pressured to spend an excessive amount of effort and time working calculations to find out whether or not they’re required to file in a sure state, no matter whether or not they are going to really owe taxes to mentioned state. As such, a day threshold is a less complicated resolution, and a 30-day threshold is affordable and per varied federal proposals to standardize these thresholds throughout states. To the extent states are involved in regards to the burden on state and native assets of nonresidents passing by, you will need to remember that vacationers pay a plethora of state and native gross sales and excise taxes on resort rooms, meals, rental automobiles, rideshare providers, gasoline, and way more, and these taxes paid relate way more carefully to state and native advantages acquired than taxes primarily based on earnings, which yield extra arbitrary tax liabilities and carry considerably greater compliance prices.

Along with adopting greater worker submitting and employer withholdingWithholding is the earnings an employer takes out of an worker’s paycheck and remits to the federal, state, and/or native authorities. It’s calculated primarily based on the quantity of earnings earned, the taxpayer’s submitting standing, the variety of allowances claimed, and any further quantity of the worker requests.

thresholds, extra states ought to contemplate adopting reciprocity agreements—particularly with their neighboring states—whereby states mutually agree that taxpayers who reside in a single state however work within the different are obligated to file solely of their state of residence.

Tax legal guidelines needs to be enforceable—and customarily enforced. Lack of compliance and enforcement are sometimes signs of a deeper downside with the character of the coverage itself. Transferring ahead, one comparatively simple however significant step policymakers can take to make future tax seasons much less burdensome is to modernize their state’s nonresident earnings tax submitting, withholding, and reciprocity legal guidelines.

Notice: This text is for informational functions solely and doesn’t represent tax planning recommendation. For tax planning recommendation, please seek the advice of a paid tax preparer.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Share