I’m persevering with to work on knowledge from HM Income & Customs on its accounts, the tax hole and different points associated to its administration of the UK’s tax system.

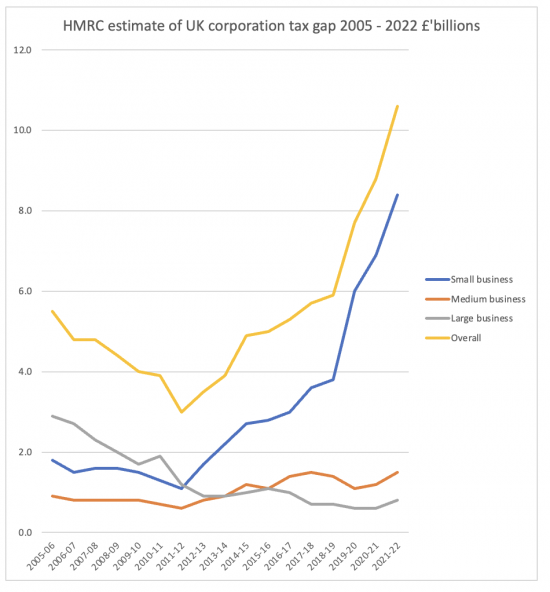

When doing so, I created this chart based mostly on knowledge in part 5 of the information information on the 2023 tax hole report, downloadable from the HMRC web site:

The tax hole is the distinction between the tax that HMRC suppose must be collected every year they usually quantity that they really get.

As will likely be obvious, since I and others started work on tax justice the big firm company tax hole has fallen from about 8 per cent of revenues to round 2 per cent of revenues. There are, after all, points I’d disagree with on each estimates, however that this pattern is appropriate is, I’m positive, appropriate.

We introduced stress to bear on the federal government on the big firm tax hole from 2005. I created country-by-country reporting that’s now in use in about 80 nations, together with the UK, to sort out this subject. Giant firm tax abuse is not the problem it was. Investing additional effort in it’s not a precedence within the UK and plenty of different nations. It truly is time that the present misguided tax justice motion took be aware: they’re barking up the mistaken tree when that is nearly the one subject that they’re nonetheless keen to speak about.

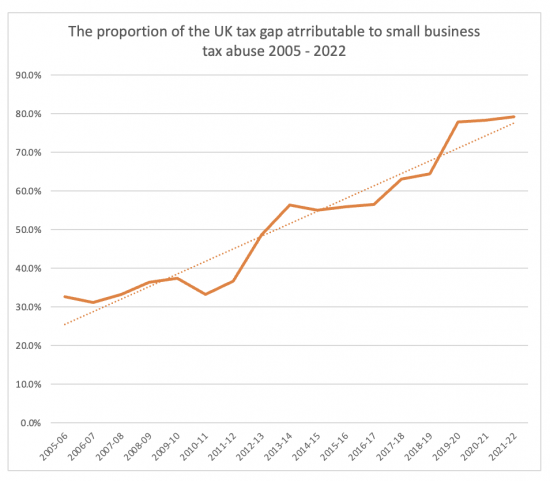

The chart does, in itself, show why. The small enterprise tax hole has gone by the roof. As a proportion of the overall UK company tax hole it has modified like this:

Small firm non-payment of tax is now the problem within the UK company tax area. HM Income & Customs do, I feel, nonetheless significantly underestimate this tax hole and its ramifications by suggesting that it is likely to be £8.4 billion a yr. The big enterprise tax hole is, of their estimate, simply ten per cent of that.

However the query is, why is that this? I’m musing on there being one very apparent trigger. Have a look at the inflexion level within the prime chart. It’s 2011/12. That’s when HM Income & Customs started to shut native tax workplaces, finish on-site PAYE inspection, and, most particularly, started the method of ending nearly all on-site VAT inspections of small companies.

If VAT will not be paid, gross sales go unrecorded. If gross sales go unrecorded, so too does revenue. So, too, by the way, does PAYE on the cash illicitly taken from the businesses concerned. The small enterprise company tax losses since 2012 arising consequently may need amounted to £25 billion in my estimate. The opposite losses could have exceeded that sum, simply. And that’s all as a result of HMRC tried to avoid wasting £1 billion, perhaps, a yr.

We’re paying an unlimited value for HM Income & Customs mismanagement in that case. They took HM Income & Customs out of the neighborhood and the worth we’re paying for that’s very excessive.