Individuals have been on the transfer in 2023, and lots of selected low-tax states over high-tax ones. That’s the discovering of current U.S. Census Bureau interstate migration information and industrial datasets launched final week by U-Haul and United Van Traces.

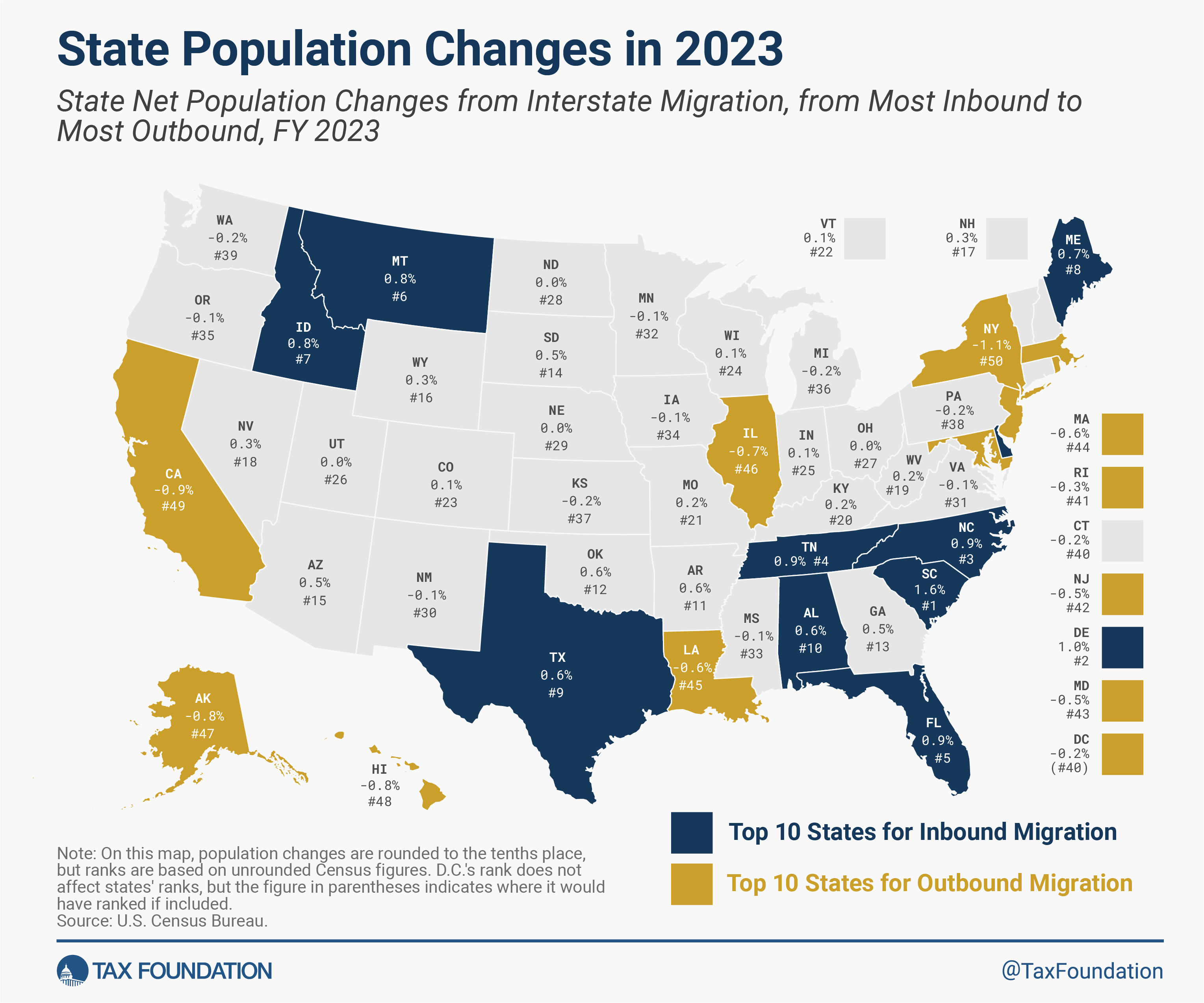

The U.S. inhabitants grew 0.49 % between July 2022 and July 2023, a rise from the earlier 12 months’s 0.37 %. Whereas worldwide migration contributed to inhabitants development on the nationwide degree, interstate migration was the important thing driver of web inhabitants modifications on the state degree. The U.S. Census Bureau’s most up-to-date interstate migration estimates present that New York misplaced the best share of its inhabitants (1.1 %) to different states between July 2022 and July 2023. Not far behind was California, which misplaced 0.9 % of its residents, adopted by Hawaii (0.8 %), Alaska (additionally 0.8 %), and Illinois (0.7 %). On the different finish of the spectrum, South Carolina noticed the best inhabitants development from web home inbound migration (1.6 %), adopted by Delaware (1.0 %) and North Carolina, Tennessee, and Florida (all 0.9 %).

This inhabitants shift paints a transparent image: Individuals are leaving high-taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities providers, items, and actions.

, high-cost-of-living states in favor of lower-tax, lower-cost options. Of the 32 states whose general state and native tax burdens per capita have been beneath the nationwide common in 2022, 24 skilled web inbound migration in FY 2023. In the meantime, of the 18 states and D.C. with tax burdens per capita at or above the nationwide common, 14 of these jurisdictions skilled web outbound migration.

Although just one element of general tax burdens, the particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges improve with earnings. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years previous, particular person earnings taxes are the largest supply of tax income within the U.S.

is especially illustrative right here. Within the high third of states for inhabitants development attributable to home migration, the common mixed high marginal state earnings tax price is about 3.8 %. Within the backside third (together with D.C.), it’s 3.5 proportion factors larger, at about 7.3 %.

5 states within the high third forgo taxes on wage earnings (Florida, South Dakota, Tennessee, and Texas, in addition to Washington, which taxes capital positive aspects earnings however not wage earnings). Even the best high marginal price in that cohort—Maine’s 7.15 %—remains to be decrease than the common high price within the backside third of states, and decrease than lots of its Northeastern U.S. friends.

Among the many backside third, 5 jurisdictions—California, Hawaii, New Jersey, New York, and the District of Columbia—have double-digit earnings tax charges, and (excepting Alaska, with no earnings tax), the bottom price is in Pennsylvania, the place a low state price of three.07 % is paired with a few of the highest native earnings tax charges within the nation. Six states within the backside third have native earnings taxes; just one within the high third does.

Simply as states with decrease earnings tax charges—or no earnings tax in any respect—have confirmed extremely engaging to interstate movers, so have states with extra impartial tax constructions. Of the 12 states that levy single-rate, versus graduated-rate, taxes on wage and wage earnings, all however 4 (Illinois, Michigan, Mississippi, and Pennsylvania) skilled web inbound migration. It is usually value noting that on the 2023 State Enterprise Tax Local weather Index, which evaluated the competitiveness of state tax constructions as of July 1, 2022, of the 25 top-ranking states, 20 skilled web inbound migration. In the meantime, of the 25 lowest-ranking states on the Index, 16 and D.C. skilled web outbound migration.

Information launched final week from U-Haul and United Van Traces, whereas much less strong than Census information—and undoubtedly influenced by these corporations’ geographic protection—present related general migration patterns. Each corporations see states like California, Illinois, Massachusetts, and New Jersey among the many largest losers, and states like South Carolina, North Carolina, Florida, Tennessee, and Texas among the many largest web gainers.

How Does Your State Examine?

Get info about taxes in your state and across the U.S.

These trade research file whole migrations, whereas inhabitants information may be put in proportion phrases. As such, states like Florida and Texas—which, in line with the Census Bureau, had probably the most inhabitants development in nominal phrases—present up prominently within the shifting trade information whereas lower-population states, like Delaware, Montana, and Idaho, are decrease on the trade information lists although they noticed inhabitants surges.

One other story from the trade information that’s much less obvious in Census inhabitants information is regional competitors, even amongst comparatively high-tax states. Vermont is first within the United Van Traces information however middle-of-the-pack for general inhabitants change as a result of the state benefited from outmigration from densely populated Northeastern cities.

Equally, U-Haul has comparatively few inbound journeys to New Hampshire, Oklahoma, and some different states in comparison with United Van Traces and, extra importantly, to Census information on inhabitants development. Comparatively native strikes, akin to these throughout the D.C. metropolitan space, could make a jurisdiction just like the District of Columbia appear to be it’s doing very nicely on United Van Traces information although the Census information exhibits web outbound, quite than inbound, migration. The trade information has limitations, but it surely stays informative.

Individuals transfer for a lot of causes. Generally taxes are expressly a part of the calculation, and oftentimes they play an oblique position by contributing to a broadly favorable financial surroundings. And different instances, in fact, they don’t think about in any respect. The Census information and these trade research can not inform us precisely why every individual moved, however there is no such thing as a denying a really robust correlation between low-tax, low-cost states and inhabitants development, in addition to a powerful correlation between good tax constructions and inhabitants development. On condition that many states, over the previous few years, have responded to strong revenues and heightened state competitors by slicing taxes and bettering their tax constructions—akin to by shifting from graduated-rate to single-rate earnings taxes—these traits could solely get extra pronounced.

The pandemic accelerated modifications to the way in which we dwell and work, making it far simpler for individuals to maneuver—they usually have. As states work to keep up or enhance their aggressive benefit, they need to take note of the place persons are shifting, and attempt to perceive why.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Share