Every tax season, widespread themes emerge. With lingering COVID-era tax advantages, not too long ago enacted federal laws, and associated tax credit, the time and effort devoted to tax analysis represents a major hurdle for a lot of professionals within the tax and accounting subject. This yr is proving to be no totally different.

Bounce to:

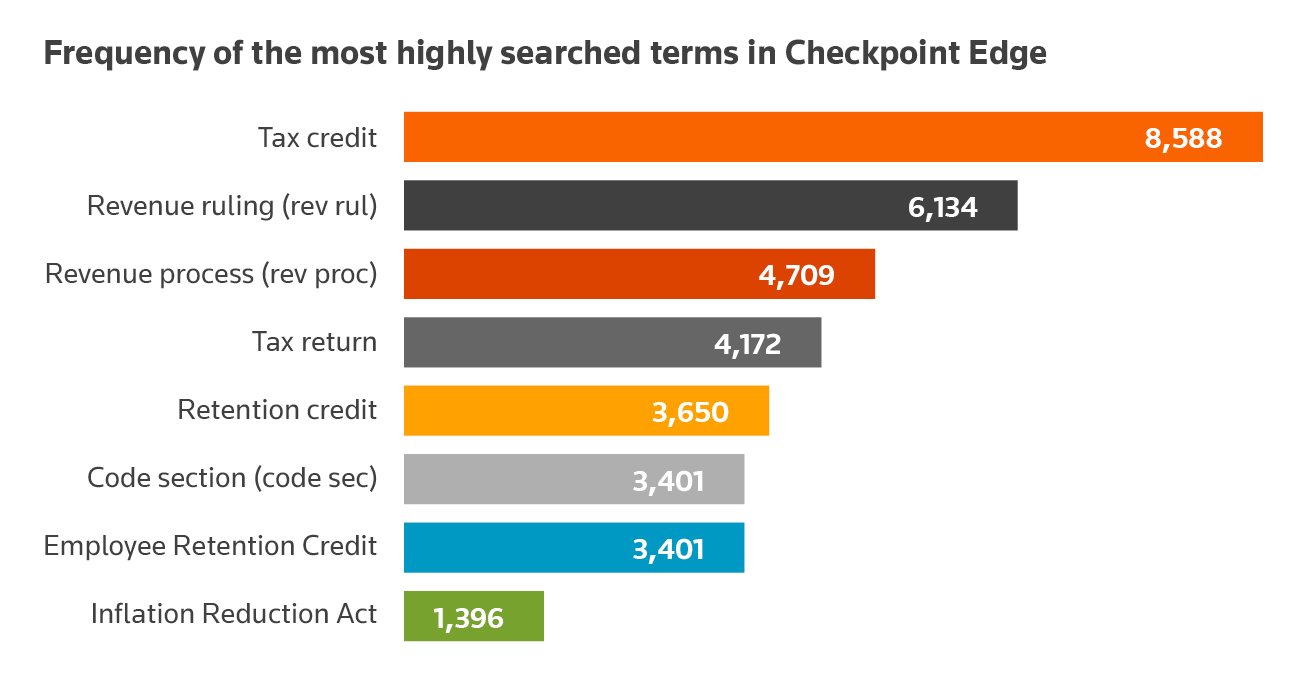

So, what are customers looking for this tax season? In accordance with our most up-to-date evaluation, a number of the most searched phrases inside Checkpoint Edge are tax credit, Worker Retention Credit score (ERC), and the Inflation Discount Act (IRA).

To successfully deal with these topics and extra, tax and accounting consultants at present should have complete and present tax analysis instruments and professional editorial evaluation at their disposal.

Let’s check out the solutions behind one in every of these scorching matters (the Worker Retention Credit score) after which learn the way a trusted tax analysis resolution can remodel analysis workflow and supply professional insights into the matters which can be high of thoughts for accountants and purchasers.

Understanding the ERC

It’s no secret that the Worker Retention Credit score has been difficult for employers who wrestle to know complicated eligibility necessities and the method to say the tax credit score, and for the IRS who continues to course of a big quantity of claims, lots of that are doubtful, regardless of the expiration of the credit score.

As a result of the ERC expired for many employers on September 30, 2021, the credit score is claimed by submitting an amended employment tax return on Kind 941-X. Nonetheless, Kind 941-X could presently solely be submitted by paper, rising processing occasions. (It needs to be famous that deliberate adjustments are coming in June of 2024.) The IRS is dedicating a number of the almost $80 billion in funding from the Inflation Discount Act of 2022 to supply extra digital submitting choices for enterprise and employment tax returns, together with Kind 941-X.

Regardless of IRS steerage, income rulings, and procedures on the credit score, aggressive advertising has led to a flood of invalid claims filed retroactively that has led to an enormous backlog. This led the IRS to name a halt of recent claims processing on September 14, 2023, and the moratorium continues to stay in impact. Within the meantime, the IRS renewed requires companies to overview their eligibility for the ERC because the company’s Felony Investigations crew begins a collection of instructional periods for tax professionals. The IRS has additionally established a withdrawal course of for companies that want to withdraw an unprocessed invalid ERC declare in addition to a Voluntary Disclosure Program for companies who obtained a credit score for an invalid declare and want to return the proceeds to keep away from penalties and curiosity (expires March 22, 2024).

The way to declare the ERC

The ERC is an extremely complicated credit score, and there are very particular eligibility necessities concerned with claiming it. Employers can declare the ERC on an authentic or amended employment tax return for certified wages paid between March 13, 2020, and Dec. 31, 2021. Nonetheless, to be eligible, employers should have:

- Sustained a full or partial suspension of operations because of orders from an acceptable governmental authority limiting commerce, journey, or group conferences due to COVID-19 throughout 2020 or the primary three quarters of 2021,

- Skilled a major decline in gross receipts throughout 2020 or a decline in gross receipts throughout the first three quarters of 2021, or

- Certified as a restoration startup enterprise for the third or fourth quarters of 2021.

Employers who didn’t declare the ERC on an initially filed quarterly payroll tax return in 2021 can declare the credit score by submitting an amended return for every quarter for which they had been eligible for the credit score. Employers who want to declare the ERC should file amended returns for any quarter ending in 2021 no later than April 15, 2025. Employers who file an annual payroll tax return can file an amended return utilizing Kind 944-X or 943-X to say the credit.

Employers claiming the credit score on an amended payroll tax return can also have to file an amended revenue tax return for the tax yr during which the credit score is claimed. Employers also needs to be sure that wages taken under consideration for the COVID-19 worker retention credit score weren’t taken under consideration for different credit.

Navigating the ERC with professional insights

With an understanding of the complexities of the Worker Retention Credit score, having an understanding about learn how to navigate its intricacies is of equal significance. Amidst the challenges posed by navigating eligibility standards, processing procedures, and benefiting from packages presently accessible for individuals who submitted invalid claims, a dependable analysis resolution turns into indispensable. That is the place many professionals discover Checkpoint Edge to be a useful instrument.

With complete assets and professional evaluation, Checkpoint Edge can make clear the intricacies of the ERC, offering worthwhile insights and sensible steerage. From understanding eligibility necessities to navigating the small print of claiming the credit score, leveraging Checkpoint Edge can deepen your understanding of the ERC and elevate your experience in tax analysis.

With an intuitive platform, customers acquire entry to a wealth of data tailor-made to demystifying the ERC. From explanations of eligibility standards to guides on claiming the credit score, Checkpoint Edge equips professionals with the knowledge they should navigate the complexities of tax legislation with ease.

Remodel tax season analysis with Checkpoint Edge

In the case of tax traits and scorching matters, the one fixed is change. To succeed, at present’s accountants require a tax analysis platform that gives in-depth evaluation with associated information, commentary, and really helpful paperwork that seamlessly combine inside their workflows, so analysis work could be accomplished shortly and confidently.

Powered by AI and machine studying, Checkpoint Edge transforms your workflow with quick, trusted solutions from absolutely vetted sources on all kinds of tax matters. Achieve entry to essentially the most up-to-date and intuitively organized collections of requirements, legal guidelines, laws, and company steerage backed by rigorous editorial processes.

With verified, dependable, and trusted public websites, Checkpoint Edge affords simultaneous search and entry to IRS, AICPA, TEI, the Massive 4, and complete state tax companies — multi function place. Plus, get in-depth evaluation of recent tax laws inside 24 hours and trending tax matters delivered to your inbox every morning.

For those who’re prepared to remain forward of the sport, anticipate your purchasers’ wants, and ship additional worth by sharing insights on the tax matters and traits that have an effect on your purchasers most, request a free trial of Checkpoint Edge at present.