EUR/USD: Market Anticipates Federal Reserve Price Minimize

● We revealed our international forecast for EUR/USD for the upcoming yr within the final week of 2023. Now, transferring from long-term projections, we return to our conventional weekly opinions, which have been carried out by the NordFX analytical group for over a decade.

The primary occasion of the previous week was undoubtedly the U.S. inflation information. The figures launched on Thursday, January 11, confirmed that the Shopper Value Index (CPI) rose by 3.4% year-on-year, in comparison with a consensus forecast of three.2% and a earlier worth of three.1%. On a month-to-month foundation, shopper inflation additionally elevated, registering 0.3% towards a forecast of 0.2% and a earlier determine of 0.1%. Then again, the core CPI, which excludes unstable meals and oil costs, decreased to three.9% from a earlier worth of 4.0% (year-on-year).

● Recall that along with his dovish remarks on the December press convention, Federal Reserve Chairman Jerome Powell created the impression that he’s not the staunch inflation fighter he seemed to be earlier. This implies that the U.S. financial authorities will now reply extra flexibly to modifications on this indicator. Consequently, the combined CPI information additional satisfied market individuals that the Fed will start to ease its coverage by the top of Q1 2024. In keeping with CME Fedwatch, the chance of a 25 foundation level fee minimize in March elevated to 68% from 61% previous to the discharge of the statistics. In the meantime, strategists on the largest banking group of the Netherlands, ING, count on a big weakening of the greenback in the direction of the top of Q2: that is after they anticipate EUR/USD will begin its rally to 1.1500. Till then, of their view, the forex market will stay fairly unstable.

● Relating to the Eurozone, statistics launched on Monday, January 8, indicated that the state of affairs within the shopper market is unhealthy, however not as dire as anticipated. Retail gross sales confirmed a decline of -1.1% year-on-year. This determine, though larger than the earlier worth of -0.8%, was considerably under the forecast of -1.5%.

On this context, the assertion by European Central Financial institution (ECB) board member Isabel Schnabel appeared fairly hawkish. She opined that financial sentiment indicators within the Eurozone have probably reached their nadir, whereas the labour market stays secure. Schnabel additionally didn’t rule out the potential of a mushy touchdown for the European economic system and a return to the inflation goal of two.0% by the top of 2024. In keeping with her, that is nonetheless achievable, however it could require the ECB to take care of a excessive rate of interest. This distinction between the hawkish stance of the pan-European mega-regulator and the dovish feedback of its abroad colleagues supported the euro, stopping EUR/USD from falling under 1.0900.

● Knowledge on industrial inflation within the U.S., launched on the finish of the workweek on Friday, January 12, additionally confirmed a decline on this indicator, however it didn’t have a powerful affect on the quotes. The Producer Value Index (PPI) was 1.8% year-on-year (forecast 1.9%, earlier worth 2.0%), and the month-to-month PPI, like in November, recorded a lower of -0.1% (forecast +0.1%).

Following the discharge of this information, EUR/USD closed the workweek at 1.0950.

At present, specialists’ opinions concerning the close to way forward for the pair present no clear path, as they’re evenly break up: 50% voted for a strengthening of the greenback, and 50% sided with the euro. Technical evaluation indicators additionally seem fairly impartial. Amongst development indicators on D1, the stability of energy between purple and inexperienced is 50% to 50%. Amongst oscillators, 25% have turned inexperienced, one other 35% are in a impartial gray, and the remaining 40% are purple, with 1 / 4 of them signalling that the pair is oversold. The closest assist for the pair is within the zone of 1.0890-1.0925, adopted by 1.0865, 1.0725-1.0740, 1.0620-1.0640, 1.0500-1.0515, 1.0450. Bulls will encounter resistance within the areas of 1.0985-1.1015, 1.1185-1.1140, 1.1230-1.1275, 1.1350, and 1.1475.

● Subsequent week, notable financial occasions embrace the discharge of Shopper Value Index (CPI) information for Germany on Tuesday, January 16, and for the Eurozone on Wednesday, January 17. Moreover, Wednesday will carry statistics on the state of the U.S. retail market. On Thursday, January 18, the standard figures for preliminary jobless claims in the USA will probably be launched. The identical day, we are going to be taught the worth of the Philadelphia Federal Reserve’s Manufacturing Enterprise Outlook Survey, and on Friday, the College of Michigan’s Shopper Sentiment Index will probably be revealed. Moreover, merchants ought to be conscious that Monday, January 15, is a public vacation within the U.S. because the nation celebrates Martin Luther King Jr. Day.

GBP/USD: Pound Retains Potential for Development

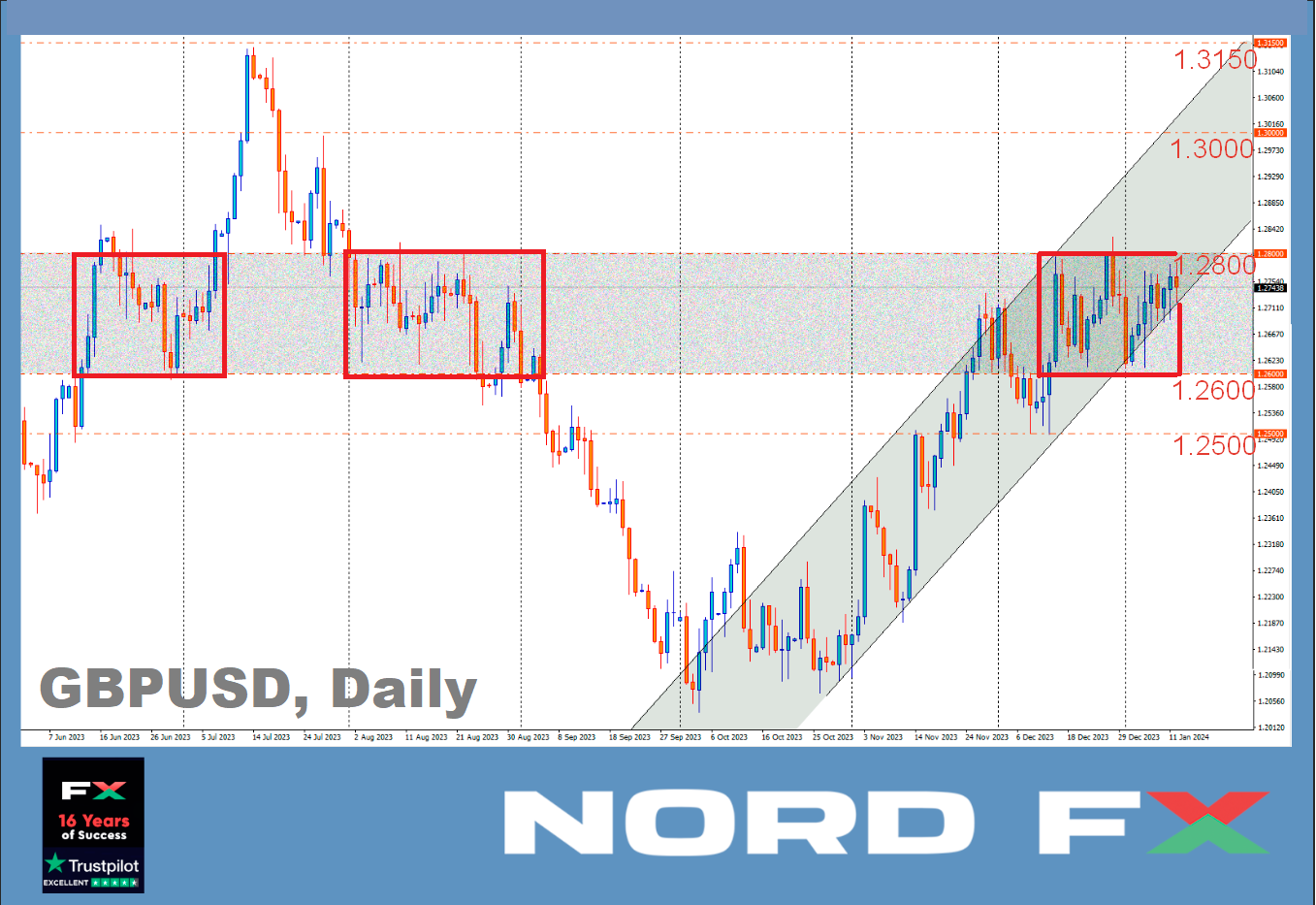

● Earlier than the New 12 months holidays, GBP/USD reached its highest degree since August 2023, touching 1.2827. It then fell by greater than 200 factors to the decrease line of the ascending channel and, bouncing off it, started to rise once more. On the time of scripting this forecast, it’s tough to confidently say that the pound has returned to a agency upward development. The dynamics of the final 4 weeks will be interpreted as a sideways development. The same sample, particularly within the 1.2600-1.2800 zone, was noticed in August. Again then, it was merely a short lived respite earlier than the pair’s fall continued with renewed vigour. It is potential that we’re witnessing an identical situation now, however with a constructive signal as an alternative of a damaging one. If that is so, we might see GBP/USD within the 1.3000-1.3150 zone in the course of the first quarter.

● Final week, the British forex was bolstered by information on inflation within the U.S. and forecasts concerning a dovish pivot by the Federal Reserve. The UK’s Workplace for Nationwide Statistics (ONS) additionally supported the pound, reporting on Friday, January 12, that the nation’s GDP in November grew by 0.3% month-on-month, towards a forecast of 0.2% and a lower of -0.3% recorded in October. Moreover, the amount of producing output rose by 0.4% month-on-month in November (forecast 0.3%, earlier worth – a decline of -1.2%). On the identical time, the British FTSE 100 index rose by 0.8%, reflecting the market’s optimistic temper and its individuals’ urge for food for danger.

● GBP/USD concluded the week at 1.2753. In keeping with economists at Scotiabank, for the pound to take care of its bullish momentum, it must confidently overcome resistance within the 1.2800-1.2820 zone. “Nonetheless,” they write, “the absence of a breakthrough within the 1.2800 space might start to weary [market participants], and the value actions over the past month are nonetheless shaping up as doubtlessly bearish.”

Regardless of the pound retaining potential for development within the medium time period, the specialists’ forecast for the approaching days leans in the direction of the greenback. 60% of them voted for a fall within the pair, 25% for its rise, and 15% most popular to stay impartial. In distinction to the specialists, the symptoms nearly unanimously favour the British forex: among the many oscillators on D1, 90% are on the facet of the pound (with 10% impartial), and amongst development indicators, all 100% are pointing upwards. If the pair strikes south, it’ll encounter assist ranges and zones at 1.2720, 1.2650, 1.2600-1.2610, 1.2500-1.2515, 1.2450, 1.2330, 1.2210, 1.2070-1.2085. Within the occasion of an increase, it’ll face resistance at ranges 1.2785-1.2820, 1.2940, 1.3000, and 1.3140-1.3150.

● For the upcoming week, notable dates embrace Tuesday, January 16, when a big batch of labour market information from the UK will probably be launched. Shopper Value Index (CPI) information will probably be revealed on Wednesday, January 17, and retail gross sales figures within the UK will probably be accessible on Friday, January 19.

USD/JPY: U.S. CPI Outperforms Japan’s CPI

● The Financial institution of Japan (BoJ) is contemplating decreasing its inflation forecast for the 2024 fiscal yr to across the mid-2% vary in its upcoming quarterly report, set to be revealed on January 23. This information was reported by the Jiji company, citing Reuters, on Thursday, January 11. Japan’s actual wages fell by 3.0%. With a pointy slowdown in wage development, Tokyo’s Shopper Value Index (CPI) was under forecasts, dropping from 2.7% to 2.4%. Deciphering these information, analysts have begun to take a position that the Financial institution of Japan would possibly delay tightening its ultra-loose financial coverage. Following this logic, merchants had been suggested to open lengthy positions within the USD/JPY pair.

Nonetheless, after reaching a peak of 146.41 on January 11, the pair reversed and commenced to say no: the lower in U.S. inflation turned out to be way more vital for market individuals than the lower in Japan’s inflation. The truth that the rate of interest on the yen will stay at a damaging degree of -0.1% isn’t so essential. What’s extra necessary is that the speed on the greenback might quickly drop by 0.25%.

● Mathias Cormann, the Secretary-Common of The Organisation for Financial Co-operation and Growth (OECD), lately acknowledged that “the Financial institution of Japan has alternatives to additional take into account the extent of tightening of its financial coverage.” Nonetheless, we have now already heard many such obscure statements and opinions. In our view, it’s way more attention-grabbing to current the technical evaluation of the present state of affairs carried out by economists on the French financial institution Societe Generale.

“They write that USD/JPY sharply recovered after forming an intermediate low round 140.20 on the finish of final month. It has returned to the 200-Day Shifting Common (200-DMA) and approached the October low of 146.60-147.40, which acts as an intermediate resistance zone. After an unsuccessful try to interrupt by means of the 50-day transferring common on the degree of 146.41 on Thursday, January 11, the pair is retreating, indicating the beginning of an preliminary pullback. “Will probably be attention-grabbing to see if the pair can maintain the 200-DMA round 143.40. Failure would imply the danger of one other decline in the direction of 140.20-139.60. A breakthrough above 146.60-147.40 is critical to verify the continuation of the rebound [upwards],” they consider at Societe Generale.

● USD/JPY ended final week at 144.90. (Curiously, the present dynamics totally align with the wave evaluation we mentioned in our earlier evaluation). Within the close to time period, 40% of specialists anticipate additional strengthening of the yen, one other 40% are in favour of the greenback, and 20% maintain a impartial place. Relating to the development indicators on D1, 60% are pointing north, whereas the remaining 40% are wanting south. Among the many oscillators, 70% are colored inexperienced (with 15% within the overbought zone), 15% are purple, and the remaining 15% are impartial gray. The closest assist degree is within the zone of 143.75-144.05, adopted by 142.20, 141.50, 140.25-140.60, 138.75-139.05, 137.25-137.50, and 136.00. Resistance ranges are positioned at 145.30, 146.00, 146.90, 147.50, 148.40, 149.80-150.00, 150.80, and 151.70-151.90.

● No vital occasions in regards to the Japanese economic system are anticipated within the coming week

CRYPTOCURRENCIES: Day X Has Arrived. What’s Subsequent?

● What many have lengthy talked about and dreamed of has lastly come to go. As anticipated, on January 10, the U.S. Securities and Alternate Fee (SEC) authorised a batch of 11 functions from funding corporations to launch spot exchange-traded funds (ETFs) primarily based on Bitcoin. Because of this, ETFs from Grayscale, in addition to from Bitwise and Hashdex, had been admitted to the NYSE Arca inventory trade. BlackRock and Valkyrie funds are being launched on Nasdaq. CBOE will host ETFs from VanEck, Knowledge Tree, Constancy, Franklin Templeton, in addition to joint funds from ARK Make investments/21 Shares and Invesco/Galaxy.

Opposite to expectations, instantly after the approval, the BTC/USD pair’s fee rose solely to $47,652 as an alternative of a jubilant surge. The explanation for such a tepid response is that the market had already priced on this occasion. Furthermore, the day earlier than, hackers breached the SEC’s account on social community X (previously Twitter) and revealed a pretend tweet concerning the approval of the long-awaited BTC-ETFs. The market then reacted to this false assertion with an increase in the principle cryptocurrency to the $48,000 mark. After the refutation, the value fell again down, and on January 10, it merely repeated what had occurred the day earlier than.

● It is necessary to notice that the SEC was not notably happy with its determination to approve the functions. The primary software for a spot ETF was filed again in 2013 by the Winklevoss brothers (Cameron & Tyler Winklevoss) and was rejected in 2017. Roughly six years have handed since then, however the regulator’s aversion to cryptocurrencies remained, and the present approval was granted considerably reluctantly and below stress. In keeping with a press launch by the company’s chair Gary Gensler, the Fee’s determination was primarily based on a ruling by the appellate court docket in Grayscale’s lawsuit concerning the transformation of a belief fund right into a spot ETF. The court docket dominated in favour of Grayscale, stating that the SEC “didn’t adequately justify its causes for refusal.” After this, delaying the approval of comparable merchandise was not wise.

Nonetheless, on January 10, Gensler didn’t maintain again in his damaging evaluation. “Regardless of the approval of spot BTC-ETFs,” he famous within the press launch, “we don’t endorse bitcoin. Traders ought to take into account the quite a few dangers related to Bitcoin and merchandise whose worth is tied to the cryptocurrency. Bitcoin is primarily a speculative, unstable asset that can also be used for unlawful actions, together with ransomware, cash laundering, evasion of sanctions, and financing of terrorism. As we speak, we authorised the itemizing and buying and selling of sure ETP spot bitcoin shares, however we didn’t approve Bitcoin,” concluded the SEC head, making it clear that the battle with digital property is much from over.

● Discussing the short-term perspective, many analysts didn’t anticipate a big rally, pointing to $48,500 as a key resistance degree. They proved appropriate: after BTC/USD breached this degree on September 11, a “promote the information” phenomenon ensued – a mass closure of buy-orders and profit-taking. Consequently, the value sharply retraced. In keeping with Coinglass, the full sum of liquidations for all cryptocurrency positions was roughly $209 million.

Relating to the long-term affect of the launch of spot bitcoin ETFs, time is required for a full evaluation. A couple of week is critical for the funds to start operations on exchanges, with funding quantity information anticipated round mid-February. If we evaluate with ETFs for different merchandise, roughly $1.2 trillion has been invested in them over the previous two years. Seven years after the 2004 launch of bodily gold ETFs, the value of this metallic quadrupled, and now over $100 billion is held in gold ETFs.

Regarding digital gold, analysts at Normal Chartered financial institution take into account the approval of bitcoin ETFs a pivotal second for the asset’s acceptance. “Bitcoin will probably see development akin to gold-linked exchange-traded merchandise,” they write. “However that is anticipated to materialize over a shorter interval: not in seven to eight years, as was the case with gold, however inside one to 2 years, contemplating the swift evolution of the crypto market.” The financial institution forecasts bitcoin’s value doubtlessly reaching $200,000 by the top of 2025. Normal Chartered estimates that by the top of 2024, exchange-traded funds might maintain between 437,000 BTC and 1.32 million BTC, equating to a market influx of $50-100 billion, creating a big value impulse for the first cryptocurrency.

Enterprise investor Chamath Palihapitiya additionally expresses a comparable sentiment. He believes that 2024 might emerge as a landmark yr for bitcoin. The billionaire highlighted that the approval of quite a few spot exchange-traded ETFs is more likely to “revolutionize BTC,” doubtlessly resulting in its widespread adoption. Palihapitiya remarked that in such a situation, by the top of 2024, bitcoin might turn out to be a staple in conventional monetary parlance.

● In keeping with CoinDesk information, the 40-day correlation between digital gold and the Nasdaq 100 know-how index has dropped to zero. Over the previous 4 years, this value correlation has been constructive, various from average (0.15) to robust (0.8), reaching its peak in the course of the bear market of 2022. Now, bitcoin has utterly “decoupled” from Nasdaq. This correlation reset might signify bitcoin’s potential as a beautiful diversification device for funding portfolios, thereby enhancing its worth.

Macro-strategist Henrik Zeberg additionally anticipates an exceptional bull market in 2024. He expects the dynamics of digital property this yr, pushed by the entry of latest gamers, to be “parabolic.” “[Bitcoin] goes to be completely explosive – it’ll shoot up vertically. I feel we are going to attain a minimum of $115,000. That is my most conservative forecast. The $150,000 degree can also be possible, and I see the potential for $250,000,” the economist notes.

Zeberg added that the primary 4 months of 2024 may very well be “extremely spectacular” for the crypto market, due to institutional and conventional buyers getting into after the approval of spot bitcoin ETFs. Those that missed out on the primary or second bull cycle will now say, “Oh, I missed the primary two instances, however I will be on this one.” Nonetheless, he believes that conventional markets are dealing with “the worst crash since 1929,” when the Nice Melancholy started within the U.S.

Famend analyst generally known as PlanB believes that the value of bitcoin might quickly attain between $100,000 and 1 million. He explains that he would not count on a BTC value drop, as its adoption degree is at present solely 2-3%. In keeping with the logistic S-curve of organizational growth and Metcalfe’s regulation, a lower in asset profitability shouldn’t be anticipated whereas the adoption degree is under 50%. Due to this fact, the analyst opines, “the principle cryptocurrency is about for exponential development for a pair extra years.”

● Certainly, alongside the optimists, there are a lot of who forecast a downward development. We mentioned a few of these views two weeks in the past in a particular evaluation titled “Forecast 2024: Bitcoin Yesterday, Tomorrow, and the Day After.” At present, it is value noting the current assertion from TV host and founding father of hedge fund Cramer & Co., Jim Cramer. He asserted that bitcoin has reached its peak and additional development shouldn’t be anticipated. This assertion was made as bitcoin surpassed the $47,000 mark. Observing bitcoin’s efficiency on January 11-12, it raises the query: “May Jim Cramer be proper?”

As of the night of January 12, when this evaluation was written, BTC/USD is experiencing a big drop, buying and selling round $43,000. The whole market capitalization of the crypto market is at $1.70 trillion, up from $1.67 trillion per week in the past. The Bitcoin Concern & Greed Index over the week has decreased from 72 to 71 factors and stays within the Greed zone.

● Opposite to bitcoin’s efficiency, the main altcoin exhibited a way more spectacular development final week. Ranging from a degree of $2,334 on January 10, ETH/USD reached a weekly excessive of $2,711 on January 12, showcasing a 16% improve. Curiously, this surge occurred after the SEC Chairman’s assertion emphasizing that the regulator’s constructive determination completely pertained to exchange-traded merchandise primarily based on bitcoin. Gary Gensler clarified that this determination “on no account alerts readiness to approve itemizing requirements for crypto property which are securities.” It is value noting that the regulator nonetheless regards solely bitcoin as a commodity, whereas contemplating “the overwhelming majority of crypto property as funding contracts (i.e., securities).” Due to this fact, the hope for the approaching arrival of spot ETFs with Ethereum and different altcoins is unfounded.

But, towards this fairly grim backdrop, ETH instantly soared. The market’s response is certainly inscrutable. Nonetheless, in the direction of the top of Friday, January 12, Ethereum adopted bitcoin in a downturn, welcoming Saturday within the $2,500 zone.

NordFX Analytical Group

Discover: These supplies usually are not funding suggestions or tips for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx