I preserve occupied with this column from Alex Johnson final month round monetary well being and financial savings. To me, one of many greatest disappointments across the previous decade of fintech innovation is how little we’re transferring the needle for the monetary well being of shoppers.

There are many nice instruments which were developed up to now decade however most individuals are nonetheless residing paycheck to paycheck.

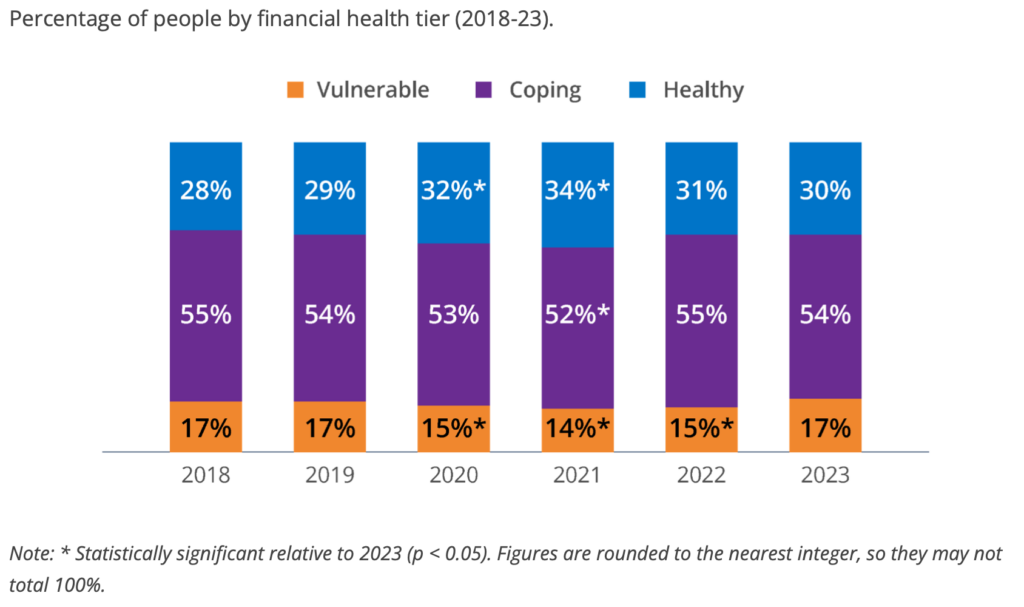

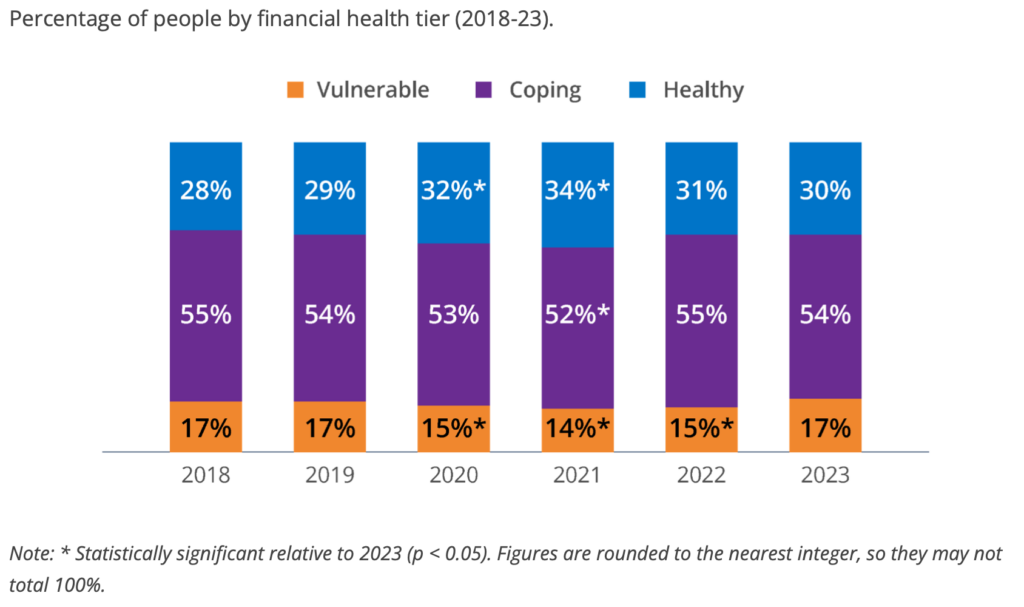

Check out the chart under from the newest Monetary Well being Community’s Annual Pulse Survey.

This exhibits the share of people who find themselves financially wholesome, financially coping and financially weak. The survey goes into nice element about how one suits inside a class however suffice it to say that as a rustic we’re doing about the identical financially yearly with a small adjustment for the pandemic stimulus in 2020 and 2021.

I like how Alex put it in his column. We have to cease treating the “residing paycheck to paycheck” phenomenon as a situation that must be cured and begin treating it as one thing that must be managed, or as Alex places it made “as benignly power as potential.”

He brings up the fascinating concept of a Payroll Financial institution Account to assist folks save, separating long-term monetary allocations and short-term spending selections. There are definitely methods to do this right now however they do require fiscal self-discipline and that’s the place so many people fall brief.

I imagine an important technique to handle the residing paycheck to paycheck phenomenon is with emergency financial savings accounts. And there’s a new sort of account that may assist with this.

New in 2024: Pension Linked Emergency Financial savings Accounts

There’s a little-discussed change that started at the beginning of the yr that may be a actual try to deal with this drawback. To be financially wholesome everybody wants an emergency financial savings account, that’s extensively accepted. However learn how to get folks began?

New laws will assist present a lift. Most of the provisions of the SECURE ACT 2.0 got here into power at the beginning of January and one characteristic that I’m very keen on is the Pension-Linked Emergency Financial savings Account (PLESA).

Because the title implies it is a financial savings account that’s linked to your current 401(okay) or comparable retirement plan. Beginning on January 1, retirement plan sponsors are actually ready so as to add a PLESA to their retirement plan.

My favourite characteristic of this plan is that it permits for auto-enrolment. A PLESA is a Roth-type account which means that contributions are with after-tax {dollars}. The utmost contribution is $2,500, in truth, your account just isn’t allowed to go above this restrict. It’s for emergency financial savings, it’s not an funding account. Members could make withdrawals at any time on a month-to-month foundation with the primary 4 withdrawals taken at no cost.

One other cool characteristic is the potential of an employer match. If an worker is receiving a 401(okay) match from their employer then they will additionally obtain a match on their PLESA, though the cash from the match goes into the 401(okay) account, not the PLESA account which I discover just a little unusual. Nonetheless, by contributing to a PLESA workers may help construct their retirement accounts courtesy of their employers.

Will this clear up the emergency financial savings disaster in America? That’s extremely unlikely, but it surely is a wonderful new instrument that would assist tens of millions of individuals construct emergency financial savings.

Fintech can be attacking emergency financial savings

Many fintech corporations are additionally tackling the emergency financial savings problem.

I actually like what SecureSave is doing (hearken to my podcast with CEO Devin Miller together with co-founder Suze Orman). It’s a comparable idea to a PLESA insofar as it’s an employer-backed emergency financial savings program. However it has not one of the regulatory necessities of a PLESA. Being a fintech firm, there’s a main give attention to consumer expertise with only a three-click signup course of. They permit for employer matching as properly.

One other fintech firm that’s utilizing a celeb connection to spice up emergency financial savings is Acorns with their new Mighty Oak Card endorsed by Dwayne “The Rock” Johnson. It is a full-featured debit card linked to a checking account with a built-in emergency financial savings account that pays 5% curiosity.

I additionally like what Sunny Day Fund is doing. It’s much like SecureSave, it’s an employer-sponsored financial savings account they usually acquired on my radar after they have been a part of the 2022 cohort of the Monetary Options Lab.

I also needs to give a shout out to Blackrock and the Blackrock Financial savings Initiative in collaboration with the Monetary Well being Community, Commonwealth and Frequent Cents Lab – all organizations I do know and respect. Since launching in 2019 the initiative has reportedly reached 10 million folks and created $2 billion in liquid financial savings concentrating on giant corporations and their worker financial savings packages.

This isn’t an enormous class for fintech since you want lots of scale to make the economics work. However it stays one of the crucial necessary areas of innovation.

We’re not going to unravel the monetary well being disaster in a single day however we have to give everybody instruments to assist. Each the federal government and fintech now have some very helpful improvements that, with time, could make an enormous distinction.