Word: This put up is a part of a collection on Portugal’s taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of basic authorities companies, items, and actions.

coverage, analyzing the way it compares internationally, offering an evaluation of present coverage, and discussing pathways towards reform. See right here and right here. For a whole evaluation of this and different tax reform choices in Portugal, obtain our Portuguese-language primer.

In its method to taxing actual property, Portugal applies each recurrent taxes on immovable property (Imposto Municipal sobre Imóveis, or IMI) in addition to a turnover tax on property transfers. Whereas Portugal may implement enhancements to its property taxA property tax is primarily levied on immovable property like land and buildings, in addition to on tangible private property that’s movable, like autos and tools. Property taxes are the only largest supply of state and native income within the U.S. and assist fund faculties, roads, police, and different companies.

base, recurrent taxes on property are one of the environment friendly kinds of taxes, and Portugal’s property tax burden lies on the European common. In distinction, Portugal’s turnover tax on actual property transfers (Imposto Municipal sobre as Transmissões Onerosas de Imóveis, or IMT) locations a severe drag on financial development by making it tougher for folks to relocate for higher jobs and residing circumstances whereas constraining funding into the event of housing and buildings. Reform efforts ought to consider eliminating the switch tax and changing it with VAT on new buildings and constructions. Any ensuing income losses from eliminating the switch tax could be simply offset with much less dangerous measures.

Recurrent Taxes on Property

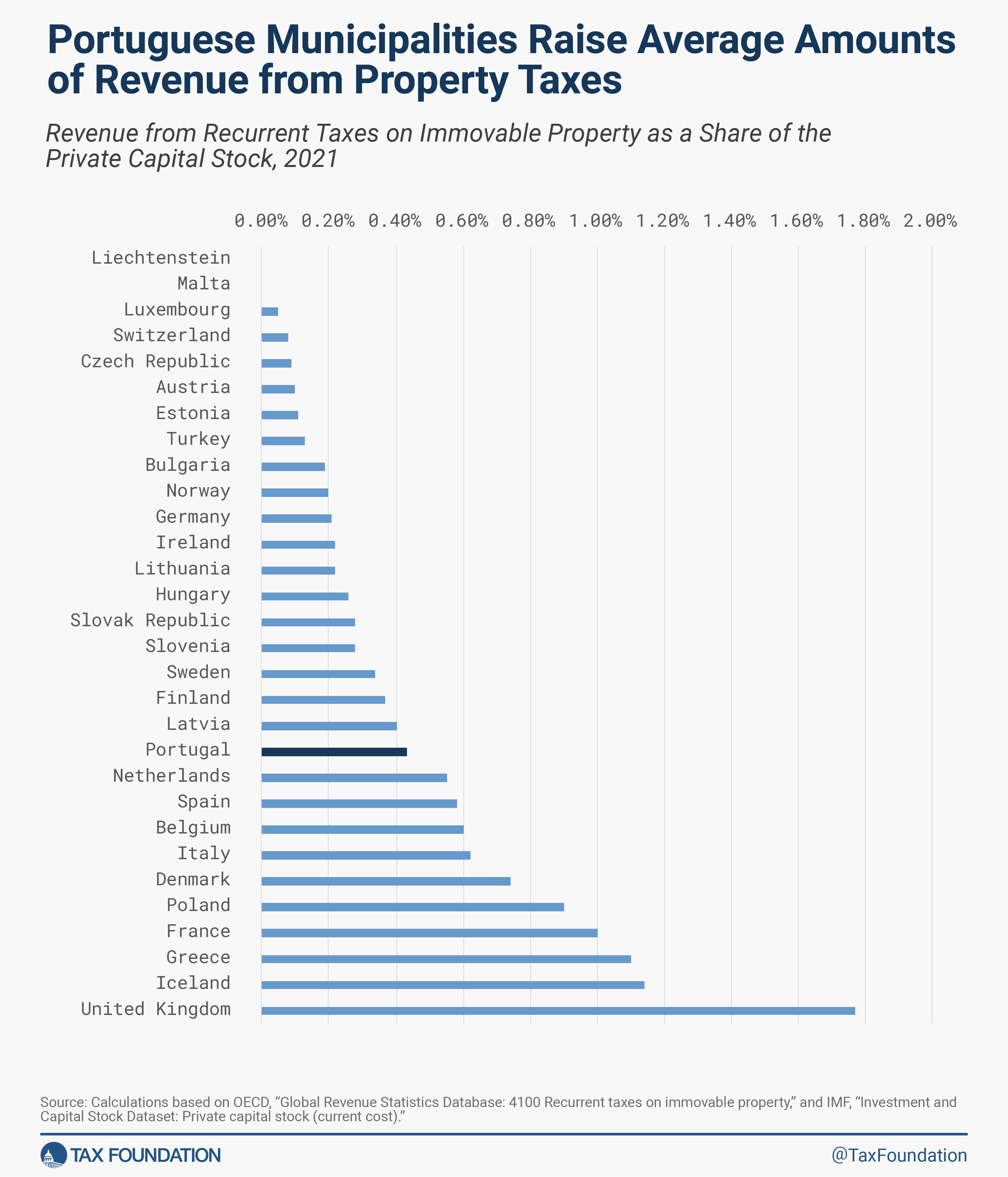

For native governments, recurrent taxes on immovable property symbolize an essential supply of tax income. In 2021, Portuguese municipalities collected EUR 1.6 billion in property tax revenues. That is equal to 0.43 p.c of the worth of Portugal’s personal capital inventory, a determine an identical to the common of the 30 European nations with accessible information.

Like most European nations, Portugal’s property tax is levied on the worth of each land and buildings and is deductible from the company earnings taxA company earnings tax (CIT) is levied by federal and state governments on enterprise income. Many firms usually are not topic to the CIT as a result of they’re taxed as pass-through companies, with earnings reportable underneath the particular person earnings tax.

. In comparison with most different kinds of taxes, recurrent taxes on immovable property are inclined to have the least dangerous impression on financial development.

Nonetheless, excessive property taxes can discourage funding in infrastructure, which companies must pay extra taxes on. Because of this, companies could select to find away from locations with excessive property taxes. One choice to enhance the effectivity of property taxes can be to repeal exemptions for particular makes use of of property, corresponding to renewable power infrastructure. Additional enhancements may very well be made by shifting the tax base in direction of land and away from buildings and constructions, an method taken by Estonia and a few federal states of Australia and Germany.

Property Switch Tax and Stamp Obligation

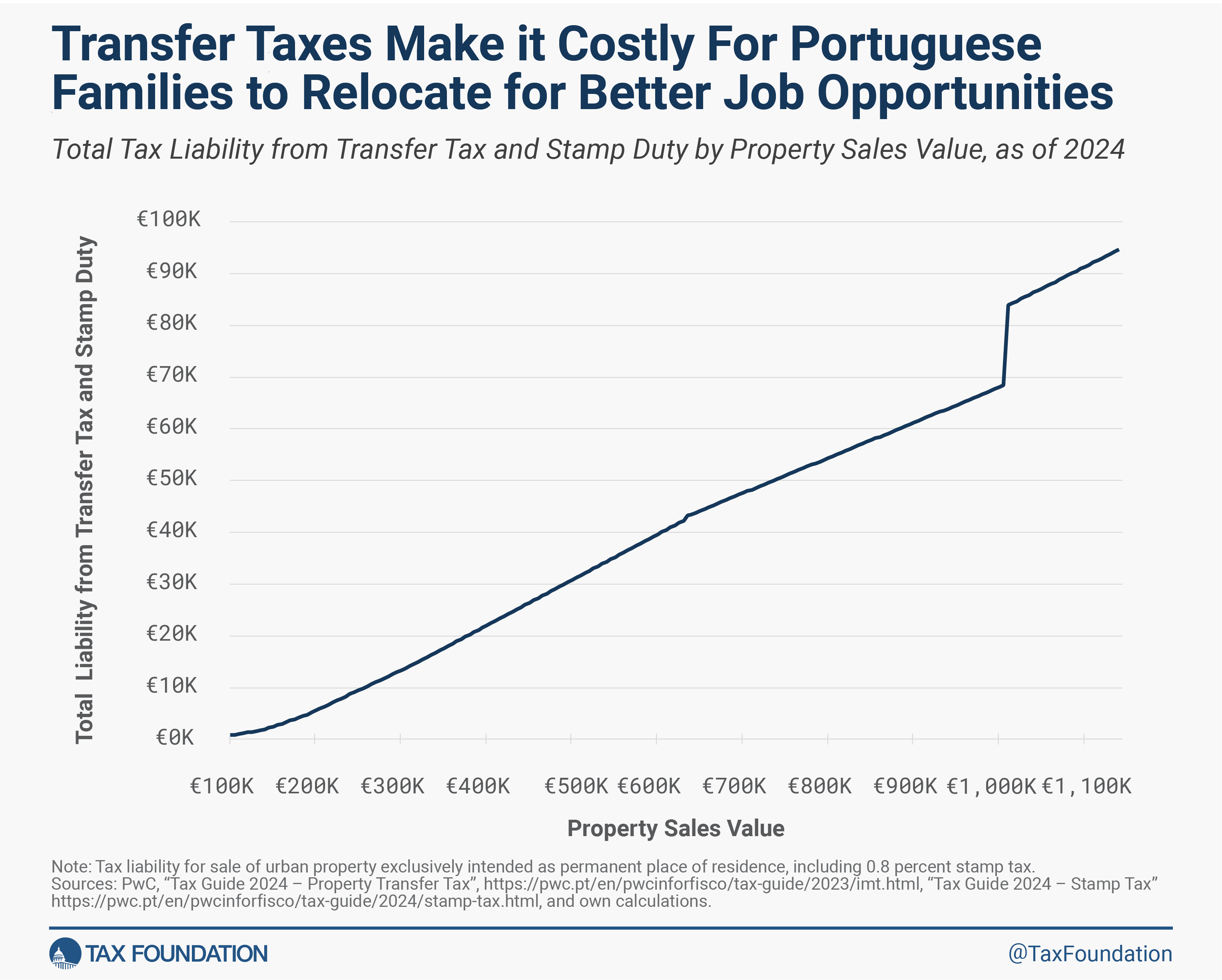

Portugal additionally levies a property switch tax (IMT) on the gross sales worth of actual property at each switch of possession, utilizing a graduated price schedule with charges between 0.8 and eight.8 p.c on city residential property, together with a 0.8 p.c stamp obligation.

The switch tax takes the type of a turnover tax, with none deductions for buying and funding prices, making such a tax design significantly dangerous to capital funding.

The property switch tax locations a hefty price ticket on the reallocation of actual property that limits folks’s means to make modifications of their residing and dealing areas. Near 80 p.c of the Portuguese reside in households that personal their house reasonably than hire it. For these households, the property switch tax makes it tougher to relocate for higher job alternatives whereas conserving aged folks in houses which can be too massive for them. For companies, switch taxes additionally make it tougher to regulate the dimensions of their operations based mostly on their spatial necessities.

Analysis additionally finds that prime transaction tax charges scale back capital funding in buildings and constructions because the transaction prices scale back the worth of a constructing over its lifetime. The lower in property values interprets into reductions in new developments, driving up rental costs and reducing housing affordability. A current research on switch tax charges in German states finds that the amount of recent residential building misplaced attributable to a rise in switch taxes from 3.5 p.c to charges between 5.5 and 6 p.c is larger than the income raised by larger charges.

Given these outsized effectivity prices, Portugal ought to eradicate its property switch tax and as an alternative levy VAT on new buildings and constructions. This may enhance the incentives for the event of housing and constructions to align with these for different items and companies, enable owners to take advantage of their residing house, and assist folks relocate to higher jobs.

In 2021, revenues from the switch tax stood at EUR 1.3 billion. Municipalities can compensate for the income loss by way of a mixture of larger property tax charges and decrease authorities spending on housing growth, which constituted EUR 400 million in 2021. The central authorities may additionally assist municipalities by apportioning a share of VAT income again to its supply jurisdictions.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share