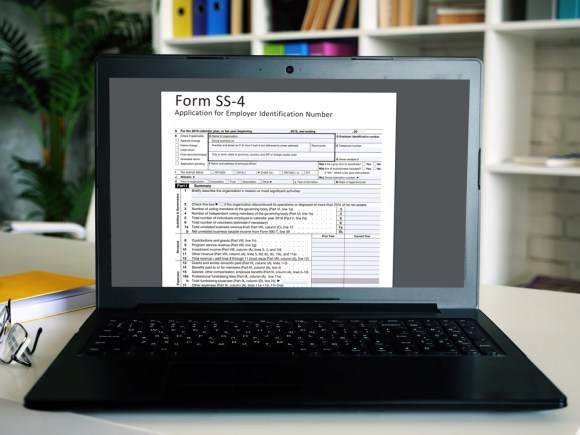

When you’re beginning a brand new enterprise, chances are you’ll must file Kind SS-4, which is an Software for an Employer Identification Quantity (EIN). Your EIN is used as a singular identifier for your enterprise while you file and report enterprise taxes, so typically, each enterprise proprietor wants one. On this weblog, you will discover out extra about Kind SS-4 and employer identification numbers, why chances are you’ll want to finish the shape, and how one can get an EIN for your enterprise.

What’s an EIN (Employer Identification Quantity)?

An employer identification quantity is a 9-digit quantity that may be a distinctive identifier for your enterprise, permitting you to report and file taxes below your enterprise title. Your EIN is basically a manner for the IRS and different organizations to tell apart between your enterprise and different companies.

When people file taxes, they use their Social Safety Quantity (SSN). Once you file taxes for your enterprise, you’ll use your EIN as an alternative of your SSN. Consider an EIN as an SSN for your enterprise. Most companies have an EIN as a result of the IRS must determine your enterprise while you’re submitting small enterprise taxes. You might also want to offer your EIN while you’re filling out sure purposes. For instance, chances are you’ll want to make use of your EIN while you apply for a small enterprise mortgage.

How Do I Know If My Enterprise Wants an EIN?

When you’re beginning a enterprise, chances are you’ll want to finish an EIN utility as a part of your launch. However how have you learnt if your enterprise is required to have one? When you meet any of the next standards, you want an EIN:

- You could have staff

- Your online business is an organization or partnership

- You file Employment, Excise, or Alcohol, Tobacco and Firearms taxes

- You withhold taxes paid on revenue (aside from wages) paid to a non-resident alien

- You could have a Keogh plan

You additionally must have an EIN should you’re concerned with all these organizations:

- Trusts, besides sure grantor-owned revocable trusts, IRAs, Exempt Group Enterprise Revenue Tax Returns

- Estates

- Actual property mortgage funding conduits

- Non-profit organizations

- Farmers’ cooperatives

- Plan directors

The right way to Apply On-line for an EIN

You may simply apply for an EIN on-line via the IRS web site. The IRS lets you decide whether or not you’re eligible, fill out a web based utility, and submit that utility to get your EIN instantly.

Take into account that there are limits when making use of for an EIN on-line, and also you’ll must restart your utility should you’re inactive for greater than quarter-hour. You may go to the on-line EIN utility web page to study extra concerning the on-line utility course of.

Advantages of Making use of for an EIN On-line

Utilizing on-line purposes is one in all our favourite ideas for tax planning. Making use of for an EIN on-line is a less complicated various to finishing a paper utility, and also you don’t have to fret about mailing in your utility. As quickly as you’re completed along with your utility, you’ll obtain an EIN for your enterprise should you fill the whole lot outright. When you apply by mail, it could possibly take greater than a month to obtain your EIN within the mail.

Making use of on-line may make it simpler to maintain all of your data organized. You may maintain essential paperwork useful whilst you fill out your utility. Whether or not you retailer the whole lot domestically or maintain essential paperwork on the cloud, you may entry them throughout your on-line utility.

The IRS makes use of a safe connection to encrypt and defend your information while you apply on-line. The place mail theft will be a problem while you mail in an utility, you may relaxation assured that your delicate information is protected while you apply via the IRS web site.

Info Wanted to Full the Kind SS-4

Earlier than finishing your Kind SS-4 and making use of for an EIN, you’ll want some details about your self and your enterprise. This consists of the kind of entity and principal exercise of your enterprise, in addition to private details about your self.

Take into account that you’ll want to offer your SSN to finish a Kind SS-4. When you can’t present an SSN for some cause, you can even present an Particular person Taxpayer Identification Quantity (ITIN) to use for an EIN for your enterprise.

You’ll additionally want to offer the date your enterprise was began or acquired, the projected variety of staff within the subsequent 12 months, and different particulars about your enterprise. You additionally must specify whether or not your anticipated staff will fall below the agricultural, family, or one other class.

Once you fill out your Kind SS-4, you’ll be requested to test a field that describes the principal exercise of your enterprise. That is primarily what your enterprise does. When you need assistance selecting the best class, a tax professional can assist.

On the applying, you additionally must specify what kind of enterprise you’re making use of for. Some choices embrace sole proprietorship, partnership, company, and church or church-controlled group. Be sure you choose the precise kind of group based mostly on the kind of enterprise you could have.

Close to the top of the applying, you’ll be requested should you’ve utilized for and obtained an EIN up to now. When you have, be sure you have that earlier EIN useful as a result of that you must enter it on the applying.

The right way to Put together and Submit a Onerous Copy Kind SS-4

You even have the choice to arrange a paper Kind SS-4 and mail it to the IRS. Nonetheless, most taxpayers discover the net possibility rather more handy since you may obtain your EIN instantly.

You might submit the paper Kind SS-4 by fax or mail. For extra data, see the Directions for Kind SS-4.

Underneath the Fax-TIN program, you may obtain your EIN by fax typically inside 4 enterprise days. Full and fax Kind SS-4 to the IRS utilizing the suitable fax quantity listed in The place To File or Fax. Fax-TIN numbers can solely be used to use for an EIN. The numbers could change with out discover. Fax-TIN is out there 24 hours a day, 7 days per week. You should definitely present your fax quantity so the IRS can fax the EIN again to you.

When you resolve to use by mail, ensure that to finish Kind SS-4 a minimum of 4 to five weeks earlier than you will have the EIN. Signal and date the applying and mail it to the suitable handle listed in The place To File or Fax. You may name the IRS at 800-829-4933 to ask concerning the standing of an utility by mail.

When you make a mistake in your Kind SS-4, you need to ship a letter to the IRS to allow them to know that you must appropriate your data. The IRS provides you with directions to appropriate any data which may be incorrect. As well as, you’ll want to finish Kind 8822-B if that you must make any adjustments to your Kind SS-4. It’s essential to maintain your SS-4 present.

When you require help with finishing your Kind SS-4 or have every other questions, TurboTax is right here to assist. Whether or not you wish to do your taxes your self or have a TurboTax professional file for you, we’ll be sure you get each greenback you deserve and your largest attainable refund – assured.