Citi is a TPG promoting accomplice.

The Citi Premier® Card (see charges and charges) is Citi’s mid-tier journey card, incomes bonus factors on journey purchases and providing the flexibility to switch rewards to precious switch companions.

However with so many different good choices, is the Premier value its $95 annual charge? Here is what it’s essential to know earlier than making use of.

Welcome bonus

The Citi Premier is at the moment providing a sign-up bonus of 60,000 ThankYou® Factors factors after you spend $4,000 throughout the first three months from account opening. TPG values these factors at 1.8 cents every, making this bonus value $1,080.

You possibly can switch your Citi ThankYou Factors to 19 switch companions. possibility is to make use of Air France-KLM Flying Blue to guide enterprise class awards from the U.S. to Europe for simply 50,000 miles per particular person one-way.

On the resort aspect, you may switch your factors at a 1:1 ratio to Wyndham Rewards and at a 1:2 ratio to Alternative Privileges. These applications can each present glorious worth not simply at funds properties but additionally when touring close to holidays when money charges are excessive however factors charges aren’t vulnerable to fluctuation.

Associated: 5 of the most effective Citi ThankYou Rewards redemption candy spots

Stable factors incomes

In the event you ask folks what they like concerning the Citi Premier card, the most typical reply is probably going that it earns factors in well-liked spending classes.

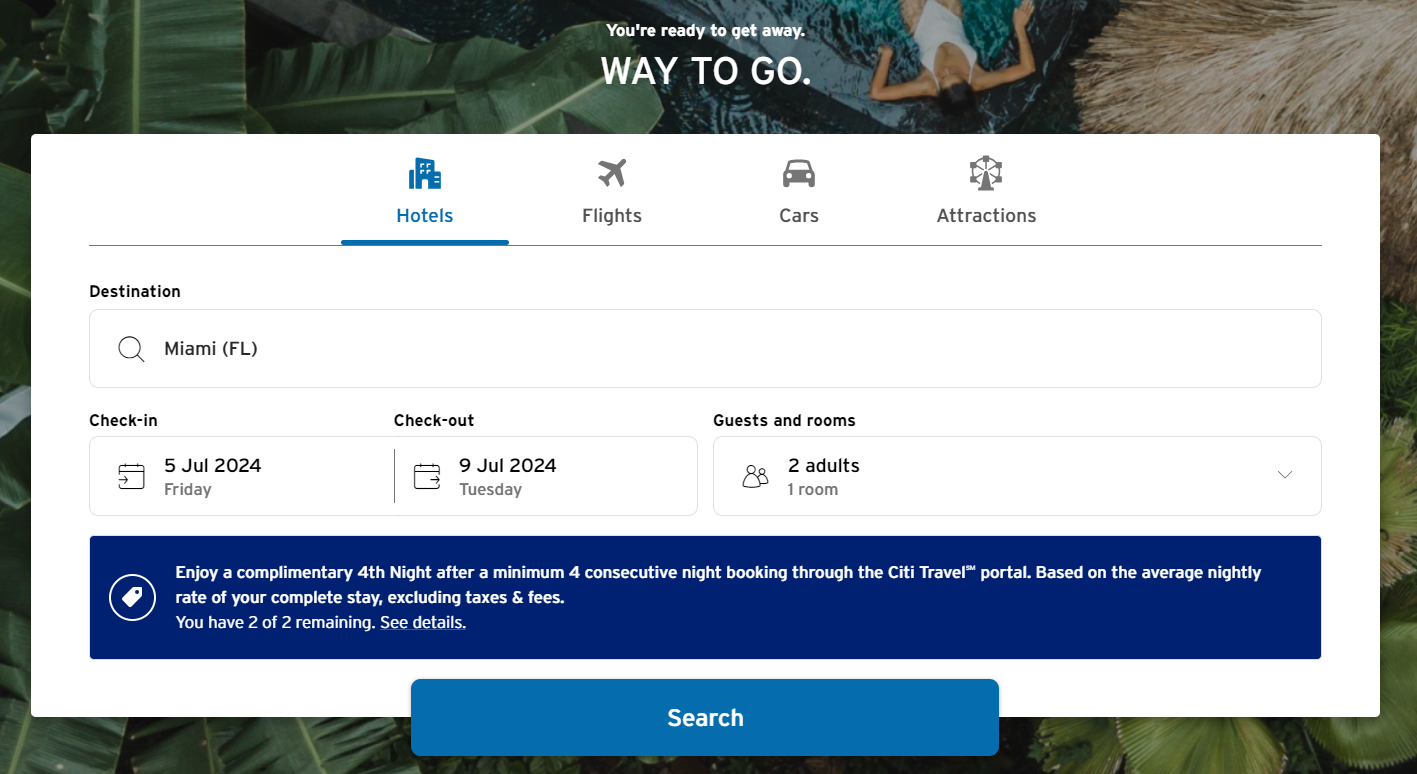

Via June 30, 2024, cardholders can earn 10 factors per greenback spent on resorts, automobile leases and points of interest (excluding air journey) when reserving by way of the Citi Journey portal.

Day by day E-newsletter

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

As well as, the Premier earns 3 factors per greenback on air journey, resorts, gasoline stations, supermarkets and eating places (together with takeout) and 1 level per greenback on all different purchases.

Bank card author Danyal Ahmed commonly makes use of his Citi Premier card to pay for gasoline and grocery procuring which helps him accumulate his ThankYou factors rapidly. Incomes bonus factors on on a regular basis spend is what motivated him to use for the cardboard, along with Citi Premier’s switch spectacular companions.

Plus, the Premier’s bonus classes apply worldwide, versus some playing cards that solely provide these bonus factors on purchases throughout the U.S.

Associated: Find out how to redeem Citi ThankYou factors for optimum worth

$100 annual resort credit score

As a cardholder, you may get an annual good thing about $100 off a single resort keep of $500 or extra (excluding taxes and charges) while you guide by way of Citi’s journey portal.

Nevertheless, whereas this profit sounds promising and is likely to be nice when staying at boutique, unbiased properties, it might not yield the $100 in financial savings you count on.

When testing out the $100 resort credit score on the Citi Premier, TPG discovered that the profit was usually value considerably lower than $100. That is as a result of Citi’s journey portal does not all the time have the bottom price — particularly while you think about members-only charges in your favourite resort chain.

Associated: The Citi Journey portal is getting an entire makeover: Here is what to anticipate

Cardmember protections

Whereas the Premier lacks the in depth journey and procuring protections we love on different playing cards, it does provide two vital protections: prolonged guarantee safety and injury and theft safety.

The prolonged guarantee safety on the Citi Premier provides a further 24 months to a producer’s guarantee. The injury and theft safety profit can present for the restore or alternative of an merchandise that is broken or stolen inside 90 days of buy (as much as $10,000 per merchandise and a $50,000 annual restrict).

World Elite Mastercard advantages

As a World Elite Mastercard cardholder, you may take pleasure in additional perks like World Emergency Providers, a $5 Lyft credit score while you take no less than three rides in a month and a ShopRunner membership that gives free two-day delivery for quite a few on-line purchases.

Leisure perks

Anybody with a Citi bank card, together with the Citi Premier card, can entry Citi Leisure. This will present entry to unique occasions and precedence entry or advance ticket gross sales to concert events, reveals and performances, movie festivals and extra.

Backside line

Since chances are you’ll not get the complete $100 worth from the resort profit, whether or not the Citi Premier is value its $95 annual charge will come right down to the factors you earn and the way you worth them.

In the event you can maximize the bonus classes and get good worth from Citi’s switch companions, chances are you’ll discover you get worth properly past the annual charge value. Nevertheless, if you need extra tangible worth from assertion credit and different perks, you may probably need to go along with a completely different bank card.

Apply right here: Citi Premier® Card with a 60,000-point welcome bonus after you spend $4,000 in your card inside three months of account opening