Newest Updates

- Up to date to mirror the implementation of structural adjustments in a number of states.

- Up to date to mirror current state tax coverage developments.

- Initially printed.

Within the first century of state earnings taxation, solely 4 states transitioned from a graduated-rate to a single-rate, or flat, particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges improve with earnings. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years outdated, particular person earnings taxes are the largest supply of tax income within the U.S.

construction. However the previous few years have introduced vital deal with taxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities companies, items, and actions.

reduction, and with that, one thing of a flat tax revolution.

Within the 15 months from July 2021 to September 2022, 5 states enacted legal guidelines to remodel their graduated-rate earnings taxes into single-rate tax constructions: Arizona enacted flat taxAn earnings tax is known as a “flat tax” when all taxable earnings is topic to the identical tax price, no matter earnings degree or belongings.

laws in July 2021, adopted by Iowa in March 2022, Mississippi and Georgia in April 2022, and Idaho in September 2022.

Whereas no further flat taxes had been enacted in 2023, legislators in a number of further states have had critical deliberations on this problem and might be on the cusp of constructing the same transition over the following few years. In Kansas, a invoice to transform to a single-rate tax construction handed the Home and Senate however was vetoed by the governor in each 2023 and 2024. Whereas the legislature’s veto override try didn’t move in 2023, an override try is predicted once more this legislative session and should have a higher likelihood of succeeding. Equally, in Missouri and Oklahoma—two states with almost flat bracket constructions—lawmakers have additionally not too long ago mentioned the opportunity of transferring to a single-rate system.

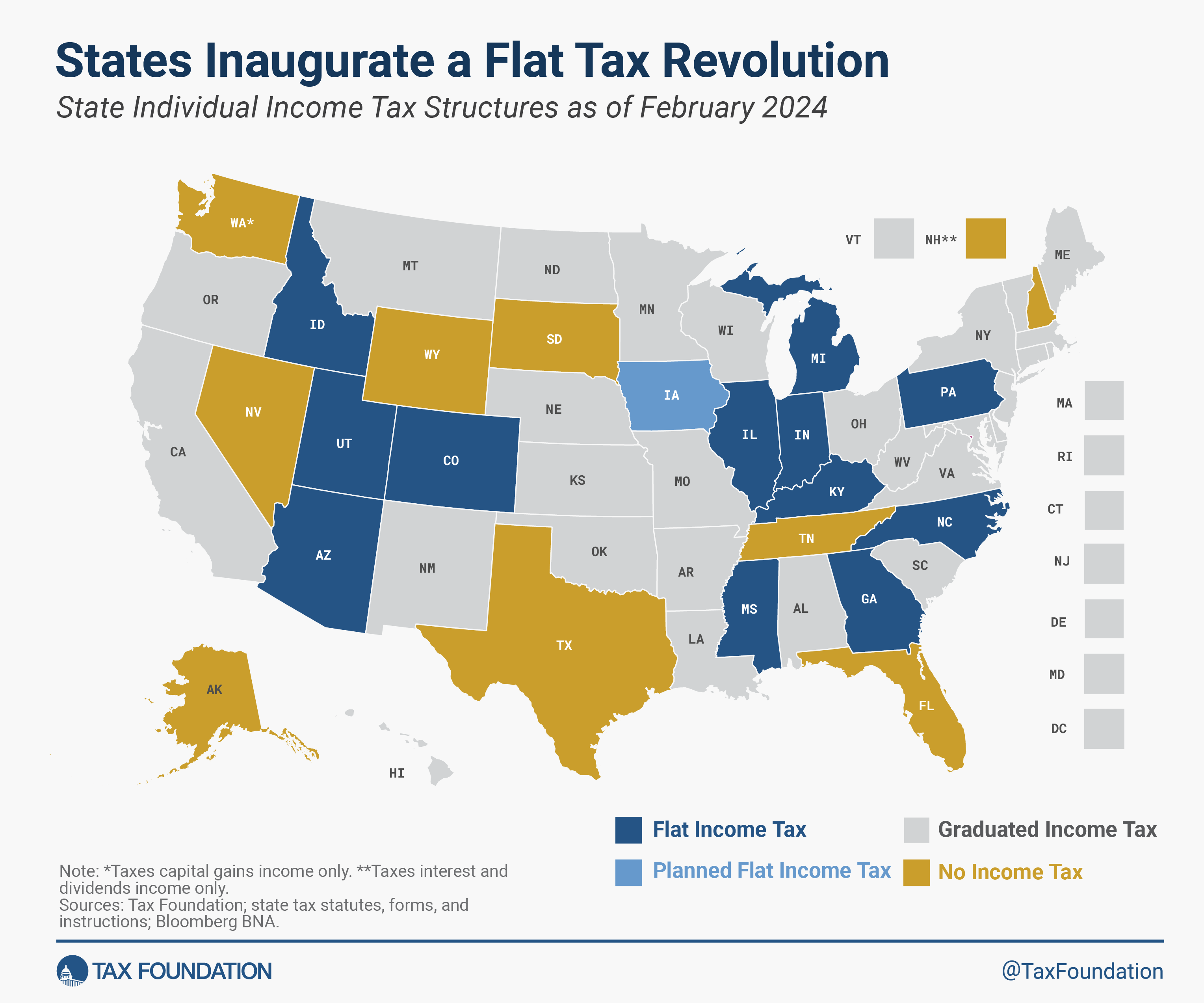

At the moment, 12 states have a flat particular person earnings tax construction, whereas 9 states don’t levy a person earnings tax on wage or wage earnings in any respect. Twenty-nine states and the District of Columbia have a graduated-rate tax construction, however one in all these states (Iowa) is at the moment within the strategy of phasing in a flat tax.

A Transient Historical past of State Revenue Tax Construction

In 1987, the seventy fifth anniversary of state earnings taxation, Colorado changed its half-century-old graduated-rate earnings tax with a single-rate tax. It will take one other 30 years for an additional state to comply with swimsuit, when Utah carried out a flat tax in 2007. Subsequent got here North Carolina in 2014, as a part of that state’s complete reforms, adopted by Kentucky, which carried out a single price in 2019. They joined 5 different states that already had flat taxes: Illinois, Indiana, Massachusetts, Michigan, and Pennsylvania. (It is very important be aware, nonetheless, that Massachusetts’ flat tax has since been dismantled, with voters’ adoption in November 2022 of a constitutional modification imposing a 4 proportion level surtaxA surtax is an extra tax levied on high of an already current enterprise or particular person tax and may have a flat or progressive price construction. Surtaxes are usually enacted to fund a particular program or initiative, whereas income from broader-based taxes, just like the particular person earnings tax, usually cowl a large number of packages and companies.

on earnings exceeding $1 million as of January 1, 2023.)

The primary state earnings tax, carried out in Wisconsin in 1912, had a two-rate construction. The primary flat tax was Massachusetts’ tax, which went into impact in 1917. 5 states had earnings taxes again then, with Massachusetts and Virginia each implementing them that January. Solely 5 years handed between the primary progressive earnings tax and the primary flat earnings tax, however 75 years handed between the primary progressive earnings tax and the primary time one was transitioned from a graduated- to a single-rate construction. It took greater than a century for the primary three states—Colorado, North Carolina, and Kentucky—to make the transition from a graduated- to a single-rate construction, making it all of the extra notable that 5 states—Arizona, Iowa, Mississippi, Georgia, and Idaho—enacted legal guidelines to make that very same transition inside a matter of solely 15 months in 2021 and 2022.

In 2021 and 2022, 5 States Enacted Flat Taxes in a Span of 15 Months

In July 2021, Arizona lawmakers enacted laws to part in a flat tax price of two.5 % utilizing tax triggers that made the timing of such a transition topic to income availability. This regulation was briefly held up in litigation however obtained courtroom clearance in 2022 to transfer ahead, and, upon the tax triggers being met, a flat price of two.5 % was carried out in January 2023.

Underneath complete tax reform laws enacted in March 2022, Iowa is phasing in a 3.9 % flat price by 2026, transferring additional and additional away from the graduated-rate tax that not way back topped out at 8.98 %. Given the state’s robust continued fiscal situation, Gov. Kim Reynolds (R) has proposed considerably accelerating the implementation of the flat tax by two years, such {that a} flat price of three.65 % would apply retroactively to the 2024 tax yr. In the meantime, the Home and Senate tax-writing committee chairs have launched their very own laws to part down—and ultimately remove—the person earnings tax, in addition to a separate proposal that might enshrine the flat tax construction within the state’s structure.

Mississippi’s flat tax, which took impact in 2023, was initially set at a price of 5 %, however that price was lowered to 4.7 % in 2024 and is scheduled to lower to 4.4 % in 2025 and 4.0 % in 2026.

Georgia’s flat tax laws, which was additionally adopted in 2022, was the latest to take impact, with the transition to a flat price of 5.49 % occurring on January 1, 2024. Topic to tax triggers, this price might be lowered by 0.1 proportion factors every year till it reaches 4.99 %, though lawmakers have signaled a willingness to think about accelerating these price reductions.

Lastly, in a 2022 particular session, Idaho adopted a 5.8 % flat tax, changing the four-bracket tax system that was beforehand in impact. This modification was efficient beginning with the 2023 tax yr.

Advantages of Shifting to a Flat Tax Construction

Supporters of flat taxes typically establish their simplicity as one in all their salient options. That is true, however it’s necessary to cease and ask what is supposed by this. It’s not sufficient to merely state {that a} single price is easier than a number of charges, as a result of, whereas trivially true, that tells us comparatively little. It’s not notably tough to make use of tax tables to establish one’s tax legal responsibility.

Flat taxes are meaningfully easy, nonetheless, in a number of methods. State income forecasting—in addition to projecting the income results of potential tax adjustments—is way extra simply achieved underneath a flat tax construction. Flat taxes additionally make it simpler for taxpayers to estimate their tax legal responsibility and the way it might change underneath totally different earnings situations, enhancing tax transparency and probably enhancing some taxpayers’ financial decision-making.

Flat taxes additionally accord higher with taxpayers’ impressions of tax burdens primarily based on headline charges. People and small companies could also be extra drawn to a state with a comparatively decrease flat price than one with a graduated-rate system, even when the 2 methods yield related liabilities. Flat taxes additionally simplify the perform by which taxpayers resolve whether or not to work or make investments extra on the margin, since all marginal returns to labor and funding are uncovered to the identical price.

Of higher significance for taxpayers, nonetheless, is that flat-rate earnings taxes are inclined to perform as a bulwark in opposition to pointless tax will increase, and to offer higher certainty for particular person and enterprise taxpayers. Financial choices are made on the margin; selections about investments, labor, or relocation might be made on the idea of the impact on the subsequent greenback of earnings, not the prior ones. A aggressive high marginal price issues most for financial progress, and flat earnings taxes—given their “all-in” nature—not solely imply a decrease price on that all-important margin, however they are usually tougher to boost sooner or later, whereas extremely graduated taxes are extra prone to focused, however typically economically inefficient, tax hikes. Notably, all 4 states that transitioned from a graduated-rate to a single-rate particular person earnings tax earlier than 2023 now have flat charges which might be all between 0.5 and 1.05 proportion factors decrease than they had been when the transition to a flat tax first occurred.

Taxpayers appear to sense this intuitively: in Illinois, for example, voters in November 2020 lopsidedly rejected a constitutional modification that might have permitted a graduated-rate construction though the initially proposed tax improve wouldn’t have elevated tax legal responsibility for the overwhelming majority of voters. Illinoisans appeared to acknowledge that, as soon as the precept of a graduated-rate construction is established, it might turn out to be far simpler to boost earnings tax charges on increasingly taxpayers—even setting apart the unfavourable implications transferring away from a flat tax would have had for the state’s financial competitiveness.

That is one motive why states with almost flat earnings taxes ought to take into account ending the job, as Georgia, Idaho, and Mississippi have not too long ago executed. In Alabama, for example, the present three-bracket system, with the highest price kicking in at $3,000 of earnings for single filers, solely gives $40 in tax financial savings in comparison with taxing all earnings on the high price. Elevating the normal deductionThe usual deduction reduces a taxpayer’s taxable earnings by a set quantity decided by the federal government. It was almost doubled for all courses of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers to not itemize deductions when submitting their federal earnings taxes.

would simply present the identical progressive advantages whereas embracing the simplicity and—extra importantly—the understanding and stability of a single-rate tax. Three different states likewise have high charges that kick in at or beneath $10,000 for single filers, together with Arkansas, Missouri, and Oklahoma, all states through which continued earnings tax reform and reduction stays a precedence.

These states now current a chance for reform culminating in a flat tax, however in addition they function a cautionary story in regards to the implications of not indexing a graduated-rate earnings tax. When Alabama adopted its graduated-rate earnings tax in 1935, the vast majority of taxpayers had been totally exempt, and few taxpayers had been topic to the highest marginal price of 5 % on earnings above $3,000, which is equal to roughly $67,500 in 2024, larger than at this time’s median family earnings within the state and a small fortune in Despair-era Alabama. Over time, the dearth of inflationInflation is when the overall worth of products and companies will increase throughout the economic system, decreasing the buying energy of a forex and the worth of sure belongings. The identical paycheck covers much less items, companies, and payments. It’s typically known as a “hidden tax,” because it leaves taxpayers much less well-off resulting from larger prices and “bracket creep,” whereas rising the federal government’s spending energy.

indexing has subjected the overwhelming majority of taxpayers’ earnings to the highest marginal price.

Of the 12 states that have already got flat taxes, 4 enshrine that standing of their state constitutions, locking within the profit and making it tougher for lawmakers to boost taxes by switching to a progressive taxA progressive tax is one the place the common tax burden will increase with earnings. Excessive-income households pay a disproportionate share of the tax burden, whereas low- and middle-income taxpayers shoulder a comparatively small tax burden.

regime. It is a notably necessary safety for small enterprise homeowners, since about 95 % of all companies are pass-through companies topic to particular person, not company, earnings taxes, and the overwhelming majority of pass-through enterpriseA pass-through enterprise is a sole proprietorship, partnership, or S company that isn’t topic to the company earnings tax; as a substitute, this enterprise experiences its earnings on the particular person earnings tax returns of the homeowners and is taxed at particular person earnings tax charges.

earnings is earned by firms uncovered to states’ high marginal earnings tax charges. In Illinois, for example, the place lawmakers championed a failed constitutional modification to allow a graduated-rate earnings tax, 93 % of pass-through enterprise earnings was on returns with greater than $200,000 in adjusted gross earnings (AGI), and over half of all pass-through enterprise earnings was reported on returns displaying greater than $1 million in AGI. Mountain climbing the highest marginal price is not only in regards to the rich; it’s in regards to the state’s small companies, too, and about offering a higher degree of certainty for entrepreneurs making location choices.

States that at the moment have flat taxes however that haven’t but constitutionally protected their single-rate tax constructions ought to take into account doing so. The next desk exhibits states that at the moment have, or are on monitor to implement, a flat tax; their date of implementation (previous or future); and whether or not a single price tax is constitutionally mandated. Of the 4 states which have had flat taxes from the beginning, three enshrine this standing of their structure. Of the eight that transitioned, just one does.

In 2021 and 2022 alone, inside the span of 15 months, extra states enacted legal guidelines changing graduated-rate particular person earnings tax constructions into single-rate earnings tax constructions than did so in the entire 108-year historical past of state earnings taxation up till that time. In a number of further states, lawmakers are working to see that this momentum continues. For states that wish to take away obstacles to upward mobility and enterprise funding whereas selling long-term financial progress and enhancing their aggressive standing, transferring from a graduated-rate to a single-rate particular person earnings tax construction whereas decreasing the highest marginal price is among the many most beneficial tax reforms lawmakers may undertake.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Share