KEY

TAKEAWAYS

- The S&P notched new document highs in 5 consecutive buying and selling periods however snapped the profitable streak on Friday

- Buyers nonetheless are complacent, as indicated by the CBOE Volatility index

- The benchmark 10-year Treasury yield stays inside a 4% to 4.2% vary

Within the first week of 2024, traders appeared unsure that the inventory market would proceed the tail finish of 2023 rally. However right here we’re, three weeks later, and the S&P 500 Index ($SPX) notches new document highs 5 buying and selling periods in a row. The final time this occurred? November 2021.

It will have been good to see the S&P 500 hit a document shut to complete the buying and selling week. It got here so shut.

Buyers are not apprehensive about something proper now. The CBOE Volatility Index ($VIX) stays comparatively low at 13.29. This week, we obtained perception into some key financial information, which indicated, general, that the US financial system is slowing. This was excellent news for the inventory market, which retains going and going.

The Fed’s most trusted inflation information level, the Private-Consumption Expenditures (PCE) elevated by 2.9%, under the three.0% estimate. However shopper spending went up 0.7% in December, larger than anticipated. Customers continued to buy, despite the fact that private revenue was flat. The place’s the cash coming from?

Earlier within the week, the This autumn GDP was launched, indicating the US financial system grew at a 3.3% annual fee within the fourth quarter. It is larger than economists estimated, however it’s additionally slower than Q3’s progress, which was 4.9%.

So, general, the info main as much as this week means that inflation has softened whereas the US financial system remains to be sturdy. Nonetheless, the expansion is decelerating. Does that imply the US will see a comfortable touchdown? It is in all probability too early to inform, however it’s one thing to pay attention for when Chairman Powell takes the rostrum subsequent week after the Federal Reserve resolution on rates of interest.

The Fed is predicted to carry rates of interest regular of their subsequent assembly, however traders will likely be listening for any clues hinting when fee cuts will begin. In accordance with the CME FedWatch Device, there’s a couple of 50% likelihood of the Fed chopping charges by 25 foundation factors of their March assembly.

Equities Nonetheless Rising

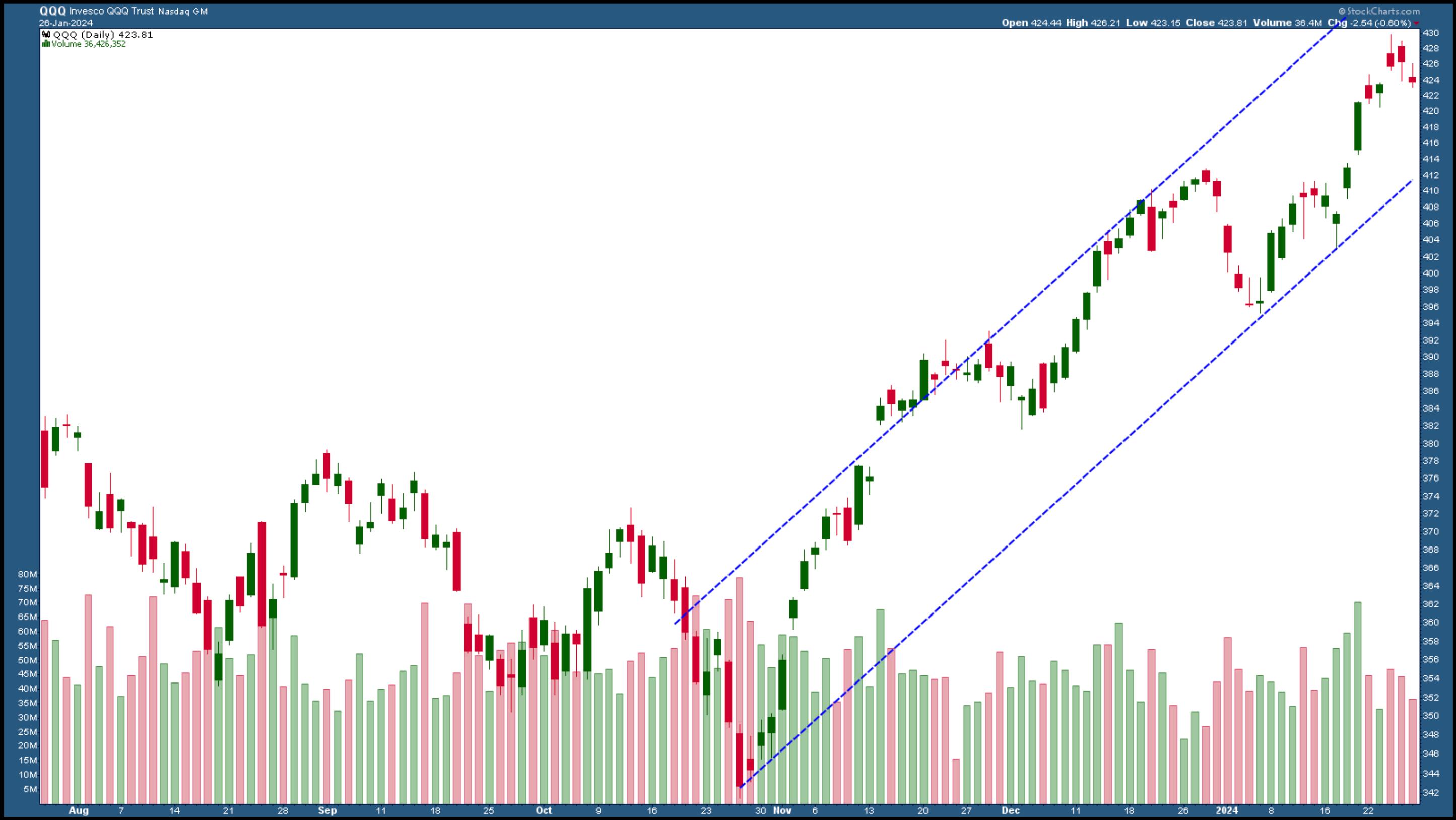

The inventory market appears to be content material with how the financial system is performing. The S&P 500 ($SPX) and Dow Jones Industrial Common ($INDU) have been notching new highs this week. Know-how shares are again in favor, with many Tech and Communication Companies reporting earnings subsequent week. Intel’s disappointing steerage might have dampened the keenness in Tech, however general, the sector has been rallying. The Invesco QQQ Belief (QQQ) has been rising since late October 2023 (see chart under).

CHART 1. DAILY CHART OF QQQ. QQQ has been transferring in an upward-sloping channel. A break above or under this channel might be a sign to which course the QQQ will transfer.Chart supply: StockCharts.com. For academic functions.

Subsequent week, some key tech gamers will likely be reporting earnings. Chip shares are below strain after Intel’s and KLA Corp’s weaker steerage. Buyers will likely be intently listening to AMD’s earnings subsequent week. Will AMD present steerage just like Intel’s? If it does, it is going to ship a damaging sentiment rippling by the sector. Watch the upward-sloping channel within the QQQ; a break above or under the channel will likely be a sign of which course the QQQ will transfer.

This is the reason traders ought to at all times have a look at the broad image when analyzing the inventory market.

One helpful indicator to observe is the Bullish % Index (BPI). It is useful to have a ChartList of the BPI for the completely different sectors and main indexes. Wanting by the BPI for the 11 S&P sectors, as of now, Client Staples, Utilities, and Vitality are the one three sectors favoring the bears. However that would change.

Fed Week On the Radar

Curiously, regardless of the rise in equities, the benchmark US 10-year Treasury yield ($TNX) has stabilized at across the 4.0–4.2% vary. Is the bond market telling us one thing we might not know?

CHART 2. 10-YEAR US TREASURY YIELD STABILIZING. Watch the 10-year Treasury yields as we head into Fed week. They might be telling you one thing you will have missed.Chart supply: StockCharts.com. For academic functions.

Subsequent week may carry some volatility, with a number of of the Magnificent Seven reporting subsequent week and the FOMC assembly.

Finish-of-Week Wrap-Up

- S&P 500 down 0.07% at 38109.43, Dow Jones Industrial Common up 0.16% ; Nasdaq Composite down 0.36% at 15455.36

- $VIX down 1.41% at 13.26

- Greatest performing sector for the week: Vitality

- Worst performing sector for the week: Client Discretionary

- High 5 Giant Cap SCTR shares: Affirm Holdings (AFRM), Tremendous Micro Laptop, Inc. (SMCI); Veritiv Holdings, LLC (VRT); Nutanix Inc. (NTNX); CrowdStrike Holdings (CRWD)

On the Radar Subsequent Week

- Earnings week continues, with Superior Micro Gadgets (AMD), Alphabet Inc. (GOOGL), Microsoft Corp. (MSFT), Apple Inc. (AAPL), Amazon.com Inc. (AMZN), and Meta Platforms, Inc. (META) reporting.

- Federal Reserve Curiosity Charge resolution

- Jan Non-Farm Payrolls (NFP)

- November S&P/Case-Shiller Dwelling Costs

- Fed Curiosity Charge Determination

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra